Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Read the problem information in the first photo, then the Question & Answer for the problem in the 2nd paragraph. After, answer the following Question:

Read the problem information in the first photo, then the Question & Answer for the problem in the 2nd paragraph. After, answer the following Question: What would be the answer if the lease payments discount rate changed to 8% and the quarterly payment amount to $2,398,303?

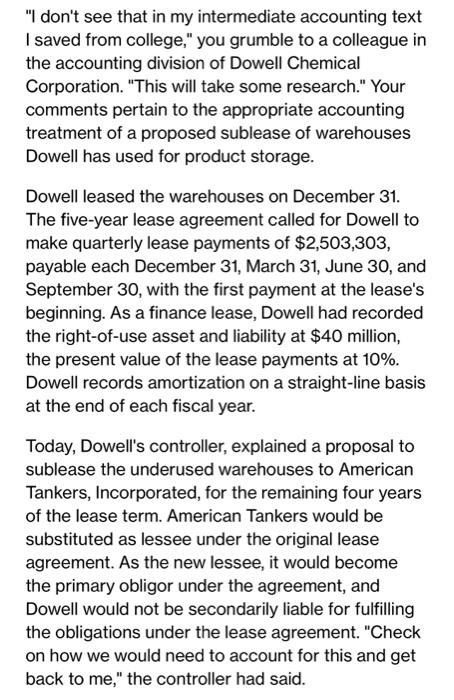

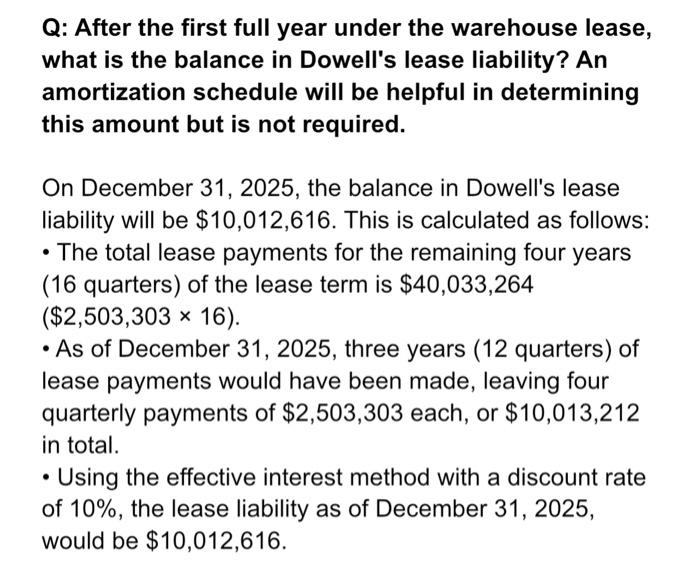

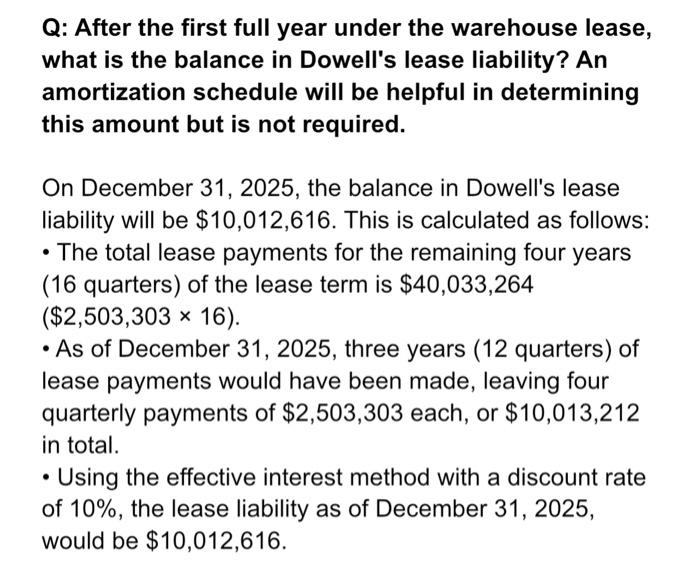

"I don't see that in my intermediate accounting text I saved from college," you grumble to a colleague in the accounting division of Dowell Chemical Corporation. "This will take some research." Your comments pertain to the appropriate accounting treatment of a proposed sublease of warehouses Dowell has used for product storage. Dowell leased the warehouses on December 31. The five-year lease agreement called for Dowell to make quarterly lease payments of $2,503,303, payable each December 31, March 31, June 30, and September 30, with the first payment at the lease's beginning. As a finance lease, Dowell had recorded the right-of-use asset and liability at $40 million, the present value of the lease payments at 10%. Dowell records amortization on a straight-line basis at the end of each fiscal year. Today, Dowell's controller, explained a proposal to sublease the underused warehouses to American Tankers, Incorporated, for the remaining four years of the lease term. American Tankers would be substituted as lessee under the original lease agreement. As the new lessee, it would become the primary obligor under the agreement, and Dowell would not be secondarily liable for fulfilling the obligations under the lease agreement. "Check on how we would need to account for this and get back to me," the controller had said. Q: After the first full year under the warehouse lease, what is the balance in Dowell's lease liability? An amortization schedule will be helpful in determining this amount but is not required. On December 31, 2025, the balance in Dowell's lease liability will be $10,012,616. This is calculated as follows: - The total lease payments for the remaining four years (16 quarters) of the lease term is $40,033,264 ($2,503,30316). -As of December 31, 2025, three years (12 quarters) of lease payments would have been made, leaving four quarterly payments of $2,503,303 each, or $10,013,212 in total. - Using the effective interest method with a discount rate of 10%, the lease liability as of December 31,2025 , would be $10,012,616

"I don't see that in my intermediate accounting text I saved from college," you grumble to a colleague in the accounting division of Dowell Chemical Corporation. "This will take some research." Your comments pertain to the appropriate accounting treatment of a proposed sublease of warehouses Dowell has used for product storage. Dowell leased the warehouses on December 31. The five-year lease agreement called for Dowell to make quarterly lease payments of $2,503,303, payable each December 31, March 31, June 30, and September 30, with the first payment at the lease's beginning. As a finance lease, Dowell had recorded the right-of-use asset and liability at $40 million, the present value of the lease payments at 10%. Dowell records amortization on a straight-line basis at the end of each fiscal year. Today, Dowell's controller, explained a proposal to sublease the underused warehouses to American Tankers, Incorporated, for the remaining four years of the lease term. American Tankers would be substituted as lessee under the original lease agreement. As the new lessee, it would become the primary obligor under the agreement, and Dowell would not be secondarily liable for fulfilling the obligations under the lease agreement. "Check on how we would need to account for this and get back to me," the controller had said. Q: After the first full year under the warehouse lease, what is the balance in Dowell's lease liability? An amortization schedule will be helpful in determining this amount but is not required. On December 31, 2025, the balance in Dowell's lease liability will be $10,012,616. This is calculated as follows: - The total lease payments for the remaining four years (16 quarters) of the lease term is $40,033,264 ($2,503,30316). -As of December 31, 2025, three years (12 quarters) of lease payments would have been made, leaving four quarterly payments of $2,503,303 each, or $10,013,212 in total. - Using the effective interest method with a discount rate of 10%, the lease liability as of December 31,2025 , would be $10,012,616

Read the problem information in the first photo, then the Question & Answer for the problem in the 2nd paragraph.

After, answer the following Question: What would be the answer if the lease payments discount rate changed to 8% and the quarterly payment amount to $2,398,303?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started