Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Read the overview below and complete the activities that follow. Assessing how well a company's strategy is presently working involves evaluating the strategy from both

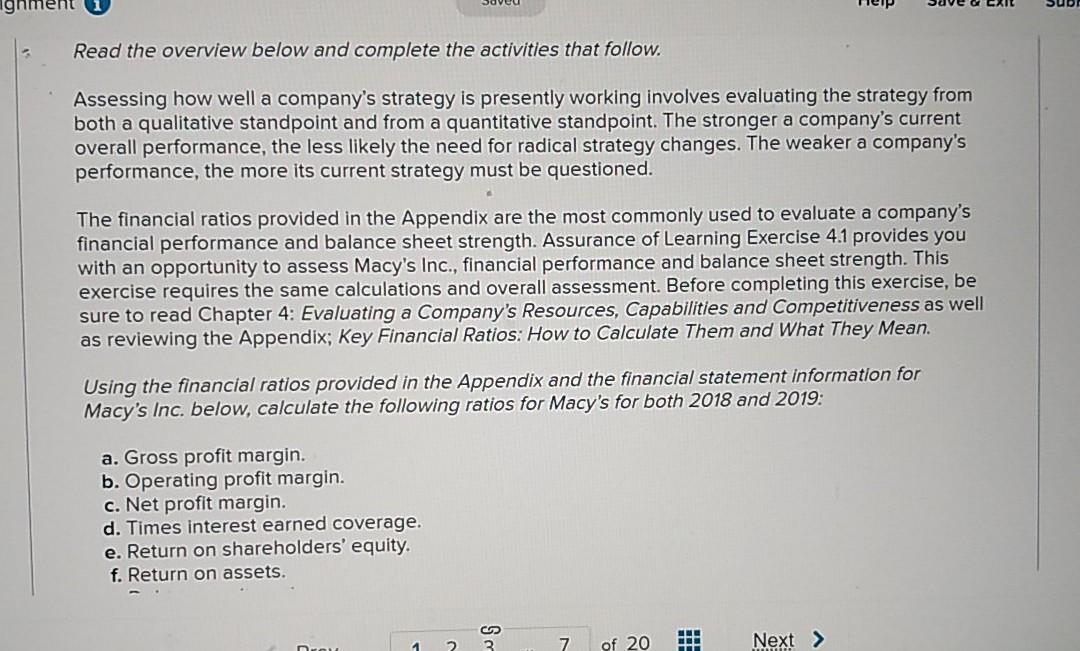

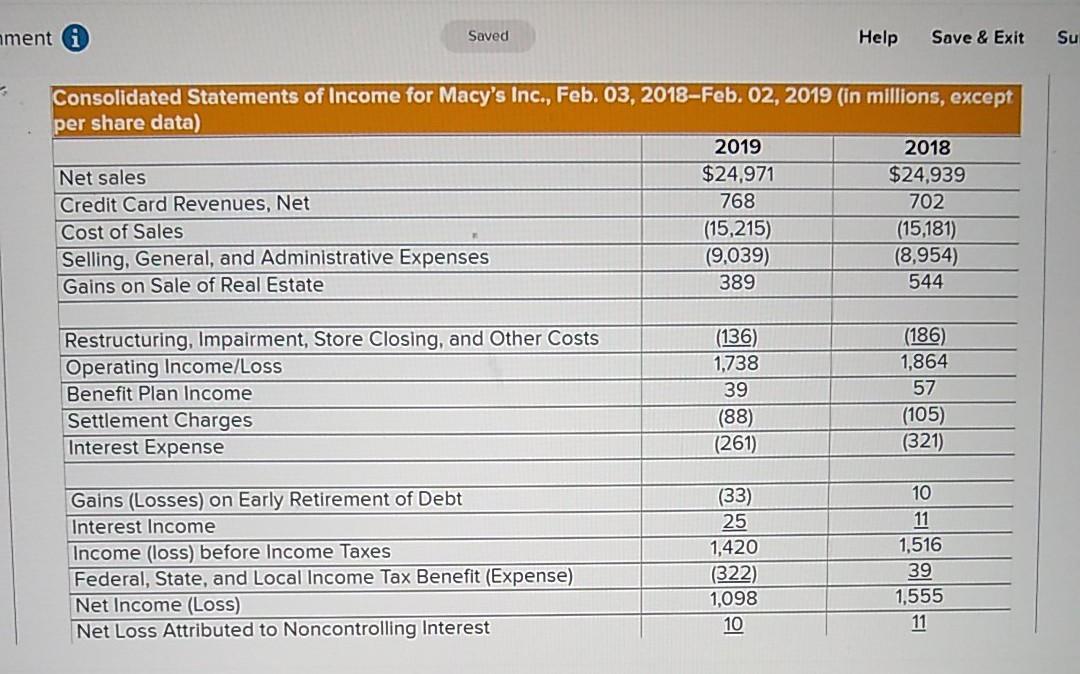

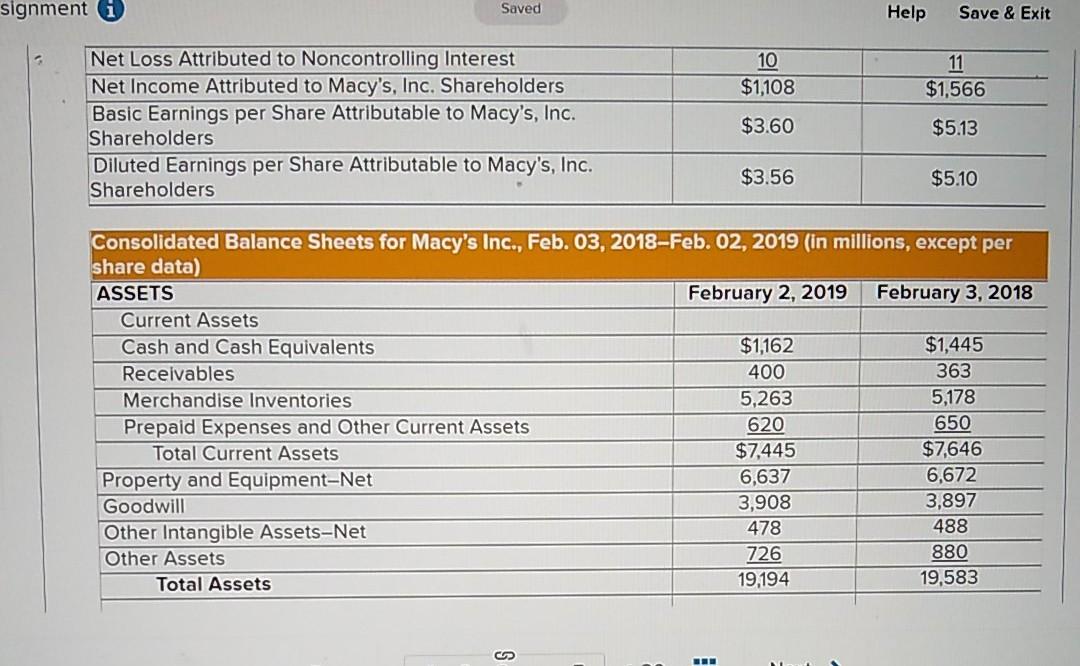

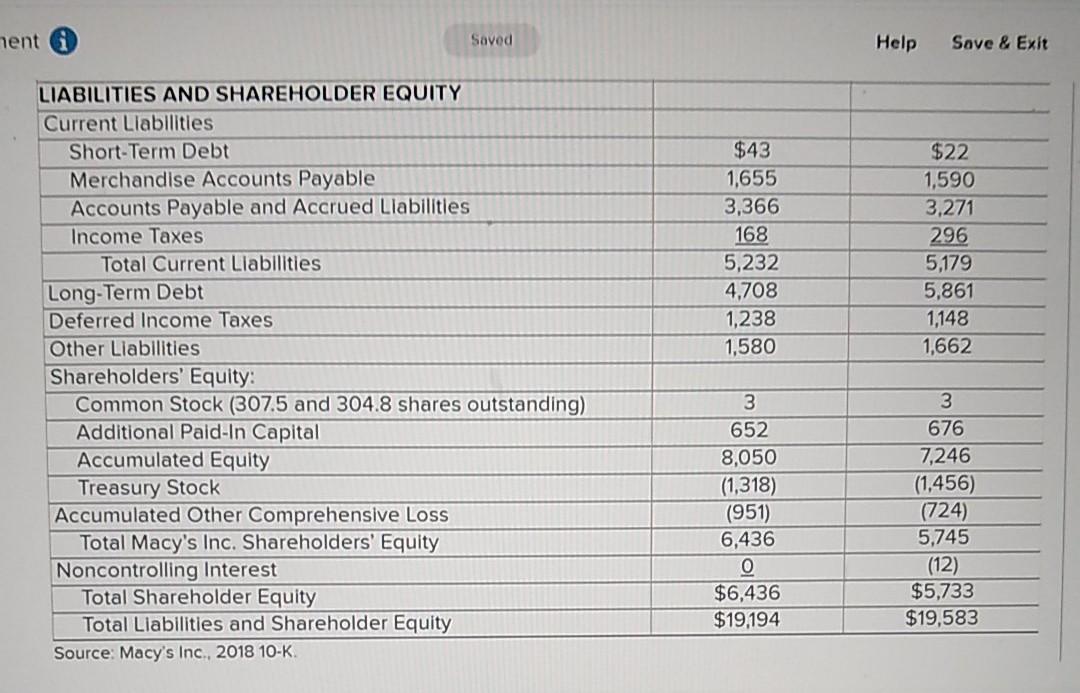

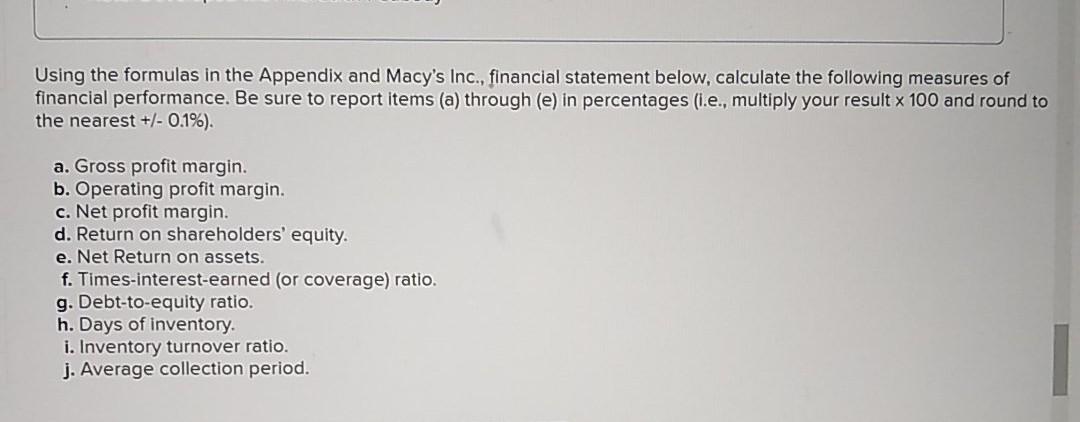

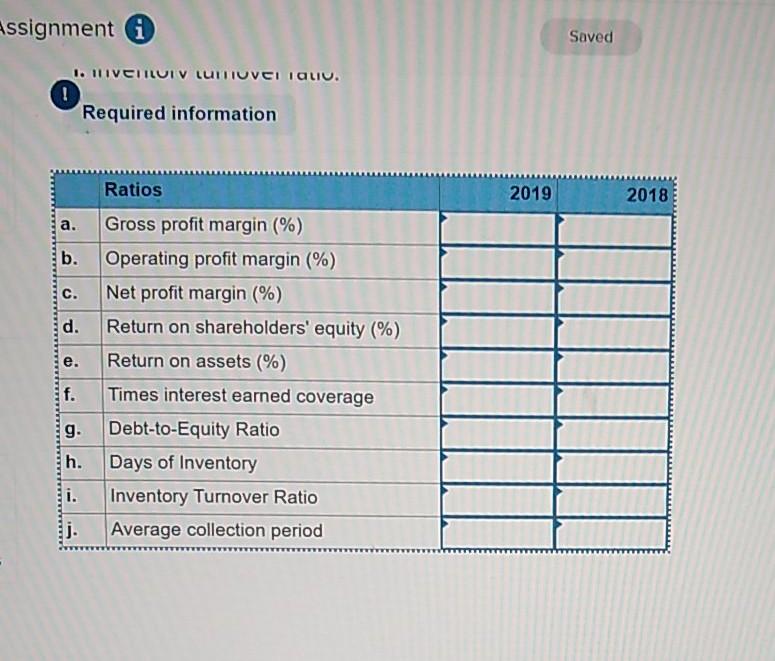

Read the overview below and complete the activities that follow. Assessing how well a company's strategy is presently working involves evaluating the strategy from both a qualitative standpoint and from a quantitative standpoint. The stronger a company's current overall performance, the less likely the need for radical strategy changes. The weaker a company's performance, the more its current strategy must be questioned. The financial ratios provided in the Appendix are the most commonly used to evaluate a company's financial performance and balance sheet strength. Assurance of Learning Exercise 4.1 provides you with an opportunity to assess Macy's Inc., financial performance and balance sheet strength. This exercise requires the same calculations and overall assessment. Before completing this exercise, be sure to read Chapter 4: Evaluating a Company's Resources, Capabilities and Competitiveness as well as reviewing the Appendix; Key Financial Ratios: How to Calculate them and What They Mean. Using the financial ratios provided in the Appendix and the financial statement information for Macy's Inc. below, calculate the following ratios for Macy's for both 2018 and 2019: a. Gross profit margin. b. Operating profit margin. c. Net profit margin. d. Times interest earned coverage. e. Return on shareholders' equity. f. Return on assets. LE TO 3 of 20 Next > ament Saved Help Save & Exit Su Consolidated Statements of Income for Macy's Inc., Feb. 03, 2018-Feb. 02, 2019 (in