read the report and answer the questions

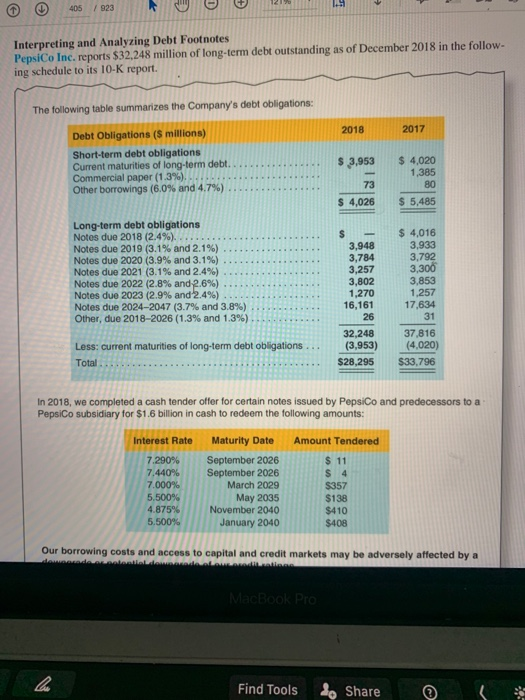

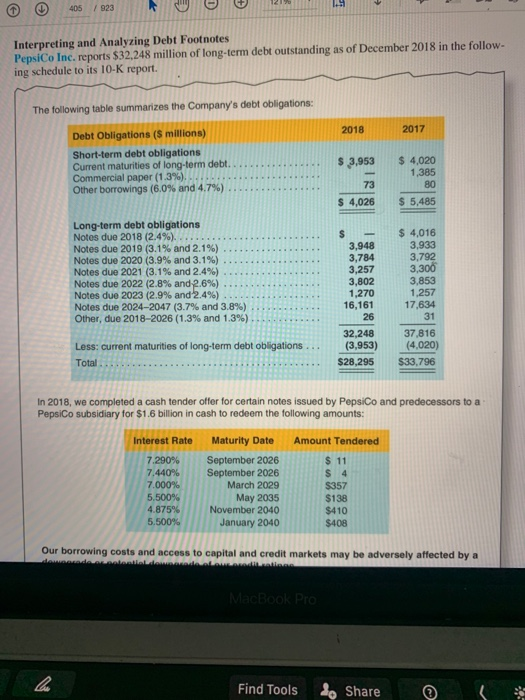

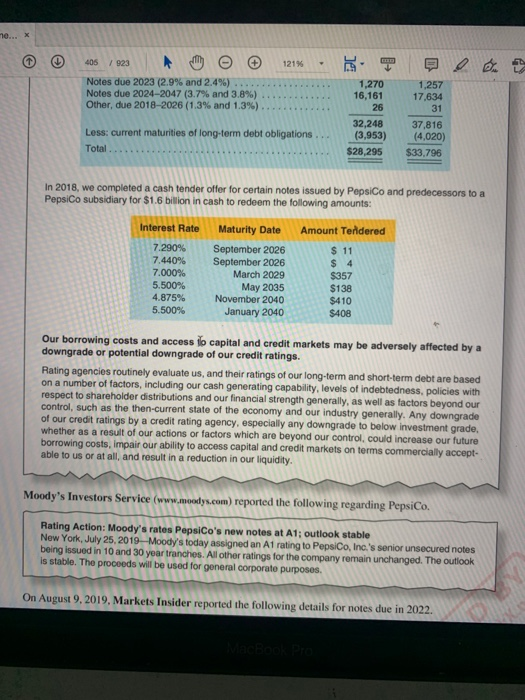

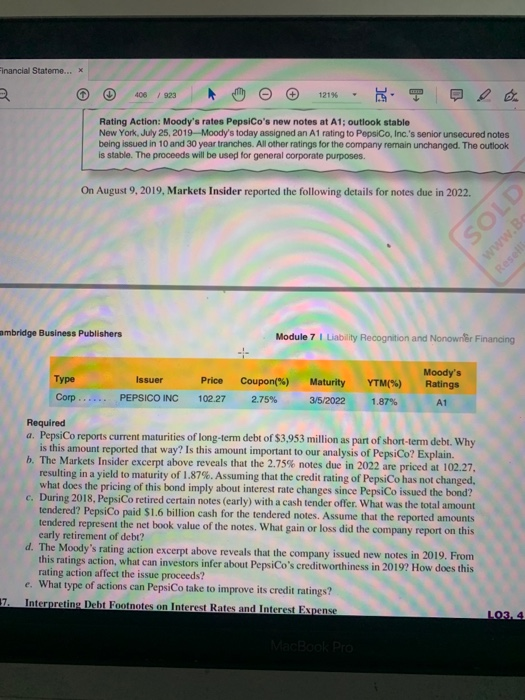

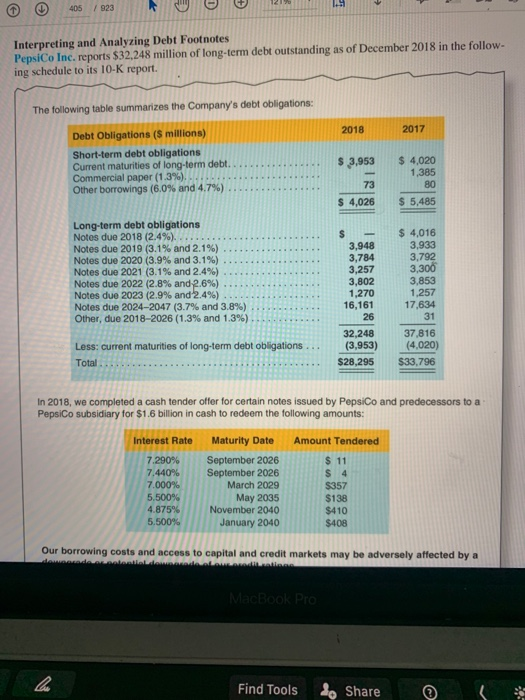

405 1. / 923 Interpreting and Analyzing Debt Footnotes PepsiCo Inc. reports $32,248 million of long-term debt outstanding as of December 2018 in the follow- ing schedule to its 10-K report. The following table summarizes the Company's debt obligations: 2018 2017 Debt Obligations (s millions) Short-term debt obligations Current maturities of long-term debt. Commercial paper (1.3%) Other borrowings (6.0% and 4.7%) $ 3,953 $ 4,020 1,385 80 73 $ 4,026 $ 5,485 Long-term debt obligations Notes due 2018 (2.4%) Notes due 2019 (3.1% and 2.1%) Notes due 2020 (3.9% and 3.1%) Notes due 2021 (3.1% and 2.4%) Notes due 2022 (2.8% and 2.6%) Notes due 2023 (2.9% and 2.4%) Notes due 2024-2047 (3.7% and 3.8%) Other, due 2018-2026 (1.3% and 1.3%) s 3,948 3,784 3,257 3,802 1,270 16,161 26 32,248 (3,953) $28,295 $ 4,016 3,933 3,792 3,300 3,853 1,257 17,634 31 Less: current maturities of long-term debt obligations 37.816 (4.020) $33,796 Total In 2018, we completed a cash tender offer for certain notes issued by PepsiCo and predecessors to a PepsiCo subsidiary for $1.6 billion in cash to redeem the following amounts: Interest Rate Amount Tendered 7.290% 7.440% 7.000% 5.500% 4.875% 5.500% Maturity Date September 2026 September 2026 March 2029 May 2035 November 2040 January 2040 $ 11 $ 4 $357 $138 $410 $408 Our borrowing costs and access to capital and credit markets may be adversely affected by a dows MacBook Pro ha Find Tools do Share me... X 405 / 923 121% es Notes due 2023 (2.9% and 2.4%) Notes due 2024-2047 (3.7% and 3.8%) Other, due 2018-2026 (1.3% and 1.3%) 1,270 16,161 26 32,248 (3,953) $28,295 1,257 17,634 31 37,816 (4,020) $33,796 Less: current maturities of long-term debt obligations Total In 2018, we completed a cash tender offer for certain notes issued by PepsiCo and predecessors to a PepsiCo subsidiary for $1.6 billion in cash to redeem the following amounts: Interest Rate 7.290% 7.440% 7.000% 5.500% 4.875% 5.500% Maturity Date September 2026 September 2026 March 2029 May 2035 November 2040 January 2040 Amount Terdered $ 11 $ 4 $357 $138 $410 $408 Our borrowing costs and access lo capital and credit markets may be adversely affected by a downgrade or potential downgrade of our credit ratings. Rating agencies routinely evaluate us, and their ratings of our long-term and short-term debt are based on a number of factors, including our cash generating capability, levels of indebtedness, policies with respect to shareholder distributions and our financial strength generally, as well as factors beyond our