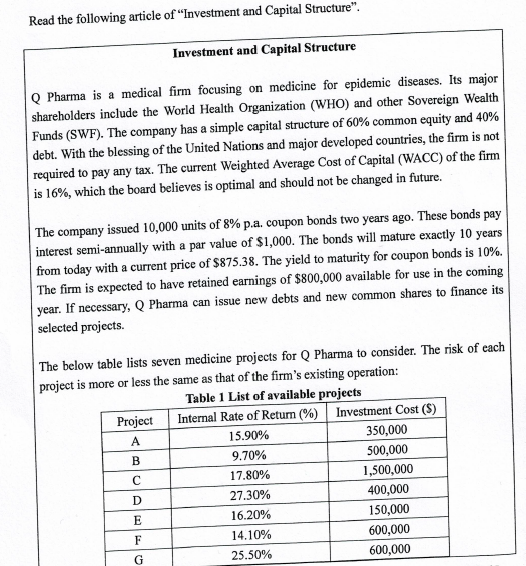

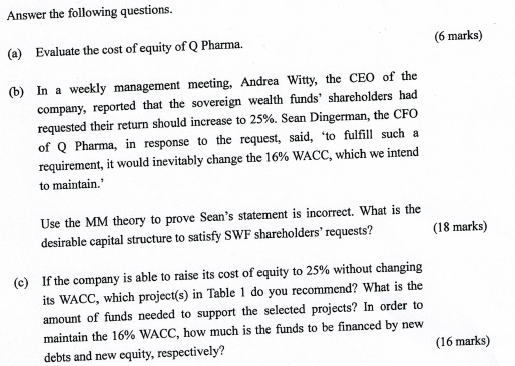

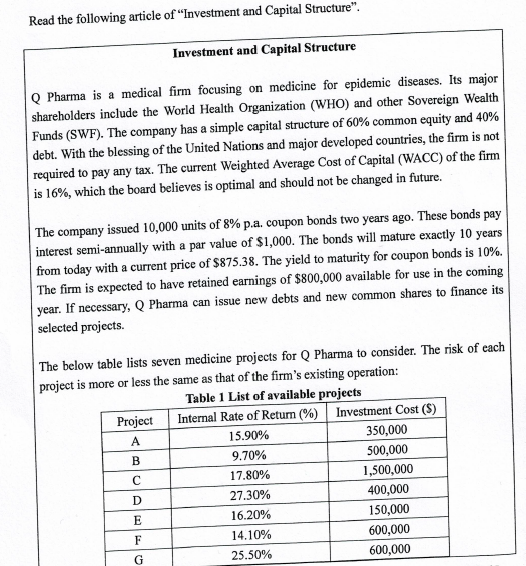

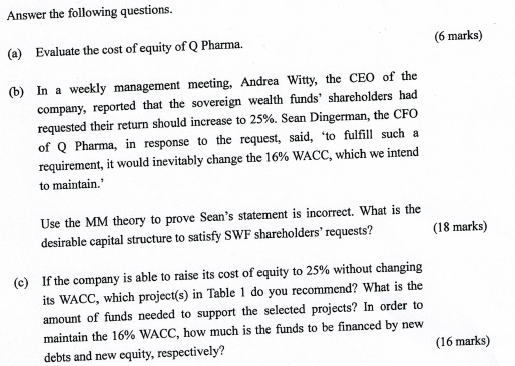

Read the following article of Investment and Capital Structure" Investment and Capital Structure Q Pharma is a medical firm focusing on medicine for epidemic diseases. Its major shareholders include the World Health Organization (WHO) and other Sovereign Wealth Funds (SWF). The company has a simple capital structure of 60% common equity and 40% debt. With the blessing of the United Nations and major developed countries, the firm is not required to pay any tax. The current Weighted Average Cost of Capital (WACC) of the firm is 16%, which the board believes is optimal and should not be changed in future. The company issued 10,000 units of 8% p.a. coupon bonds two years ago. These bonds pay interest semi-annually with a par value of $1,000. The bonds will mature exactly 10 years from today with a current price of $875.38. The yield to maturity for coupon bonds is 10%. The firm is expected to have retained earnings of $800,000 available for use in the coming year. If necessary, Q Pharma can issue new debts and new common shares to finance its selected projects. The below table lists seven medicine projects for Q Pharma to consider. The risk of each project is more or less the same as that of the firm's existing operation: Table 1 List of available projects Project Internal Rate of Return% Investment Cost (S) 15.90% 9.70% 17.80% 27.30% 16.20% 14.10% 25.50% 350,000 500,000 1,500,000 400,000 150,000 600,000 600,000 Answer the following questions. (a) Evaluate the cost of equity of Q Pharma. (b) In a weekly management meeting, Andrea Witty, the CEO of the (6 marks) company, reported that the sovereign wealth funds' shareholders had requested their return should increase to 25%. Sean Dingerman, the CFO of Q Pharma, in response to the request, said, 'to fulfill such a requirement, it would inevitably change the 16% WACC, which we intend to maintain. Use the MM theory to prove Sean's statement is incorrect. What is the desirable capital structure to satisfy SWF shareholders' requests? (18 marks) If the company is able to raise its cost of equity to 25% without changing its WACC, which project(s) in Table 1 do you recommend? What is the amount of funds needed to support the selected projects? In order to maintain the 16% WACC, how much is the funds to be financed by new debts and new equity, respectively? (c) (16 marks) Read the following article of Investment and Capital Structure" Investment and Capital Structure Q Pharma is a medical firm focusing on medicine for epidemic diseases. Its major shareholders include the World Health Organization (WHO) and other Sovereign Wealth Funds (SWF). The company has a simple capital structure of 60% common equity and 40% debt. With the blessing of the United Nations and major developed countries, the firm is not required to pay any tax. The current Weighted Average Cost of Capital (WACC) of the firm is 16%, which the board believes is optimal and should not be changed in future. The company issued 10,000 units of 8% p.a. coupon bonds two years ago. These bonds pay interest semi-annually with a par value of $1,000. The bonds will mature exactly 10 years from today with a current price of $875.38. The yield to maturity for coupon bonds is 10%. The firm is expected to have retained earnings of $800,000 available for use in the coming year. If necessary, Q Pharma can issue new debts and new common shares to finance its selected projects. The below table lists seven medicine projects for Q Pharma to consider. The risk of each project is more or less the same as that of the firm's existing operation: Table 1 List of available projects Project Internal Rate of Return% Investment Cost (S) 15.90% 9.70% 17.80% 27.30% 16.20% 14.10% 25.50% 350,000 500,000 1,500,000 400,000 150,000 600,000 600,000 Answer the following questions. (a) Evaluate the cost of equity of Q Pharma. (b) In a weekly management meeting, Andrea Witty, the CEO of the (6 marks) company, reported that the sovereign wealth funds' shareholders had requested their return should increase to 25%. Sean Dingerman, the CFO of Q Pharma, in response to the request, said, 'to fulfill such a requirement, it would inevitably change the 16% WACC, which we intend to maintain. Use the MM theory to prove Sean's statement is incorrect. What is the desirable capital structure to satisfy SWF shareholders' requests? (18 marks) If the company is able to raise its cost of equity to 25% without changing its WACC, which project(s) in Table 1 do you recommend? What is the amount of funds needed to support the selected projects? In order to maintain the 16% WACC, how much is the funds to be financed by new debts and new equity, respectively? (c) (16 marks)