Answered step by step

Verified Expert Solution

Question

1 Approved Answer

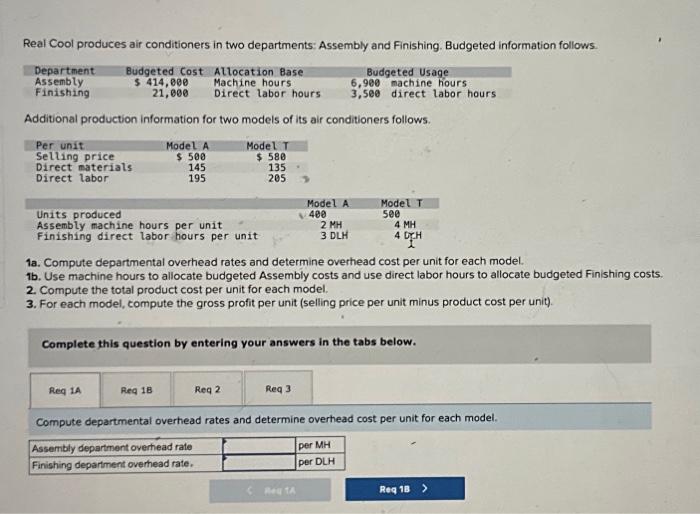

Real Cool produces air conditioners in two departments: Assembly and Finishing. Budgeted information follows. Department Assembly Finishing Budgeted Cost $414,000 21,000 Allocation Base Machine

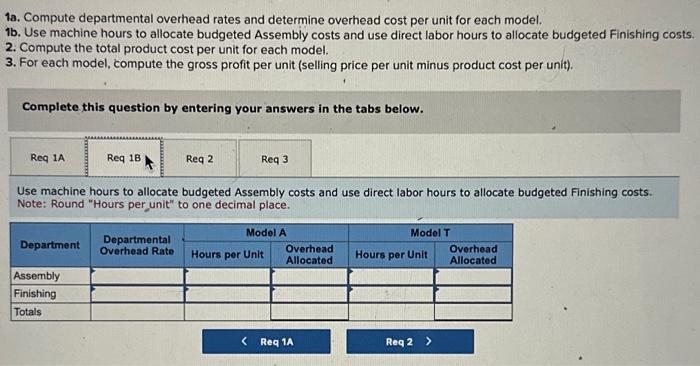

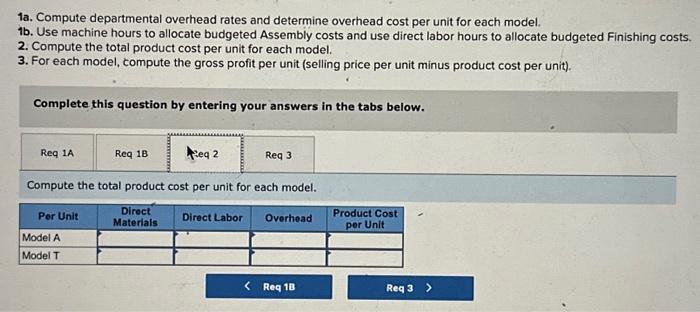

Real Cool produces air conditioners in two departments: Assembly and Finishing. Budgeted information follows. Department Assembly Finishing Budgeted Cost $414,000 21,000 Allocation Base Machine hours Direct labor hours Budgeted Usage 6,900 machine hours 3,500 direct labor hours. Additional production information for two models of its air conditioners follows. Per unit Selling price Model A $ 500 Model T $ 580 Direct materials 145 135 Direct labor 195 205 Model A 400 2 MH 3 DLH Model T 500 4 MH A DEH Units produced Assembly machine hours per unit Finishing direct labor hours per unit 1a. Compute departmental overhead rates and determine overhead cost per unit for each model. 1b. Use machine hours to allocate budgeted Assembly costs and use direct labor hours to allocate budgeted Finishing costs. 2. Compute the total product cost per unit for each model. 3. For each model, compute the gross profit per unit (selling price per unit minus product cost per unit). Complete this question by entering your answers in the tabs below. Req 1A Req 18 Req 2 Req 3 Compute departmental overhead rates and determine overhead cost per unit for each model. Assembly department overhead rate per MH Finishing department overhead rate. per DLH Reg 1A Req 18 > 1a. Compute departmental overhead rates and determine overhead cost per unit for each model. 1b. Use machine hours to allocate budgeted Assembly costs and use direct labor hours to allocate budgeted Finishing costs. 2. Compute the total product cost per unit for each model. 3. For each model, compute the gross profit per unit (selling price per unit minus product cost per unit). Complete this question by entering your answers in the tabs below. Req 1A Req 18: Req 2 Req 3 Use machine hours to allocate budgeted Assembly costs and use direct labor hours to allocate budgeted Finishing costs. Note: Round "Hours per unit" to one decimal place. Model A Model T Department Departmental Overhead Rate Hours per Unit Overhead Allocated Overhead Hours per Unit Allocated Assembly Finishing Totals < Req 1A Req 2 > 1a. Compute departmental overhead rates and determine overhead cost per unit for each model. 1b. Use machine hours to allocate budgeted Assembly costs and use direct labor hours to allocate budgeted Finishing costs. 2. Compute the total product cost per unit for each model. 3. For each model, compute the gross profit per unit (selling price per unit minus product cost per unit). Complete this question by entering your answers in the tabs below. Req 1A Req 1B eq 2 Req 3. Compute the total product cost per unit for each model. Per Unit Direct Materials Direct Labor Overhead Product Cost per Unit Model A Model T < Req 1B Req 3 >

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Answer Req 1a Departmental Overhead Rates and Overhead Cost per Unit a Departmental Overhead Rates A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663d7abacb0f9_966480.pdf

180 KBs PDF File

663d7abacb0f9_966480.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started