Answered step by step

Verified Expert Solution

Question

1 Approved Answer

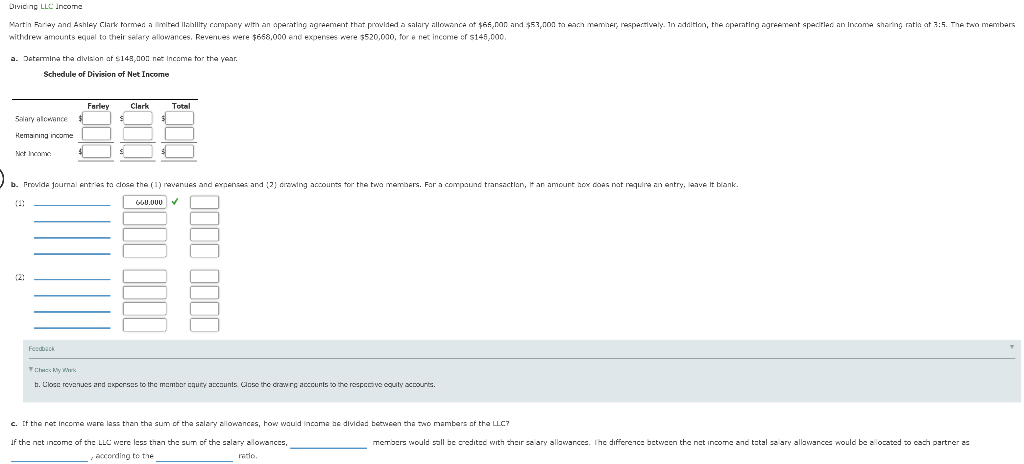

READ THE INSTRUCTIONS WELL. THANKS! Diving LLC Income Tamber, privaly. In addition, the parting gerent specifier an incoma sharing ratio at 3:5. The two members

READ THE INSTRUCTIONS WELL. THANKS!

Diving LLC Income Tamber, privaly. In addition, the parting gerent specifier an incoma sharing ratio at 3:5. The two members Martin Barley and Ashley Clark formar a n d liability company with an operating agree that provide a salary all of $69.and $53,non tan withdrew amounts equel to their selary allowances. Revenues were $668,000 and expenses were $520,000, for a net income of $145,000 a. Determine the divisan at 148,00 net income for the year. Schedule of Division of Net Income Farley Clark Salary alowance Remaring income Net Troms b. Provide fournal entresta close the (1) Anues and expense and 2) G ng cours to the twa Irambans. For a compaund transaction. It an amount or does not require an entry, Save It blank. GUUUU Feedback b. Close rovenues and exporses to the membarcuryachunis Core the crawrs accounts to the respcove oquity accounts. c. If the ret Income ware lass than tha sum of the salary allowances, how would income be divided between the two mambers of the LLC? Members would all be credited with their sa ary allowances. The difference between the nat income and total ca ary allowances would be a ocated to cash partrer as of the net income of the LLC were less than the sum of the salary a lowances, according to the ratioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started