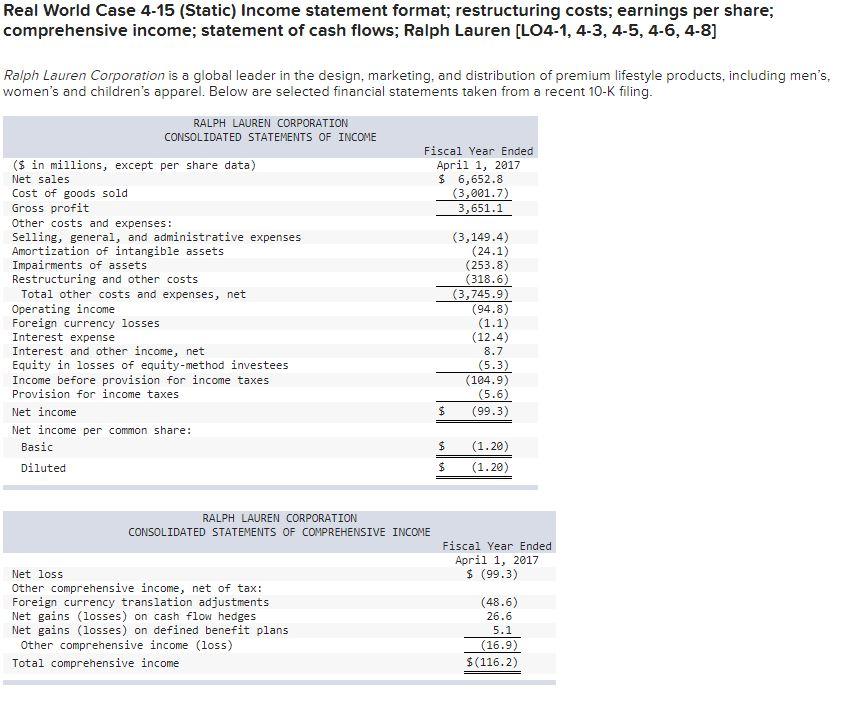

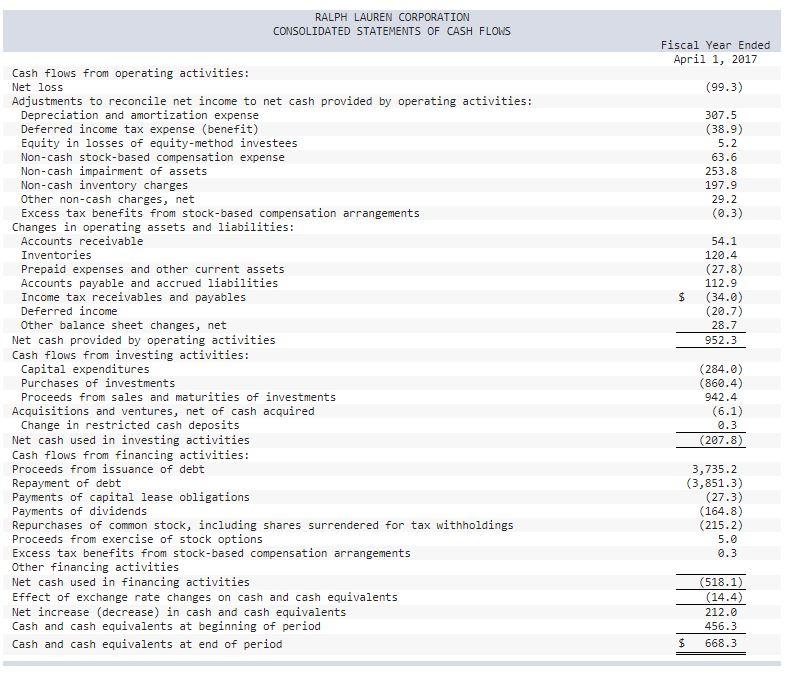

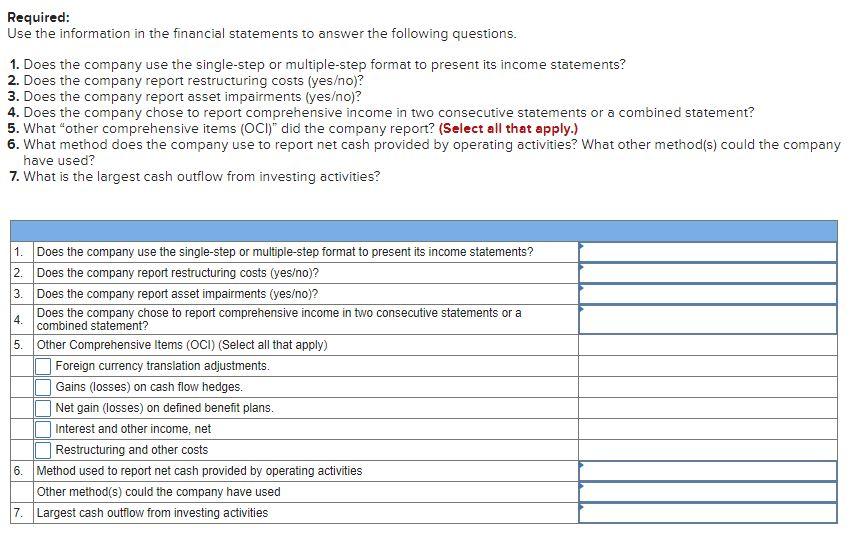

