Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Read the question above and use the chart to answer the multiple-choice the first chart is to answer Q 10 and 11. This chart is

Read the question above and use the chart to answer the multiple-choice

the first chart is to answer Q 10 and 11.

This chart is to answer questions 14-17.

Question 18-20

Question 21-23

question 24-25

Question 27-28

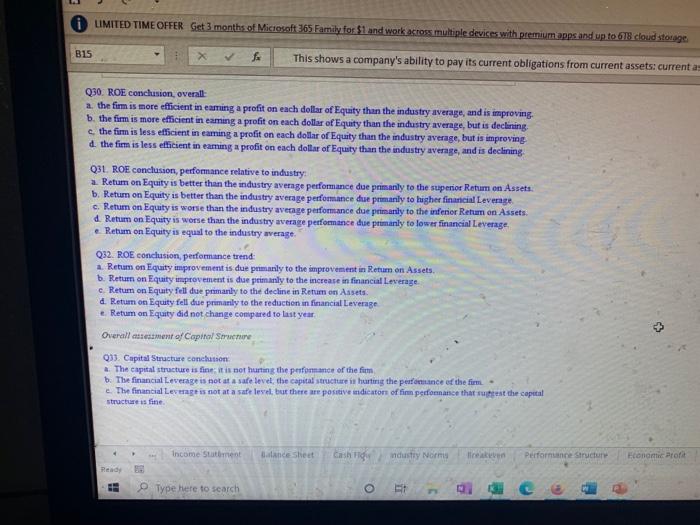

Question 30-33

Hopefully, this makes more clear.