millions, except per share data) 2019 2018 Net sales $24.971 $24,939 Credit Card Revenues, Net 768 702 Cost of Sales (15,215) (15,181) Selling, General, and Administrative Expenses (9,039) (8,954) Gains on Sale of Real Estate 389 544 Restructuring, Impairment, Store Closing, and Other Costs Operating Income/Loss Benefit Plan Income Settlement Charges Interest Expense (136) 1.738 39 (88) (261) (186) 1,864 57 (105) (321) Gains (Losses) on Early Retirement of Debt Interest Income Income (loss) before Income Taxes Federal, State, and Local Income Tax Benefit (Expense) Net Income (Loss) Net Loss Attributed to Noncontrolling Interest (33) 25 1,420 (322) 1,098 10 10 11 1,516 39 1,555 11 signment i Saved Help Save & Exit 10 $1,108 11 $1,566 Net Loss Attributed to Noncontrolling Interest Net Income Attributed to Macy's, Inc. Shareholders Basic Earnings per Share Attributable to Macy's, Inc. Shareholders Diluted Earnings per Share Attributable to Macy's, Inc. Shareholders $3.60 $5.13 $3.56 $5.10 Consolidated Balance Sheets for Macy's Inc., Feb. 03, 2018-Feb. 02, 2019 (in millions, except per share data) ASSETS February 2, 2019 February 3, 2018 Current Assets Cash and Cash Equivalents $1,162 $1,445 Receivables 400 363 Merchandise Inventories 5,263 5,178 Prepaid Expenses and Other Current Assets 620 650 Total Current Assets $7,445 $7,646 Property and Equipment-Net 6,637 6,672 Goodwill 3,908 3,897 Other Intangible Assets-Net 478 488 Other Assets 726 880 Total Assets 19,194 19,583 G BE nent Saved Help Save & Exit $43 1,655 3,366 168 5,232 4,708 1,238 1,580 $22 1,590 3,271 296 5,179 5,861 1,148 1,662 LIABILITIES AND SHAREHOLDER EQUITY Current Liabilities Short-Term Debt Merchandise Accounts Payable Accounts Payable and Accrued Liabilities Income Taxes Total Current Liabilities Long-Term Debt Deferred Income Taxes Other Liabilities Shareholders' Equity: Common Stock (307.5 and 304.8 shares outstanding) Additional Paid-In Capital Accumulated Equity Treasury Stock