Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Read the following article and summarize the main points. U.S. stocks rose as investors focused on signs of economic recovery amid further tension with China,

Read the following article and summarize the main points.

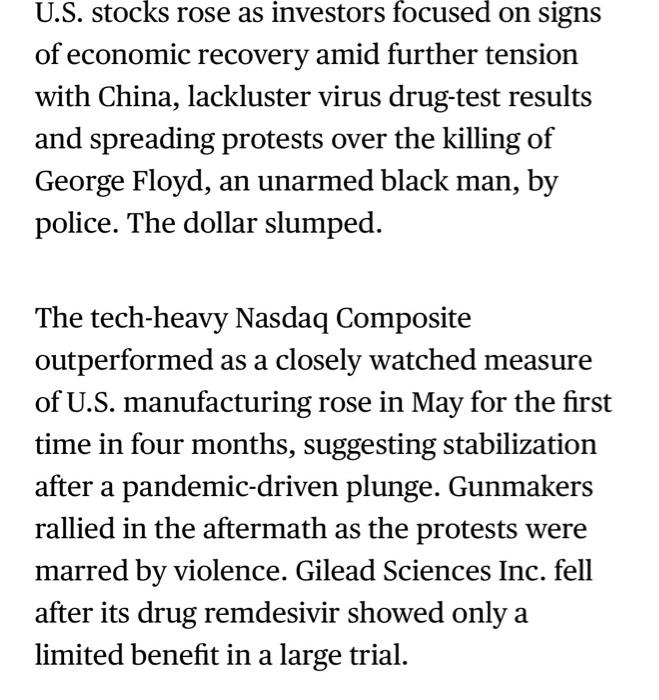

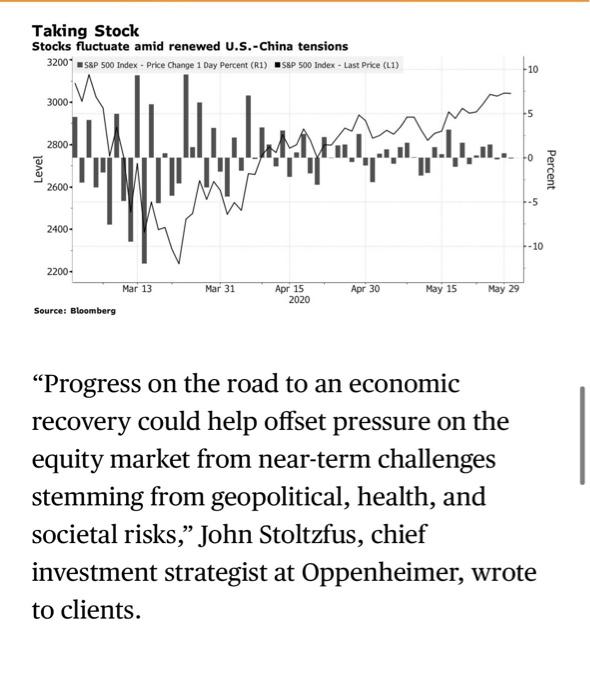

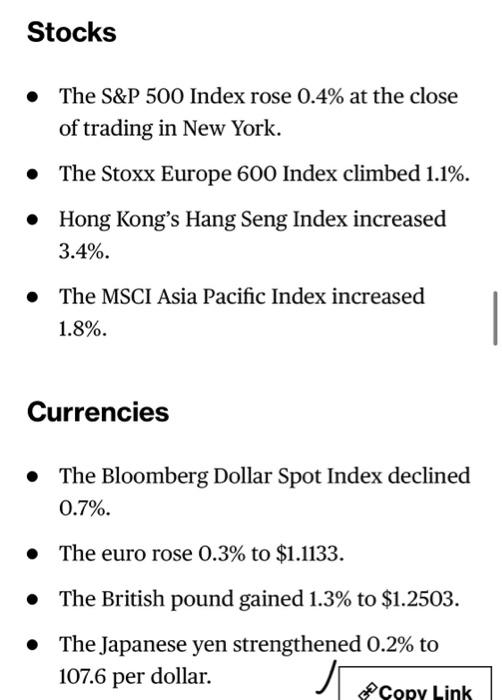

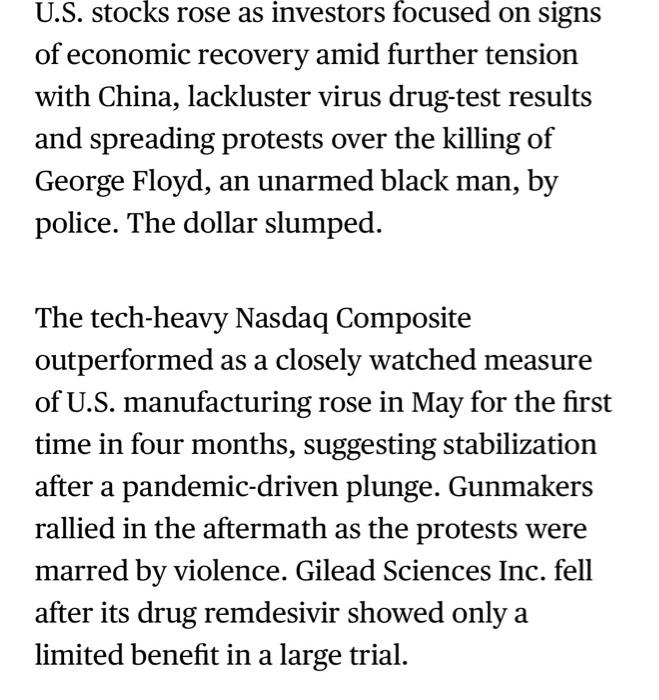

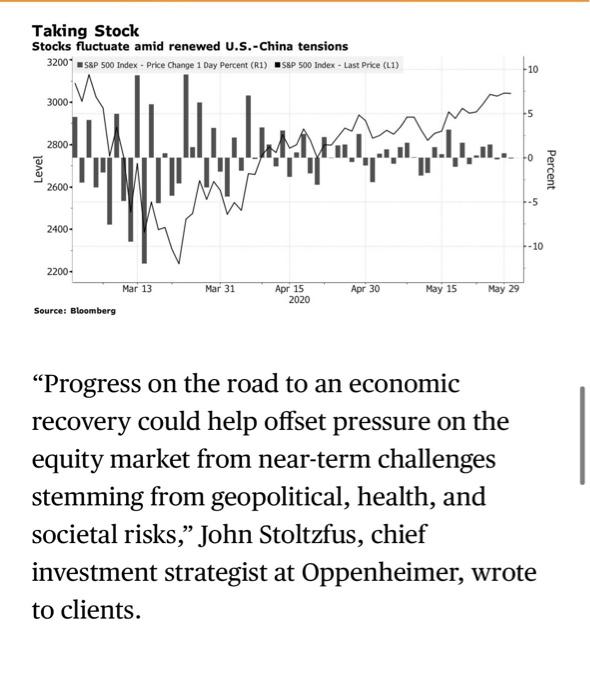

U.S. stocks rose as investors focused on signs of economic recovery amid further tension with China, lackluster virus drug-test results and spreading protests over the killing of George Floyd, an unarmed black man, by police. The dollar slumped. The tech-heavy Nasdaq Composite outperformed as a closely watched measure of U.S. manufacturing rose in May for the first time in four months, suggesting stabilization after a pandemic-driven plunge. Gunmakers rallied in the aftermath as the protests were marred by violence. Gilead Sciences Inc. fell after its drug remdesivir showed only a limited benefit in a large trial. Risk assets showed signs of resilience Monday after stocks had dipped earlier in the day following reports that Chinese officials had told agricultural companies to pause purchases of some U.S. farm goods, threatening a hard-won trade deal. Metals and emerging-market equities advanced along with shares in Europe and Asia. Taking Stock Stocks fluctuate amid renewed U.S.-China tensions 3200+ S&P 500 Index - Price Change 1 Day Percent (R1) S&P 500 Index - Last Price (LI) 10 3000- ili -5 2800- 0 Percent 2600- 2400- -- 10 2200- Mar 13 Mar 31 Apr 15 2020 Apr 30 May 15 May 29 Source: Bloomberg Progress on the road to an economic recovery could help offset pressure on the equity market from near-term challenges stemming from geopolitical, health, and societal