Read the WSJ Article Overstocks short sellers may have overdone it by Justin Lahart. Explain what may have caused the short squeeze in the case of Overstock stock? What is short interest? In what way did the margin requirement contribute to the short squeeze?

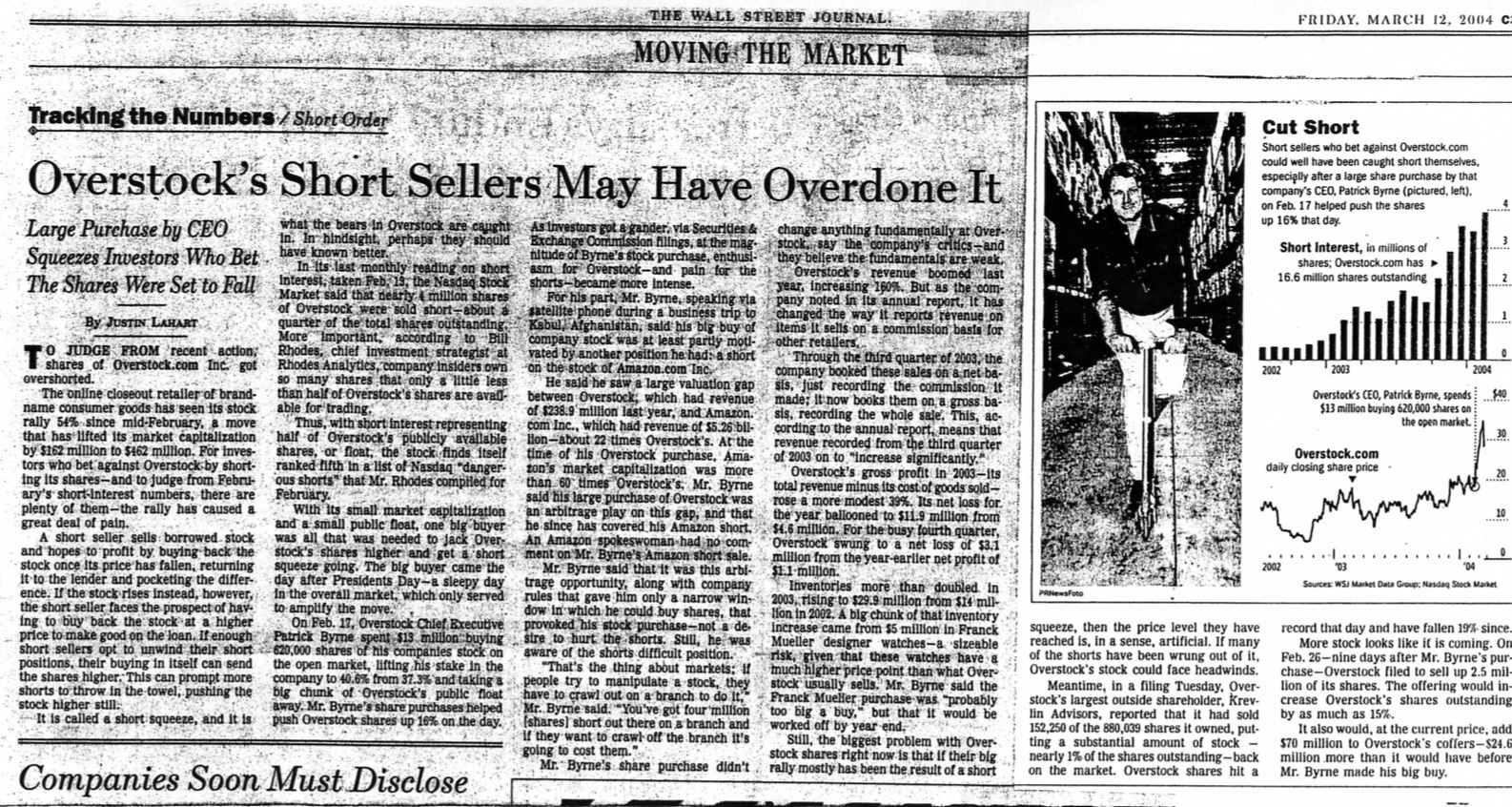

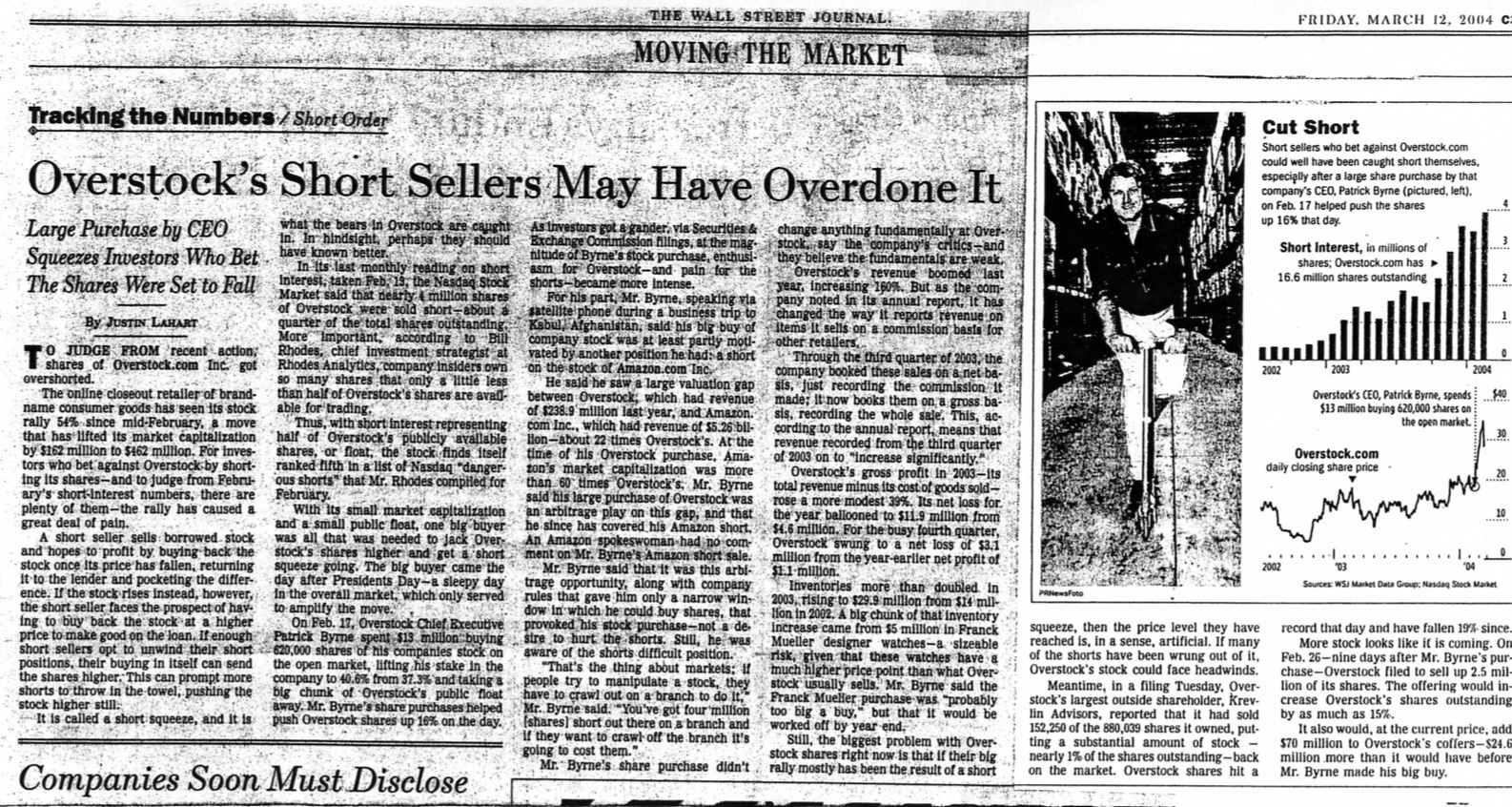

THE WALL STREET JOURNAL FRIDAY, MARCH 12, 2004 c: MOVING THE MARKET Tracking the Numbers / Short Order Overstock's Short Sellers May Have Overdone It Cut Short Short Sellers who bet against Overstock.com could well have been caught short themselves, especially after a large share purchase by that company's CEO, Patrick Byrne (pictured, left). on Feb. 17 helped push the shares up 16% that day. Short Interest, in millions of shares: Overstock.com has 16.6 million shares outstanding 2 1 2002 2003 2004 $40 Overstock's CEO, Patrick Byrne, spends $13 million buying 620,000 shares on the open market. Overstock.com daily closing share price 20 Large Purchase by CEO what the bears In Overstock are caught As lhvestors got a gander via Securities & change anything fundamentally at Over- in. In hindsight, perhaps they should Exchange Commission filings, at the mag. stock. say the company's critics and nitude of Byrne's stock purchase, enthusi they believe the fundamentals are weak. Squeezes Investors Who Bet have known better. In its last monthly reading on short asm for Overstock-and pain for the Overstock's revenue boomed last The Shares Were Set to Fall Interest, taken Feb. 15, the Nasdaq Stock shorts-became more intense. year, increasing 160%. But as the com- Market said that nearly 4 million shares For his part, Mr. Byre, speaking via pany noted in its annual report, It has of Overstock were sold short-about a satellite phone during a business trip to changed the way it reports revenue on By JUSTIN LAHART quarter of the total shares outstanding. Kabu, Afghanistan, sald his bly buy of Items It sells on a commission basis for More important, according to Bill company stock was at least partly moti other retailers. TO JUDGE FROM recent action, Rhodes, chief investment strategist at vated by another position he had: a short Through the third quarter of 2003, the I shares of Overstock.com Inc. got Rhodes Analyties, company Insiders own on the stock of Amazon.com Inc. company booked these sales on a net ba- overshorted. so many shares that only a little less He said he saw a large valuation gap sls, just recording the commission 1 The online closeout retailer of brand than half of Overstock's shares are avad between Overstock; which had revenue made; it now books them on a gross ba- name consumer goods has seen its stock able for trading. of $238.9 million last year, and Amazon. sis, recording the whole sale. This, ac- rally 54% since mid-February, a move Thus, with short interest representing