control, such as the then-current state of the economy and our industry generally. Any downgrade of our credit ratings by a credit rating agency, especially any downgrade to below investment grade, whether as a result of our actions or factors which are beyond our control, could increase our future borrowing costs, impair our ability to access capital and credit markets on terms commercially accept- able to us or at all, and result in a reduction in our liquidity. Moody's Investors Service (www.moodys.com) reported the following regarding PepsiCo. Rating Action: Moody's rates PepsiCo's new notes at A1; outlook stable New York, July 25, 2019-Moody's today assigned an A1 rating to PepsiCo, Inc.'s senior unsecured notes being issued in 10 and 30 year tranches. All other ratings for the company remain unchanged. The outlook is stable. The proceeds will be used for general corporate purposes On August 9, 2019, Markets Insider reported the following details for notes due in 2022. inancial Stateme... x 400 / 923 + 121% Rating Action: Moody's rates PepsiCo's new notes at A1; outlook stable New York, July 25, 2019 Moody's today assigned an A1 rating to PepsiCo, Inc.'s senior unsecured notes being issued in 10 and 30 year tranches. All other ratings for the company remain unchanged. The outlook is stable. The proceeds will be used for general corporate purposes. On August 9, 2019, Markets Insider reported the following details for notes due in 2022. SOLD www.B Resell mmbridge Business Publishers Module 7 I Liability Recognition and Nonownler Financing Type Issuer Price 10227 Coupon(%) 2.75% Maturity 3/5/2022 Corp... Moody's Ratings A1 YTM(%) 1.87% PEPSICO INC Required a. PepsiCo reports rent maturities of long-term debt of $3,953 million as part of short-term debt. Why is this amount reported that way? Is this amount important to our analysis of PepsiCo? Explain. b. The Markets Insider excerpt above reveals that the 2.75% notes due in 2022 are priced at 102.27. resulting in a yield to maturity of 1.87%. Assuming that the credit rating of PepsiCo has not changed, what does the pricing of this bond imply about interest rate changes since PepsiCo issued the bond? c. During 2018, PepsiCo retired certain notes (early) with a cash tender offer. What was the total amount tendered? PepsiCo paid $1.6 billion cash for the tendered notes. Assume that the reported amounts tendered represent the net book value of the notes. What gain or loss did the company report on this early retirement of debt? d. The Moody's rating action excerpt above reveals that the company issued new notes in 2019. From this ratings action, what can investors infer about PepsiCo's creditworthiness in 2019? How does this rating action affect the issue proceeds? e. What type of actions can PepsiCo