risks, John Stoltzfus, chief investment strategist at Oppenheimer, wrote to clients. Goldman Sachs Group Inc. said the U.S. labor market is showing the earliest signs of rebounding. China's Caixin purchasing managers index for manufacturing rose above 50 May, indicating an expansion. Euro- area data on Monday also signaled factories have started down their long road to recovery. Here are some key events coming up: In Europe, the ECB is expected to top up its rescue program with an additional 500 billion euros of asset purchases at a meeting on Thursday. Anything less than an expansion would be a big shock, Bloomberg Economics said. The U.S. labor market report on Friday will probably show American unemployment soared to 19.6% in May, the highest since the 1930s. These are the main moves in markets: Stocks The S&P 500 Index rose 0.4% at the close of trading in New York. Stocks The S&P 500 Index rose 0.4% at the close of trading in New York. The Stoxx Europe 600 Index climbed 1.1%. Hong Kong's Hang Seng Index increased 3.4%. The MSCI Asia Pacific Index increased 1.8% Currencies The Bloomberg Dollar Spot Index declined 0.7%. The euro rose 0.3% to $1.1133. The British pound gained 1.3% to $1.2503. The Japanese yen strengthened 0.2% to 107.6 per dollar. Copy Link The British pound gained 1.3% to $1.2503. The Japanese yen strengthened 0.2% to 107.6 per dollar. Bonds The yield on 10-year Treasuries rose one basis point to 0.66%. Germany's 10-year yield increased four basis points to -0.41%. Britain's 10-year yield climbed five basis points to 0.23%. Commodities West Texas Intermediate crude rose 0.3% to $35.59 a barrel. Gold strengthened 0.6% to $1,740.17 an ounce. Ao Commodities West Texas Intermediate crude rose 0.3% to $35.59 a barrel. . Gold strengthened 0.6% to $1,740.17 an ounce

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started