Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Read the following scenario: | Mr. Lancaster, who lives in Calgary, AB, is employed with Alberta Energies (ABE) Ltd. for the current calendar year.

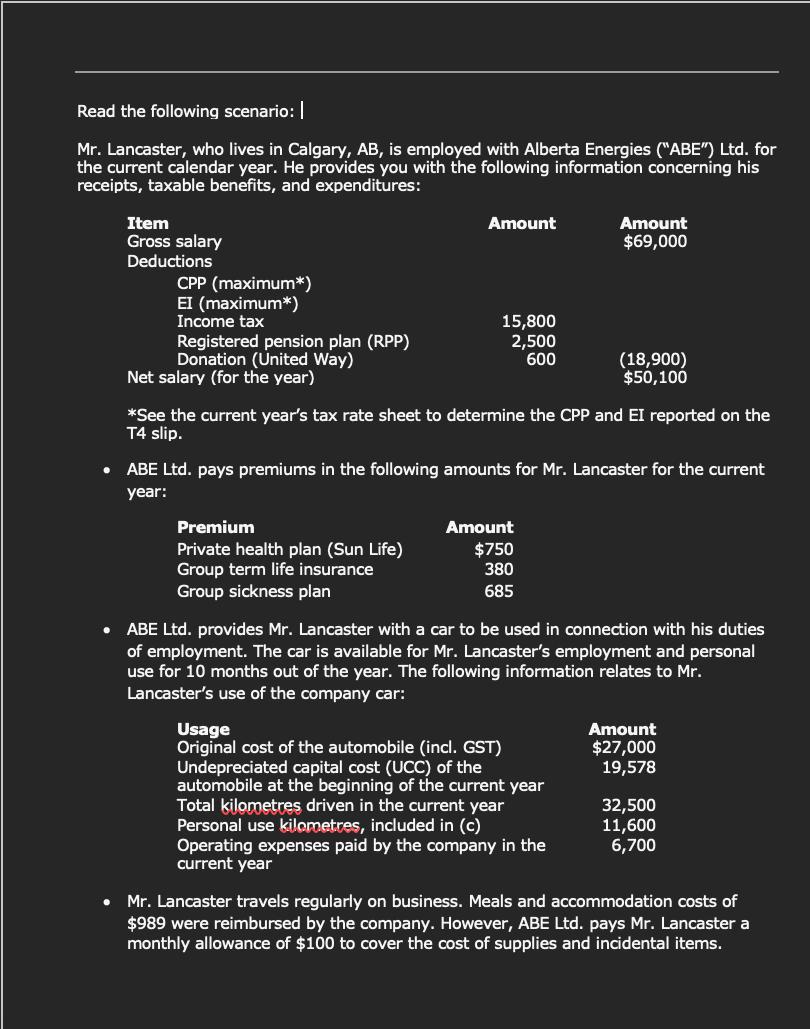

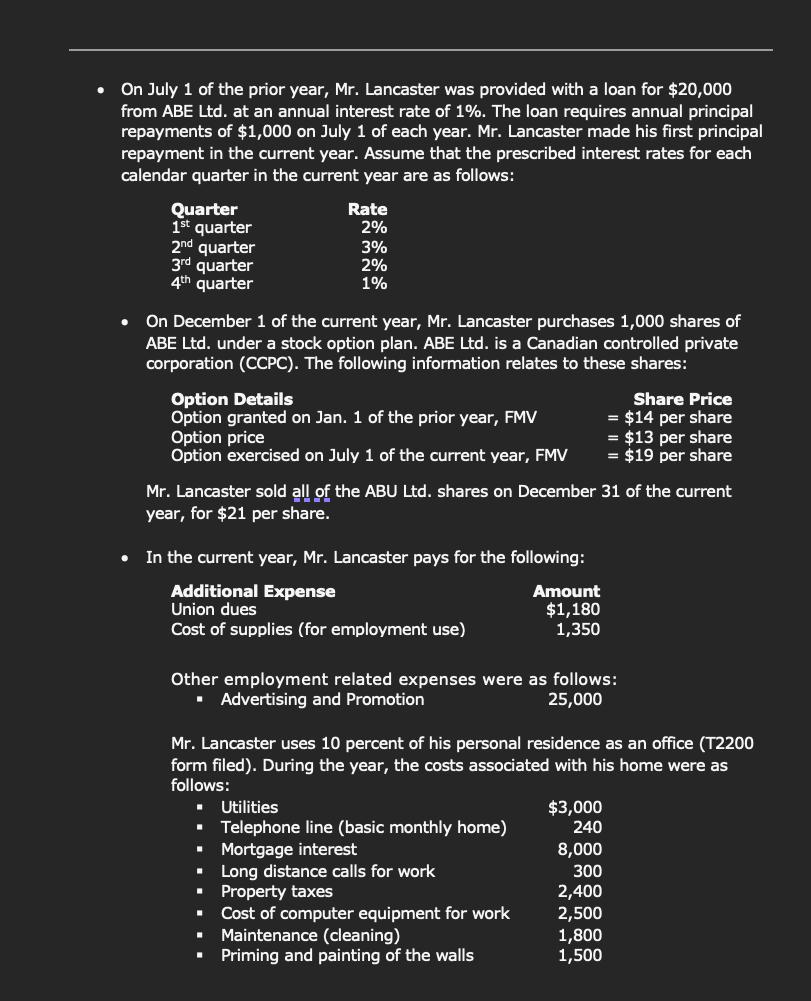

Read the following scenario: | Mr. Lancaster, who lives in Calgary, AB, is employed with Alberta Energies ("ABE") Ltd. for the current calendar year. He provides you with the following information concerning his receipts, taxable benefits, and expenditures: Item Gross salary Deductions CPP (maximum*) EI (maximum*) Income tax Registered pension plan (RPP) Donation (United Way) Net salary (for the year) Amount 15,800 2,500 600 Premium Private health plan (Sun Life) Group term life insurance Group sickness plan *See the current year's tax rate sheet to determine the CPP and EI reported on the T4 slip. Amount $69,000 ABE Ltd. pays premiums in the following amounts for Mr. Lancaster for the current year: Amount $750 380 685 (18,900) $50,100 Usage Original cost of the automobile (incl. GST) Undepreciated capital cost (UCC) of the automobile at the beginning of the current year Total kilometres driven in the current year Personal use kilometres, included in (c) Operating expenses paid by the company in the current year ABE Ltd. provides Mr. Lancaster with a car to be used in connection with his duties of employment. The car is available for Mr. Lancaster's employment and personal use for 10 months out of the year. The following information relates to Mr. Lancaster's use of the company car: Amount $27,000 19,578 32,500 11,600 6,700 Mr. Lancaster travels regularly on business. Meals and accommodation costs of $989 were reimbursed by the company. However, ABE Ltd. pays Mr. Lancaster a monthly allowance of $100 to cover the cost of supplies and incidental items. On July 1 of the prior year, Mr. Lancaster was provided with a loan for $20,000 from ABE Ltd. at an annual