com Inc., which had revenue of $5.26 bil cording to the annual report, means that that has lifted its market capitalization half of Overstock's publicly avallable Hon-about 22 times Overstock's. At the revenue recorded from the third quarter by $162 million to 5462 million. For inves shares, or float, the stock finds itsell time of his Overstock purchase, Ama of 2003 on to "increase significantly." tors who bet against Overstock by short-ranked fifth in a list of Nasdaq "danger zon's market capitalization was more Overstock's gross profit in 2003-its ing its shares - and to judge from Februous shorts" that Mr. Rhodes compted for than 60 times 'Overstock's. Mr. Byrne total revenue minus its cost of goods sold- ary's short-interest numbers, there are February. said his large purchase of Overstock was rose a more modest 39%. Its net loss for. plenty of them-the rally has caused a With its small market capitalization an arbitrage play on this gap, and that the year ballooned to $11.9 million from great deal of pain. and a small public float, one big buyer he since has covered his Amazon short. 54.6 million. For the busy fourth quarter, A short seller sells borrowed stock was all that was needed to Jack Over An Amazon spokeswoman had no com Overstock swung to a net loss of $3.1 and hopes to profit by buying back the stock's shares higher and get a short ment on Mr. Byrne's Amazon short sale. million from the year-earlier Det profit of stock once its price has fallen, returning squeeze going. The big buyer came the Mr. Byrne-sald that it was this arbi $1.1 million. it to the lender and pocketing the differ day after Presidents Day-a sleepy day trage opportunity, along with company Inventories more than doubled. In ence. If the stock rises instead, however, in the overall market, which only served rules that gave him only a narrow Win 2003, rising to $29.9 million from $14 mil- the short seller faces the prospect of hay to amplify the move. dow in which he could buy shares, that. Hon in 2002. A big chunk of that inventory ing to buy back the stock at a higher On Feb. 17, Overstock Chief Executive provoked his stock purchase-not a de. Increase came from $5 million in Franck price to make good on the loan. If enough Patrick Byme spent $13 million buying sire to hurt the shorts. Suu, he was Mueller designer watches-a. sizeable short sellers opt to unwind their short 620,000 shares of his companies stock on aware of the shorts difficult position. risk, given that these watches have & positions, their buying in itself can send the open market, lifting his stake in the "That's the thing about markets: 1 much higher price point than what Over- the shares higher. This can prompt more company to 40.6% from 37.3% and taking people try to manipulate a stock, they stock usually sells. Mr. Byrne said the shorts to throw in the