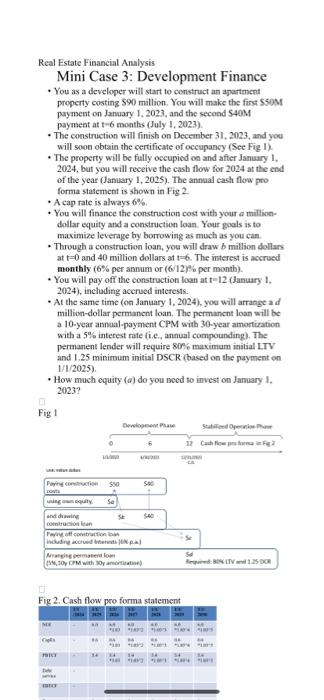

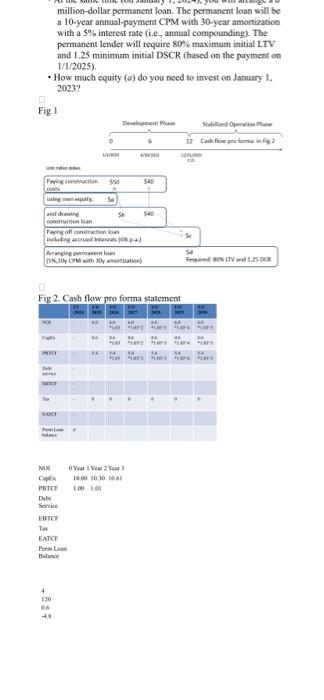

Real Estate Financial Analysis Mini Case 3: Development Finance - You as a developer will start to construct an apartment property costing S90 million. You will make the finst $50M payment on January 1, 2023, and the second 540M payment at t-6 months (July I, 2023). - The construction will finish on December 31, 2023, and you will soon obtain the certificate of occupancy (See Fig I). - The property will be fully occupied on and after January I, 2024 , but you will receive the cash flow for 2024 at the end of the year (January 1, 2025). The annual cash flow pro forma statement is shown in Fig 2. - A cap rate is always 6%. - You will finance the constraction cost with your a milliondollar equity and a construction loan. Your gools is to maximize leverage by borrowing as much as you can. - Through a construction loan, you will draw b million dollars at t=0 and 40 million dollars at t=6. The interest is accrued monthly (6\% per annum or (6/12)\% per month). - You will pay off the construction loan at t-12 (laniary 1. 2024), incloding accrued interests. - At the same time (on January 1, 2024), you will arrange a d million-dollar permanent loan. The permanent loan will be a. 10-year annual-payment CPM with 30-year amortiration with a 5% interest rate (i.e., annual compounding). The permanent lender will require 80 \$5 maximam initial LTV and 1.25 minimum initial DSCR (based on the payment on 1/1/2025). - How much cquity (a) do you need to invest on January I. 2023 ? Fig 1 un. whin inter. Fig 2. Cash flow pro forma statement million-dollar permanent loan. The permanent loan will be a 10-year annual-payment CPM with 30 -year amortization with a 5% interest rate (i.e., annual compounding). The permanent letulet will require 80% maximum initial LTV and 1.25 minimum initial DSCR (based on the jayment on 1/1/2025). - How much equity (a) do you need to invest on January 1. 2023? Fig 1 Fin 2. Cash flow oro forma statement Real Estate Financial Analysis Mini Case 3: Development Finance - You as a developer will start to construct an apartment property costing S90 million. You will make the finst $50M payment on January 1, 2023, and the second 540M payment at t-6 months (July I, 2023). - The construction will finish on December 31, 2023, and you will soon obtain the certificate of occupancy (See Fig I). - The property will be fully occupied on and after January I, 2024 , but you will receive the cash flow for 2024 at the end of the year (January 1, 2025). The annual cash flow pro forma statement is shown in Fig 2. - A cap rate is always 6%. - You will finance the constraction cost with your a milliondollar equity and a construction loan. Your gools is to maximize leverage by borrowing as much as you can. - Through a construction loan, you will draw b million dollars at t=0 and 40 million dollars at t=6. The interest is accrued monthly (6\% per annum or (6/12)\% per month). - You will pay off the construction loan at t-12 (laniary 1. 2024), incloding accrued interests. - At the same time (on January 1, 2024), you will arrange a d million-dollar permanent loan. The permanent loan will be a. 10-year annual-payment CPM with 30-year amortiration with a 5% interest rate (i.e., annual compounding). The permanent lender will require 80 \$5 maximam initial LTV and 1.25 minimum initial DSCR (based on the payment on 1/1/2025). - How much cquity (a) do you need to invest on January I. 2023 ? Fig 1 un. whin inter. Fig 2. Cash flow pro forma statement million-dollar permanent loan. The permanent loan will be a 10-year annual-payment CPM with 30 -year amortization with a 5% interest rate (i.e., annual compounding). The permanent letulet will require 80% maximum initial LTV and 1.25 minimum initial DSCR (based on the jayment on 1/1/2025). - How much equity (a) do you need to invest on January 1. 2023? Fig 1 Fin 2. Cash flow oro forma statement