interest rate of 1%. The loan requires annual principal repayments of $1,000 on July 1 of each year. Mr. Lancaster made his first principal repayment in the current year. Assume that the prescribed interest rates for each calendar quarter in the current year are as follows: Quarter 1st quarter 2nd quarter 3rd quarter 4th quarter Rate 2% On December 1 of the current year, Mr. Lancaster purchases 1,000 shares of ABE Ltd. under a stock option plan. ABE Ltd. is a Canadian controlled private corporation (CCPC). The following information relates to these shares: 3% 2% 1% Option Details Option granted on Jan. 1 of the prior year, FMV Option price Option exercised on July 1 of the current year, FMV In the current year, Mr. Lancaster pays for the following: Additional Expense Union dues Cost of supplies (for employment use) Mr. Lancaster sold all of the ABU Ltd. shares on December 31 of the current year, for $21 per share. . . Amount $1,180 1,350 Other employment related expenses were as follows: Advertising and Promotion 25,000 Long distance calls for work Property taxes Cost of computer equipment for work . Maintenance (cleaning) Priming and painting of the walls Mr. Lancaster uses 10 percent of his personal residence as an office (T2200 form filed). During the year, the costs associated with his home were as follows: . Utilities Telephone line (basic monthly home) Mortgage interest Share Price = $14 per share = $13 per share = $19 per share $3,000 240 8,000 300 2,400 2,500 1,800 1,500 Contents and property insurance 400 Required: 1. Calculate Mr. Lancaster's net employment income for the current year, in accordance with sections 5 to 8 of the Income Tax Act (ITA). Round your calculations to the nearest dollar.

Step by Step Solution

★★★★★

3.39 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Mr Lancasters net employment income for the current year we need to consider his receip...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started