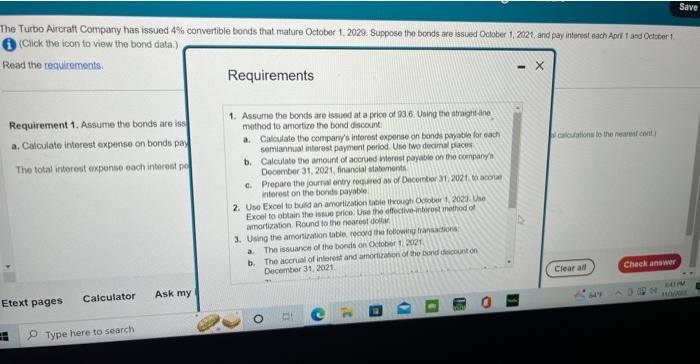

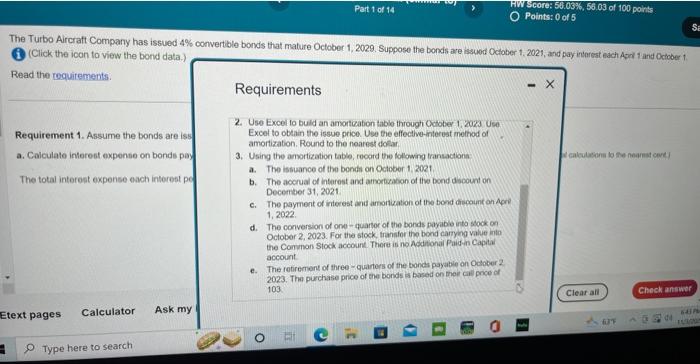

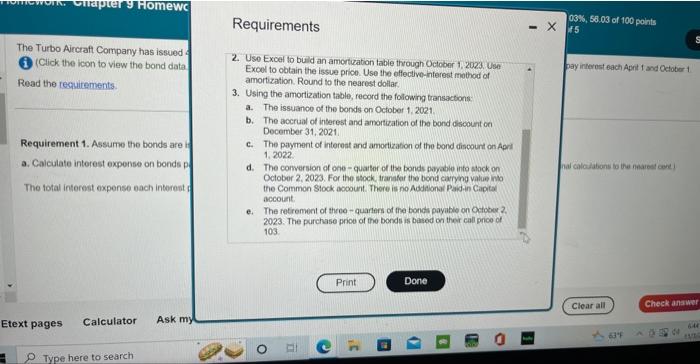

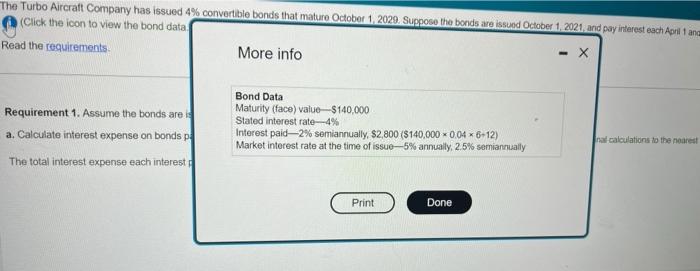

Read the requirements: Requirements Requirement 1. Assume the bonds are is 1. Assume the bonds are issued at a price of 93.6. Uaing the itragititine. method to amotien the bond dscount: a. Calculate interest expense on bonds pay a. Caloulate the company/ intorest expense an bonda pwatin for each somiannual interest payment poriod Uso fwo dearnal places The total intetest expense each interest per Docember 31, 2021, financial statoments interest on the bonds payable Excel to oblain the iswe price. Uie the offecive-intirof matiod od amortization. Round to the neareot dolitir. a. The issuaron d the bonds on october 1, 2wet. b. The acchar of interest and amorizason of the bond thigounton Decumbor 31, 2021 The Turbo Aircraft Company has issued 4% convertible bonds that mature October 1, 2029. Suppose the bonds are issuod October 1. 2021, and pay intorest each Acril 1 and Dctober 1 (1) (Click the ioon to view the borkd data.) Ine Turbo Avrcaft Company has issued of 1. (Click the icon to view the bond data Read the requirements. Requirement 1. Assume the bonds are if a. Caiculate interest expense on bonds p 2. Uso Excel to buid an amortization table through October 1,202 . Excol to obtain the issue price. Use the effective-nterest mothod of amortization. Round to the nearest dollar. 3. Using the amorization table, record the following transactons: a. The issuance of the bonds on Octobet 1.2021 3. The issuance of the bonds on October 1,2021. b. The accrual of interest and amortization of the bond discount on The total interest expense each intorest of c. The payment of interest and amortization of the bond discount on April 1.2022 d. The conversion of one - quattor of the bonds payable into stack on thecoiat. e. The retrement of thee - quarters of tha bonct payable on Oetober 2 . 2023. The purchase prioe of the bonds is bated on ther call price of Read the requirements: More info Read the requirements: Requirements Requirement 1. Assume the bonds are is 1. Assume the bonds are issued at a price of 93.6. Uaing the itragititine. method to amotien the bond dscount: a. Calculate interest expense on bonds pay a. Caloulate the company/ intorest expense an bonda pwatin for each somiannual interest payment poriod Uso fwo dearnal places The total intetest expense each interest per Docember 31, 2021, financial statoments interest on the bonds payable Excel to oblain the iswe price. Uie the offecive-intirof matiod od amortization. Round to the neareot dolitir. a. The issuaron d the bonds on october 1, 2wet. b. The acchar of interest and amorizason of the bond thigounton Decumbor 31, 2021 The Turbo Aircraft Company has issued 4% convertible bonds that mature October 1, 2029. Suppose the bonds are issuod October 1. 2021, and pay intorest each Acril 1 and Dctober 1 (1) (Click the ioon to view the borkd data.) Ine Turbo Avrcaft Company has issued of 1. (Click the icon to view the bond data Read the requirements. Requirement 1. Assume the bonds are if a. Caiculate interest expense on bonds p 2. Uso Excel to buid an amortization table through October 1,202 . Excol to obtain the issue price. Use the effective-nterest mothod of amortization. Round to the nearest dollar. 3. Using the amorization table, record the following transactons: a. The issuance of the bonds on Octobet 1.2021 3. The issuance of the bonds on October 1,2021. b. The accrual of interest and amortization of the bond discount on The total interest expense each intorest of c. The payment of interest and amortization of the bond discount on April 1.2022 d. The conversion of one - quattor of the bonds payable into stack on thecoiat. e. The retrement of thee - quarters of tha bonct payable on Oetober 2 . 2023. The purchase prioe of the bonds is bated on ther call price of Read the requirements: More info