Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Read the Cohesion Case in Chapter 1 of the text: Nestle S.A. 2016. Prepare a case analysis. Take note that we are not going to

Read the Cohesion Case in Chapter 1 of the text: Nestle S.A. 2016. Prepare a case analysis. Take note that we are not going to focus on solutions or the development of new strategy, rather your task is to evaluate the situation and identify current or potential problems, if any. Also critical in your analysis is mission and vision assessment as well as the internal and external evaluation.

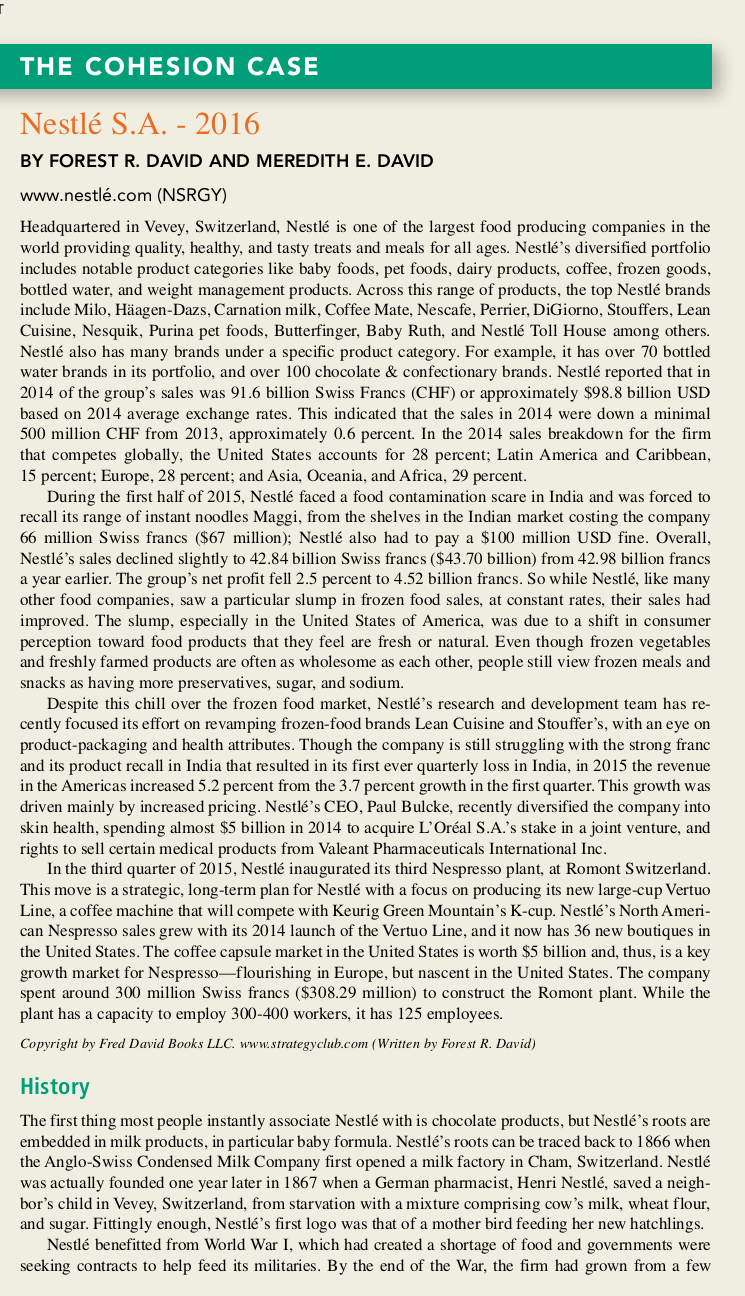

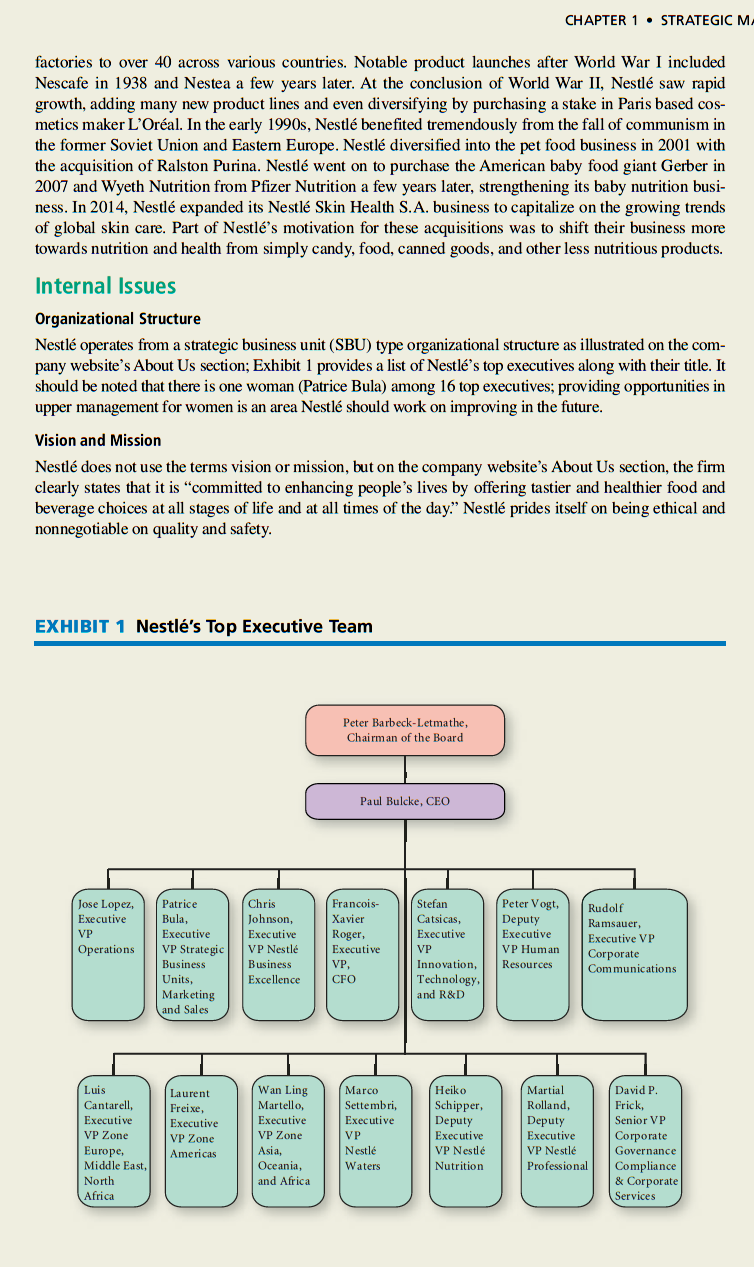

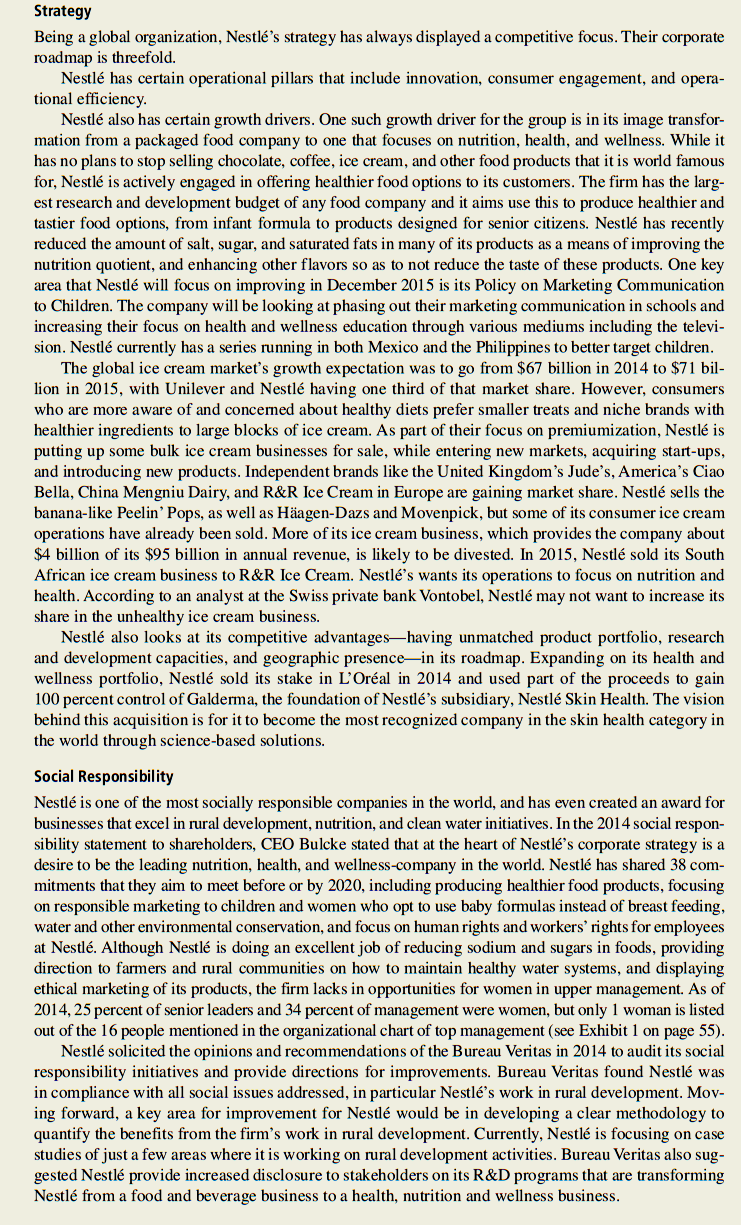

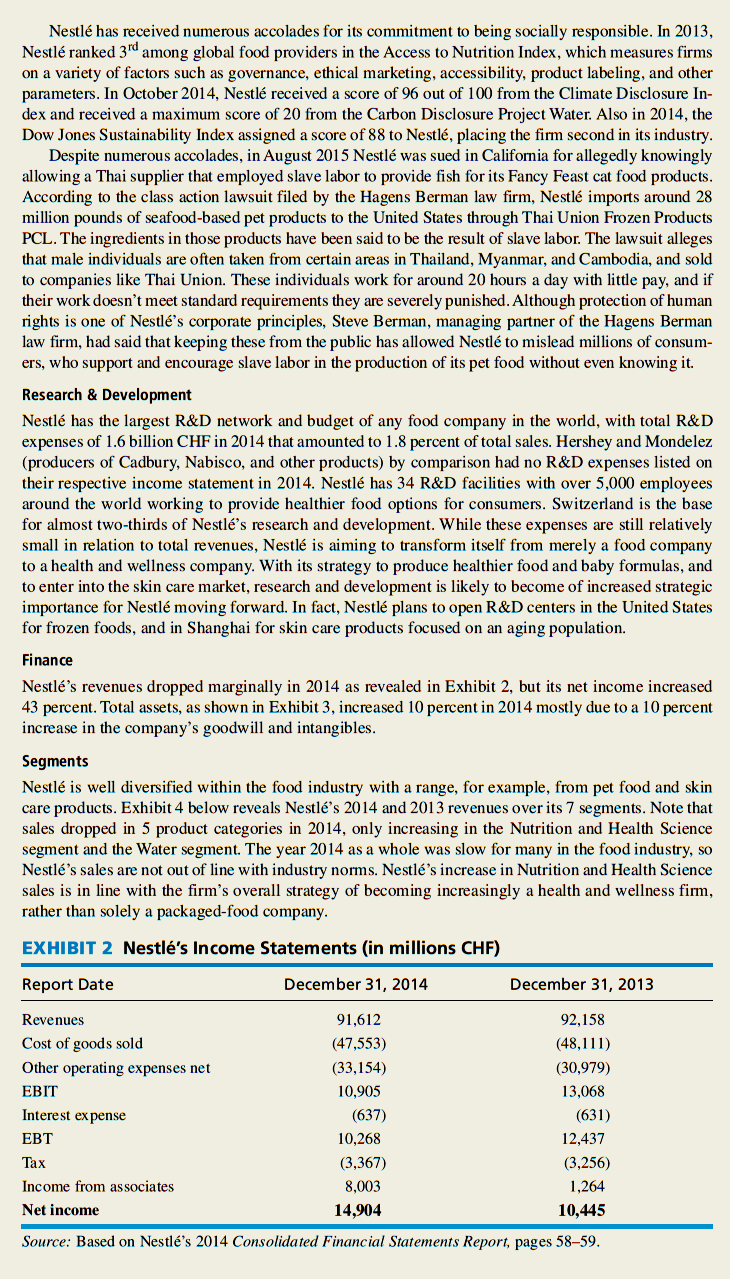

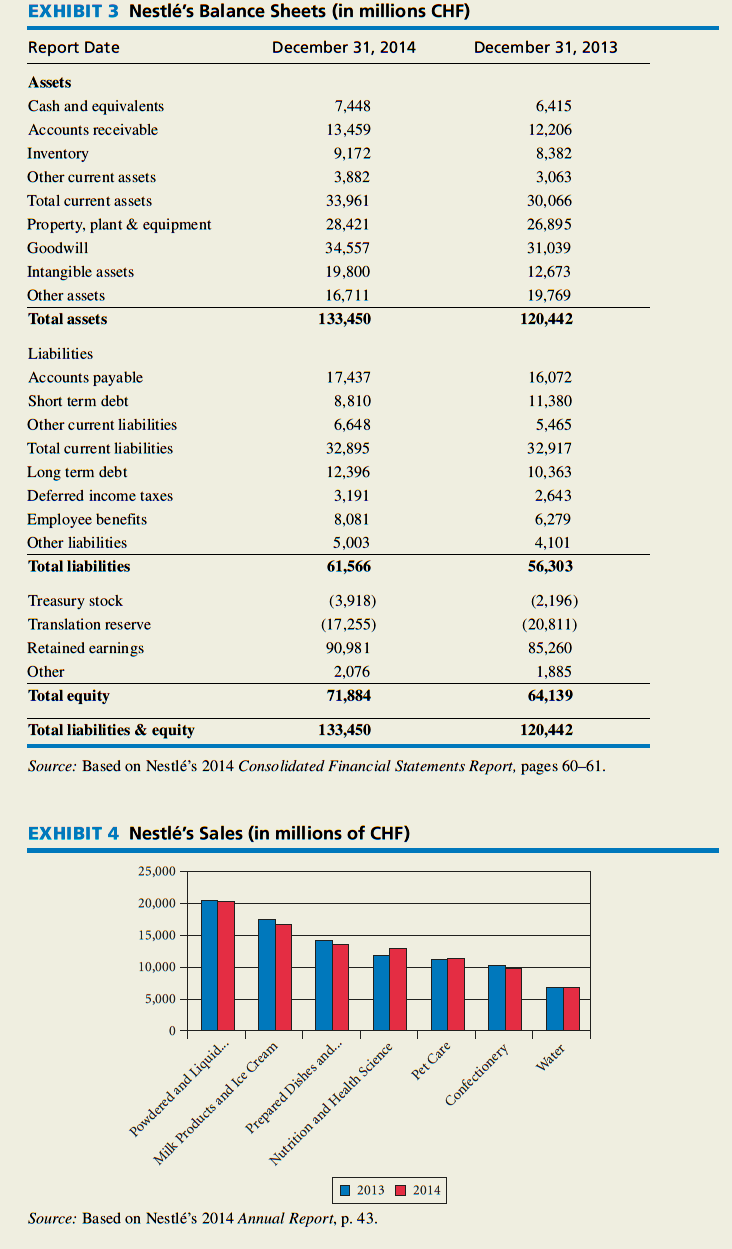

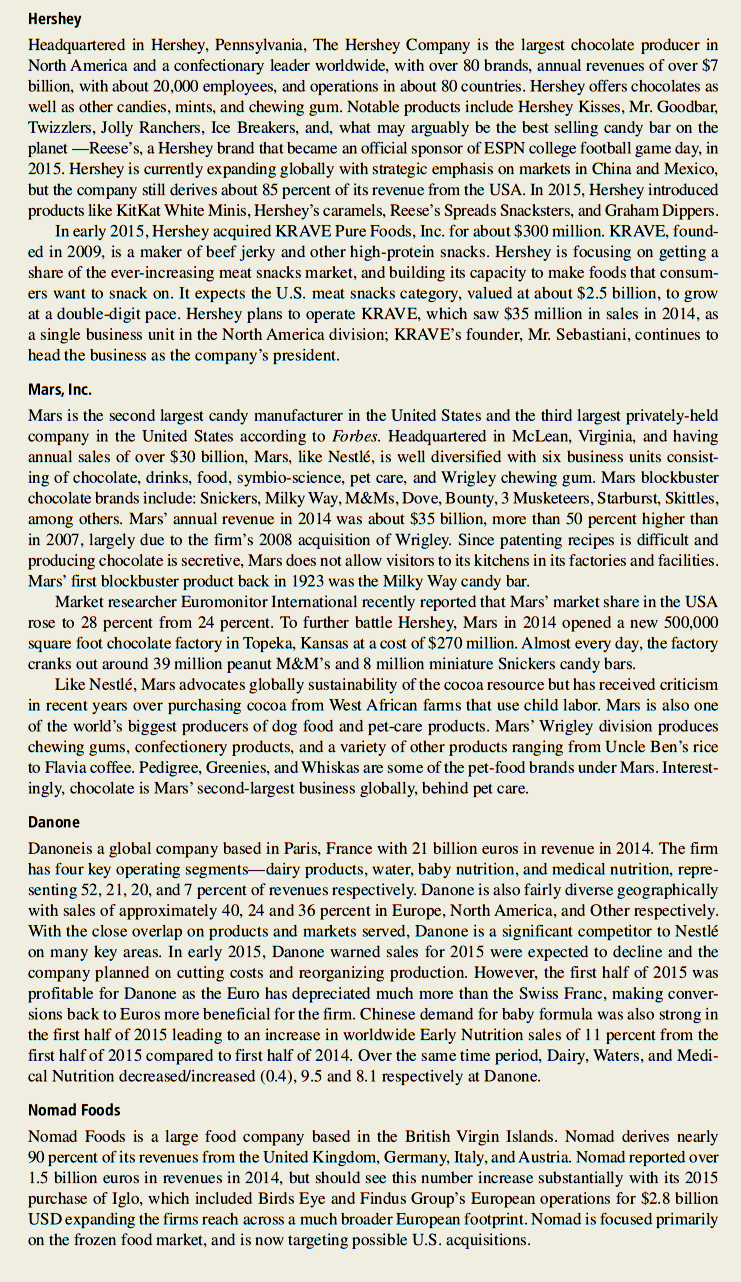

BY FOREST R. DAVID AND MEREDITH E. DAVID www.nestl.com (NSRGY) Headquartered in Vevey, Switzerland, Nestl is one of the largest food producing companies in the world providing quality, healthy, and tasty treats and meals for all ages. Nestl's diversified portfolio includes notable product categories like baby foods, pet foods, dairy products, coffee, frozen goods, bottled water, and weight management products. Across this range of products, the top Nestl brands include Milo, Hagen-Dazs, Carnation milk, Coffee Mate, Nescafe, Perrier, DiGiorno, Stouffers, Lean Cuisine, Nesquik, Purina pet foods, Butterfinger, Baby Ruth, and Nestl Toll House among others. Nestl also has many brands under a specific product category. For example, it has over 70 bottled water brands in its portfolio, and over 100 chocolate \& confectionary brands. Nestl reported that in 2014 of the group's sales was 91.6 billion Swiss Francs (CHF) or approximately $98.8 billion USD based on 2014 average exchange rates. This indicated that the sales in 2014 were down a minimal 500 million CHF from 2013, approximately 0.6 percent. In the 2014 sales breakdown for the firm that competes globally, the United States accounts for 28 percent; Latin America and Caribbean, 15 percent; Europe, 28 percent; and Asia, Oceania, and Africa, 29 percent. During the first half of 2015, Nestle faced a food contamination scare in India and was forced to recall its range of instant noodles Maggi, from the shelves in the Indian market costing the company 66 million Swiss francs (\$67 million); Nestl also had to pay a \$100 million USD fine. Overall, Nestl's sales declined slightly to 42.84 billion Swiss francs ( $43.70 billion) from 42.98 billion francs a year earlier. The group's net profit fell 2.5 percent to 4.52 billion francs. So while Nestl, like many other food companies, saw a particular slump in frozen food sales, at constant rates, their sales had improved. The slump, especially in the United States of America, was due to a shift in consumer perception toward food products that they feel are fresh or natural. Even though frozen vegetables and freshly farmed products are often as wholesome as each other, people still view frozen meals and snacks as having more preservatives, sugar, and sodium. Despite this chill over the frozen food market, Nestl's research and development team has recently focused its effort on revamping frozen-food brands Lean Cuisine and Stouffer's, with an eye on product-packaging and health attributes. Though the company is still struggling with the strong franc and its product recall in India that resulted in its first ever quarterly loss in India, in 2015 the revenue in the Americas increased 5.2 percent from the 3.7 percent growth in the first quarter. This growth was driven mainly by increased pricing. Nestl's CEO, Paul Bulcke, recently diversified the company into skin health, spending almost $5 billion in 2014 to acquire L'Oral S.A.'s stake in a joint venture, and rights to sell certain medical products from Valeant Pharmaceuticals International Inc. In the third quarter of 2015, Nestl inaugurated its third Nespresso plant, at Romont Switzerland. This move is a strategic, long-term plan for Nestl with a focus on producing its new large-cup Vertuo Line, a coffee machine that will compete with Keurig Green Mountain's K-cup. Nestl's North American Nespresso sales grew with its 2014 launch of the Vertuo Line, and it now has 36 new boutiques in the United States. The coffee capsule market in the United States is worth $5 billion and, thus, is a key growth market for Nespresso-flourishing in Europe, but nascent in the United States. The company spent around 300 million Swiss francs (\$308.29 million) to construct the Romont plant. While the plant has a capacity to employ 300-400 workers, it has 125 employees. Copyright by Fred David Books LLC. www.strategyclub.com (Written by Forest R. David) History The first thing most people instantly associate Nestl with is chocolate products, but Nestl's roots are embedded in milk products, in particular baby formula. Nestl's roots can be traced back to 1866 when the Anglo-Swiss Condensed Milk Company first opened a milk factory in Cham, Switzerland. Nestl was actually founded one year later in 1867 when a German pharmacist, Henri Nestl, saved a neighbor's child in Vevey, Switzerland, from starvation with a mixture comprising cow's milk, wheat flour, and sugar. Fittingly enough, Nestl's first logo was that of a mother bird feeding her new hatchlings. Nestl benefitted from World War I, which had created a shortage of food and governments were seeking contracts to help feed its militaries. By the end of the War, the firm had grown from a few factories to over 40 across various countries. Notable product launches after World War I included Nescafe in 1938 and Nestea a few years later. At the conclusion of World War II, Nestl saw rapid growth, adding many new product lines and even diversifying by purchasing a stake in Paris based cosmetics maker L'Oral. In the early 1990s, Nestl benefited tremendously from the fall of communism in the former Soviet Union and Eastern Europe. Nestle diversified into the pet food business in 2001 with the acquisition of Ralston Purina. Nestl went on to purchase the American baby food giant Gerber in 2007 and Wyeth Nutrition from Pfizer Nutrition a few years later, strengthening its baby nutrition business. In 2014, Nestl expanded its Nestl Skin Health S.A. business to capitalize on the growing trends of global skin care. Part of Nestl's motivation for these acquisitions was to shift their business more towards nutrition and health from simply candy, food, canned goods, and other less nutritious products. Internal Issues Organizational Structure Nestl operates from a strategic business unit (SBU) type organizational structure as illustrated on the company website's About Us section; Exhibit 1 provides a list of Nestl's top executives along with their title. It should be noted that there is one woman (Patrice Bula) among 16 top executives; providing opportunities in upper management for women is an area Nestl should work on improving in the future. Vision and Mission Nestl does not use the terms vision or mission, but on the company website's About Us section, the firm clearly states that it is "committed to enhancing people's lives by offering tastier and healthier food and beverage choices at all stages of life and at all times of the day." Nestl prides itself on being ethical and nonnegotiable on quality and safety. Strategy Being a global organization, Nestl's strategy has always displayed a competitive focus. Their corporate roadmap is threefold. Nestl has certain operational pillars that include innovation, consumer engagement, and operational efficiency. Nestle also has certain growth drivers. One such growth driver for the group is in its image transformation from a packaged food company to one that focuses on nutrition, health, and wellness. While it has no plans to stop selling chocolate, coffee, ice cream, and other food products that it is world famous for, Nestl is actively engaged in offering healthier food options to its customers. The firm has the largest research and development budget of any food company and it aims use this to produce healthier and tastier food options, from infant formula to products designed for senior citizens. Nestl has recently reduced the amount of salt, sugar, and saturated fats in many of its products as a means of improving the nutrition quotient, and enhancing other flavors so as to not reduce the taste of these products. One key area that Nestl will focus on improving in December 2015 is its Policy on Marketing Communication to Children. The company will be looking at phasing out their marketing communication in schools and increasing their focus on health and wellness education through various mediums including the television. Nestl currently has a series running in both Mexico and the Philippines to better target children. The global ice cream market's growth expectation was to go from $67 billion in 2014 to $71 billion in 2015, with Unilever and Nestl having one third of that market share. However, consumers who are more aware of and concerned about healthy diets prefer smaller treats and niche brands with healthier ingredients to large blocks of ice cream. As part of their focus on premiumization, Nestl is putting up some bulk ice cream businesses for sale, while entering new markets, acquiring start-ups, and introducing new