Accumulated Other Comprehensive Loss Total Macy's Inc. Shareholders' Equity Noncontrolling Interest Total Shareholder Equity Total Liabilities and Shareholder Equity Source: Macy's Inc., 2018 10-K. 3 652 8,050 (1,318) (951) 6,436 0 $6,436 $19,194 3 676 7,246 (1,456) (724) 5,745 (12) $5,733 $19,583 Using the formulas in the Appendix and Macy's Inc., financial statement below, calculate the following measures of financial performance. Be sure to report items (a) through (e) in percentages (i.e., multiply your result x 100 and round to the nearest +/- 0.1%). a. Gross profit margin. b. Operating profit margin. c. Net profit margin. d. Return on shareholders' equity. e. Net Return on assets. f. Times-interest-earned (or coverage) ratio. g. Debt-to-equity ratio. h. Days of inventory. i. Inventory turnover ratio. j. Average collection period. Saved Assignment i 1. . ! Required information 2019 2018 a. b. C. d. e. Ratios Gross profit margin (%) Operating profit margin (%) Net profit margin (%) Return on shareholders' equity (%) Return on assets (%) Times interest earned coverage Debt-to-Equity Ratio Days of Inventory Inventory Turnover Ratio Average collection period f. g. h. i. j. Read the overview below and complete the activities that follow. Assessing how well a company's strategy is presently working involves evaluating the strategy from both a qualitative standpoint and from a quantitative standpoint. The stronger a company's current overall performance, the less likely the need for radical strategy changes. The weaker a company's performance, the more its current strategy must be questioned. The financial ratios provided in the Appendix are the most commonly used to evaluate a company's financial performance and balance sheet strength. Assurance of Learning Exercise 4.1 provides you with an opportunity to assess Macy's Inc., financial performance and balance sheet strength. This exercise requires the same calculations and overall