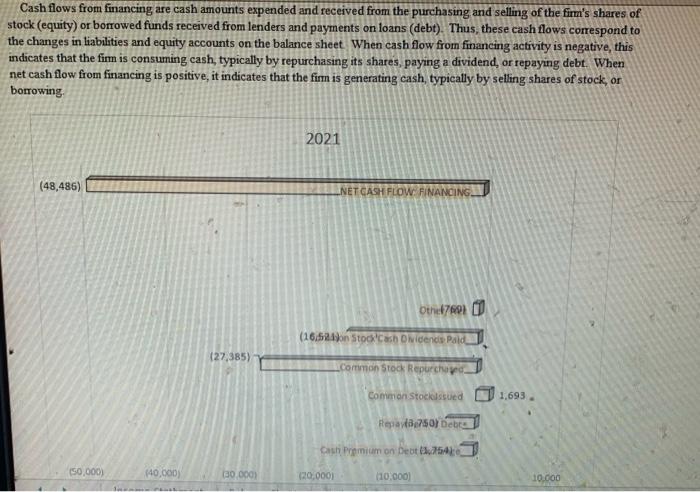

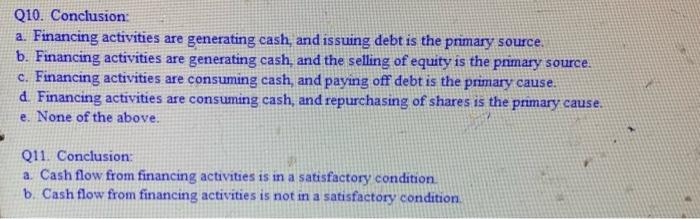

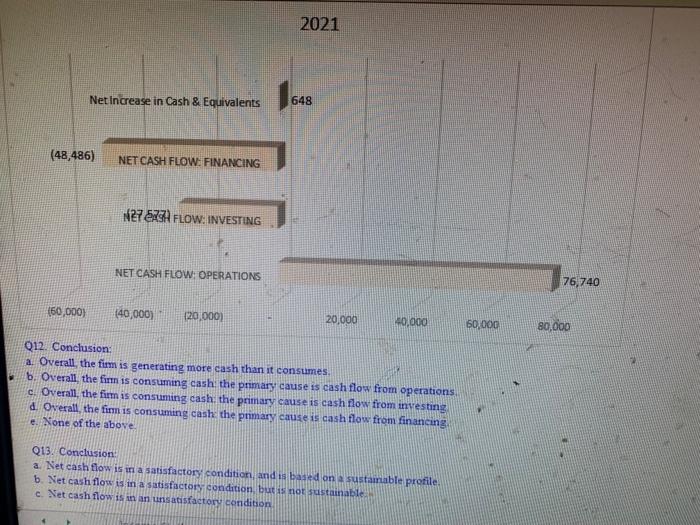

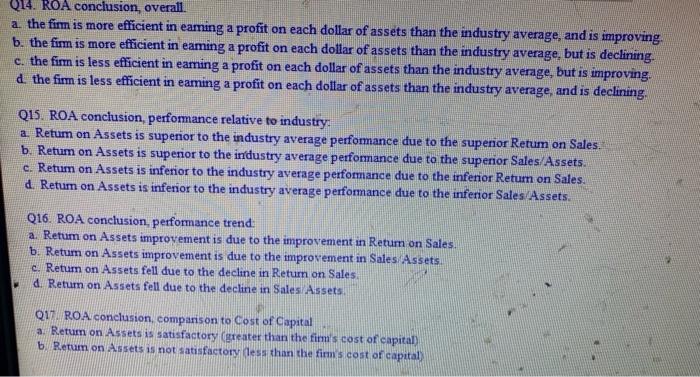

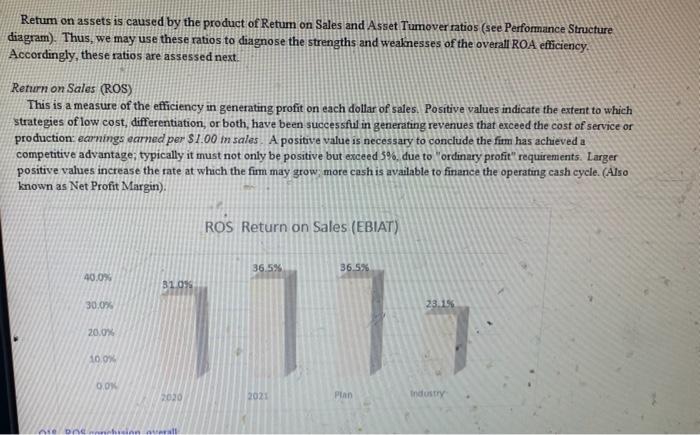

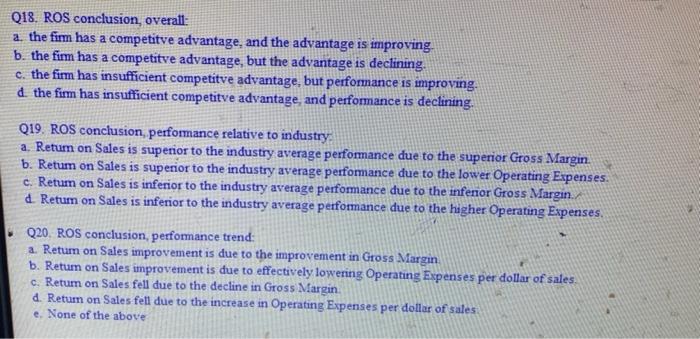

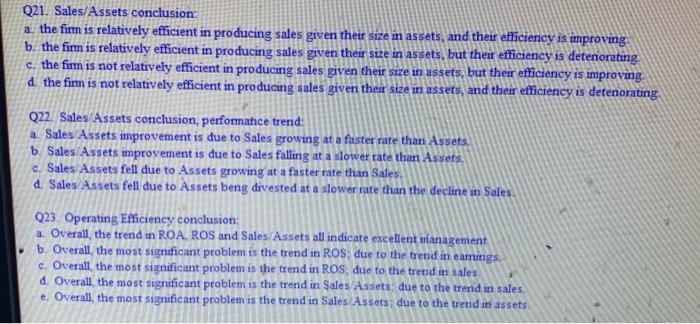

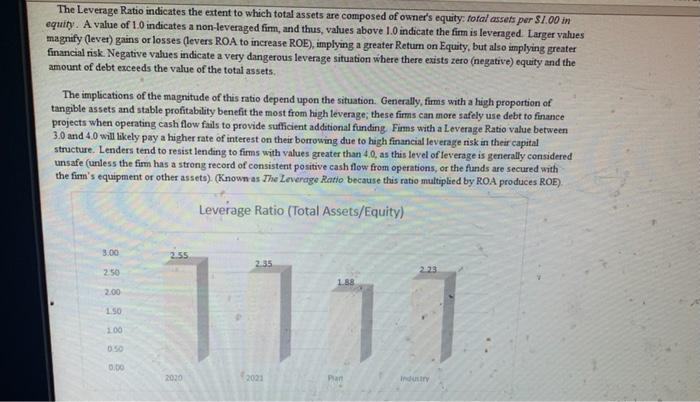

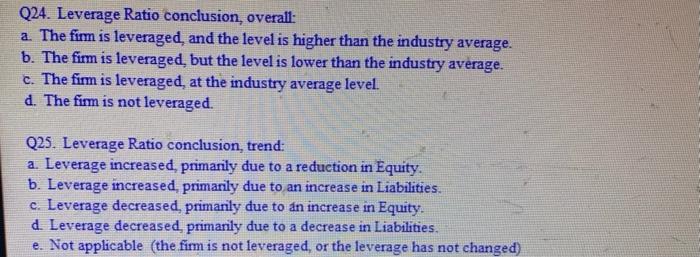

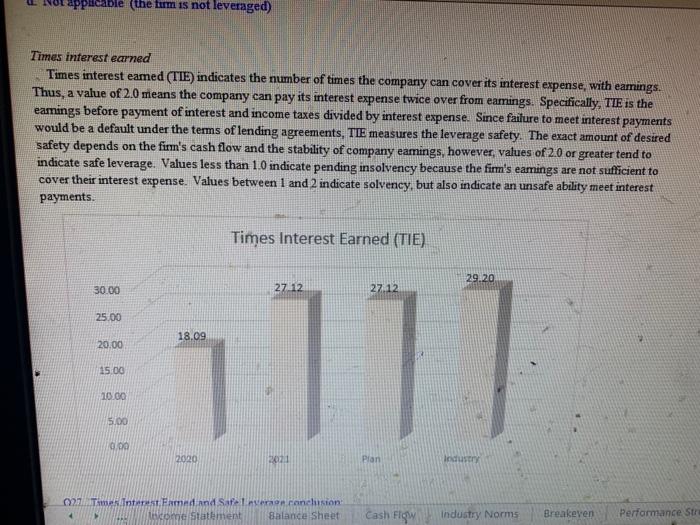

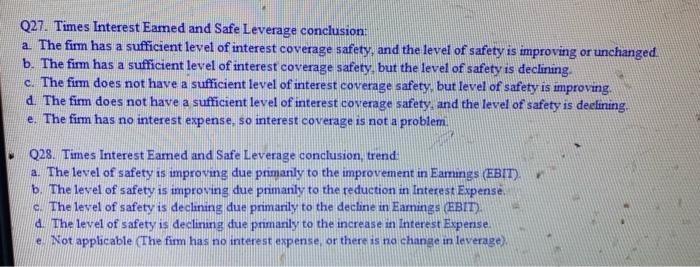

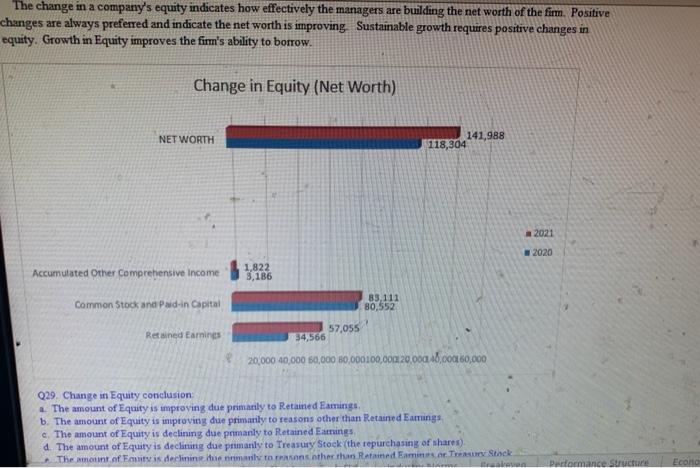

Cash flows from financing are cash amounts expended and received from the purchasing and selling of the firm's shares of stock (equity) or borrowed funds received from lenders and payments on loans (debt). Thus, these cash flows correspond to the changes in liabilities and equity accounts on the balance sheet. When cash flow from financing activity is negative, this indicates that the fimm is consuming cash, typically by repurchasing its shares, paying a dividend, or repaying debt. When net cash flow from financing is positive, it indicates that the firm is generating cash, typically by selling shares of stock, or borrowing 2021 (48,486) NET CASH FLOW. FINANCING Othd760100 (16.681) Stoo Cash Dividende Pold 127,385) Common Stock Repurch Common Stockelsted 1,693 Repav750) Debt Cast Promium on Deot 3.754 50,000) 140.000) 30.000 20.000 110.000 10.000 Q10. Conclusion: a. Financing activities are generating cash, and issuing debt is the primary source. b. Financing activities are generating cash and the selling of equity is the primary source. c. Financing activities are consuming cash, and paying off debt is the primary cause. d. Financing activities are consuming cash, and repurchasing of shares is the primary cause. e. None of the above. Q11. Conclusion: a. Cash flow from financing activities is in a satisfactory condition b. Cash flow from financing activities is not in a satisfactory condition 2021 Net Increase in Cash & Equivalents 648 (48,486) NET CASH FLOW: FINANCING N272231 FLOW: INVESTING NET CASH FLOW: OPERATIONS 76,740 460,000) 40,000) 120.0001 20,000 40,000 60.000 80,000 012. Conclusion: a. Overall, the firm is generating more cash than it consumes. 6. Overall the firm is consuming cash the primary cause is cash flow from operations c. Overall, the firm is consuming cash: the primary cause is cash flow from investing d. Overall the firm is consuming cash the primary cause is cash flow from financing e. None of the above Q13. Conclusion a. Net cash flow is in a satisfactory condition, and is based on a sustainable profile b. Net cash flow is in a satisfactory condition, but is not sustainable c. Net cash flow is in in unsatisfactory condition Operating Efficiency Operating efficiency is the productivity achieved by management in employing the resources of the fim. The primary measures are retum on assets, retum on sales, and asset tumover. These ratios will be analyzed according to both their efficiency trend and comparison to industry average efficiency. The first ratio that will be discussed is retum on assets. Return on Assets (ROA) This shows the overall efficiency of management in generating eamings given the