Answered step by step

Verified Expert Solution

Question

1 Approved Answer

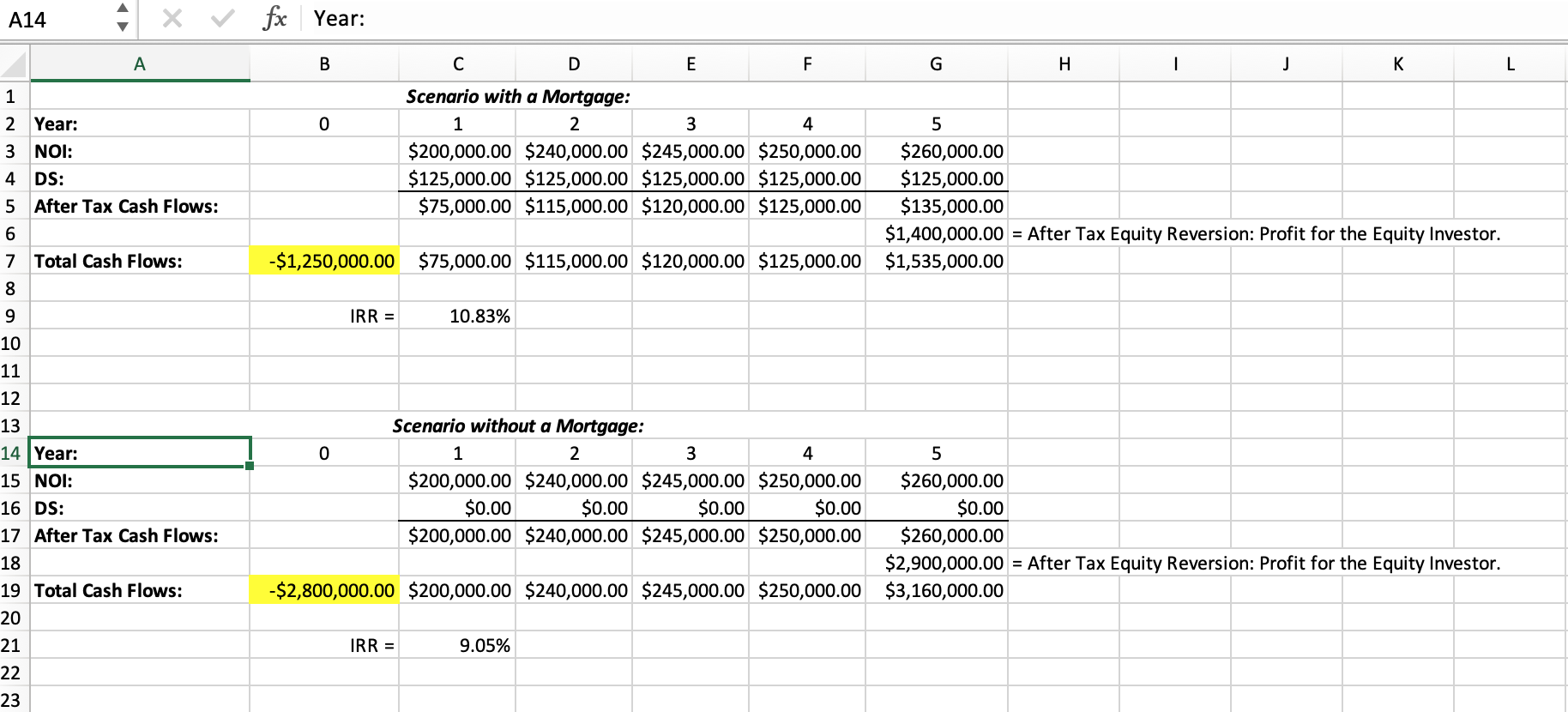

Real estate & Finance D) Lets suppose that you lose a tenant in year 3, which lowers the NOI in years 3, 4 and 5

Real estate & Finance

D) Lets suppose that you lose a tenant in year 3, which lowers the NOI in years 3, 4 and 5 by $100,000 in each year. What is the new IRR for both scenarios?

E) Explain the outcome of D)

F) When you lose a tenant it is likely that the value of your property at sale will also decline, hence cells G6 and G18 will also be affected. Explain how and why the sale price will change and what the effect on the IRR is?

G) Which scenario is more risky? Explain.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started