Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Read the following scenario. Answer the questions regarding the scenario to choose which type of document you need to write to meet your communication

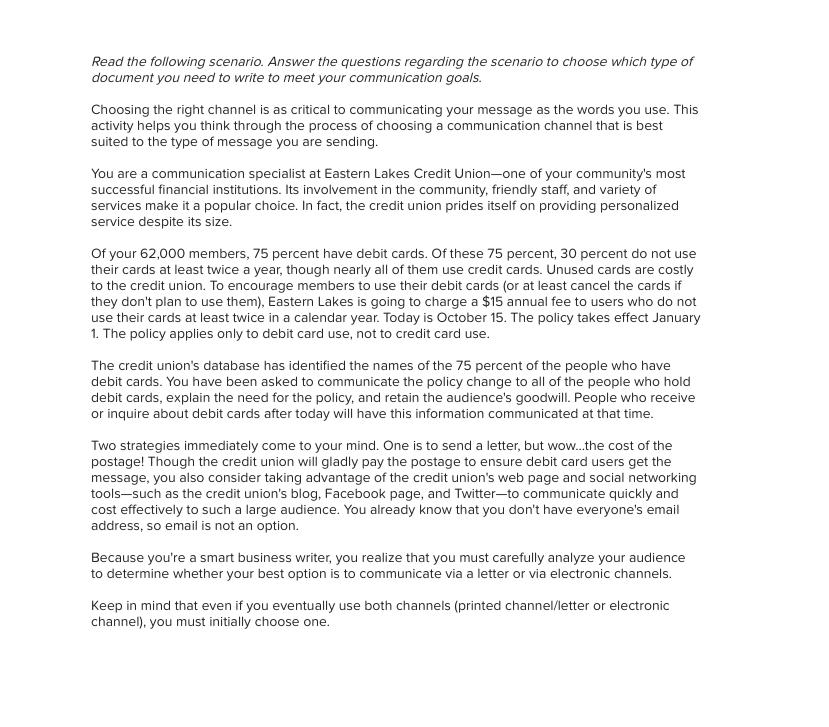

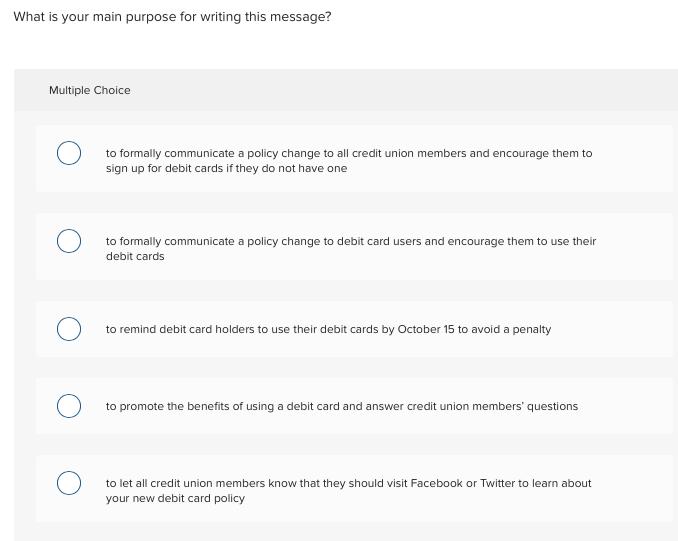

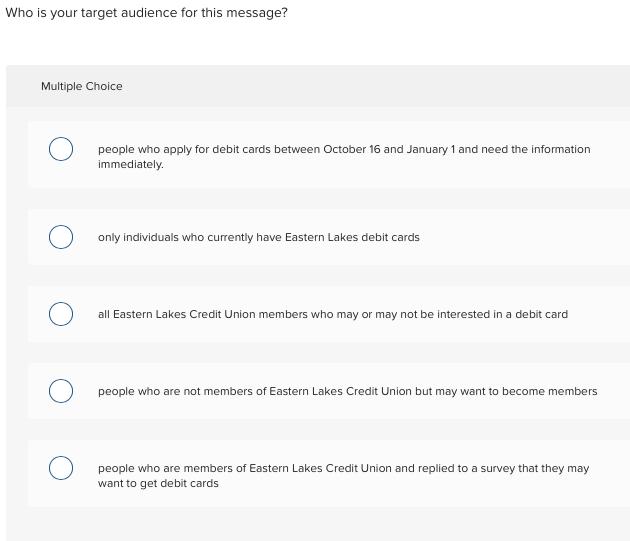

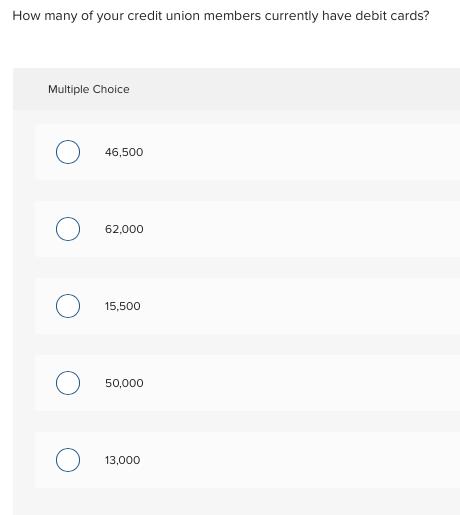

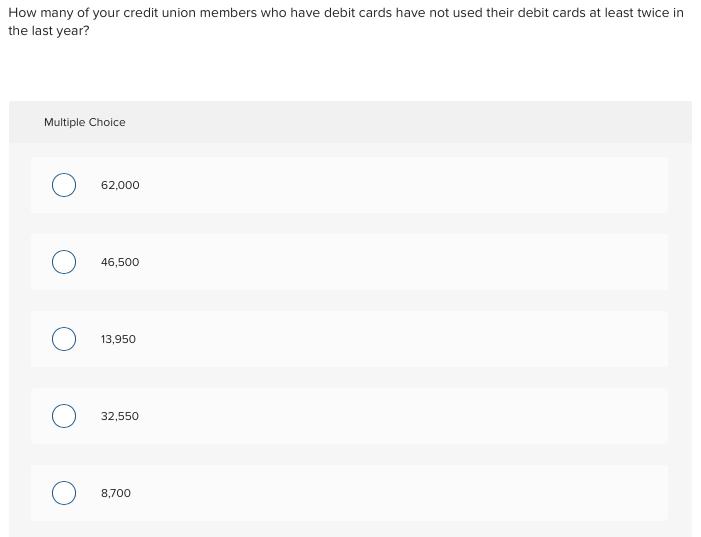

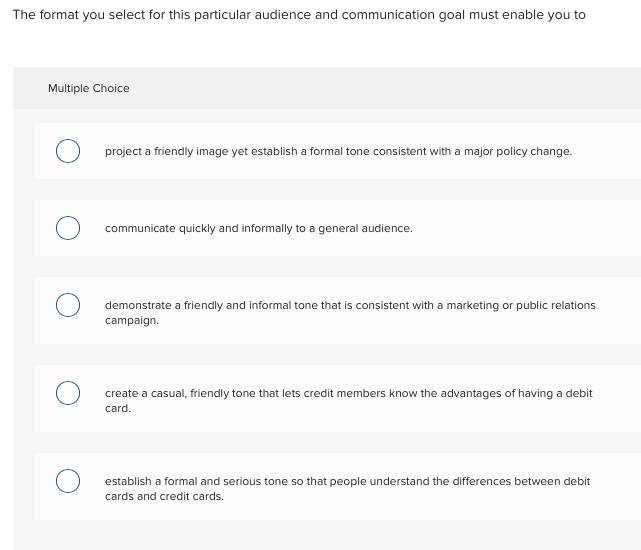

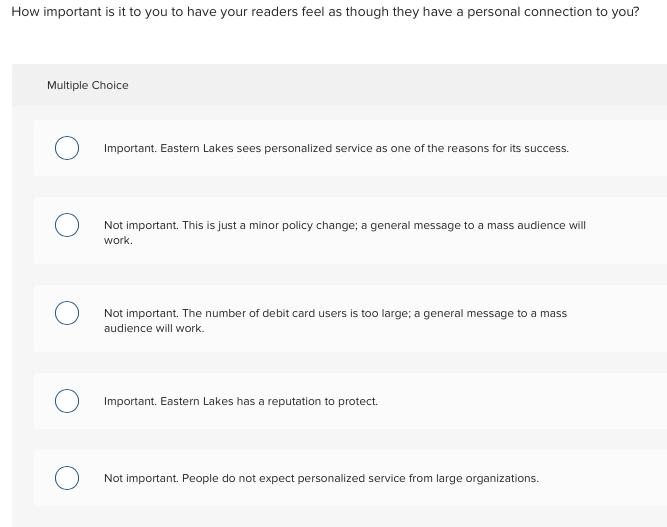

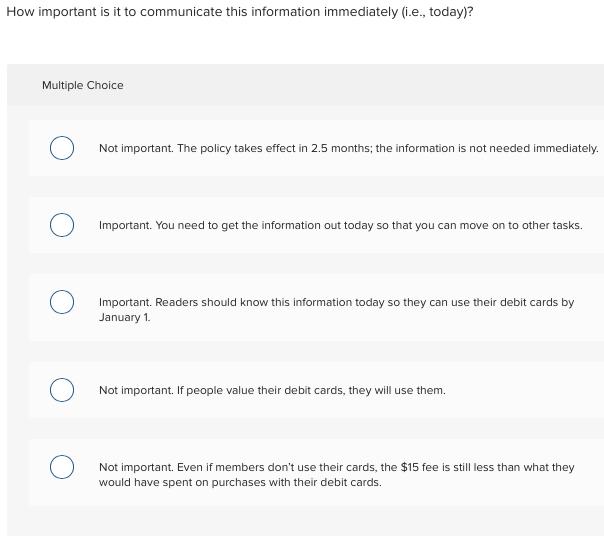

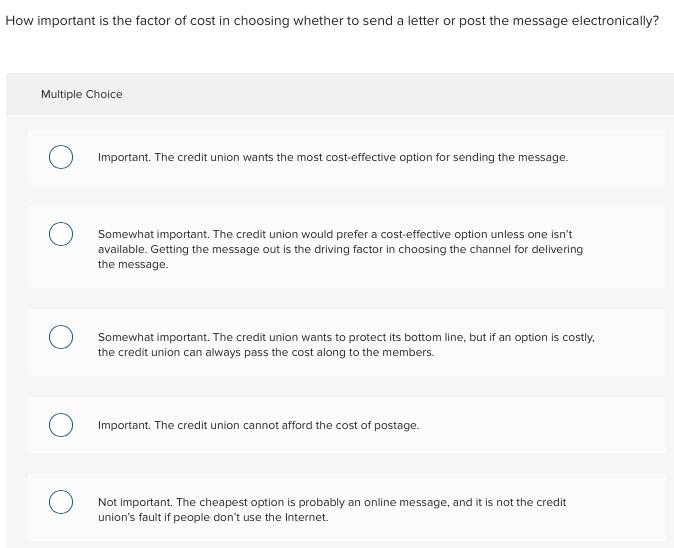

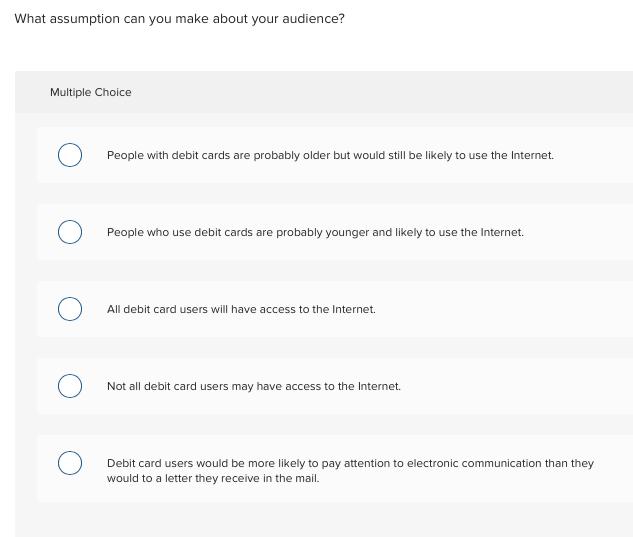

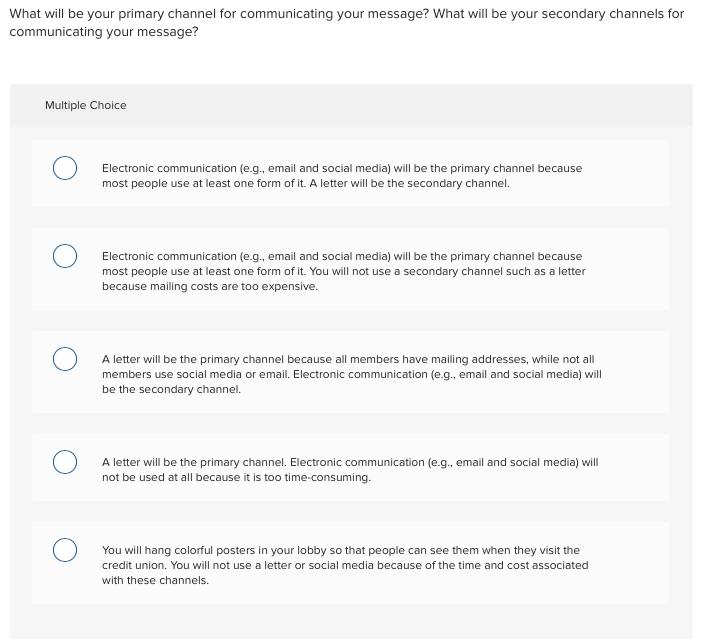

Read the following scenario. Answer the questions regarding the scenario to choose which type of document you need to write to meet your communication goals. Choosing the right channel is as critical to communicating your message as the words you use. This activity helps you think through the process of choosing a communication channel that is best suited to the type of message you are sending. You are a communication specialist at Eastern Lakes Credit Union-one of your community's most successful financial institutions. Its involvement in the community, friendly staff, and variety of services make it a popular choice. In fact, the credit union prides itself on providing personalized service despite its size. Of your 62,000 members, 75 percent have debit cards. Of these 75 percent, 30 percent do not use their cards at least twice a year, though nearly all of them use credit cards. Unused cards are costly to the credit union. To encourage members to use their debit cards (or at least cancel the cards if they don't plan to use them), Eastern Lakes is going to charge a $15 annual fee to users who do not use their