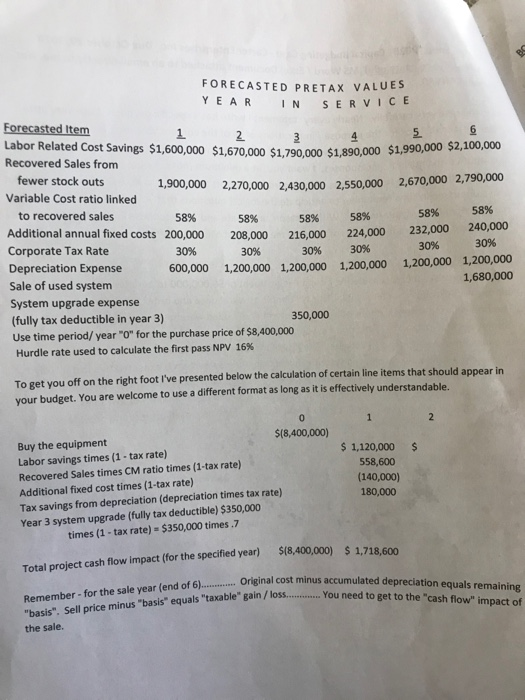

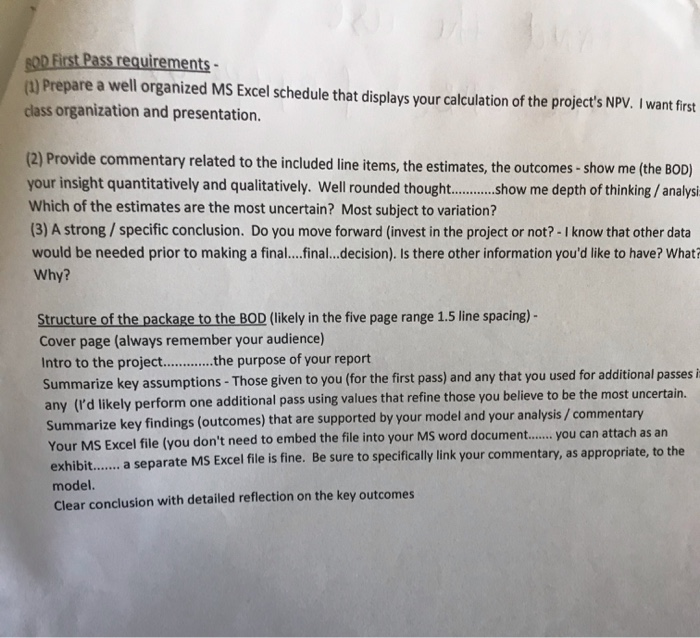

Read the case very carefully. Nearly every statement I write has a specific purpose. I use very little "filler" material. Look for the purpose / implications of all of the content you are given within the case. You need to think carefully and with well-rounded diligence. I need to see true insight in your quantitative and qualitative responses. I want you, at a minimum (note the use of the word minimum) to address the baseline requirements of the board of directors (given to you at the end of the case) but as we discussed in class remember to anticipate the logical questions that you might get when you (in real practice) deliver your findings. Within reason, anticipate and address these logical questions. The bar is raised on the grading for this one. Show me your best MBA level effort. Proof thoroughly. BACKGROUND Carter Enterprises Inc. is considering a capital investment of $8,000,000 to purchase a new computerized/robotic materials handling system for its warehouse and order fulfillment operations. The firm is facing the retirement of an atypical number of skilled warehouse and order fulfillment employees and instead of hiring one new employee for each one retiree, the firm is considering hiring one new employee for each 3 retirees. The loss of manpower is expected to be offset by the efficiencies of the new automated system. In addition, the new system is expected to substantially improve inventory management and thus reduce the number and dollar amount of merchandise stock outs and the accompanying number of unhappy customers and dollar amount of lost sales. Your bottom line mission is to calculate the net present value of the proposed project and provide analysis related to moving ahead with the automation or not. DETAILED FINANCIAL FORECASTS The forecasted, ready to place into service, cost of the new system is $8,400,000. Expected labor and related cost savings as well as other key forecasts are displayed in the chart below. These amounts were provided to you by various sources and should be used in your first pass preparation Carter expects to have a six year operational period for the equipment. At the end of year six Carter expects to sell the equipment for approximately 20% of the original in service cost. Carter has historically used a hurdle rate of 16% to evaluate capital projects. The firm's WACC is approximately 10%. The firm has never undertaken a project like this that was so dependent on the use of new technology. Existing staff does not possess the necessary technical skills to fully operate the new equipment. Between training and new hires, that expertise will hopefully be obtained. The cost of training existing staff and to be hired technical staff is included in the values below. Many of these forecasts were developed with the help of the equipment manufacturer. Remember - for the sale year (end of 6)........ Original cost minus accumulated depreciation equals remaining "basis". Sell price minus "basis equals "taxable gain/loss....... You need to get to the cash flow" impact of IN 58% FORECASTED PRETAX VALUES YEAR SERVICE Forecasted Item 1 2 3 5 6 Labor Related Cost Savings $1,600,000 $1,670,000 $1,790,000 $1,890,000 $1,990,000 $2,100,000 Recovered Sales from fewer stock outs 1,900,000 2,270,000 2,430,000 2,550,000 2,670,000 2,790,000 Variable Cost ratio linked to recovered sales 58% 58% 58% 58% 58% Additional annual fixed costs 200,000 208,000 216,000 224,000 232,000 240,000 Corporate Tax Rate 30% 30% 30% 30% 30% 30% Depreciation Expense 600,000 1,200,000 1,200,000 1,200,000 1,200,000 1,200,000 Sale of used system 1,680,000 System upgrade expense (fully tax deductible in year 3) 350,000 Use time period/year "O" for the purchase price of $8,400,000 Hurdle rate used to calculate the first pass NPV 16% To get you off on the right foot I've presented below the calculation of certain line items that should appear in your budget. You are welcome to use a different format as long as it is effectively understandable. 