total amount of assets in the company: earnings per $1.00 in assets. Thus, this is a very broad measure of the operating efficiency of management. Large (positive) values are preferred. (Also known as 'ROA' and often misnamed Retum on Investment RON ROA (EBIAT) 50.096 44 25 400% 30.0% 1 19.14 20.0% 14.7% 16 195 10.0 519 0.00 2020 2021 plan Indus Cost or 5 RON ronion serait Income Statumont Ready Balance Sheet Cash FM industry Norms Breakeyon Performance Structure Q14. ROA conclusion, overall a. the firm is more efficient in eaming a profit on each dollar of assets than the industry average, and is improving b. the firm is more efficient in eaming a profit on each dollar of assets than the industry average, but is declining. c. the firm is less efficient in eaming a profit on each dollar of assets than the industry average, but is improving. d. the firm is less efficient in eaming a profit on each dollar of assets than the industry average, and is declining Q15. ROA conclusion, performance relative to industry. a. Retum on Assets is superior to the industry average performance due to the superior Retum on Sales. b. Retum on Assets is superior to the industry average performance due to the superior Sales/Assets. c. Retum on Assets is inferior to the industry average performance due to the infenor Retum on Sales. d. Retum on Assets is inferior to the industry average perfomance due to the inferior Sales Assets. Q16. ROA conclusion, performance trend: a. Retum on Assets improvement is due to the improvement in Return on Sales. b. Retum on Assets improvement is due to the improvement in Sales Assets c. Retum on Assets fell due to the decline in Return on Sales d. Return on Assets fell due to the decline in Sales Assets 017 ROA conclusion, companson to Cost of Capital a Retum on Assets is satisfactory (greater than the firm's cost of capital) Retum on Assets is not satisfactory (less than the fim's cost of capital) Retum on assets is caused by the product of Retum on Sales and Asset Tumover ratios (see Performance Structure diagram). Thus, we may use these ratios to diagnose the strengths and weaknesses of the overall ROA efficiency. Accordingly, these ratios are assessed next. Return on Sales (ROS) This is a measure of the efficiency in generating profit on each dollar of sales. Positive values indicate the extent to which strategies of low cost, differentiation, or both, have been successful in generating revenues that exceed the cost of service or production: earnings earned per $1.00 in sales. A positive value is necessary to conclude the firm has achieved a competitive advantage; typically it must not only be positive but exceed 3%, due to "ordinary profit" requirements. Larger positive values increase the rate at which the firm may grow more cash is available to finance the operating cash cycle. (Also known as Net Profit Margin). ROS Return on Sales (EBIAT) 36.5% 365 40.0% 31.0% 30.0 23.156 " 200 160 00 2021 PAD Industry all ... Q18. ROS conclusion, overall: a. the firm has a competitve advantage, and the advantage is improving b. the firm has a competitve advantage, but the advantage is declining. c. the firm