take to improve its credit ratings? Interpreting Debt Footnotes on Interest Rates and Interest Expense 17. LO3 4 MACBOOK Pro 405 1. / 923 Interpreting and Analyzing Debt Footnotes PepsiCo Inc. reports $32,248 million of long-term debt outstanding as of December 2018 in the follow- ing schedule to its 10-K report. The following table summarizes the Company's debt obligations: 2018 2017 Debt Obligations (s millions) Short-term debt obligations Current maturities of long-term debt. Commercial paper (1.3%) Other borrowings (6.0% and 4.7%) $ 3,953 $ 4,020 1,385 80 73 $ 4,026 $ 5,485 Long-term debt obligations Notes due 2018 (2.4%) Notes due 2019 (3.1% and 2.1%) Notes due 2020 (3.9% and 3.1%) Notes due 2021 (3.1% and 2.4%) Notes due 2022 (2.8% and 2.6%) Notes due 2023 (2.9% and 2.4%) Notes due 2024-2047 (3.7% and 3.8%) Other, due 2018-2026 (1.3% and 1.3%) s 3,948 3,784 3,257 3,802 1,270 16,161 26 32,248 (3,953) $28,295 $ 4,016 3,933 3,792 3,300 3,853 1,257 17,634 31 Less: current maturities of long-term debt obligations 37.816 (4.020) $33,796 Total In 2018, we completed a cash tender offer for certain notes issued by PepsiCo and predecessors to a PepsiCo subsidiary for $1.6 billion in cash to redeem the following amounts: Interest Rate Amount Tendered 7.290% 7.440% 7.000% 5.500% 4.875% 5.500% Maturity Date September 2026 September 2026 March 2029 May 2035 November 2040 January 2040 $ 11 $ 4 $357 $138 $410 $408 Our borrowing costs and access to capital and credit markets may be adversely affected by a dows MacBook Pro ha Find Tools do Share me... X 405 / 923 121% es Notes due 2023 (2.9% and 2.4%) Notes due 2024-2047 (3.7% and 3.8%) Other, due 2018-2026 (1.3% and 1.3%) 1,270 16,161 26 32,248 (3,953) $28,295 1,257 17,634 31 37,816 (4,020) $33,796 Less: current maturities of long-term debt obligations Total In 2018, we completed a cash tender offer for certain notes issued by PepsiCo and predecessors to a PepsiCo subsidiary for $1.6 billion in cash to redeem the following amounts: Interest Rate 7.290% 7.440% 7.000% 5.500% 4.875% 5.500% Maturity Date September 2026 September 2026 March 2029 May 2035 November 2040 January 2040 Amount Terdered $ 11 $ 4 $357 $138 $410 $408 Our borrowing costs and access lo capital and credit markets may be adversely affected by a downgrade or potential downgrade of our credit ratings. Rating agencies routinely evaluate us, and their ratings of our long-term and short-term debt are based on a number of factors, including our cash generating capability, levels of indebtedness, policies with respect to shareholder distributions and our financial strength generally, as well as factors beyond our control, such as the then-current state of the economy and our industry generally. Any downgrade of our credit ratings by a credit