Question

READING William is a budding impresario. He has written a play, and applied for grants, and was awarded project grants by the Toronto Arts Council,

READING

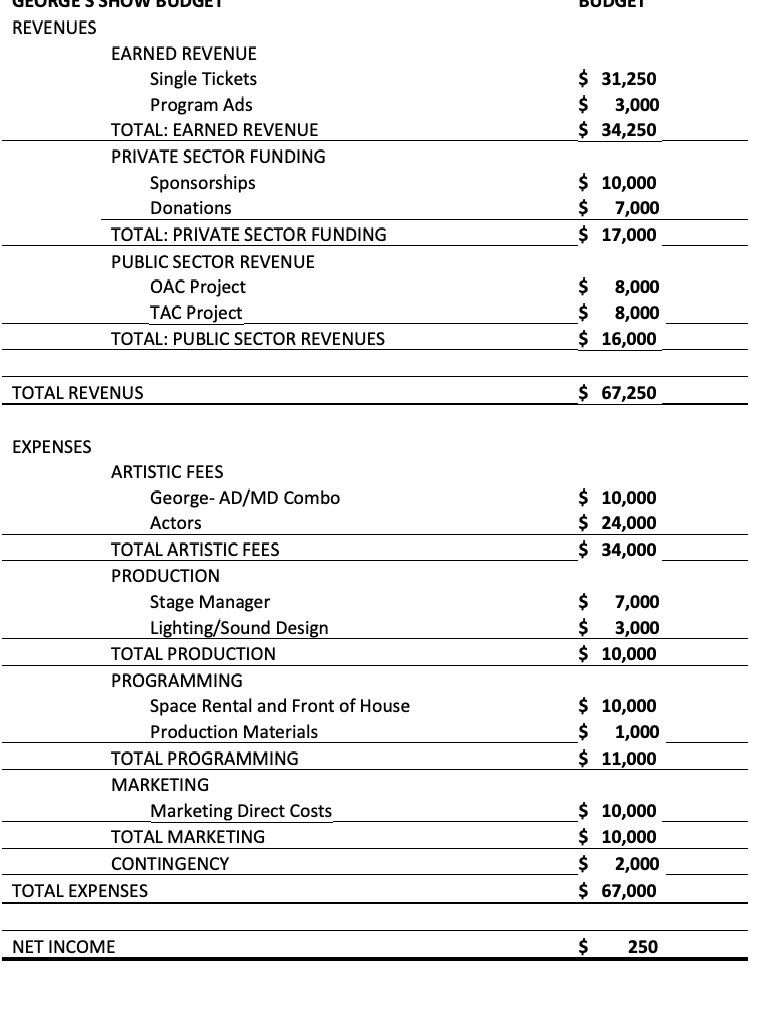

William is a budding impresario. He has written a play, and applied for grants, and was awarded project grants by the Toronto Arts Council, and the Ontario Arts Council ($8,000 each). He has found a theatre to book, negotiated with designers, actors, stage managers, and potential sponsors. He has come up with a budget that balances and will even pay him (though he will not be able to quit his day job yet). The budget is in schedule one.

William has planned 6 weeks of theatre rental (5 for rehearsal and one for the show run). He will have 5 performances over a single weekend at the end of May (Friday night, Saturday and Sunday matinees, and Saturday and Sunday evenings). The theatre holds 500 people, and William plans to sell tickets at $25 each. William knows that conservative budgets are safer, so he is only budgeting for 50% ticket sales ($31,250) over the 5 shows, which means if he is able to sell more tickets, he may make a profit that he can put to his next production. The theatre rent is $10,000 for the 6 weeks, and William must pay half (non-refundable) at the time of booking. The theatre includes all front-of-house and ticketing costs. It sells the tickets on William's behalf, and 30 days after the close of the last performance, forwards the sale money to William minus the other half of the rental.

William also plans to sell program advertising space to local businesses. He thinks he will make $3000 by doing this, and plans to ask for a 50% deposit, and 50% in May once the programs are printed, so he can show the investors the ads with the final bill. He will be canvasing the neighborhood business in March. He is also selling sponsor packages to larger businesses in exchange for additional advertising and free tickets for their clients (not included in the ticket sale projections). He expects to raise another $10,000 by doing this and expects he will have received all of this money by March. Finally, he will fundraise for individual donations, which he expects will raise $7000. He has set-up a go-fund-me campaign, and donations have already started trickling in (mostly from very supportive friends and family, but also from the public). He expects $5000 to come in gradually leading up to the show, and another $2000 to be donated by patrons who attend the performance.

For staff, William is acting as the Artistic-Director and the Managing Director combo- as many ambitious people trying to start their own project do. He is also the director of the play, and is doing all the fundraising himself, because he doesn't have money to spend on that. Luckily, rehearsals don't start until April, so he has a lot of lead time to work on the fundraising. He is planning to pay himself $1000 per month for ten months starting now (September) and ending June- the month after the show. He got the OAC grant in September and expects the TAC grant in October (as promised by the approval letter), so the money is there to get him going on the project. He has another part-time job, so he has enough to live on.

The play requires 4 actors, and he has hired all Equity (an actor's union) members who must be paid at least $1000 per week, and they must be paid every week during rehearsals and performances, by Thursday. This adds up to $24,000. He has also hired an Equity Stage Manager, who has the same rules, but is hired one week earlier get everything organized. He has hired a lighting/sound designer for $3000. The local design union requires that William pay half the contract amount on contract signing, and the other half on opening night. The play is set in current times, in a young person's apartment, so William did not hire a set or costume designer, thinking he could put together something himself, using things from home, but he budgeted $1000 for incidental materials.

In light of everything he is already doing, William realized he is not good at marketing, and won't have time to a good job of it on his own, so he is hiring a local marketing firm for $10,000, to help him get the word out, and make sure he hits his box office targets. It is not a low fee, but it includes all advertising purchases and printing costs. The firm requires a 30% deposit by January to start the work, and the remaining 70% is due the week before opening in May.

He has built in a $2000 contingency (which is almost 3% of the project) in case revenues are a little low or expenses are a little high. Even with that built in, conservative ticket sales, and all hard costs that cannot increase unexpectedly, William has a projected surplus of $250. He thinks everything looks great and nothing can go wrong. It is September now, and he plans to sign the venue and designer contracts and pay the deposits. Should he?

Is everything in order with William project?

Why you do or do not think this plan will work

Do you have any ideas of William?

What should he do?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started