cards at least twice in a calendar year. Today is October 15. The policy takes effect January 1. The policy applies only to debit card use, not to credit card use. The credit union's database has identified the names of the 75 percent of the people who have debit cards. You have been asked to communicate the policy change to all of the people who hold debit cards, explain the need for the policy, and retain the audience's goodwill. People who receive or inquire about debit cards after today will have this information communicated at that time. Two strategies immediately come to your mind. One is to send a letter, but wow...the cost of the postage! Though the credit union will gladly pay the postage to ensure debit card users get the message, you also consider taking advantage of the credit union's web page and social networking tools-such as the credit union's blog, Facebook page, and Twitter-to communicate quickly and cost effectively to such a large audience. You already know that you don't have everyone's email address, so email is not an option. Because you're a smart business writer, you realize that you must carefully analyze your audience to determine whether your best option is to communicate via a letter or via electronic channels. Keep in mind that even if you eventually use both channels (printed channel/letter or electronic channel), you must initially choose one. What is your main purpose for writing this message? Multiple Choice to formally communicate a policy change to all credit union members and encourage them to sign up for debit cards if they do not have one to formally communicate a policy change to debit card users and encourage them to use their debit cards to remind debit card holders to use their debit cards by October 15 to avoid a penalty to promote the benefits of using a debit card and answer credit union members' questions to let all credit union members know that they should visit Facebook or Twitter to learn about your new debit card policy Who is your target audience for this message? Multiple Choice people who apply for debit cards between October 16 and January 1 and need the information immediately. only individuals who currently have Eastern Lakes debit cards all Eastern Lakes Credit Union members who may or may not be interested in a debit card people who are not members of Eastern Lakes Credit Union but may want to become members people who are members of Eastern Lakes Credit Union and replied to a survey that they may want to get debit cards How many of your credit union members currently have debit cards? Multiple Choice 46,500 62,000 15,500 50,000 13,000 How many of your credit union members who have debit cards have not used their debit cards at least twice in the last year? Multiple Choice 62,000 46,500 13,950 32,550 8,700 The format you select for this particular audience and communication goal must enable you to Multiple Choice project a friendly image yet establish a formal tone consistent with a major policy change. communicate quickly and informally to a general audience. demonstrate a friendly and informal tone that is consistent with a marketing or public relations campaign. create a casual, friendly tone that lets credit members know the advantages of having a debit card. establish a formal and serious tone so that people understand the differences between debit cards and credit cards. How important is it to you to have your readers feel as though they have a personal connection to you? Multiple Choice Important. Eastern Lakes sees personalized service as one of the reasons for its