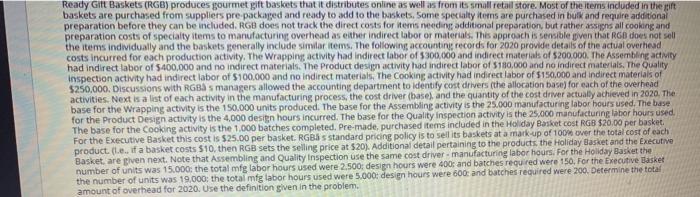

Ready Gift Baskets (RGB) produces gourmet gift baskets that it distributes online as well as from its small retail store. Most of the items induded in the gift baskets are purchased from suppliers pre packaged and ready to add to the baskets. Some specialty items are purchased in bulk and require additional preparation before they can be included. RGB does not track the direct costs for items needing additional preparation, but rather assigns all cooking and preparation costs of specialty items to manufacturing overhead as either indirect labor or materials. This approach is sensible piven that RGB does not sell the items individually and the baskets generally include similar items. The following accounting records for 2020 provide details of the actual overhead costs incurred for each production activity. The Wrapping activity had indirect labor of $300,000 and indirect materials of $200.000. The Assembling activity had indirect labor of $400,000 and no Indirect materials. The Product design activity had indirect labor of $180,000 and no indirect materials. The Quality Inspection activity had indirect labor of $100.000 and no Indirect materials, The Cooking activity had indirect labor of $150,000 and indirect materials of $250,000. Discussions with RGB s managers allowed the accounting department to identify cost drivers (the allocation base) for each of the overhead activities. Next is a list of each activity in the manufacturing process, the cost driver (base), and the quantity of the cost driver actually achieved in 2020. The base for the Wrapping activity is the 150,000 units produced. The base for the Assembling activity is the 25.000 manufacturing labor hours used. The base for the Product Design activity is the 4,000 design hours incurred. The base for the Quality inspection activity is the 25.000 manufacturing labor hours used. The base for the Cooking activity is the 1.000 batches completed. Pre-made, purchased items included in the Holiday Basket cost RGB $20,00 per basket For the Executive Basket this cost is $25.00 per basket. RGB s standard pricing policy is to sell its baskets at a mark-up of 100% over the total cost of each product. (.e. if a basket costs $10, then RGB sets the selling price at $20). Additional detail pertaining to the products the Holiday Basket and the Executive Basket, are given next. Note that Assembling and Quality Inspection use the same cost driver manufacturing labor hours. For the Holiday Basket the number of units was 15.000: the total mfg labor hours used were 2.500 design hours were 400 and batches required were 150. For the Executive Basket the number of units was 19.000: the total mfg labor hours used were 5.000 design hours were 600 and batches required were 200. Determine the total amount of overhead for 2020. Use the definition given in the problem. Ready Gift Baskets (RGB) produces gourmet gift baskets that it distributes online as well as from its small retail store. Most of the items induded in the gift baskets are purchased from suppliers pre packaged and ready to add to the baskets. Some specialty items are purchased in bulk and require additional preparation before they can be included. RGB does not track the direct costs for items needing additional preparation, but rather assigns all cooking and preparation costs of specialty items to manufacturing overhead as either indirect labor or materials. This approach is sensible piven that RGB does not sell the items individually and the baskets generally include similar items. The following accounting records for 2020 provide details of the actual overhead costs incurred for each production activity. The Wrapping activity had indirect labor of $300,000 and indirect materials of $200.000. The Assembling activity had indirect labor of $400,000 and no Indirect materials. The Product design activity had indirect labor of $180,000 and no indirect materials. The Quality Inspection activity had indirect labor of $100.000 and no Indirect materials, The Cooking activity had indirect labor of $150,000 and indirect materials of $250,000. Discussions with RGB s managers allowed the accounting department to identify cost drivers (the allocation base) for each of the overhead activities. Next is a list of each activity in the manufacturing process, the cost driver (base), and the quantity of the cost driver actually achieved in 2020. The base for the Wrapping activity is the 150,000 units produced. The base for the Assembling activity is the 25.000 manufacturing labor hours used. The base for the Product Design activity is the 4,000 design hours incurred. The base for the Quality inspection activity is the 25.000 manufacturing labor hours used. The base for the Cooking activity is the 1.000 batches completed. Pre-made, purchased items included in the Holiday Basket cost RGB $20,00 per basket For the Executive Basket this cost is $25.00 per basket. RGB s standard pricing policy is to sell its baskets at a mark-up of 100% over the total cost of each product. (.e. if a basket costs $10, then RGB sets the selling price at $20). Additional detail pertaining to the products the Holiday Basket and the Executive Basket, are given next. Note that Assembling and Quality Inspection use the same cost driver manufacturing labor hours. For the Holiday Basket the number of units was 15.000: the total mfg labor hours used were 2.500 design hours were 400 and batches required were 150. For the Executive Basket the number of units was 19.000: the total mfg labor hours used were 5.000 design hours were 600 and batches required were 200. Determine the total amount of overhead for 2020. Use the definition given in the