products. Independent brands like the United Kingdom's Jude's, America's Ciao Bella, China Mengniu Dairy, and R\&R Ice Cream in Europe are gaining market share. Nestl sells the banana-like Peelin' Pops, as well as Hagen-Dazs and Movenpick, but some of its consumer ice cream operations have already been sold. More of its ice cream business, which provides the company about $4 billion of its $95 billion in annual revenue, is likely to be divested. In 2015 , Nestl sold its South African ice cream business to R\&R Ice Cream. Nestls wants its operations to focus on nutrition and health. According to an analyst at the Swiss private bank Vontobel, Nestl may not want to increase its share in the unhealthy ice cream business. Nestl also looks at its competitive advantages-having unmatched product portfolio, research and development capacities, and geographic presence - in its roadmap. Expanding on its health and wellness portfolio, Nestl sold its stake in L'Oral in 2014 and used part of the proceeds to gain 100 percent control of Galderma, the foundation of Nestl's subsidiary, Nestl Skin Health. The vision behind this acquisition is for it to become the most recognized company in the skin health category in the world through science-based solutions. Social Responsibility Nestl is one of the most socially responsible companies in the world, and has even created an award for businesses that excel in rural development, nutrition, and clean water initiatives. In the 2014 social responsibility statement to shareholders, CEO Bulcke stated that at the heart of Nestl's corporate strategy is a desire to be the leading nutrition, health, and wellness-company in the world. Nestl has shared 38 commitments that they aim to meet before or by 2020 , including producing healthier food products, focusing on responsible marketing to children and women who opt to use baby formulas instead of breast feeding, water and other environmental conservation, and focus on human rights and workers' rights for employees at Nestl. Although Nestl is doing an excellent job of reducing sodium and sugars in foods, providing direction to farmers and rural communities on how to maintain healthy water systems, and displaying ethical marketing of its products, the firm lacks in opportunities for women in upper management. As of 2014,25 percent of senior leaders and 34 percent of management were women, but only 1 woman is listed out of the 16 people mentioned in the organizational chart of top management (see Exhibit 1 on page 55). Nestl solicited the opinions and recommendations of the Bureau Veritas in 2014 to audit its social responsibility initiatives and provide directions for improvements. Bureau Veritas found Nestl was in compliance with all social issues addressed, in particular Nestl's work in rural development. Moving forward, a key area for improvement for Nestl would be in developing a clear methodology to quantify the benefits from the firm's work in rural development. Currently, Nestl is focusing on case studies of just a few areas where it is working on rural development activities. Bureau Veritas also suggested Nestl provide increased disclosure to stakeholders on its R\&D programs that are transforming Nestl from a food and beverage business to a health, nutrition and wellness business. Nestl has received numerous accolades for its commitment to being socially responsible. In 2013, Nestl ranked 3rd among global food providers in the Access to Nutrition Index, which measures firms on a variety of factors such as governance, ethical marketing, accessibility, product labeling, and other parameters. In October 2014, Nestl received a score of 96 out of 100 from the Climate Disclosure Index and received a maximum score of 20 from the Carbon Disclosure Project Water. Also in 2014, the Dow Jones Sustainability Index assigned a score of 88 to Nestl, placing the firm second in its industry. Despite numerous accolades, in August 2015 Nestl was sued in California for allegedly knowingly allowing a Thai supplier that employed slave labor to provide fish for its Fancy Feast cat food products. According to the class action lawsuit filed by the Hagens Berman law firm, Nestl imports around 28 million pounds of seafood-based pet products to the United States through Thai Union Frozen Products PCL. The ingredients in those products have been said to be the result of slave labor. The lawsuit alleges that male individuals are often taken from certain areas in Thailand, Myanmar, and Cambodia, and sold to companies like Thai Union. These individuals work for around 20 hours a day with little pay, and if their work doesn't meet standard requirements they are severely punished. Although protection of human rights is one of Nestl's corporate principles, Steve Berman, managing partner of the Hagens Berman law firm, had said that keeping these from the public has allowed Nestl to mislead millions of consumers, who support and encourage slave labor in the production of its pet food without even knowing it. Research \& Development Nestl has the largest R\&D network and budget of any food company in the world, with total R\&D expenses of 1.6 billion CHF in 2014 that amounted to 1.8 percent of total sales. Hershey and Mondelez (producers of Cadbury, Nabisco, and other products) by comparison had no R\&D expenses listed on their respective income statement in 2014. Nestl has 34R&D facilities with over 5,000 employees around the world working to provide healthier food options for consumers. Switzerland is the base for almost two-thirds of Nestl's research and development. While these expenses are still relatively small in relation to total revenues, Nestl is aiming to transform itself from merely a food company to a health and wellness company. With its strategy to produce healthier food and baby formulas, and to enter into the skin care market, research and development is likely to become of increased strategic importance for Nestl moving forward. In fact, Nestl plans to open R\&D centers in the United States for frozen foods, and in Shanghai for skin care products focused on an aging population. Finance Nestl's revenues dropped marginally in 2014 as revealed in Exhibit 2, but its net income increased 43 percent. Total assets, as shown in Exhibit 3, increased 10 percent in 2014 mostly due to a 10 percent increase in the company's goodwill and intangibles. Segments Nestl is well diversified within the food industry with a range, for example, from pet food and skin care products. Exhibit 4 below reveals Nestl's 2014 and 2013 revenues over its 7 segments. Note that sales dropped in 5 product categories in 2014, only increasing in the Nutrition and Health Science segment and the Water segment. The year 2014 as a whole was slow for many in the food industry, so Nestl's sales are not out of line with industry norms. Nestl's increase in Nutrition and Health Science sales is in line with the firm's overall strategy of becoming increasingly a health and wellness firm, rather than solely a packaged-food company. EXHIBIT 2 Nestl's Income Statements (in millions CHF) Source: Based on Nestl's 2014 Consolidated Financial Statements Report, pages 58-59. source: sased on ivestue s U14 Consollaatea r manclat statements Keport, pages ou-01. EXHIBIT 4 Nestl's Sales (in millions of CHF) Source: Based on Nestl's 2014 Annual Report, p. 43. EXHIBIT 5 Nestl's 2014 Operating Profit Breakdown Powdered and Liquid Beverages Milk Products and Ice Cream Prepared Dishes and Cooking Aids Nutrition and Health Science Pet Care Confectionery Water Source: Based on Nestl's 2014 Annual Report, p. 43. Exhibit 5 represents Nestl's operating profits for each division during 2014. Note that Nestl Water profits only comprise 4 percent of the company total. Nevertheless, Nestle's sales and profits are quite diversified, with no one product category generating more than 30 percent of total 2014 operating profits. Much like Nestl's product categories, Nestl's geographical diversification is quite good, with roughly a quarter of 2014 revenues divided between Europe, North America, Asia, and the rest of the world as shown by Exhibit 6 . It is quite remarkable that Nestl is not overly dependent on any one region. If needed, Nestl should divert its resources to more profitable regions. For example, in 2014 Nestl's sales in Brazil, Philippines, and Russia increased 10.6, 9.4, and 13.4 percent respectively, based on local currency (not taking into account exchanges rates with the Swiss Franc). These three nations are fairly sizable in volume as well, with Brazil producing the 4th largest revenues of any country served by Nestl, and Philippines and Russia ranking 8th and 12th globally in Nestl's total sales. No other country in the top 12 experienced growth in local currency over 3 percent, with several reporting lower sales in 2014 than 2013. Nestl did suffer from the depreciation of the Russian ruble, Mexican peso, and Australian dollar in 2014. The first half of 2015, however, continued to indicate a slowdown in emerging markets, especially China, while established markets remained stable. Competitors Nestl competes primarily in the food and beverage business with 70 percent of operating profits derived from these products and the remaining profits derived relatively evenly between skin care and pet food products. Within the food and beverage business, Nestl finds itself competing with global chocolate giants, Hershey, Mars and others, along with firms such as French-based Danone, European focused Nomad Foods, U.S.