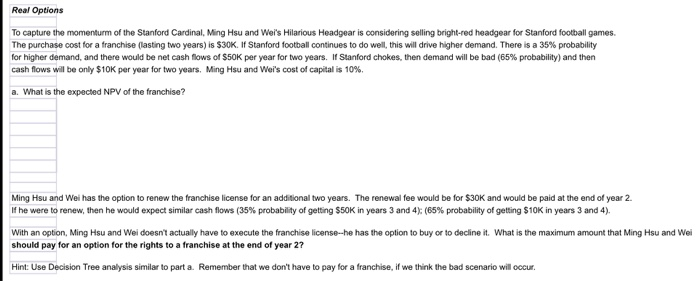

Real Options To capture the momenturm of the Stanford Cardinal, Ming Hsu and Wei's Hilarious Headgear is considering selling bright-red headgear for Stanford football games. The purchase cost for a franchise (lasting two years) is $30K. If Stanford football continues to do well, this will drive higher demand. There is a 35% probability for higher demand, and there would be net cash flows of $50K per year for two years. If Stanford chokes, then demand will be bad (65% probability) and then cash flows will be only $10K per year for two years. Ming Hsu and Wei's cost of capital is 10% a. What is the expected NPV of the franchise? Ming Hsu and Wei has the option to renew the franchise license for an additional two years. The renewal fee would be for $30K and would be paid at the end of year 2 If he were to renew, then he would expect similar cash flows (35% probability of getting $50K in years 3 and 4): (65% probability of getting $10K in years 3 and 4). With an option, Ming Hsu and Wei doesn't actually have to execute the franchise license--he has the option to buy or to decline it. What is the maximum amount that Ming Hsu and Wei should pay for an option for the rights to a franchise at the end of year 2? Hint: Use Decision Tree analysis similar to part a. Remember that we don't have to pay for a franchise, if we think the bad scenario will occur. Real Options To capture the momenturm of the Stanford Cardinal, Ming Hsu and Wei's Hilarious Headgear is considering selling bright-red headgear for Stanford football games. The purchase cost for a franchise (lasting two years) is $30K. If Stanford football continues to do well, this will drive higher demand. There is a 35% probability for higher demand, and there would be net cash flows of $50K per year for two years. If Stanford chokes, then demand will be bad (65% probability) and then cash flows will be only $10K per year for two years. Ming Hsu and Wei's cost of capital is 10% a. What is the expected NPV of the franchise? Ming Hsu and Wei has the option to renew the franchise license for an additional two years. The renewal fee would be for $30K and would be paid at the end of year 2 If he were to renew, then he would expect similar cash flows (35% probability of getting $50K in years 3 and 4): (65% probability of getting $10K in years 3 and 4). With an option, Ming Hsu and Wei doesn't actually have to execute the franchise license--he has the option to buy or to decline it. What is the maximum amount that Ming Hsu and Wei should pay for an option for the rights to a franchise at the end of year 2? Hint: Use Decision Tree analysis similar to part a. Remember that we don't have to pay for a franchise, if we think the bad scenario will occur