towel, pushing the big chunk of Overstock's public float have to crawl out on a branch to do it. Franck Muelter purchase was probably stock higher still away. Mr. Bymne's share purchases helped Mr. Bymne sald. "You've got four million too big a buy." but that it would be It is called a short squeeze, and it is push Overstock shares up 16% on the day. Ishares) short out there on a branch and worked off by year end. If they want to crawl off the branch it's Still, the biggest problem with Over going to cost them." stock shares right now is that if their big Mr. Byrne's share purchase didn't rally mostly has been the result of a short 10 2002 03 04 Sources: WSJ Market Data Group: Nasdaq Stock Market PRNEWSFoto squeeze, then the price level they have reached is, in a sense, artificial. If many of the shorts have been wrung out of it, Overstock's stock could face headwinds. Meantime, in a filing Tuesday. Over- stock's largest outside shareholder, krev- lin Advisors, reported that it had sold 152,250 of the 880,039 shares it owned, put- ting a substantial amount of stock - nearly 1% of the shares outstanding-back on the market. Overstock shares hit a record that day and have fallen 19% since More stock looks like it is coming. On Feb. 26-nine days after Mr. Byrne's pur- chase-Overstock filed to sell up 2.5 mil- lion of its shares. The offering would in- crease Overstock's shares outstanding by as much as 15%. It also would, at the current price, add $70 million to Overstock's coffers-$24.6 million more than it would have before Mr. Byrne made his big buy. Companies Soon Must Disclose THE WALL STREET JOURNAL FRIDAY, MARCH 12, 2004 c: MOVING THE MARKET Tracking the Numbers / Short Order Overstock's Short Sellers May Have Overdone It Cut Short Short Sellers who bet against Overstock.com could well have been caught short themselves, especially after a large share purchase by that company's CEO, Patrick Byrne (pictured, left). on Feb. 17 helped push the shares up 16% that day. Short Interest, in millions of shares: Overstock.com has 16.6 million shares outstanding 2 1 2002 2003 2004 $40 Overstock's CEO, Patrick Byrne, spends $13 million buying 620,000 shares on the open market. Overstock.com daily closing share price 20 Large Purchase by CEO what the bears In Overstock are caught As lhvestors got a gander via Securities & change anything fundamentally at Over- in. In hindsight, perhaps they should Exchange Commission filings, at the mag. stock. say the company's critics and nitude of Byrne's stock purchase, enthusi they believe the fundamentals are weak. Squeezes Investors Who Bet have known better. In its last monthly reading on short asm for Overstock-and pain for the Overstock's revenue boomed last The Shares Were Set to Fall Interest, taken Feb. 15, the Nasdaq Stock shorts-became more intense. year, increasing 160%. But