-based Kraft, and many more. In the skin care business, Nestl competes with a slew of consumer products firms such as giant Unilever. On pet foods, Nestl competes with familiar competitors such as the world leader in pet food, which may be surprising to some, Mars. Del Monte, along with Procter \& Gamble (P\&G) are also in the pet food business. EXHIBIT 6 Nestl's 2014 Sales Breakdown by Geographic Region Europe US \& Canada Asia Latin America \& Caribbean Africa Oceania Source: Based on Nestl's 2014 Annual Report, p. 47. Hershey Headquartered in Hershey, Pennsylvania, The Hershey Company is the largest chocolate producer in North America and a confectionary leader worldwide, with over 80 brands, annual revenues of over $7 billion, with about 20,000 employees, and operations in about 80 countries. Hershey offers chocolates as well as other candies, mints, and chewing gum. Notable products include Hershey Kisses, Mr. Goodbar, Twizzlers, Jolly Ranchers, Ice Breakers, and, what may arguably be the best selling candy bar on the planet -Reese's, a Hershey brand that became an official sponsor of ESPN college football game day, in 2015. Hershey is currently expanding globally with strategic emphasis on markets in China and Mexico, but the company still derives about 85 percent of its revenue from the USA. In 2015, Hershey introduced products like KitKat White Minis, Hershey's caramels, Reese's Spreads Snacksters, and Graham Dippers. In early 2015 , Hershey acquired KRAVE Pure Foods, Inc. for about $300 million. KRAVE, founded in 2009, is a maker of beef jerky and other high-protein snacks. Hershey is focusing on getting a share of the ever-increasing meat snacks market, and building its capacity to make foods that consumers want to snack on. It expects the U.S. meat snacks category, valued at about $2.5 billion, to grow at a double-digit pace. Hershey plans to operate KRAVE, which saw $35 million in sales in 2014, as a single business unit in the North America division; KRAVE's founder, Mr. Sebastiani, continues to head the business as the company's president. Mars, Inc. Mars is the second largest candy manufacturer in the United States and the third largest privately-held company in the United States according to Forbes. Headquartered in McLean, Virginia, and having annual sales of over $30 billion, Mars, like Nestl, is well diversified with six business units consisting of chocolate, drinks, food, symbio-science, pet care, and Wrigley chewing gum. Mars blockbuster chocolate brands include: Snickers, Milky Way, M\&Ms, Dove, Bounty, 3 Musketeers, Starburst, Skittles, among others. Mars' annual revenue in 2014 was about $35 billion, more than 50 percent higher than in 2007 , largely due to the firm's 2008 acquisition of Wrigley. Since patenting recipes is difficult and producing chocolate is secretive, Mars does not allow visitors to its kitchens in its factories and facilities. Mars' first blockbuster product back in 1923 was the Milky Way candy bar. Market researcher Euromonitor International recently reported that Mars' market share in the USA rose to 28 percent from 24 percent. To further battle Hershey, Mars in 2014 opened a new 500,000 square foot chocolate factory in Topeka, Kansas at a cost of $270 million. Almost every day, the factory cranks out around 39 million peanut M\&M's and 8 million miniature Snickers candy bars. Like Nestl, Mars advocates globally sustainability of the cocoa resource but has received criticism in recent years over purchasing cocoa from West African farms that use child labor. Mars is also one of the world's biggest producers of dog food and pet-care products. Mars' Wrigley division produces chewing gums, confectionery products, and a variety of other products ranging from Uncle Ben's rice to Flavia coffee. Pedigree, Greenies, and Whiskas are some of the pet-food brands under Mars. Interestingly, chocolate is Mars' second-largest business globally, behind pet care. Danone Danoneis a global company based in Paris, France with 21 billion euros in revenue in 2014. The firm has four key operating segments-dairy products, water, baby nutrition, and medical nutrition, representing 52,21,20, and 7 percent of revenues respectively. Danone is also fairly diverse geographically with sales of approximately 40, 24 and 36 percent in Europe, North America, and Other respectively. With the close overlap on products and markets served, Danone is a significant competitor to Nestl on many key areas. In early 2015 , Danone warned sales for 2015 were expected to decline and the company planned on cutting costs and reorganizing production. However, the first half of 2015 was profitable for Danone as the Euro has depreciated much more than the Swiss Franc, making conversions back to Euros more beneficial for the firm. Chinese demand for baby formula was also strong in the first half of 2015 leading to an increase in worldwide Early Nutrition sales of 11 percent from the first half of 2015 compared to first half of 2014. Over the same time period, Dairy, Waters, and Medical Nutrition decreased/increased (0.4), 9.5 and 8.1 respectively at Danone. Nomad Foods Nomad Foods is a large food company based in the British Virgin Islands. Nomad derives nearly 90 percent of its revenues from the United Kingdom, Germany, Italy, and Austria. Nomad reported over 1.5 billion euros in revenues in 2014, but should see this number increase substantially with its 2015 purchase of Iglo, which included Birds Eye and Findus Group's European operations for \$2.8 billion USD expanding the firms reach across a much broader European footprint. Nomad is focused primarily on the frozen food market, and is now targeting possible U.S. acquisitions. External Issues Flavor Enhancers There is a growing awareness of sugars harmful effects on people in particular high-fructose corn syrup and salt. Hershey is a high-profile example of the move away from high-fructose corn syrup that has may fuel weight gain and diabetes, using sugar in some of its products as a replacement for high-fructose corn syrup. However, the American Medical Association stated that restricting the use of syrup is not supported with enough evidence. The Corn Refiners Association, through research by firms like Mintel and Nielsen, analyzed perceptions of sweeteners and observed that 67 percent of consumers felt specific sweetener types were less important than moderation. In the food and beverage industry, soda constitutes a large portion of the high-fructose corn syrup market. Hunt's ketchup is one product to have reverted to using corn syrup after having tried more sugar because there was no change in the sales. The U.S. Food and Drug Administration (FDA) had denied requests made by some companies to have their sweetening agent renamed "corn sugar" on nutrition labels. In addition to this, in July 2015 the FDA proposed forcing food producing companies to add the percent daily value of added sugar on all nutrition labels like the percent daily allowance of salt, fat, and other ingredients, which are listed on the product labels. Any added sugar, just as in the case of corn syrup, can have dramatic effects on the body. Added sugars are linked to diabetes, tooth decay, heart problems, weight gain, and many other health problems. In response to sugar being harmful, there is a growing global demand for artificial sweeteners as a means to reduce calories, stabilize blood sugar levels, and just an overall healthier choice rather than raw sugar. However, to date, research in this area is not conclusive as some studies reveal artificial sweeteners are similar to raw sugar once ingested. Europe has banned several artificial sweetener products such as Stevia and aspartame from lack on conclusive research, but other nations such as Japan and the United States have been using the same sweeteners for decades. Never the less, there is a growing public awareness toward both raw and artificial sugars. Another common flavor enhancer found in food is salt. Table salt has been linked to water retention, high blood pressure, stomach cancer, osteoporosis, and killing of beneficial bacterial in the body. Many medical researches recommend limiting salt consumption to 6 grams a day, however the World Health Organization suggests the average person consumes between 9 and 12 grams of salt daily. Many food companies are attempting to reduce the amount of sodium in their products as global awareness increases on the harmful effects of a high salt diet. Nestl, for example is experimenting with reducing both salt and sugar from its foods and replacing them with natural flavorings. Cocoa Prices Over 100 years ago, chocolate was generally considered a luxury for the rich and out of the grasp of lower income customers. However, today consumers in emerging markets worldwide are able to afford increasingly higher quality chocolates that require better and higher percentages of cocoa. Unlike other crops such as corn or soybeans, cocoa is more difficult to produce and cocoa prices are expected to rise substantially moving forward, according to the International Cocoa Organization (ICO). Typically cocoa trees take upwards of 10 years to mature