has insufficient competitve advantage, but performance is improving. d the firm has insufficient competitve advantage, and performance is declining. Q19. ROS conclusion, performance relative to industry a. Retum on Sales is superior to the industry average performance due to the superior Gross Margin b. Retum on Sales is superior to the industry average performance due to the lower Operating Expenses. c. Retum on Sales is inferior to the industry average performance due to the inferior Gross Margin. d. Retum on Sales is inferior to the industry average performance due to the higher Operating Expenses. Q20. ROS conclusion, performance trend: a. Return on Sales improvement is due to the improvement in Gross Margin b. Retum on Sales improvement is due to effectively lowering Operating Expenses per dollar of sales c. Retum on Sales fell due to the decline in Gross Margin d. Return on Sales fell due to the increase in Operating Expenses per dollar of sales e. None of the above Asset Turnover (AT) This indicates the extent to which management is efficient in its use of all the company's assets to produce sales (effective sales volume expansion strategies): sales per $1.00 in assets. Large (increasing) values are preferred. (Also known as Rate of Asset Tumover, ROAT, or Sales to Assets Ratio). Sales/Assets 1191 2.00 150 1 1.00 0.47 0.50 0.44 050 0.00 2020 2031 Plan Industry Q21. Sales/Assets conclusion: a. the firm is relatively efficient in producing sales given their size in assets, and their efficiency is improving. b. the firm is relatively efficient in producing sales given their size in assets, but their efficiency is deteriorating c. the firm is not relatively efficient in producing sales given their size in assets, but their efficiency is improving d. the fimm is not relatively efficient in producing sales given their size in assets, and their efficiency is detentorating Q22. Sales Assets conclusion, perfomance trend: a Sales Assets improvement is due to Sales growing at a faster rate than Assets 6. Sales Assets improsement is due to Sales falling at a slower rate than Assets c. Sales Assets fell due to Assets growing at a faster rate than Sales d. Sales Assets fell due to Assets beng divested at a slower rate than the decline in Sales Q23. Operating Efficiency conclusion: a. Overall, the trend in ROA, ROS and Sales/Assets all indicate excellent management b. Overall, the most significant problem is the trend in ROS due to the trend in earings c. Overall the most significant problem is the trend in ROS, due to the trend in sales d. Overall the most significant problem is the trend in Sales Assets due to the trend in sales, e. Overall, the most significant problem is the trend in Sales Assets due to the trend in assets The Leverage Ratio indicates the extent to which total assets are composed of owner's equity. total assets par $1.00 in equity. A value of 1.0 indicates a non-leveraged firm, and thus, values above 1.0 indicate the firm is leveraged. Larger values magnify (levet) gains or losses (levers ROA to increase ROE), implying a greater Retum on Equity, but also implying greater financial risk. Negative values