real estate case study

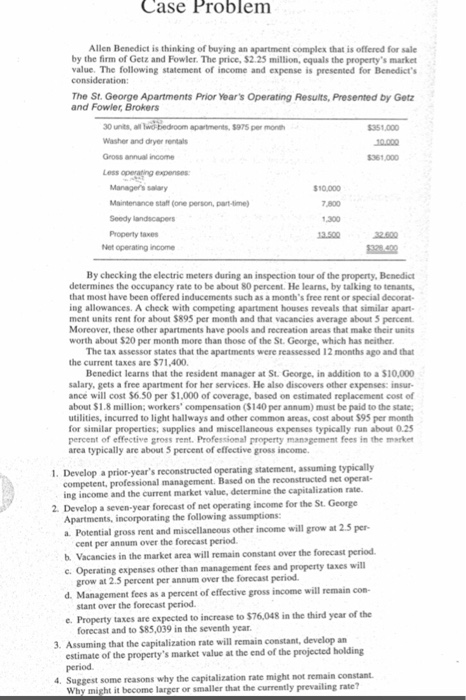

Case Problem Allen Benedict is thinking of buying an apartment complex that is offered for sale by the firm of Getz and Fowler. The price, $2.25 million, equals the property's market value. The following statement of income and expense is presented for Benedict's The St. George Apartments Prior Year's Operating Results, Presented by Getz and Fowler, Brokers 30 units, al Washer and dryer rentals Gross annual income Less operating expenses apartments, $975 per month 351,000 361,000 Managers salary Maintenance staft (one person, part-time Seedy landscapers 10.000 7,800 1,300 3.500 32.600 Net operating income By checking the electric meters during an inspection tour of the property, Benedict determines the occupancy rate to be about 80 percent. He learns, by talking to tenants, that most have been offered inducements such as a month's free rent or special decorat- ing allowances. A check with competing apartment houses reveals that similar apart ment units rent for about $895 per month and that vacancies average about 5 percent Moreover, these other apartments have pools and recreation areas that make their units worth about $20 per month more than those of the St. George, which has neither The tax assessor states that the apartments were reassessed 12 months ago and that the current taxes are $71,400 Benedict learns that the resident manager at St. George, in addition to a $10,000 salary, gets a free apartment for her services. He also discovers other expenses: insur- ance will cost $6.50 per $1,000 of coverage, based on estimated replacement cost of about $1.8 million; workers" compensation ($140 per annum) must be paid to the state, utilities, incurred to light hallways and other common areas, cost about $95 per month for similar properties; percent of effective gross rent. Professional property management fees in the market area typically are about 5 percent of effective gross income supplies and miscellancous expenses typically run about 0.25 1. Develop a prior-year's reconstructed operating statement, assuming typically the reconstructed net operat- competent, professional management. Based on ing income and the current market value, determine the capitalization rate. 2. Develop a seven-year forecast of net operating income for the St. George Apartments, incorporating the following assumptions: a. Potential gross rent and miscellaneous other income will grow at 2.5 per- cent per annum over the forecast period b. Vacancies in the market area will remain constant over the forecast periocd c. Operating expenses other than management fees and property taxes will grow at 2.5 percent per annum over the forecast period d. Management fees as a percent of effective gross income will remain con- stant over the forecast period e. Property taxes are expected to increase to $76,048 in the third year of the forecast and to $85,039 in the seventh year 3. Assuming that the capitalization rate will remain constant, develop an estimate of the property's market value at the end of the projected holding period Suggest some reasons why the capitalization rate might not remain constant Why might it become larger or smaller that the currently prevailing rate