and many trees now are old, not yielding the same number or quality of beans. Farmers are also switching to more profitable crops, even as the price per ton of cocoa approaches $3,000 per ton. Analysts estimate the cocoa price would need to be $3,500 per ton to maintain current production rates from farmers. In fact the ICO expects the demand to production ratio to be the highest ever by 2018 , since it started keeping records in 1960. In 2013 alone, worldwide consumption of cocoa beans was up 32 percent from 2012 and Chinese demand is projected to rise 5 percent annually through 2018. To help combat the new demand, Mars and Nestl have spent millions to educate farmers in West Africa on proper techniques and in developing new types of cocoa trees. The Ebola virus outbreak in West Africa threatened hundreds of cocoa farms. North American based Blommer Chocolate Company is a top cocoa processor and one of the main suppliers to rival Hershey and other chocolate producing companies. Blommer is expanding its processing capacity to meet strong chocolate demand in the United States. Nevertheless, chocolate companies are facing tough choices that include raising prices, reducing portion sizes, or even using less cocoa in its products. As early as 2006, Hershey started using substitutes for cocoa butter in the production of Krackel and Mr. Goodbar which resulted in the firm having to change the label "milk chocolate" to "made with chocolate" or "chocolate candy" to comply with the FDA protocols for labeling of chocolate food items. Hershey however is now switching both Krackel and Mr. Goodbar back to solid milk chocolate, meaning the bars will contain at least 10 percent cocoa per FDA regulations to be called milk chocolate. Potential Taxes and Health-Minded Public There is a growing awareness worldwide to unhealthy eating, especially when it comes to sugars, processed foods, and animal fats. Many different governments (local, regional and national) have (or plan to) increased taxes or flat out banned unhealthy items. Taxes are viewed by governments much like tobacco taxes as a way not only to curb citizens' consumption but also as an additional means of revenues. For example, Connecticut recently proposed a 2 percent additional tax on all soda, suggesting it would provide $144 million in annual revenues and reduce soda consumption in the state. New York City has banned most sugary drinks 16oz and larger from being served. The Navajos Nation, the largest American Indian Reservation in the United States with 300,000 members, is proposing a tax of up to 7 percent on fatty snacks and soda, up from the current level of 5 percent, while healthy food items are excluded from taxation. Former NBA star Yao Ming is campaigning in his home country of China to promote healthier eating and exercise habits. Mexico recently passed legislation to significantly tax both sugary drinks and high calorie items such as candy. Peru, Uruguay, and Costa Rica banned all junk food from public schools, including candy bars, back in 2012. Many other nations in Latin America require red or yellow circles around sugar content on items depending on their sugar content. All of these actions and trends are a threat to Nestl. Increasing obesity is a major problem among the world's population. Processed sugar negatively impacts the body by increasing your chances of tooth decay, obesity, and diabetes, and additionally can significantly increase ones chances of getting heart disease and even cancer. Scientific tests reveal that sugar is basically a food for cancer cells and people that drink 2 soft drinks a week are 87 percent more likely to develop pancreatic cancer. For comparison, a Nestl Butterfinger and Baby Ruth contain 29 and 33 grams of sugar respectively, and a can of cola contains around 39g of sugar. Sugar is also believed to be damaging to your skin, looks and overall mood. Moving forward, Nestl could consider increased marketing of dark chocolate, which contain good antioxidants, but is much higher in saturated fat than milk chocolate and contains high levels of sugar. Sugar free candy has also been linked to cancer and weight gain, partly because artificial sweeteners are not healthy. By 2017, almost 150 artificial ingredients, like artificial sweeteners, preservatives and artificial flavor enhancers, will be discarded from Panera Bread Company's kitchens. Food companies are increasingly eliminating unnatural and unhealthy ingredients. For example, natural colorings made from turmeric and paprika will replace Kraft Heinz Company's artificial colorings in its macaroni and cheese product, and PepsiCo's Diet Pepsi will see a switch from artificial sweetener aspartame to sucralose. After an environmental advocacy group said it found nanoparticles, through laboratory tests, in the Dunkin Donut's white powdered sugar, the company will do away with titanium dioxide (a whitening agent used in sunscreen) from its recipes. Nanoparticles, like titanium dioxide, may cause damage to cells and tissues. Hair Care, Skin Care, Cosmetics The hair care, skin care and cosmetic industry in the USA accounts for over $55 billion in annual sales and enjoyed a growth rate of nearly 6 percent from 2010 through 2014 . Much like many food products, consumers still purchased beauty products at relatively high rates even during the recession. Growth is projected to continue through 2020 at rate of nearly 4 percent. Hair care and skin care products are the two largest revenue producing contributions to the industry as a whole with revenues each of approximately $13 billion totaling just short of 50 percent of total revenues combined. Higher marketing and R\&D expenses, along with a growing concern for reduced packaging, animal safety, and product safety all negatively hurt profits. Consumers also are quick to switch from brand to brand, and are showing less brand loyalty presenting both threats and opportunities for producers. There is also a growing influx of imported products from around the world on all price points. Generally perceived higher quality products are imported from Europe, where perceived lower quality and lower priced products are imported from Mexico and China. Skin care products continue to grow as a percent of total industry market share as more and more people are using these products, including men. In 2014, skin care products barely trailed hair care products in industry wide sales, but are expected to be the largest revenue producing product category moving forward. Firms promote antiaging treatments and wrinkle reducing creams. Even creams promoted to remove back circles from under the eyes are available. Sunscreen is also in this category. Este Lauder's CEO recently suggested that men's skin care products may outpace company-wide growth at his firm moving forward. Activist Shareholders Food and beverage companies have been popular targets for activist shareholders because of their bloated lackluster growth. In August 2015, Bill Ackman disclosed a stake in Mondelz International, spurring speculation that he would seek cost cuts and potentially a sale. Similarly ConAgra Foods and Boulder Brands have recently faced calls for shakeups. So far however, activist investors have mainly targeted U.S. food companies, but Nestl's underperformance is attracting prying eyes. Nestl is grappling with falling demand for its biscuits and peanut-milk beverages in China and the recall in India of its popular Maggi instant noodles. Its frozen-food business is not performing well. Given the activist shareholder environment, Nestl may want to consider divesting its frozen-food division, along with the company's 23.2 percent stake in cosmetics maker L'Oral S.A. Nestl could add 21 billion euros ( $23 billion) of cash flow through 2018 by gradually reducing its stake in L'Oral, said Jeff Stent, an analyst at Exane BNP Paribas. Nestl could use that money to boost its share buyback or to make acquisitions. Additionally, an activist shareholder could require Nestl to sell is its skin-health business. Nestl acquired full control of the Galderma wrinkle treatment and acne medication business from joint-venture partner L'Oral in 2014, but skincare does not fit well with food and beverages. To significantly impact Nestl, an activist investor would need at least a 1 percent stake, said Urs Beck, a fund manager at EFG Asset Management. That would cost more than $2 billion. Jenny Craig and PowerBar are two examples of businesses that Nestl acquired, held onto for too long and got depressed prices for in later divestitures. The political environment in Switzerland also gives activist investors another reason to "go for" Nestl. Switzerland has instituted a "fat-cat" referendum that gives shareholders more say over salaries and the ability to eject an entire board. Even Nestl's Chairman Peter Brabeck-Letmathe has said new Swiss laws threaten the company's long-term strategy. A new proposal that would allow investors to sue management and directors, even amid opposition by most shareholders, is also flawed, he has said."Activist shareholders and plaintiffs" lawyers would be granted free reign," Brabeck-Lemathe says. Future Nestl has many internal and external issues to consider as the company struggles to help feed the world and reward shareholders, employees, and customers. The company is determined to become a renowned nutrition and corporate wellness company, but many of its products still are unhealthy for consumption. Nestl needs a clear strategic plan going forward. Develop a three-year strategic plan for Nestl S.A. that will enable the company to meet its many obligations to the many shareholders who expect to see the company grow both revenues and profits annually