indicate a very dangerous leverage situation where there exists zero (negative) equity and the amount of debt exceeds the value of the total assets. The implications of the magnitude of this ratio depend upon the situation. Generally, firms with a high proportion of tangible assets and stable profitability benefit the most from high leverage; these firms can more safely use debt to finance projects when operating cash flow fails to provide sufficient additional funding Fims with a Leverage Ratio value between 3.0 and 4.0 will likely pay a higher rate of interest on their borrowing due to high financial leverage risk in their capital structure. Lenders tend to resist lending to firms with values greater than 4.0, as this level of leverage is generally considered unsafe (unless the firm has a strong record of consistent positive cash flow from operations, or the funds are secured with the firm's equipment or other assets). (Known as The Leverage Ratio because this ratio multiplied by ROA produces ROE) Leverage Ratio (Total Assets/Equity) 3.00 2.55 250 2.00 1111 1.50 100 0.50 0.00 2020 2003 TY Q24. Leverage Ratio conclusion, overall: a. The firm is leveraged, and the level is higher than the industry average. b. The firm is leveraged, but the level is lower than the industry average. c. The firm is leveraged, at the industry average level. d. The film is not leveraged. Q25. Leverage Ratio conclusion, trend: a. Leverage increased primarily due to a reduction in Equity. b. Leverage increased, primarily due to an increase in Liabilities. c. Leverage decreased, primarily due to an increase in Equity. d Leverage decreased primarily due to a decrease in Liabilities. e. Not applicable (the fim is not leveraged, or the leverage has not changed) This shows a company's ability to pay its current obligations from current a Positive and Negative Leverage Leverage is a double-edged sword. It can magnify gains, or magnify losses. Positive leverage occurs only when the retum on borrowed funds is greater than the cost of the debt (debt yield). Negative leverage occurs when the return is less than the cost of debt. In this analysis we do not know exactly, the retum on borrowed funds so the average retum for all assets is used. Thus, if the Retum on Assets is greater than the cost of debt, then the leverage is considered positive and that would mean Retum on Assets is being leveraged to improve Retum on Equity Conversely, if ROA is less than the cost of debt, then the leverage is considered to be negative and in that case ROA is being leveraged, but it is reducing ROE. 2021 19.196 20.0% 15.0% 10.0% 4.00% 5.0% 0.0% ROA TEBATI Cost of Debt Q26. Positive and Negative Leverage conclusion a. The firm is positvely leveraged increasing leverage will increase ROE b. The firm is negatively leveraged increasing leverage will decrease ROE. The primary problem is low ROA c. The fimm is negatively leveraged, increasing leverage will decrease ROE The primary problemas the high cost of Debt d. Not applicable (the fimm is not leveraged) Income Statement Balance Sheet Industry Norms Breakeven Performance Structure Ready Cash Fique Ecan applicable (the