Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Read the problems carefully, answer it completely and correctly. Answer 17 and 18. Show complete solution. Thank you godbless Abad, a partner of the accounting

Read the problems carefully, answer it completely and correctly. Answer 17 and 18. Show complete solution. Thank you godbless

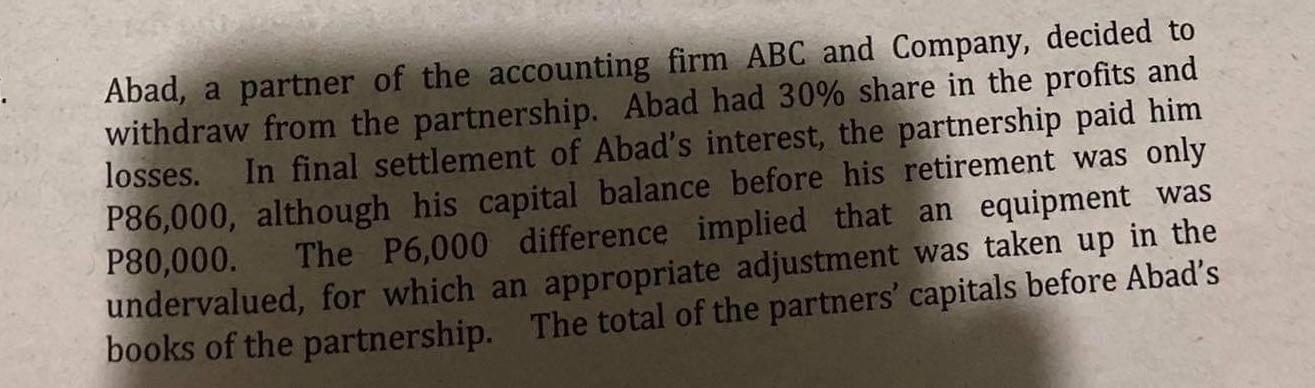

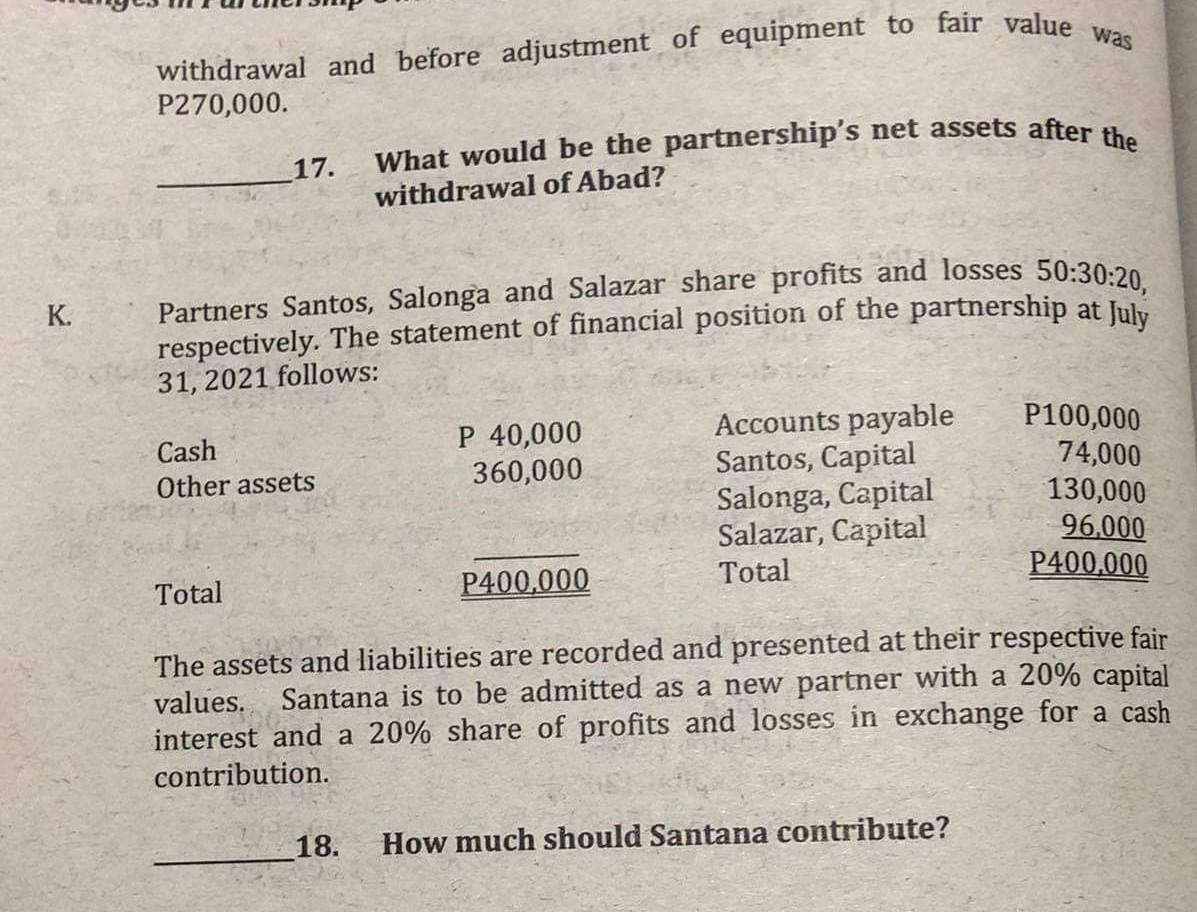

Abad, a partner of the accounting firm ABC and Company, decided to withdraw from the partnership. Abad had 30% share in the profits and losses. In final settlement of Abad's interest, the partnership paid him P86,000, although his capital balance before his retirement was only P80,000. The P6,000 difference implied that an equipment was undervalued, for which an appropriate adjustment was taken up in the books of the partnership. The total of the partners' capitals before Abad's was withdrawal and before adjustment of equipment to fair value P270,000 What would be the partnership's net assets after the 17. withdrawal of Abad? K. Partners Santos, Salonga and Salazar share profits and losses 50:30:20, respectively. The statement of financial position of the partnership at July 31, 2021 follows: Cash Other assets P 40,000 360,000 Accounts payable Santos, Capital Salonga, Capital Salazar, Capital Total P100,000 74,000 130,000 96,000 P400.000 Total P400,000 The assets and liabilities are recorded and presented at their respective fair values. Santana is to be admitted as a new partner with a 20% capital interest and a 20% share of profits and losses in exchange for a cash contribution. 18. How much should Santana contributeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started