BY FOREST R. DAVID AND MEREDITH E. DAVID www.nestl.com (NSRGY) Headquartered in Vevey, Switzerland, Nestl is one of the largest food producing companies in the world providing quality, healthy, and tasty treats and meals for all ages. Nestl's diversified portfolio includes notable product categories like baby foods, pet foods, dairy products, coffee, frozen goods, bottled water, and weight management products. Across this range of products, the top Nestl brands include Milo, Hagen-Dazs, Carnation milk, Coffee Mate, Nescafe, Perrier, DiGiorno, Stouffers, Lean Cuisine, Nesquik, Purina pet foods, Butterfinger, Baby Ruth, and Nestl Toll House among others. Nestl also has many brands under a specific product category. For example, it has over 70 bottled water brands in its portfolio, and over 100 chocolate \& confectionary brands. Nestl reported that in 2014 of the group's sales was 91.6 billion Swiss Francs (CHF) or approximately $98.8 billion USD based on 2014 average exchange rates. This indicated that the sales in 2014 were down a minimal 500 million CHF from 2013, approximately 0.6 percent. In the 2014 sales breakdown for the firm that competes globally, the United States accounts for 28 percent; Latin America and Caribbean, 15 percent; Europe, 28 percent; and Asia, Oceania, and Africa, 29 percent. During the first half of 2015, Nestle faced a food contamination scare in India and was forced to recall its range of instant noodles Maggi, from the shelves in the Indian market costing the company 66 million Swiss francs (\$67 million); Nestl also had to pay a \$100 million USD fine. Overall, Nestl's sales declined slightly to 42.84 billion Swiss francs ( $43.70 billion) from 42.98 billion francs a year earlier. The group's net profit fell 2.5 percent to 4.52 billion francs. So while Nestl, like many other food companies, saw a particular slump in frozen food sales, at constant rates, their sales had improved. The slump, especially in the United States of America, was due to a shift in consumer perception toward food products that they feel are fresh or natural. Even though frozen vegetables and freshly farmed products are often as wholesome as each other, people still view frozen meals and snacks as having more preservatives, sugar, and sodium. Despite this chill over the frozen food market, Nestl's research and development team has recently focused its effort on revamping frozen-food brands Lean Cuisine and Stouffer's, with an eye on product-packaging and health attributes. Though the company is still struggling with the strong franc and its product recall in India that resulted in its first ever quarterly loss in India, in 2015 the revenue in the Americas increased 5.2 percent from the 3.7 percent growth in the first quarter. This growth was driven mainly by increased pricing. Nestl's CEO, Paul Bulcke, recently diversified the company into skin health, spending almost $5 billion in 2014 to acquire L'Oral S.A.'s stake in a joint venture, and rights to sell certain medical products from Valeant Pharmaceuticals International Inc. In the third quarter of 2015, Nestl inaugurated its third Nespresso plant, at Romont Switzerland. This move is a strategic, long-term plan for Nestl with a focus on producing its new large-cup Vertuo Line, a coffee machine that will compete with Keurig Green Mountain's K-cup. Nestl's North American Nespresso sales grew with its 2014 launch of the Vertuo Line, and it now has 36 new boutiques in the United States. The coffee capsule market in the United States is worth $5 billion and, thus, is a key growth market for Nespresso-flourishing in Europe, but nascent in the United States. The company spent around 300 million Swiss francs (\$308.29 million) to construct the Romont plant. While the plant has a capacity to employ 300-400 workers, it has 125 employees. Copyright by Fred David Books LLC. www.strategyclub.com (Written by Forest R. David) History The first thing most people instantly associate Nestl with is chocolate products, but Nestl's roots are embedded in milk products, in particular baby formula. Nestl's roots can be traced back to 1866 when the Anglo-Swiss Condensed Milk Company first opened a milk factory in Cham, Switzerland. Nestl was actually founded one year later in 1867 when a German pharmacist, Henri Nestl, saved a neighbor's child in Vevey, Switzerland, from starvation with a mixture comprising cow's milk, wheat flour, and sugar. Fittingly enough, Nestl's first logo was that of a mother bird feeding her new hatchlings. Nestl benefitted from World War I, which had created a shortage of food and governments were seeking contracts to help feed its militaries. By the end of the War, the firm had grown from a few factories to over 40 across various countries. Notable product launches after World War I included Nescafe in 1938 and Nestea a few years later. At the conclusion of World War II, Nestl saw rapid growth, adding many new product lines and even diversifying by purchasing a stake in Paris based cosmetics maker L'Oral. In the early 1990s, Nestl benefited tremendously from the fall of communism in the former Soviet Union and Eastern Europe. Nestle diversified into the pet food business in 2001 with the acquisition of Ralston Purina. Nestl went on to purchase the American baby food giant Gerber in 2007 and Wyeth Nutrition from Pfizer Nutrition a few years later, strengthening its baby nutrition business. In 2014, Nestl expanded its Nestl Skin Health S.A. business to capitalize on the growing trends of global skin care. Part of Nestl's motivation for these acquisitions was to shift their business more towards nutrition and health from simply candy, food, canned goods, and other less nutritious products. Internal Issues Organizational Structure Nestl operates from a strategic business unit (SBU) type organizational structure as illustrated on the company website's About Us section; Exhibit 1 provides a list of Nestl's top executives along with their title. It should be noted that there is one woman (Patrice Bula) among 16 top executives; providing opportunities in upper management for women is an area Nestl should work on improving in the future. Vision and Mission Nestl does not use the terms vision or mission, but on the company website's About Us section, the firm clearly states that it is "committed to enhancing people's lives by offering tastier and healthier food and beverage choices at all stages of life and at all times of the day." Nestl prides itself on being ethical and nonnegotiable on quality and safety. Strategy Being a global organization, Nestl's strategy has always displayed a competitive focus. Their corporate roadmap is threefold. Nestl has certain operational pillars that include innovation, consumer engagement, and operational efficiency. Nestle also has certain growth drivers. One such growth driver for the group is in its image transformation from a packaged food company to one that focuses on nutrition, health, and wellness. While it has no plans to stop selling chocolate, coffee, ice cream, and other food products that it is world famous for, Nestl is actively engaged in offering healthier food options to its customers. The firm has the largest research and development budget of any food company and it aims use this to produce healthier and tastier food options, from infant formula to products designed for senior citizens. Nestl has recently reduced the amount of salt, sugar, and saturated fats in many of its products as a means of improving the nutrition quotient, and enhancing other flavors so as to not reduce the taste of these products. One key area that Nestl will focus on improving in December 2015 is its Policy on Marketing Communication to Children. The company will be looking at phasing out their marketing communication in schools and increasing their focus on health and wellness education through various mediums including the television. Nestl currently has a series running in both Mexico and the Philippines to better target children. The global ice cream market's growth expectation was to go from $67 billion in 2014 to $71 billion in 2015, with Unilever and Nestl having one third of that market share. However, consumers who are more aware of and concerned about healthy diets prefer smaller treats and niche brands with healthier ingredients to large blocks of ice cream. As part of their focus on premiumization, Nestl is putting up some bulk ice cream businesses for sale, while entering new markets, acquiring start-ups, and introducing new products. Independent brands like the United Kingdom's Jude's, America's Ciao Bella, China Mengniu Dairy, and R\&R Ice Cream in Europe are gaining market share. Nestl sells the banana-like Peelin' Pops, as well as Hagen-Dazs and Movenpick, but some of its consumer ice cream operations have already been sold. More of its ice cream business, which provides the company about $4 billion of its $95 billion in annual revenue, is likely to be