Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Real Estate Pro Forma I just need to see the work for the answer above. All of thedata I was given is above Check answers

Real Estate Pro Forma

I just need to see the work for the answer above. All of thedata I was given is above "Check answers"

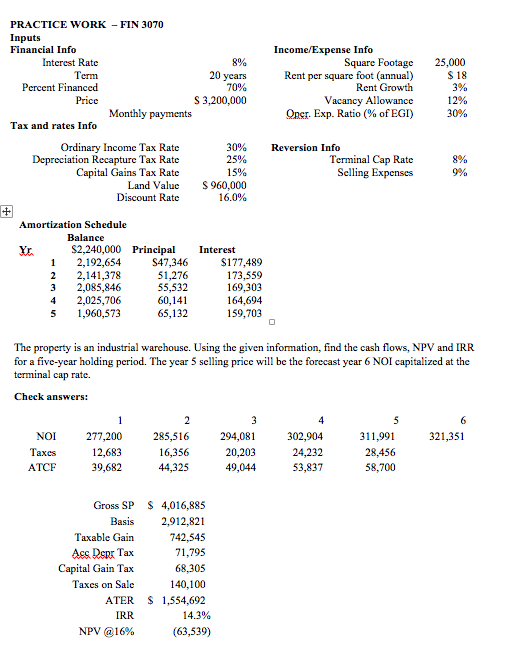

PRACTICE WORK - FIN 3070 Inputs Financial Info Interest Rate Term Percent Financed Price Tax and rates Info + Ordinary Income Tax Rate Depreciation Recapture Tax Rate Capital Gains Tax Rate Land Value Discount Rate Amortization Schedule Balance 1 2 3 Monthly payments 5 NOI Taxes ATCF $2,240,000 Principal 2,192,654 2,141,378 2,085,846 2,025,706 1,960,573 277,200 12,683 39,682 $47,346 51,276 55,532 60,141 65,132 Basis Taxable Gain Ass. Dspr Tax Capital Gain Tax Taxes on Sale ATER IRR NPV @16% 2 8% 20 years 70% S 3,200,000 285,516 16,356 44,325 $ 960,000 16.0% Gross SP $ 4,016,885 2,912,821 742,545 71,795 Interest 30% 25% 15% 68,305 140,100 $1,554,692 14.3% (63,539) $177,489 173,559 169,303 164,694 159,703 The property is an industrial warehouse. Using the given information, find the cash flows, NPV and IRR for a five-year holding period. The year 5 selling price will be the forecast year 6 NOI capitalized at the terminal cap rate. Check answers: 3 Income/Expense Info 294,081 20,203 49,044 Square Footage Rent per square foot (annual) Rent Growth 0 Vacancy Allowance Oner. Exp. Ratio (% of EGI) Reversion Info Terminal Cap Rate Selling Expenses 4 302,904 24,232 53,837 5 25,000 $18 311,991 28,456 58,700 3% 12% 30% 8% 9% 6 321,351

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION The calculation of the cash flows NPV and IRR for the industrial warehouse property Heres t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started