form is not leveraged) Times interest earned Times interest eamed (TIE) indicates the number of times the company can cover its interest expense, with eamings. Thus, a value of 2.0 means the company can pay its interest expense twice over from earings. Specifically. TIE is the eamings before payment of interest and income taxes divided by interest expense. Since failure to meet interest payments would be a default under the terms of lending agreements, TIE measures the leverage safety. The exact amount of desired safety depends on the firm's cash flow and the stability of company eamings, however, values of 2.0 or greater tend to indicate safe leverage. Values less than 1.0 indicate pending insolvency because the firm's eamings are not sufficient to cover their interest expense. Values between 1 and 2 indicate solvency, but also indicate an unsafe ability meet interest payments. Times Interest Earned (TIE) 29.20 30.00 27.12 27.12 25.00 18.09 20.00 71 15.00 10.00 500 0.00 2020 2021 Plan Industry 02. TAM Interest Emend Saf Inveron conclusion come Statement Balance Sheet Cash Figw Industry Norms Breakeven Performance Stre a Q27. Times Interest Eamed and Safe Leverage conclusion: a. The fim has a sufficient level of interest coverage safety, and the level of safety is improving or unchanged. b. The firm has a sufficient level of interest coverage safety, but the level of safety is declining. c. The firm does not have a sufficient level of interest coverage safety, but level of safety is improving d. The firm does not have a sufficient level of interest coverage safety, and the level of safety is declining, e. The firm has no interest expense. so interest coverage is not a problem. Q28. Times Interest Eamed and Safe Leverage conclusion, trend: a. The level of safety is improving due primanly to the improvement in Eamings (EBIT) b. The level of safety is improving due primanly to the reduction in Interest Expense, c. The level of safety is declining due primarily to the decline in Earnings (EBIT) d. The level of safety is declining due primarily to the increase in Interest Expense. e. Not applicable (The firm has no interest expense, or there is no change in leverage) The change in a company's equity indicates how effectively the managers are building the net worth of the firm. Positive changes are always preferred and indicate the net worth is improving Sustainable growth requires positive changes in equity. Growth in Equity improves the firm's ability to borrow. Change in Equity (Net Worth) NET WORTH 141,988 118,304 2021 2020 Accumutated other comprehensive Income 1,822 3,186 Common Stock and Paud in Capital 83,111 80,552 Retained Earnings 57,055 34,566 20,000 40,000 50,000 80,000100,00 20,00 6,00 60,000 Q29. Change in Equity conclusion a. The amount of Equity is improving due primarily to Retained Eatings b. The amount of Equity is improving due primarily to reasons other than Retained Earrings c. The amount of Equity is declining due prmanly to Retained Earrings d. The amount of Equity is declining due primarily to Treasury Stock (the repurchasing of shares) The amount of Eatis declinin teman Anther than Ratnined