Answered step by step

Verified Expert Solution

Question

1 Approved Answer

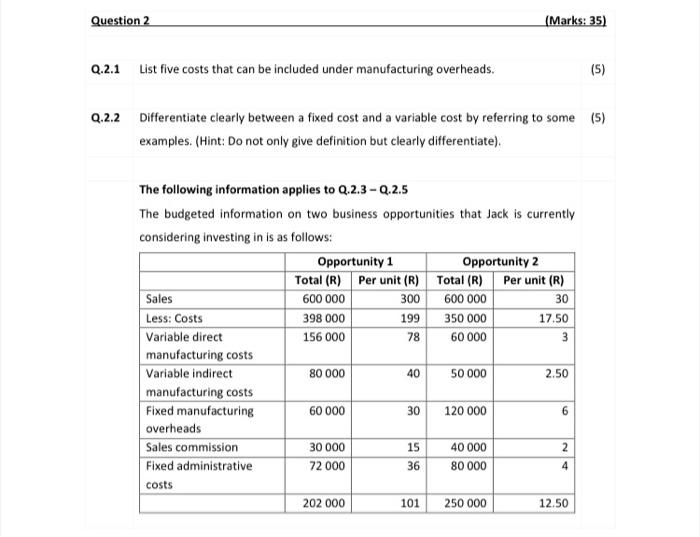

read the information on the picture. Everything is there. Question 2 (Marks: 35) Q.2.1 List five costs that can be included under manufacturing overheads. (5)

read the information on the picture. Everything is there.

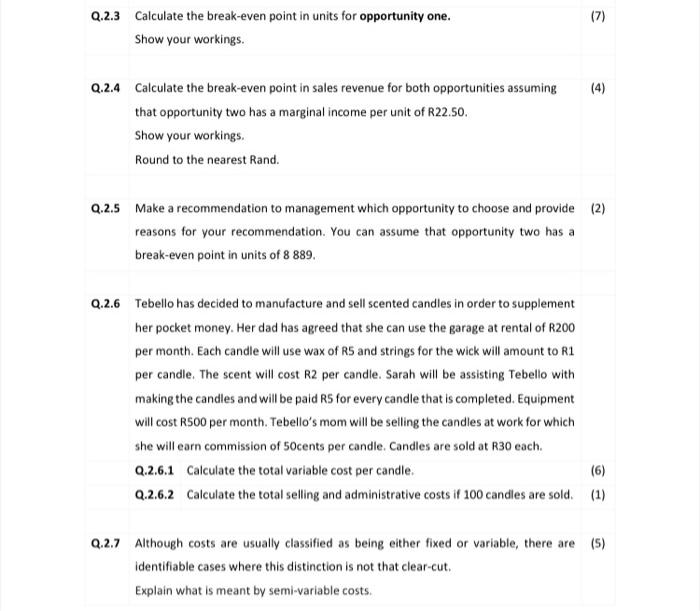

Question 2 (Marks: 35) Q.2.1 List five costs that can be included under manufacturing overheads. (5) Q.2.2 Differentiate clearly between a fixed cost and a variable cost by referring to some (5) examples. (Hint: Do not only give definition but clearly differentiate). The following information applies to Q.2.3 -2.2.5 The budgeted information on two business opportunities that Jack is currently considering investing in is as follows: Opportunity 1 Opportunity 2 Total (R) Per unit (R) Total (R) Per unit (R) Sales 600 000 300 600 000 30 Less: Costs 398 000 199 350 000 17.50 Variable direct 156 000 78 60 000 3 manufacturing costs Variable indirect 80 000 50 000 2.50 manufacturing costs Fixed manufacturing 60 000 30 120 000 6 overheads Sales commission 30 000 15 40 000 Fixed administrative 72 000 36 80 000 4 40 2 costs 202 000 101 250 000 12.50 (7) Q.2.3 Calculate the break-even point in units for opportunity one. Show your workings. Q.2.4 Calculate the break-even point in sales revenue for both opportunities assuming that opportunity two has a marginal income per unit of R22.50. Show your workings. Round to the nearest Rand. Q.2.5 Make a recommendation to management which opportunity to choose and provide (2) reasons for your recommendation. You can assume that opportunity two has a break-even point in units of 8 889. Q.2.6 Tebello has decided to manufacture and sell scented candles in order to supplement her pocket money. Her dad has agreed that she can use the garage at rental of R200 per month. Each candle will use wax of Rs and strings for the wick will amount to R1 per candle. The scent will cost R2 per candle. Sarah will be assisting Tebello with making the candles and will be paid Rs for every candle that is completed. Equipment will cost R500 per month. Tebello's mom will be selling the candles at work for which she will earn commission of 50cents per candle. Candles are sold at R30 each. 2.2.6.1 Calculate the total variable cost per candle. (6) 2.2.6.2 Calculate the total selling and administrative costs if 100 candles are sold. (1) Q.2.7 Although costs are usually classified as being either fixed or variable, there are (5) identifiable cases where this distinction is not that clear-cut. Explain what is meant by semi-variable costs. Question 2 (Marks: 35) Q.2.1 List five costs that can be included under manufacturing overheads. (5) Q.2.2 Differentiate clearly between a fixed cost and a variable cost by referring to some (5) examples. (Hint: Do not only give definition but clearly differentiate). The following information applies to Q.2.3 -2.2.5 The budgeted information on two business opportunities that Jack is currently considering investing in is as follows: Opportunity 1 Opportunity 2 Total (R) Per unit (R) Total (R) Per unit (R) Sales 600 000 300 600 000 30 Less: Costs 398 000 199 350 000 17.50 Variable direct 156 000 78 60 000 3 manufacturing costs Variable indirect 80 000 50 000 2.50 manufacturing costs Fixed manufacturing 60 000 30 120 000 6 overheads Sales commission 30 000 15 40 000 Fixed administrative 72 000 36 80 000 4 40 2 costs 202 000 101 250 000 12.50 (7) Q.2.3 Calculate the break-even point in units for opportunity one. Show your workings. Q.2.4 Calculate the break-even point in sales revenue for both opportunities assuming that opportunity two has a marginal income per unit of R22.50. Show your workings. Round to the nearest Rand. Q.2.5 Make a recommendation to management which opportunity to choose and provide (2) reasons for your recommendation. You can assume that opportunity two has a break-even point in units of 8 889. Q.2.6 Tebello has decided to manufacture and sell scented candles in order to supplement her pocket money. Her dad has agreed that she can use the garage at rental of R200 per month. Each candle will use wax of Rs and strings for the wick will amount to R1 per candle. The scent will cost R2 per candle. Sarah will be assisting Tebello with making the candles and will be paid Rs for every candle that is completed. Equipment will cost R500 per month. Tebello's mom will be selling the candles at work for which she will earn commission of 50cents per candle. Candles are sold at R30 each. 2.2.6.1 Calculate the total variable cost per candle. (6) 2.2.6.2 Calculate the total selling and administrative costs if 100 candles are sold. (1) Q.2.7 Although costs are usually classified as being either fixed or variable, there are (5) identifiable cases where this distinction is not that clear-cut. Explain what is meant by semi-variable costs Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started