Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Read the Semester Case Study and answer the question below. Julie Welk, Head of Finance calls you into her office and says: I have

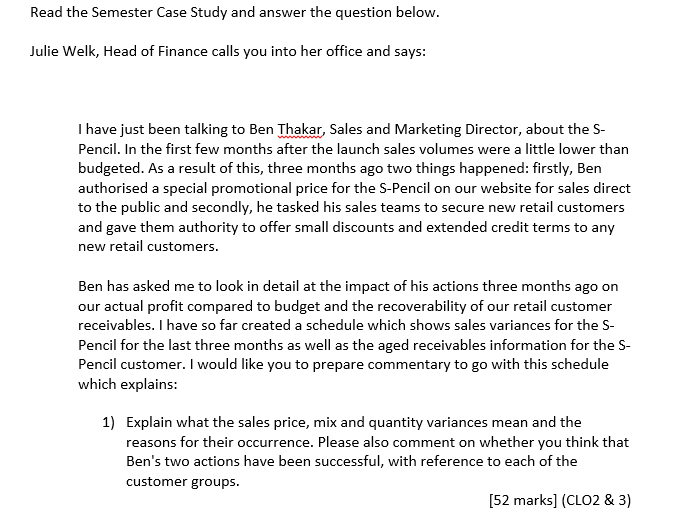

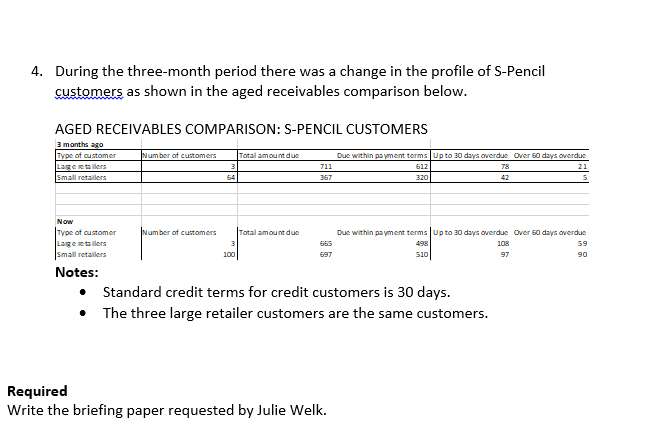

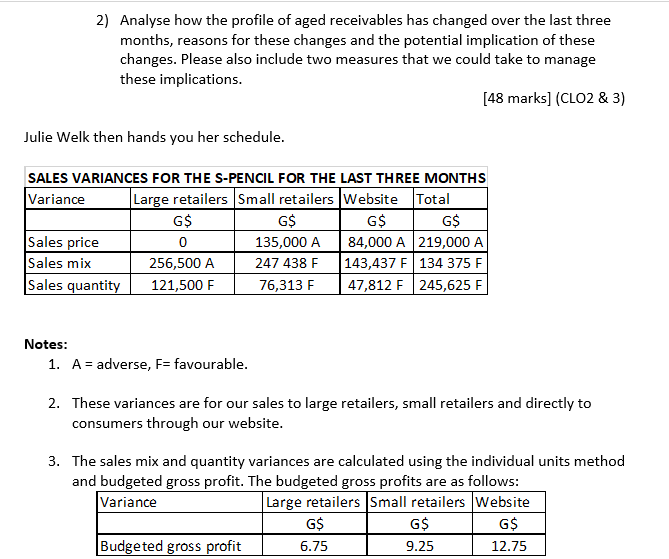

Read the Semester Case Study and answer the question below. Julie Welk, Head of Finance calls you into her office and says: I have just been talking to Ben Thakar, Sales and Marketing Director, about the S- Pencil. In the first few months after the launch sales volumes were a little lower than budgeted. As a result of this, three months ago two things happened: firstly, Ben authorised a special promotional price for the S-Pencil on our website for sales direct to the public and secondly, he tasked his sales teams to secure new retail customers and gave them authority to offer small discounts and extended credit terms to any new retail customers. Ben has asked me to look in detail at the impact of his actions three months ago on our actual profit compared to budget and the recoverability of our retail customer receivables. I have so far created a schedule which shows sales variances for the S- Pencil for the last three months as well as the aged receivables information for the S- Pencil customer. I would like you to prepare commentary to go with this schedule which explains: 1) Explain what the sales price, mix and quantity variances mean and the reasons for their occurrence. Please also comment on whether you think that Ben's two actions have been successful, with reference to each of the customer groups. [52 marks] (CLO2 & 3) 4. During the three-month period there was a change in the profile of S-Pencil customers as shown in the aged receivables comparison below. AGED RECEIVABLES COMPARISON: S-PENCIL CUSTOMERS 3 months ago Type of customer Large retailers Small retailers Number of customers Total amount due 3 711 64 367 Due within payment terms Up to 30 days overdue Over 60 days overdue 612 320 78 21 42 Now Type of customer Large retailers Number of customers 100 Total amount due Due within payment terms Up to 30 days overdue Over 60 days overdue 665 697 498 108 59 510 97 90 Small retailers Notes: Standard credit terms for credit customers is 30 days. The three large retailer customers are the same customers. Required Write the briefing paper requested by Julie Welk. 2) Analyse how the profile of aged receivables has changed over the last three months, reasons for these changes and the potential implication of these changes. Please also include two measures that we could take to manage these implications. [48 marks] (CLO2 & 3) Julie Welk then hands you her schedule. SALES VARIANCES FOR THE S-PENCIL FOR THE LAST THREE MONTHS Large retailers Small retailers Website Variance Total Sales price G$ 0 G$ G$ G$ 135,000 A 84,000 A 219,000 A Sales mix 256,500 A 247 438 F 143,437 F 134 375 F Sales quantity 121,500 F 76,313 F 47,812 F 245,625 F Notes: 1. A = adverse, F= favourable. 2. These variances are for our sales to large retailers, small retailers and directly to consumers through our website. 3. The sales mix and quantity variances are calculated using the individual units method and budgeted gross profit. The budgeted gross profits are as follows: Large retailers Small retailers Website Variance G$ Budgeted gross profit 6.75 G$ G$ 9.25 12.75

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started