Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Read the given extract and highlight your findings in a detail note Extract: UWill household debt make the cost of living crisis worse? New data

Read the given extract and highlight your findings in a detail note

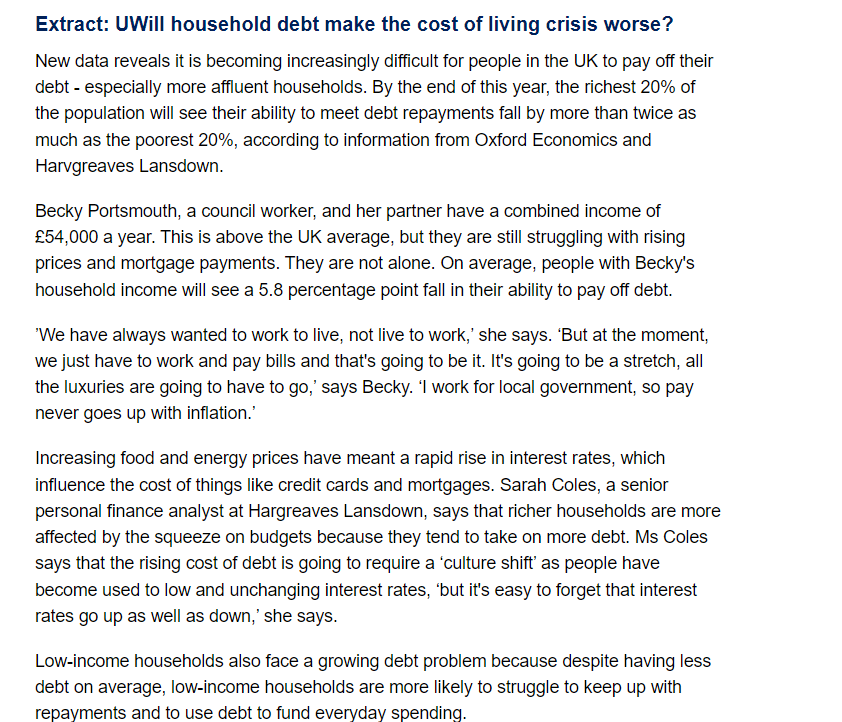

Extract: UWill household debt make the cost of living crisis worse? New data reveals it is becoming increasingly difficult for people in the UK to pay off their debt - especially more affluent households. By the end of this year, the richest 20% of the population will see their ability to meet debt repayments fall by more than twice as much as the poorest 20%, according to information from Oxford Economics and Harvgreaves Lansdown. Becky Portsmouth, a council worker, and her partner have a combined income of 54,000 a year. This is above the UK average, but they are still struggling with rising prices and mortgage payments. They are not alone. On average, people with Becky's household income will see a 5.8 percentage point fall in their ability to pay off debt. 'We have always wanted to work to live, not live to work,' she says. 'But at the moment, we just have to work and pay bills and that's going to be it. It's going to be a stretch, all the luxuries are going to have to go,' says Becky. 'I work for local government, so pay never goes up with inflation.' Increasing food and energy prices have meant a rapid rise in interest rates, which influence the cost of things like credit cards and mortgages. Sarah Coles, a senior personal finance analyst at Hargreaves Lansdown, says that richer households are more affected by the squeeze on budgets because they tend to take on more debt. Ms Coles says that the rising cost of debt is going to require a 'culture shift' as people have become used to low and unchanging interest rates, but it's easy to forget that interest rates go up as well as down,' she says. Low-income households also face a growing debt problem because despite having less debt on average, low-income households are more likely to struggle to keep up with repayments and to use debt to fund everyday spending.

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Key Findings Debt Struggles Across Income Groups Both affluent and lowincome households are facing challenges in paying off debts due to rising living ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started