1 2 $ 0 Buy the equipment $(8,400,000) Labor savings times (1 - tax rate) Recovered Sales times CM ratio times (1-tax rate) Additional fixed cost times (1-tax rate) Tax savings from depreciation (depreciation times tax rate) Year 3 system upgrade (fully tax deductible) $350,000 times (1 - tax rate) = $350,000 times.7 $ 1,120,000 558,600 (140,000) 180,000 $(8,400,000) $ 1,718,600 Total project cash flow impact (for the specified year) the sale. SOD First Pass requirements - (1) Prepare a well organized MS Excel schedule that displays your calculation of the project's NPV. I want first class organization and presentation. (2) Provide commentary related to the included line items, the estimates, the outcomes - show me (the BOD) your insight quantitatively and qualitatively. Well rounded thought..........show me depth of thinking / analysi Which of the estimates are the most uncertain? Most subject to variation? (3) A strong / specific conclusion. Do you move forward (invest in the project or not? I know that other data would be needed prior to making a final....final...decision). Is there other information you'd like to have? What? Why? Structure of the package to the BOD (likely in the five page range 1.5 line spacing) - Cover page (always remember your audience) Intro to the project.............the purpose of your report Summarize key assumptions - Those given to you (for the first pass) and any that you used for additional passes i any (I'd likely perform one additional pass using values that refine those you believe to be the most uncertain. Summarize key findings (outcomes) that are supported by your model and your analysis / commentary Your MS Excel file (you don't need to embed the file into your MS word document....... you can attach as an exhibit....... a separate MS Excel file is fine. Be sure to specifically link your commentary, as appropriate, to the model. Clear conclusion with detailed reflection on the key outcomes Read the case very carefully. Nearly every statement I write has a specific purpose. I use very little "filler" material. Look for the purpose / implications of all of the content you are given within the case. You need to think carefully and with well-rounded diligence. I need to see true insight in your quantitative and qualitative responses. I want you, at a minimum (note the use of the word minimum) to address the baseline requirements of the board of directors (given to you at the end of the case) but as we discussed in class remember to anticipate the logical questions that you might get when you (in real practice) deliver your findings. Within reason, anticipate and address these logical questions. The bar is raised on the grading for this one. Show me your best MBA level effort. Proof thoroughly. BACKGROUND Carter Enterprises Inc. is considering a capital investment of $8,000,000 to purchase a new computerized/robotic materials handling system for its warehouse and order fulfillment operations. The firm is facing the retirement of an atypical number of skilled warehouse and order fulfillment employees and instead of hiring one new employee for each one retiree, the firm is considering hiring one new employee for each 3 retirees. The loss of manpower is expected to be offset by the efficiencies of the new automated system. In addition, the new system is expected to substantially improve inventory management and thus reduce the number and dollar amount of merchandise stock outs and the accompanying number of unhappy customers and dollar amount of lost sales. Your bottom line mission is to calculate the net present value of the proposed project and provide analysis related to moving ahead with the automation or not. DETAILED FINANCIAL FORECASTS The forecasted, ready to place into service, cost of the new system is $8,400,000. Expected labor and related cost savings as well as other key forecasts are displayed in the chart