success. Not important. This is just a minor policy change; a general message to a mass audience will work. Not important. The number of debit card users is too large; a general message to a mass audience will work. Important. Eastern Lakes has a reputation to protect. Not important. People do not expect personalized service from large organizations. How important is it to communicate this information immediately (i.e., today)? Multiple Choice Not important. The policy takes effect in 2.5 months; the information is not needed immediately. Important. You need to get the information out today so that you can move on to other tasks. Important. Readers should know this information today so they can use their debit cards by January 1. Not important. If people value their debit cards, they will use them. Not important. Even if members don't use their cards, the $15 fee is still less than what they would have spent on purchases with their debit cards. How important is the factor of cost in choosing whether to send a letter or post the message electronically? Multiple Choice Important. The credit union wants the most cost-effective option for sending the message. Somewhat important. The credit union would prefer a cost-effective option unless one isn't available. Getting the message out is the driving factor in choosing the channel for delivering the message. Somewhat important. The credit union wants to protect its bottom line, but if an option is costly, the credit union can always pass the cost along to the members. Important. The credit union cannot afford the cost of postage. Not important. The cheapest option is probably an online message, and it is not the credit union's fault if people don't use the Internet. What assumption can you make about your audience? Multiple Choice People with debit cards are probably older but would still be likely to use the Internet. People who use debit cards are probably younger and likely to use the Internet. All debit card users will have access to the Internet. Not all debit card users may have access to the Internet. Debit card users would be more likely to pay attention to electronic communication than they would to a letter they receive in the mail. What will be your primary channel for communicating your message? What will be your secondary channels for communicating your message? Multiple Choice Electronic communication (e.g., email and social media) will be the primary channel because most people use at least one form of it. A letter will be the secondary channel. Electronic communication (e.g., email and social media) will be the primary channel because most people use at least one form of it. You will not use a secondary channel such as a letter because mailing costs are too expensive. A letter will be the primary channel because all members have mailing addresses, while not all members use social media or email. Electronic communication (e.g., email and social media) will be the secondary channel. A letter will be the primary channel. Electronic communication (e.g., email and social media) will not be used at all because it is too time-consuming. You will hang colorful posters in your lobby so that people can see them when they visit the credit union. You will not use a letter or social media because of the time and cost associated with these channels.

Step by Step Solution

★★★★★

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below To officially notify debit card users of a policy change and urge them to utilize their d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started