divested. In 2015 , Nestl sold its South African ice cream business to R\&R Ice Cream. Nestls wants its operations to focus on nutrition and health. According to an analyst at the Swiss private bank Vontobel, Nestl may not want to increase its share in the unhealthy ice cream business. Nestl also looks at its competitive advantages-having unmatched product portfolio, research and development capacities, and geographic presence - in its roadmap. Expanding on its health and wellness portfolio, Nestl sold its stake in L'Oral in 2014 and used part of the proceeds to gain 100 percent control of Galderma, the foundation of Nestl's subsidiary, Nestl Skin Health. The vision behind this acquisition is for it to become the most recognized company in the skin health category in the world through science-based solutions. Social Responsibility Nestl is one of the most socially responsible companies in the world, and has even created an award for businesses that excel in rural development, nutrition, and clean water initiatives. In the 2014 social responsibility statement to shareholders, CEO Bulcke stated that at the heart of Nestl's corporate strategy is a desire to be the leading nutrition, health, and wellness-company in the world. Nestl has shared 38 commitments that they aim to meet before or by 2020 , including producing healthier food products, focusing on responsible marketing to children and women who opt to use baby formulas instead of breast feeding, water and other environmental conservation, and focus on human rights and workers' rights for employees at Nestl. Although Nestl is doing an excellent job of reducing sodium and sugars in foods, providing direction to farmers and rural communities on how to maintain healthy water systems, and displaying ethical marketing of its products, the firm lacks in opportunities for women in upper management. As of 2014,25 percent of senior leaders and 34 percent of management were women, but only 1 woman is listed out of the 16 people mentioned in the organizational chart of top management (see Exhibit 1 on page 55). Nestl solicited the opinions and recommendations of the Bureau Veritas in 2014 to audit its social responsibility initiatives and provide directions for improvements. Bureau Veritas found Nestl was in compliance with all social issues addressed, in particular Nestl's work in rural development. Moving forward, a key area for improvement for Nestl would be in developing a clear methodology to quantify the benefits from the firm's work in rural development. Currently, Nestl is focusing on case studies of just a few areas where it is working on rural development activities. Bureau Veritas also suggested Nestl provide increased disclosure to stakeholders on its R\&D programs that are transforming Nestl from a food and beverage business to a health, nutrition and wellness business. Nestl has received numerous accolades for its commitment to being socially responsible. In 2013, Nestl ranked 3rd among global food providers in the Access to Nutrition Index, which measures firms on a variety of factors such as governance, ethical marketing, accessibility, product labeling, and other parameters. In October 2014, Nestl received a score of 96 out of 100 from the Climate Disclosure Index and received a maximum score of 20 from the Carbon Disclosure Project Water. Also in 2014, the Dow Jones Sustainability Index assigned a score of 88 to Nestl, placing the firm second in its industry. Despite numerous accolades, in August 2015 Nestl was sued in California for allegedly knowingly allowing a Thai supplier that employed slave labor to provide fish for its Fancy Feast cat food products. According to the class action lawsuit filed by the Hagens Berman law firm, Nestl imports around 28 million pounds of seafood-based pet products to the United States through Thai Union Frozen Products PCL. The ingredients in those products have been said to be the result of slave labor. The lawsuit alleges that male individuals are often taken from certain areas in Thailand, Myanmar, and Cambodia, and sold to companies like Thai Union. These individuals work for around 20 hours a day with little pay, and if their work doesn't meet standard requirements they are severely punished. Although protection of human rights is one of Nestl's corporate principles, Steve Berman, managing partner of the Hagens Berman law firm, had said that keeping these from the public has allowed Nestl to mislead millions of consumers, who support and encourage slave labor in the production of its pet food without even knowing it. Research \& Development Nestl has the largest R\&D network and budget of any food company in the world, with total R\&D expenses of 1.6 billion CHF in 2014 that amounted to 1.8 percent of total sales. Hershey and Mondelez (producers of Cadbury, Nabisco, and other products) by comparison had no R\&D expenses listed on their respective income statement in 2014. Nestl has 34R&D facilities with over 5,000 employees around the world working to provide healthier food options for consumers. Switzerland is the base for almost two-thirds of Nestl's research and development. While these expenses are still relatively small in relation to total revenues, Nestl is aiming to transform itself from merely a food company to a health and wellness company. With its strategy to produce healthier food and baby formulas, and to enter into the skin care market, research and development is likely to become of increased strategic importance for Nestl moving forward. In fact, Nestl plans to open R\&D centers in the United States for frozen foods, and in Shanghai for skin care products focused on an aging population. Finance Nestl's revenues dropped marginally in 2014 as revealed in Exhibit 2, but its net income increased 43 percent. Total assets, as shown in Exhibit 3, increased 10 percent in 2014 mostly due to a 10 percent increase in the company's goodwill and intangibles. Segments Nestl is well diversified within the food industry with a range, for example, from pet food and skin care products. Exhibit 4 below reveals Nestl's 2014 and 2013 revenues over its 7 segments. Note that sales dropped in 5 product categories in 2014, only increasing in the Nutrition and Health Science segment and the Water segment. The year 2014 as a whole was slow for many in the food industry, so Nestl's sales are not out of line with industry norms. Nestl's increase in Nutrition and Health Science sales is in line with the firm's overall strategy of becoming increasingly a health and wellness firm, rather than solely a packaged-food company. EXHIBIT 2 Nestl's Income Statements (in millions CHF) Source: Based on Nestl's 2014 Consolidated Financial Statements Report, pages 58-59. source: sased on ivestue s U14 Consollaatea r manclat statements Keport, pages ou-01. EXHIBIT 4 Nestl's Sales (in millions of CHF) Source: Based on Nestl's 2014 Annual Report, p. 43. EXHIBIT 5 Nestl's 2014 Operating Profit Breakdown Powdered and Liquid Beverages Milk Products and Ice Cream Prepared Dishes and Cooking Aids Nutrition and Health Science Pet Care Confectionery Water Source: Based on Nestl's 2014 Annual Report, p. 43. Exhibit 5 represents Nestl's operating profits for each division during 2014. Note that Nestl Water profits only comprise 4 percent of the company total. Nevertheless, Nestle's sales and profits are quite diversified, with no one product category generating more than 30 percent of total 2014 operating profits. Much like Nestl's product categories, Nestl's geographical diversification is quite good, with roughly a quarter of 2014 revenues divided between Europe, North America, Asia, and the rest of the world as shown by Exhibit 6 . It is quite remarkable that Nestl is not overly dependent on any one region. If needed, Nestl should divert its resources to more profitable regions. For example, in 2014 Nestl's sales in Brazil, Philippines, and Russia increased 10.6, 9.4, and 13.4 percent respectively, based on local currency (not taking into account exchanges rates with the Swiss Franc). These three nations are fairly sizable in volume as well, with Brazil producing the 4th largest revenues of any country served by Nestl, and Philippines and Russia ranking 8th and 12th globally in Nestl's total sales. No other country in the top 12 experienced growth in local currency over 3 percent, with several reporting lower sales in 2014 than 2013. Nestl did suffer from the depreciation of the Russian ruble, Mexican peso, and Australian dollar in 2014. The first half of 2015, however, continued to indicate a slowdown in emerging markets, especially China, while established markets remained stable. Competitors Nestl competes primarily in the food and beverage business with 70 percent of operating profits derived from these products and the remaining profits derived relatively evenly between skin care and pet food products. Within the food and beverage business, Nestl finds itself competing with global chocolate giants, Hershey, Mars and others, along with firms such as French-based Danone, European focused Nomad Foods, U.S.