Answered step by step

Verified Expert Solution

Question

1 Approved Answer

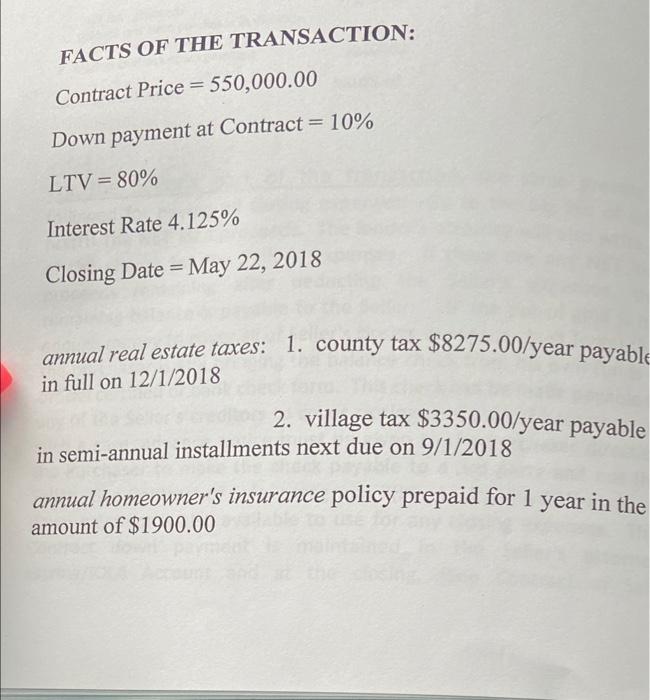

real estate closing FACTS OF THE TRANSACTION: Contract Price = 550,000.00 Down payment at Contract = 10% LTV=80% Interest Rate 4.125% Closing Date = May