below. These amounts were provided to you by various sources and should be used in your first pass preparation Carter expects to have a six year operational period for the equipment. At the end of year six Carter expects to sell the equipment for approximately 20% of the original in service cost. Carter has historically used a hurdle rate of 16% to evaluate capital projects. The firm's WACC is approximately 10%. The firm has never undertaken a project like this that was so dependent on the use of new technology. Existing staff does not possess the necessary technical skills to fully operate the new equipment. Between training and new hires, that expertise will hopefully be obtained. The cost of training existing staff and to be hired technical staff is included in the values below. Many of these forecasts were developed with the help of the equipment manufacturer. Remember - for the sale year (end of 6)........ Original cost minus accumulated depreciation equals remaining "basis". Sell price minus "basis equals "taxable gain/loss....... You need to get to the cash flow" impact of IN 58% FORECASTED PRETAX VALUES YEAR SERVICE Forecasted Item 1 2 3 5 6 Labor Related Cost Savings $1,600,000 $1,670,000 $1,790,000 $1,890,000 $1,990,000 $2,100,000 Recovered Sales from fewer stock outs 1,900,000 2,270,000 2,430,000 2,550,000 2,670,000 2,790,000 Variable Cost ratio linked to recovered sales 58% 58% 58% 58% 58% Additional annual fixed costs 200,000 208,000 216,000 224,000 232,000 240,000 Corporate Tax Rate 30% 30% 30% 30% 30% 30% Depreciation Expense 600,000 1,200,000 1,200,000 1,200,000 1,200,000 1,200,000 Sale of used system 1,680,000 System upgrade expense (fully tax deductible in year 3) 350,000 Use time period/year "O" for the purchase price of $8,400,000 Hurdle rate used to calculate the first pass NPV 16% To get you off on the right foot I've presented below the calculation of certain line items that should appear in your budget. You are welcome to use a different format as long as it is effectively understandable. 1 2 $ 0 Buy the equipment $(8,400,000) Labor savings times (1 - tax rate) Recovered Sales times CM ratio times (1-tax rate) Additional fixed cost times (1-tax rate) Tax savings from depreciation (depreciation times tax rate) Year 3 system upgrade (fully tax deductible) $350,000 times (1 - tax rate) = $350,000 times.7 $ 1,120,000 558,600 (140,000) 180,000 $(8,400,000) $ 1,718,600 Total project cash flow impact (for the specified year) the sale. SOD First Pass requirements - (1) Prepare a well organized MS Excel schedule that displays your calculation of the project's NPV. I want first class organization and presentation. (2) Provide commentary related to the included line items, the estimates, the outcomes - show me (the BOD) your insight quantitatively and qualitatively. Well rounded thought..........show me depth of thinking / analysi Which of the estimates are the most uncertain? Most subject to variation? (3) A strong / specific conclusion. Do you move forward (invest in the project or not? I know that other data would be needed prior to making a final....final...decision). Is there other information you'd like to have? What? Why? Structure of the package to the BOD (likely in the five page range 1.5 line spacing) - Cover page (always remember your audience) Intro to the project.............the purpose of your report Summarize key assumptions - Those given to you (for the first pass) and any that you used for additional passes i any (I'd likely perform one additional pass using values that refine those you believe to be the most uncertain. Summarize key findings (outcomes) that are supported by your model and your analysis / commentary Your MS Excel file (you don't need to embed the file into your MS word document....... you can attach as an exhibit....... a separate MS Excel file is fine. Be sure to specifically link your commentary, as appropriate, to the model. Clear conclusion with detailed reflection on the key outcomes