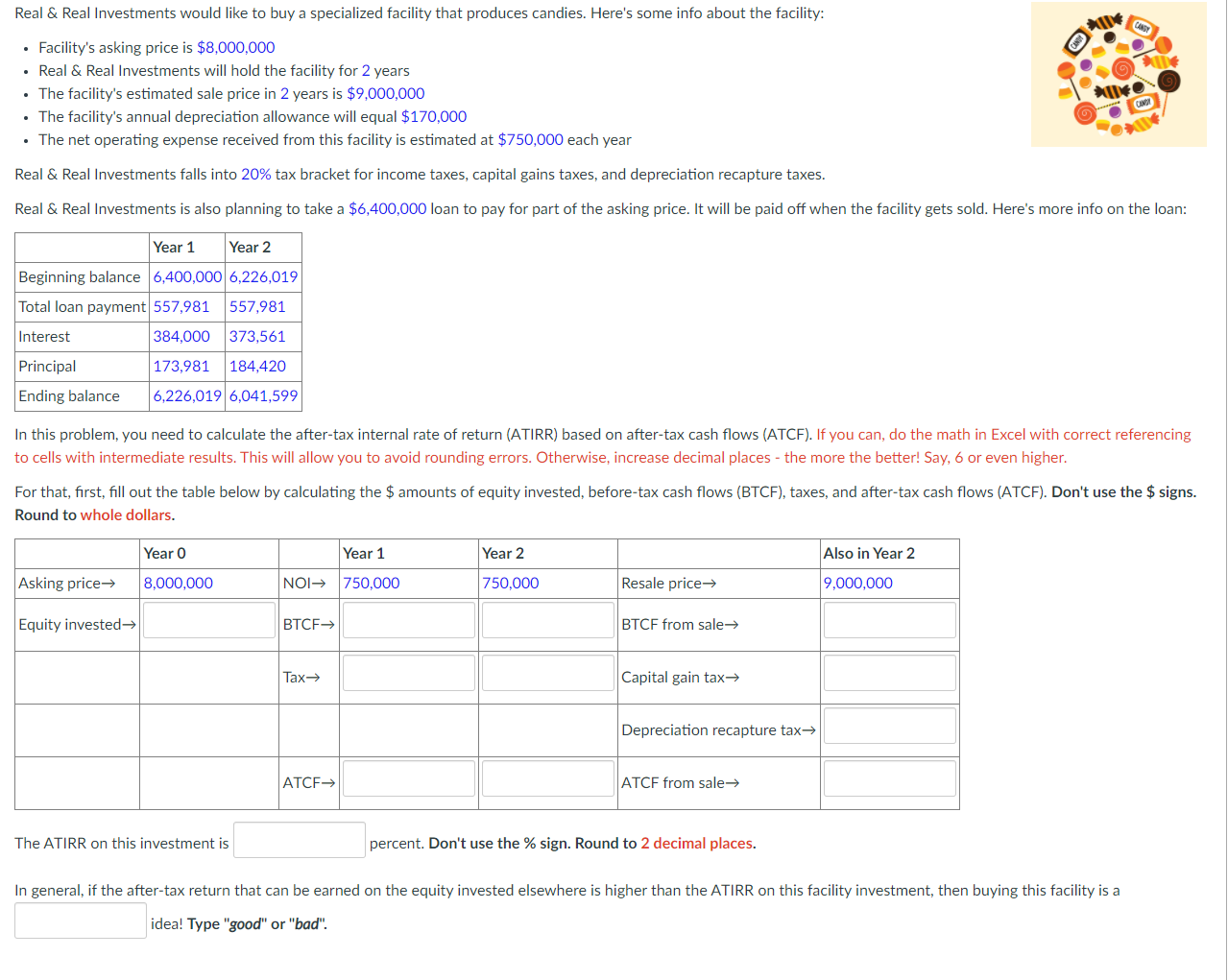

Real & Real Investments would like to buy a specialized facility that produces candies. Here's some info about the facility: Facility's asking price is $8,000,000 Real & Real Investments will hold the facility for 2 years . The facility's estimated sale price in 2 years is $9,000,000 The facility's annual depreciation allowance will equal $170,000 The net operating expense received from this facility is estimated at $750,000 each year Real & Real Investments falls into 20% tax bracket for income taxes, capital gains taxes, and depreciation recapture taxes. Real & Real Investments is also planning to take a $6,400,000 loan to pay for part of the asking price. It will be paid off when the facility gets sold. Here's more info on the loan: Year 1 Year 2 Beginning balance 6,400,000 6,226,019 Total loan payment 557,981 557,981 Interest 384,000 373,561 Principal 173,981 184,420 Ending balance 6,226,019 6,041,599 In this problem, you need to calculate the after-tax internal rate of return (ATIRR) based on after-tax cash flows (ATCF). If you can, do the math in Excel with correct referencing to cells with intermediate results. This will allow you to avoid rounding errors. Otherwise, increase decimal places - the more the better! Say, 6 or even higher. For that, first, fill out the table below by calculating the $ amounts of equity invested, before-tax cash flows (BTCF), taxes, and after-tax cash flows (ATCF). Don't use the $ signs. Round to whole dollars. Year o Year 1 Year 2 Also in Year 2 Asking price 8.000.000 NOI 750,000 750,000 Resale price 9,000,000 Equity invested BTCF BTCF from sale Tax Capital gain tax Depreciation recapture tax ATCF ATCF from sale The ATIRR on this investment is percent. Don't use the % sign. Round to 2 decimal places. In general, if the after-tax return that can be earned on the equity invested elsewhere is higher than the ATIRR on this facility investment, then buying this facility is a idea! Type "good" or "bad". Real & Real Investments would like to buy a specialized facility that produces candies. Here's some info about the facility: Facility's asking price is $8,000,000 Real & Real Investments will hold the facility for 2 years . The facility's estimated sale price in 2 years is $9,000,000 The facility's annual depreciation allowance will equal $170,000 The net operating expense received from this facility is estimated at $750,000 each year Real & Real Investments falls into 20% tax bracket for income taxes, capital gains taxes, and depreciation recapture taxes. Real & Real Investments is also planning to take a $6,400,000 loan to pay for part of the asking price. It will be paid off when the facility gets sold. Here's more info on the loan: Year 1 Year 2 Beginning balance 6,400,000 6,226,019 Total loan payment 557,981 557,981 Interest 384,000 373,561 Principal 173,981 184,420 Ending balance 6,226,019 6,041,599 In this problem, you need to calculate the after-tax internal rate of return (ATIRR) based on after-tax cash flows (ATCF). If you can, do the math in Excel with correct referencing to cells with intermediate results. This will allow you to avoid rounding errors. Otherwise, increase decimal places - the more the better! Say, 6 or even higher. For that, first, fill out the table below by calculating the $ amounts of equity invested, before-tax cash flows (BTCF), taxes, and after-tax cash flows (ATCF). Don't use the $ signs. Round to whole dollars. Year o Year 1 Year 2 Also in Year 2 Asking price 8.000.000 NOI 750,000 750,000 Resale price 9,000,000 Equity invested BTCF BTCF from sale Tax Capital gain tax Depreciation recapture tax ATCF ATCF from sale The ATIRR on this investment is percent. Don't use the % sign. Round to 2 decimal places. In general, if the after-tax return that can be earned on the equity invested elsewhere is higher than the ATIRR on this facility investment, then buying this facility is a idea! Type "good" or "bad