as the com- Market said that nearly 4 million shares For his part, Mr. Byre, speaking via pany noted in its annual report, It has of Overstock were sold short-about a satellite phone during a business trip to changed the way it reports revenue on By JUSTIN LAHART quarter of the total shares outstanding. Kabu, Afghanistan, sald his bly buy of Items It sells on a commission basis for More important, according to Bill company stock was at least partly moti other retailers. TO JUDGE FROM recent action, Rhodes, chief investment strategist at vated by another position he had: a short Through the third quarter of 2003, the I shares of Overstock.com Inc. got Rhodes Analyties, company Insiders own on the stock of Amazon.com Inc. company booked these sales on a net ba- overshorted. so many shares that only a little less He said he saw a large valuation gap sls, just recording the commission 1 The online closeout retailer of brand than half of Overstock's shares are avad between Overstock; which had revenue made; it now books them on a gross ba- name consumer goods has seen its stock able for trading. of $238.9 million last year, and Amazon. sis, recording the whole sale. This, ac- rally 54% since mid-February, a move Thus, with short interest representing com Inc., which had revenue of $5.26 bil cording to the annual report, means that that has lifted its market capitalization half of Overstock's publicly avallable Hon-about 22 times Overstock's. At the revenue recorded from the third quarter by $162 million to 5462 million. For inves shares, or float, the stock finds itsell time of his Overstock purchase, Ama of 2003 on to "increase significantly." tors who bet against Overstock by short-ranked fifth in a list of Nasdaq "danger zon's market capitalization was more Overstock's gross profit in 2003-its ing its shares - and to judge from Februous shorts" that Mr. Rhodes compted for than 60 times 'Overstock's. Mr. Byrne total revenue minus its cost of goods sold- ary's short-interest numbers, there are February. said his large purchase of Overstock was rose a more modest 39%. Its net loss for. plenty of them-the rally has caused a With its small market capitalization an arbitrage play on this gap, and that the year ballooned to $11.9 million from great deal of pain. and a small public float, one big buyer he since has covered his Amazon short. 54.6 million. For the busy fourth quarter, A short seller sells borrowed stock was all that was needed to Jack Over An Amazon spokeswoman had no com Overstock swung to a net loss of $3.1 and hopes to profit by buying back the stock's shares higher and get a short ment on Mr. Byrne's Amazon short sale. million from the year-earlier Det profit of stock once its price has fallen, returning squeeze going. The big buyer came the Mr. Byrne-sald that it was this arbi $1.1 million. it to the