-based Kraft, and many more. In the skin care business, Nestl competes with a slew of consumer products firms such as giant Unilever. On pet foods, Nestl competes with familiar competitors such as the world leader in pet food, which may be surprising to some, Mars. Del Monte, along with Procter \& Gamble (P\&G) are also in the pet food business. EXHIBIT 6 Nestl's 2014 Sales Breakdown by Geographic Region Europe US \& Canada Asia Latin America \& Caribbean Africa Oceania Source: Based on Nestl's 2014 Annual Report, p. 47. Hershey Headquartered in Hershey, Pennsylvania, The Hershey Company is the largest chocolate producer in North America and a confectionary leader worldwide, with over 80 brands, annual revenues of over $7 billion, with about 20,000 employees, and operations in about 80 countries. Hershey offers chocolates as well as other candies, mints, and chewing gum. Notable products include Hershey Kisses, Mr. Goodbar, Twizzlers, Jolly Ranchers, Ice Breakers, and, what may arguably be the best selling candy bar on the planet -Reese's, a Hershey brand that became an official sponsor of ESPN college football game day, in 2015. Hershey is currently expanding globally with strategic emphasis on markets in China and Mexico, but the company still derives about 85 percent of its revenue from the USA. In 2015, Hershey introduced products like KitKat White Minis, Hershey's caramels, Reese's Spreads Snacksters, and Graham Dippers. In early 2015 , Hershey acquired KRAVE Pure Foods, Inc. for about $300 million. KRAVE, founded in 2009, is a maker of beef jerky and other high-protein snacks. Hershey is focusing on getting a share of the ever-increasing meat snacks market, and building its capacity to make foods that consumers want to snack on. It expects the U.S. meat snacks category, valued at about $2.5 billion, to grow at a double-digit pace. Hershey plans to operate KRAVE, which saw $35 million in sales in 2014, as a single business unit in the North America division; KRAVE's founder, Mr. Sebastiani, continues to head the business as the company's president. Mars, Inc. Mars is the second largest candy manufacturer in the United States and the third largest privately-held company in the United States according to Forbes. Headquartered in McLean, Virginia, and having annual sales of over $30 billion, Mars, like Nestl, is well diversified with six business units consisting of chocolate, drinks, food, symbio-science, pet care, and Wrigley chewing gum. Mars blockbuster chocolate brands include: Snickers, Milky Way, M\&Ms, Dove, Bounty, 3 Musketeers, Starburst, Skittles, among others. Mars' annual revenue in 2014 was about $35 billion, more than 50 percent higher than in 2007 , largely due to the firm's 2008 acquisition of Wrigley. Since patenting recipes is difficult and producing chocolate is secretive, Mars does not allow visitors to its kitchens in its factories and facilities. Mars' first blockbuster product back in 1923 was the Milky Way candy bar. Market researcher Euromonitor International recently reported that Mars' market share in the USA rose to 28 percent from 24 percent. To further battle Hershey, Mars in 2014 opened a new 500,000 square foot chocolate factory in Topeka, Kansas at a cost of $270 million. Almost every day, the factory cranks out around 39 million peanut M\&M's and 8 million miniature Snickers candy bars. Like Nestl, Mars advocates globally sustainability of the cocoa resource but has received criticism in recent years over purchasing cocoa from West African farms that use child labor. Mars is also one of the world's biggest producers of dog food and pet-care products. Mars' Wrigley division produces chewing gums, confectionery products, and a variety of other products ranging from Uncle Ben's rice to Flavia coffee. Pedigree, Greenies, and Whiskas are some of the pet-food brands under Mars. Interestingly, chocolate is Mars' second-largest business globally, behind pet care. Danone Danoneis a global company based in Paris, France with 21 billion euros in revenue in 2014. The firm has four key operating segments-dairy products, water, baby nutrition, and medical nutrition, representing 52,21,20, and 7 percent of revenues respectively. Danone is also fairly diverse geographically with sales of approximately 40, 24 and 36 percent in Europe, North America, and Other respectively. With the close overlap on products and markets served, Danone is a significant competitor to Nestl on many key areas. In early 2015 , Danone warned sales for 2015 were expected to decline and the company planned on cutting costs and reorganizing production. However, the first half of 2015 was profitable for Danone as the Euro has depreciated much more than the Swiss Franc, making conversions back to Euros more beneficial for the firm. Chinese demand for baby formula was also strong in the first half of 2015 leading to an increase in worldwide Early Nutrition sales of 11 percent from the first half of 2015 compared to first half of 2014. Over the same time period, Dairy, Waters, and Medical Nutrition decreased/increased (0.4), 9.5 and 8.1 respectively at Danone. Nomad Foods Nomad Foods is a large food company based in the British Virgin Islands. Nomad derives nearly 90 percent of its revenues from the United Kingdom, Germany, Italy, and Austria. Nomad reported over 1.5 billion euros in revenues in 2014, but should see this number increase substantially with its 2015 purchase of Iglo, which included Birds Eye and Findus Group's European operations for \$2.8 billion USD expanding the firms reach across a much broader European footprint. Nomad is focused primarily on the frozen food market, and is now targeting possible U.S. acquisitions. External Issues Flavor Enhancers There is a growing awareness of sugars harmful effects on people in particular high-fructose corn syrup and salt. Hershey is a high-profile example of the move away from high-fructose corn syrup that has may fuel weight gain and diabetes, using sugar in some of its products as a replacement for high-fructose corn syrup. However, the American Medical Association stated that restricting the use of syrup is not supported with enough evidence. The Corn Refiners Association, through research by firms like Mintel and Nielsen, analyzed perceptions of sweeteners and observed that 67 percent of consumers felt specific sweetener types were less important than moderation. In the food and beverage industry, soda constitutes a large portion of the high-fructose corn syrup market. Hunt's ketchup is one product to have reverted to using corn syrup after having tried more sugar because there was no change in the sales. The U.S. Food and Drug Administration (FDA) had denied requests made by some companies to have their sweetening agent renamed "corn sugar" on nutrition labels. In addition to this, in July 2015 the FDA proposed forcing food producing companies to add the percent daily value of added sugar on all nutrition labels like the percent daily allowance of salt, fat, and other ingredients, which are listed on the product labels. Any added sugar, just as in the case of corn syrup, can have dramatic effects on the body. Added sugars are linked to diabetes, tooth decay, heart problems, weight gain, and many other health problems. In response to sugar being harmful, there is a growing global demand for artificial sweeteners as a means to reduce calories, stabilize blood sugar levels, and just an overall healthier choice rather than raw sugar. However, to date, research in this area is not conclusive as some studies reveal artificial sweeteners are similar to raw sugar once ingested. Europe has banned several artificial sweetener products such as Stevia and aspartame from lack on conclusive research, but other nations such as Japan and the United States have been using the same sweeteners for decades. Never the less, there is a growing public awareness toward both raw and artificial sugars. Another common flavor enhancer found in food is salt. Table salt has been linked to water retention, high blood pressure, stomach cancer, osteoporosis, and killing of beneficial bacterial in the body. Many medical researches recommend limiting salt consumption to 6 grams a day, however the World Health Organization suggests the average person consumes between 9 and 12 grams of salt daily. Many food companies are attempting to reduce the amount of sodium in their products as global awareness increases on the harmful effects of a high salt diet. Nestl, for example is experimenting with reducing both salt and sugar from its foods and replacing them with natural flavorings. Cocoa Prices Over 100 years ago, chocolate was generally considered a luxury for the rich and out of the grasp of lower income customers. However, today consumers in emerging markets worldwide are able to afford increasingly higher quality chocolates that require better and higher percentages of cocoa. Unlike other crops such as corn or soybeans, cocoa is more difficult to produce and cocoa prices are expected to rise substantially moving forward, according to the International Cocoa Organization (ICO). Typically cocoa trees take upwards of 10 years to mature and many trees now are old, not yielding the same number or quality of beans. Farmers are also switching to more profitable crops, even as the price per ton of cocoa approaches $3,000 per ton. Analysts estimate the cocoa price would need to be $3,500 per ton to maintain current production rates from farmers. In fact the ICO expects the demand to production ratio to be the highest ever by 2018 , since it started keeping records in 1960. In 