Eminor Stock havina Performance Structure Econo Return on Equity This indicates how effectively the owners (shareholders) investment is being employed the efficiency with which managers use the owners' equity investment to produce eamings: net income generated per $1.00 in equity. Larger (positive) values are preferred. ROE and ROA differ only by the extent to which the firm is leveraged. Thus, any difference between ROE and ROA is a measure of the effect of the capital structure on the firm's performance. Alas, there is no free lunch: any increase in ROE performance due to leverage is off-set by the risk associated with leverage and thus, changes in capital structure tend to have no effect on the value of the fimm. (Also known as 'ROE and Retum on Net Worth) ROE Return on Equity (EBIAT) 95.294 100.096 80.0% 60.0% 43.2% 1 1 37.4% 30.1% 40:0 20.06 0.04 2020 202 PINO Industry LIMITED TIME OFFER Get 3 months of Microsoft 365 Family for $1 and work across multiple devices with premium apps and up to 618 cloud storage B15 This shows a company's ability to pay its current obligations from current assets: current a Q30. ROE conclusion, overall a. the firm is more efficient in eaming a profit on each dollar of Equity than the industry average, and is improving b. the firm is more efficient in eaming a profit on each dollar of Equity than the industry average, but is declining c. the firm is less efficient in eaming a profit on each dollar of Equity than the industry average, but is improving d. the firm is less efficient in eaming a profit on each dollar of Equity than the industry average, and is declining Q31. ROE conclusion, performance relative to industry a Retum on Equity is better than the industry average performance due primanly to the superior Retum on Assets b. Return on Equity is better than the industry average performance due primanly to higher financial Leverage c. Retum on Equity is worse than the industry average performance due primarily to the inferior Rehum on Assets. d. Retum on Equity is worse than the industry average performance due primanly to lower financial Leverage e Retuum on Equity is equal to the industry average Q32. ROE conclusion, performance trend: a. Retum on Equity improvement is due pamanly to the improvement in Return on Assets b. Return on Equity improvement is due primanly to the increase in financial Leverage c Retum on Equity fell due primanly to the decline in Retum on Assets d. Betum on Equity fell due primarily to the reduction in financial Leverage e Retum on Equity did not change compared to last year Overall assessment of Capital Struere 033. Capital Structure conclusion The capital structure is fine it is not hurting the performance of the fum b. The financial Leverage is not at a safe level, the capital structures hurting the performance of the fim- e. The financial Leverage is not at a sate level, but there are positive indicators of finn performance that rust the capital structure is fine Income Statement Balance Sheet Cash industry Norm Irekin Performance Structure Economic prof Ready 3 Type here to search o

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started