assessment. Before completing this exercise, be sure to read Chapter 4: Evaluating a Company's Resources, Capabilities and Competitiveness as well as reviewing the Appendix; Key Financial Ratios: How to Calculate them and What They Mean. Using the financial ratios provided in the Appendix and the financial statement information for Macy's Inc. below, calculate the following ratios for Macy's for both 2018 and 2019: a. Gross profit margin. b. Operating profit margin. c. Net profit margin. d. Times interest earned coverage. e. Return on shareholders' equity. f. Return on assets. LE TO 3 of 20 Next > ament Saved Help Save & Exit Su Consolidated Statements of Income for Macy's Inc., Feb. 03, 2018-Feb. 02, 2019 (in millions, except per share data) 2019 2018 Net sales $24.971 $24,939 Credit Card Revenues, Net 768 702 Cost of Sales (15,215) (15,181) Selling, General, and Administrative Expenses (9,039) (8,954) Gains on Sale of Real Estate 389 544 Restructuring, Impairment, Store Closing, and Other Costs Operating Income/Loss Benefit Plan Income Settlement Charges Interest Expense (136) 1.738 39 (88) (261) (186) 1,864 57 (105) (321) Gains (Losses) on Early Retirement of Debt Interest Income Income (loss) before Income Taxes Federal, State, and Local Income Tax Benefit (Expense) Net Income (Loss) Net Loss Attributed to Noncontrolling Interest (33) 25 1,420 (322) 1,098 10 10 11 1,516 39 1,555 11 signment i Saved Help Save & Exit 10 $1,108 11 $1,566 Net Loss Attributed to Noncontrolling Interest Net Income Attributed to Macy's, Inc. Shareholders Basic Earnings per Share Attributable to Macy's, Inc. Shareholders Diluted Earnings per Share Attributable to Macy's, Inc. Shareholders $3.60 $5.13 $3.56 $5.10 Consolidated Balance Sheets for Macy's Inc., Feb. 03, 2018-Feb. 02, 2019 (in millions, except per share data) ASSETS February 2, 2019 February 3, 2018 Current Assets Cash and Cash Equivalents $1,162 $1,445 Receivables 400 363 Merchandise Inventories 5,263 5,178 