lender and pocketing the differ day after Presidents Day-a sleepy day trage opportunity, along with company Inventories more than doubled. In ence. If the stock rises instead, however, in the overall market, which only served rules that gave him only a narrow Win 2003, rising to $29.9 million from $14 mil- the short seller faces the prospect of hay to amplify the move. dow in which he could buy shares, that. Hon in 2002. A big chunk of that inventory ing to buy back the stock at a higher On Feb. 17, Overstock Chief Executive provoked his stock purchase-not a de. Increase came from $5 million in Franck price to make good on the loan. If enough Patrick Byme spent $13 million buying sire to hurt the shorts. Suu, he was Mueller designer watches-a. sizeable short sellers opt to unwind their short 620,000 shares of his companies stock on aware of the shorts difficult position. risk, given that these watches have & positions, their buying in itself can send the open market, lifting his stake in the "That's the thing about markets: 1 much higher price point than what Over- the shares higher. This can prompt more company to 40.6% from 37.3% and taking people try to manipulate a stock, they stock usually sells. Mr. Byrne said the shorts to throw in the towel, pushing the big chunk of Overstock's public float have to crawl out on a branch to do it. Franck Muelter purchase was probably stock higher still away. Mr. Bymne's share purchases helped Mr. Bymne sald. "You've got four million too big a buy." but that it would be It is called a short squeeze, and it is push Overstock shares up 16% on the day. Ishares) short out there on a branch and worked off by year end. If they want to crawl off the branch it's Still, the biggest problem with Over going to cost them." stock shares right now is that if their big Mr. Byrne's share purchase didn't rally mostly has been the result of a short 10 2002 03 04 Sources: WSJ Market Data Group: Nasdaq Stock Market PRNEWSFoto squeeze, then the price level they have reached is, in a sense, artificial. If many of the shorts have been wrung out of it, Overstock's stock could face headwinds. Meantime, in a filing Tuesday. Over- stock's largest outside shareholder, krev- lin Advisors, reported that it had sold 152,250 of the 880,039 shares it owned, put- ting a substantial amount of stock - nearly 1% of the shares outstanding-back on the market. Overstock shares hit a record that day and have fallen 19% since More stock looks like it is coming. On Feb. 26-nine days after Mr. Byrne's pur- chase-Overstock filed to sell up 2.5 mil- lion of its shares. The offering would in- crease Overstock's shares outstanding by as much as 15%. It also would, at the current price, add $70 million to Overstock's coffers-$24.6 million more than it would have before Mr. Byrne made his big buy. Companies Soon Must Disclose