real estate closing

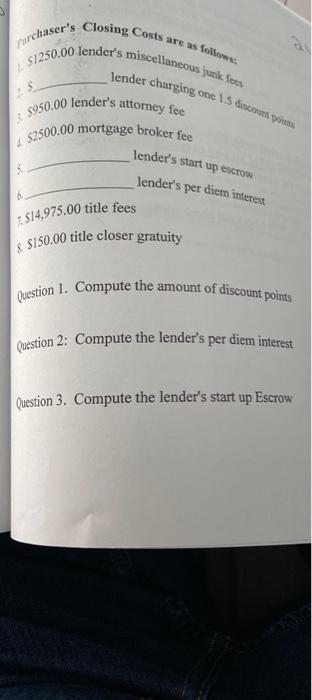

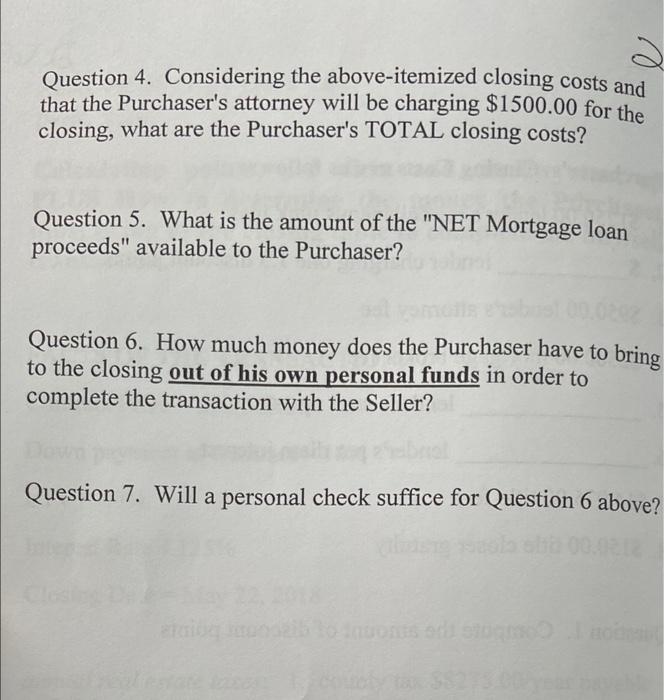

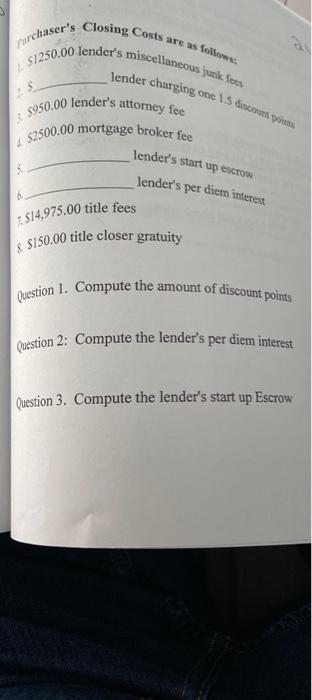

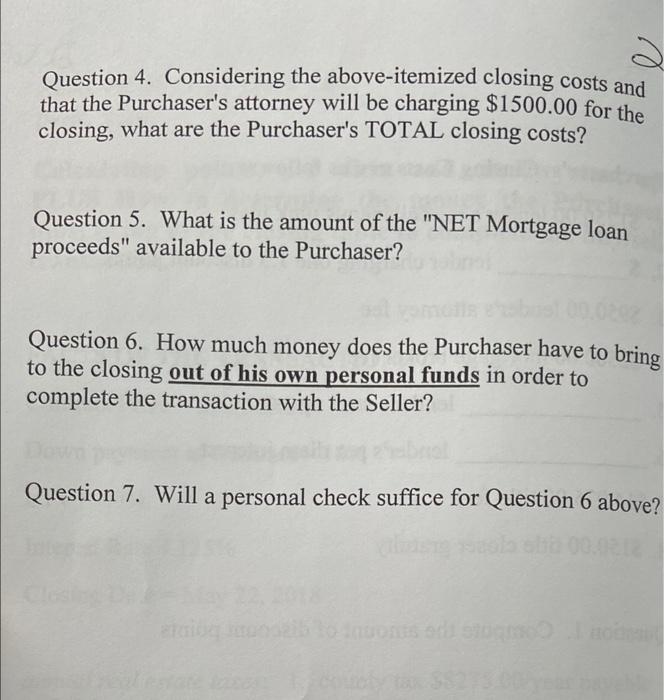

FACTS OF THE TRANSACTION: Contract Price = 550,000.00 Down payment at Contract = 10% LTV=80% Interest Rate 4.125% Closing Date = May 22, 2018 annual real estate taxes: 1. county tax $8275.00/year payable in full on 12/1/2018 2. village tax $3350.00/year payable in semi-annual installments next due on 9/1/2018 annual homeowner's insurance policy prepaid for 1 year in the amount of $1900.00 rarchaser's Closing Costs are as follows: $1250.00 lender's miscellaneous junk fees 1 lender charging one 1.5 discount points $950.00 lender's attorney fee 3 4 $2500.00 mortgage broker fee lender's start up escrow lender's per diem interest 7. $14,975.00 title fees &$150.00 title closer gratuity Question 1. Compute the amount of discount points Question 2: Compute the lender's per diem interest Question 3. Compute the lender's start up Escrow Question 4. Considering the above-itemized closing costs and that the Purchaser's attorney will be charging $1500.00 for the closing, what are the Purchaser's TOTAL closing costs? Question 5. What is the amount of the "NET Mortgage loan proceeds" available to the Purchaser? Question 6. How much money does the Purchaser have to bring to the closing out of his own personal funds in order to complete the transaction with the Seller? Question 7. Will a personal check suffice for Question 6 above? FACTS OF THE TRANSACTION: Contract Price = 550,000.00 Down payment at Contract = 10% LTV=80% Interest Rate 4.125% Closing Date = May 22, 2018 annual real estate taxes: 1. county tax $8275.00/year payable in full on 12/1/2018 2. village tax $3350.00/year payable in semi-annual installments next due on 9/1/2018 annual homeowner's insurance policy prepaid for 1 year in the amount of $1900.00 rarchaser's Closing Costs are as follows: $1250.00 lender's miscellaneous junk fees 1 lender charging one 1.5 discount points $950.00 lender's attorney fee 3 4 $2500.00 mortgage broker fee lender's start up escrow lender's per diem interest 7. $14,975.00 title fees &$150.00 title closer gratuity Question 1. Compute the amount of discount points Question 2: Compute the lender's per diem interest Question 3. Compute the lender's start up Escrow Question 4. Considering the above-itemized closing costs and that the Purchaser's attorney will be charging $1500.00 for the closing, what are the Purchaser's TOTAL closing costs? Question 5. What is the amount of the "NET Mortgage loan proceeds" available to the Purchaser? Question 6. How much money does the Purchaser have to bring to the closing out of his own personal funds in order to complete the transaction with the Seller? Question 7. Will a personal check suffice for Question 6 above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started