rating agency, especially any downgrade to below investment grade, whether as a result of our actions or factors which are beyond our control, could increase our future borrowing costs, impair our ability to access capital and credit markets on terms commercially accept- able to us or at all, and result in a reduction in our liquidity. Moody's Investors Service (www.moodys.com) reported the following regarding PepsiCo. Rating Action: Moody's rates PepsiCo's new notes at A1; outlook stable New York, July 25, 2019-Moody's today assigned an A1 rating to PepsiCo, Inc.'s senior unsecured notes being issued in 10 and 30 year tranches. All other ratings for the company remain unchanged. The outlook is stable. The proceeds will be used for general corporate purposes On August 9, 2019, Markets Insider reported the following details for notes due in 2022. inancial Stateme... x 400 / 923 + 121% Rating Action: Moody's rates PepsiCo's new notes at A1; outlook stable New York, July 25, 2019 Moody's today assigned an A1 rating to PepsiCo, Inc.'s senior unsecured notes being issued in 10 and 30 year tranches. All other ratings for the company remain unchanged. The outlook is stable. The proceeds will be used for general corporate purposes. On August 9, 2019, Markets Insider reported the following details for notes due in 2022. SOLD www.B Resell mmbridge Business Publishers Module 7 I Liability Recognition and Nonownler Financing Type Issuer Price 10227 Coupon(%) 2.75% Maturity 3/5/2022 Corp... Moody's Ratings A1 YTM(%) 1.87% PEPSICO INC Required a. PepsiCo reports rent maturities of long-term debt of $3,953 million as part of short-term debt. Why is this amount reported that way? Is this amount important to our analysis of PepsiCo? Explain. b. The Markets Insider excerpt above reveals that the 2.75% notes due in 2022 are priced at 102.27. resulting in a yield to maturity of 1.87%. Assuming that the credit rating of PepsiCo has not changed, what does the pricing of this bond imply about interest rate changes since PepsiCo issued the bond? c. During 2018, PepsiCo retired certain notes (early) with a cash tender offer. What was the total amount tendered? PepsiCo paid $1.6 billion cash for the tendered notes. Assume that the reported amounts tendered represent the net book value of the notes. What gain or loss did the company report on this early retirement of debt? d. The Moody's rating action excerpt above reveals that the company issued new notes in 2019. From this ratings action, what can investors infer about PepsiCo's creditworthiness in 2019? How does this rating action affect the issue proceeds? e. What type of actions can PepsiCo take to improve its credit ratings? Interpreting Debt Footnotes on Interest Rates and Interest Expense 17. LO3 4 MACBOOK Pro