2013 alone, worldwide consumption of cocoa beans was up 32 percent from 2012 and Chinese demand is projected to rise 5 percent annually through 2018. To help combat the new demand, Mars and Nestl have spent millions to educate farmers in West Africa on proper techniques and in developing new types of cocoa trees. The Ebola virus outbreak in West Africa threatened hundreds of cocoa farms. North American based Blommer Chocolate Company is a top cocoa processor and one of the main suppliers to rival Hershey and other chocolate producing companies. Blommer is expanding its processing capacity to meet strong chocolate demand in the United States. Nevertheless, chocolate companies are facing tough choices that include raising prices, reducing portion sizes, or even using less cocoa in its products. As early as 2006, Hershey started using substitutes for cocoa butter in the production of Krackel and Mr. Goodbar which resulted in the firm having to change the label "milk chocolate" to "made with chocolate" or "chocolate candy" to comply with the FDA protocols for labeling of chocolate food items. Hershey however is now switching both Krackel and Mr. Goodbar back to solid milk chocolate, meaning the bars will contain at least 10 percent cocoa per FDA regulations to be called milk chocolate. Potential Taxes and Health-Minded Public There is a growing awareness worldwide to unhealthy eating, especially when it comes to sugars, processed foods, and animal fats. Many different governments (local, regional and national) have (or plan to) increased taxes or flat out banned unhealthy items. Taxes are viewed by governments much like tobacco taxes as a way not only to curb citizens' consumption but also as an additional means of revenues. For example, Connecticut recently proposed a 2 percent additional tax on all soda, suggesting it would provide $144 million in annual revenues and reduce soda consumption in the state. New York City has banned most sugary drinks 16oz and larger from being served. The Navajos Nation, the largest American Indian Reservation in the United States with 300,000 members, is proposing a tax of up to 7 percent on fatty snacks and soda, up from the current level of 5 percent, while healthy food items are excluded from taxation. Former NBA star Yao Ming is campaigning in his home country of China to promote healthier eating and exercise habits. Mexico recently passed legislation to significantly tax both sugary drinks and high calorie items such as candy. Peru, Uruguay, and Costa Rica banned all junk food from public schools, including candy bars, back in 2012. Many other nations in Latin America require red or yellow circles around sugar content on items depending on their sugar content. All of these actions and trends are a threat to Nestl. Increasing obesity is a major problem among the world's population. Processed sugar negatively impacts the body by increasing your chances of tooth decay, obesity, and diabetes, and additionally can significantly increase ones chances of getting heart disease and even cancer. Scientific tests reveal that sugar is basically a food for cancer cells and people that drink 2 soft drinks a week are 87 percent more likely to develop pancreatic cancer. For comparison, a Nestl Butterfinger and Baby Ruth contain 29 and 33 grams of sugar respectively, and a can of cola contains around 39g of sugar. Sugar is also believed to be damaging to your skin, looks and overall mood. Moving forward, Nestl could consider increased marketing of dark chocolate, which contain good antioxidants, but is much higher in saturated fat than milk chocolate and contains high levels of sugar. Sugar free candy has also been linked to cancer and weight gain, partly because artificial sweeteners are not healthy. By 2017, almost 150 artificial ingredients, like artificial sweeteners, preservatives and artificial flavor enhancers, will be discarded from Panera Bread Company's kitchens. Food companies are increasingly eliminating unnatural and unhealthy ingredients. For example, natural colorings made from turmeric and paprika will replace Kraft Heinz Company's artificial colorings in its macaroni and cheese product, and PepsiCo's Diet Pepsi will see a switch from artificial sweetener aspartame to sucralose. After an environmental advocacy group said it found nanoparticles, through laboratory tests, in the Dunkin Donut's white powdered sugar, the company will do away with titanium dioxide (a whitening agent used in sunscreen) from its recipes. Nanoparticles, like titanium dioxide, may cause damage to cells and tissues. Hair Care, Skin Care, Cosmetics The hair care, skin care and cosmetic industry in the USA accounts for over $55 billion in annual sales and enjoyed a growth rate of nearly 6 percent from 2010 through 2014 . Much like many food products, consumers still purchased beauty products at relatively high rates even during the recession. Growth is projected to continue through 2020 at rate of nearly 4 percent. Hair care and skin care products are the two largest revenue producing contributions to the industry as a whole with revenues each of approximately $13 billion totaling just short of 50 percent of total revenues combined. Higher marketing and R\&D expenses, along with a growing concern for reduced packaging, animal safety, and product safety all negatively hurt profits. Consumers also are quick to switch from brand to brand, and are showing less brand loyalty presenting both threats and opportunities for producers. There is also a growing influx of imported products from around the world on all price points. Generally perceived higher quality products are imported from Europe, where perceived lower quality and lower priced products are imported from Mexico and China. Skin care products continue to grow as a percent of total industry market share as more and more people are using these products, including men. In 2014, skin care products barely trailed hair care products in industry wide sales, but are expected to be the largest revenue producing product category moving forward. Firms promote antiaging treatments and wrinkle reducing creams. Even creams promoted to remove back circles from under the eyes are available. Sunscreen is also in this category. Este Lauder's CEO recently suggested that men's skin care products may outpace company-wide growth at his firm moving forward. Activist Shareholders Food and beverage companies have been popular targets for activist shareholders because of their bloated lackluster growth. In August 2015, Bill Ackman disclosed a stake in Mondelz International, spurring speculation that he would seek cost cuts and potentially a sale. Similarly ConAgra Foods and Boulder Brands have recently faced calls for shakeups. So far however, activist investors have mainly targeted U.S. food companies, but Nestl's underperformance is attracting prying eyes. Nestl is grappling with falling demand for its biscuits and peanut-milk beverages in China and the recall in India of its popular Maggi instant noodles. Its frozen-food business is not performing well. Given the activist shareholder environment, Nestl may want to consider divesting its frozen-food division, along with the company's 23.2 percent stake in cosmetics maker L'Oral S.A. Nestl could add 21 billion euros ( $23 billion) of cash flow through 2018 by gradually reducing its stake in L'Oral, said Jeff Stent, an analyst at Exane BNP Paribas. Nestl could use that money to boost its share buyback or to make acquisitions. Additionally, an activist shareholder could require Nestl to sell is its skin-health business. Nestl acquired full control of the Galderma wrinkle treatment and acne medication business from joint-venture partner L'Oral in 2014, but skincare does not fit well with food and beverages. To significantly impact Nestl, an activist investor would need at least a 1 percent stake, said Urs Beck, a fund manager at EFG Asset Management. That would cost more than $2 billion. Jenny Craig and PowerBar are two examples of businesses that Nestl acquired, held onto for too long and got depressed prices for in later divestitures. The political environment in Switzerland also gives activist investors another reason to "go for" Nestl. Switzerland has instituted a "fat-cat" referendum that gives shareholders more say over salaries and the ability to eject an entire board. Even Nestl's Chairman Peter Brabeck-Letmathe has said new Swiss laws threaten the company's long-term strategy. A new proposal that would allow investors to sue management and directors, even amid opposition by most shareholders, is also flawed, he has said."Activist shareholders and plaintiffs" lawyers would be granted free reign," Brabeck-Lemathe says. Future Nestl has many internal and external issues to consider as the company struggles to help feed the world and reward shareholders, employees, and customers. The company is determined to become a renowned nutrition and corporate wellness company, but many of its products still are unhealthy for consumption. Nestl needs a clear strategic plan going forward. Develop a three-year strategic plan for Nestl S.A. that will enable the company to meet its many obligations to the many shareholders who expect to see the company grow both revenues and profits annually Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started