Prepaid Expenses and Other Current Assets 620 650 Total Current Assets $7,445 $7,646 Property and Equipment-Net 6,637 6,672 Goodwill 3,908 3,897 Other Intangible Assets-Net 478 488 Other Assets 726 880 Total Assets 19,194 19,583 G BE nent Saved Help Save & Exit $43 1,655 3,366 168 5,232 4,708 1,238 1,580 $22 1,590 3,271 296 5,179 5,861 1,148 1,662 LIABILITIES AND SHAREHOLDER EQUITY Current Liabilities Short-Term Debt Merchandise Accounts Payable Accounts Payable and Accrued Liabilities Income Taxes Total Current Liabilities Long-Term Debt Deferred Income Taxes Other Liabilities Shareholders' Equity: Common Stock (307.5 and 304.8 shares outstanding) Additional Paid-In Capital Accumulated Equity Treasury Stock Accumulated Other Comprehensive Loss Total Macy's Inc. Shareholders' Equity Noncontrolling Interest Total Shareholder Equity Total Liabilities and Shareholder Equity Source: Macy's Inc., 2018 10-K. 3 652 8,050 (1,318) (951) 6,436 0 $6,436 $19,194 3 676 7,246 (1,456) (724) 5,745 (12) $5,733 $19,583 Using the formulas in the Appendix and Macy's Inc., financial statement below, calculate the following measures of financial performance. Be sure to report items (a) through (e) in percentages (i.e., multiply your result x 100 and round to the nearest +/- 0.1%). a. Gross profit margin. b. Operating profit margin. c. Net profit margin. d. Return on shareholders' equity. e. Net Return on assets. f. Times-interest-earned (or coverage) ratio. g. Debt-to-equity ratio. h. Days of inventory. i. Inventory turnover ratio. j. Average collection period. Saved Assignment i 1. . ! Required information 2019 2018 a. b. C. d. e. Ratios Gross profit margin (%) Operating profit margin (%) Net profit margin (%) Return on shareholders' equity (%) Return on assets (%) Times interest earned coverage Debt-to-Equity Ratio Days of Inventory Inventory Turnover Ratio Average collection period f. g. h. i. j

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started