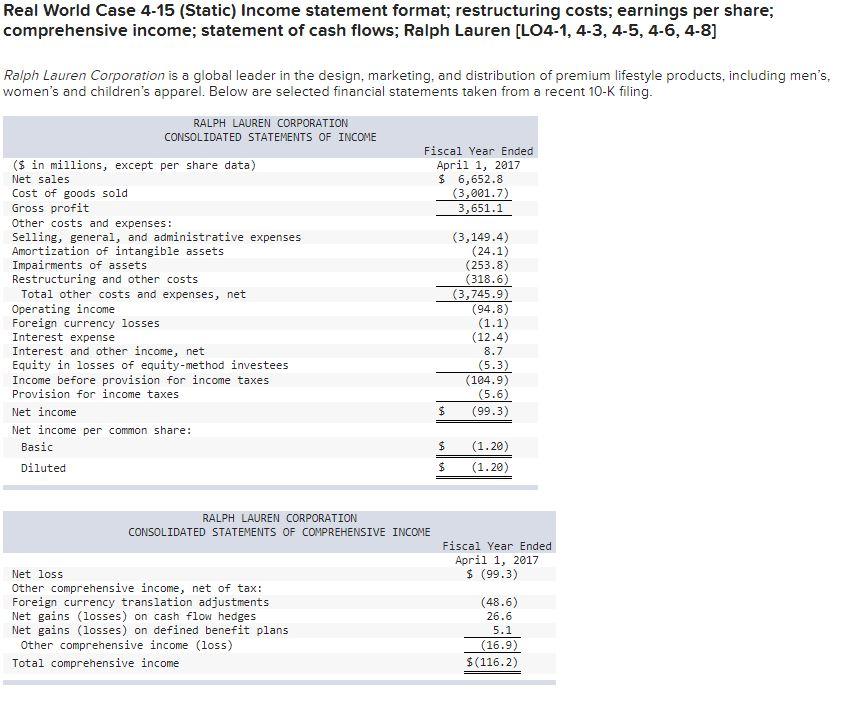

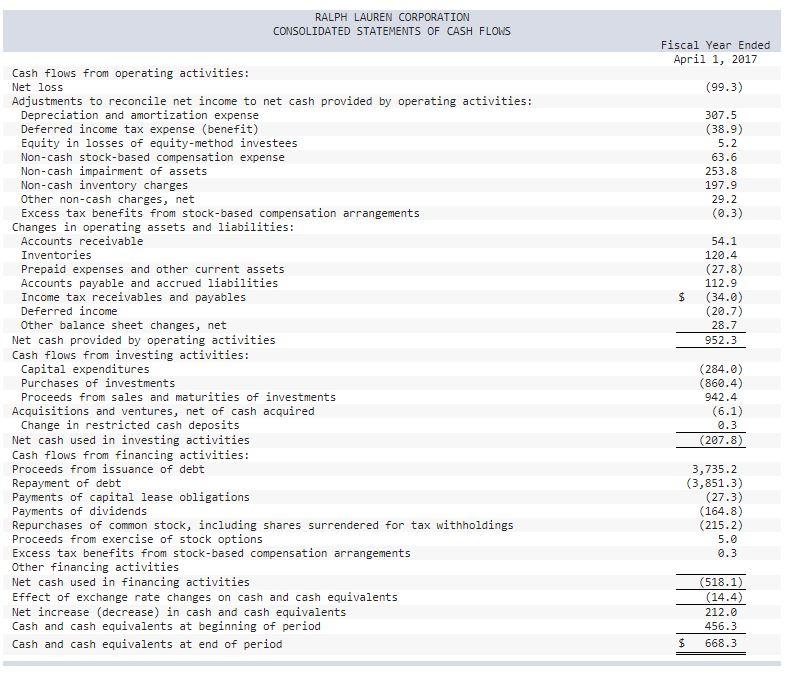

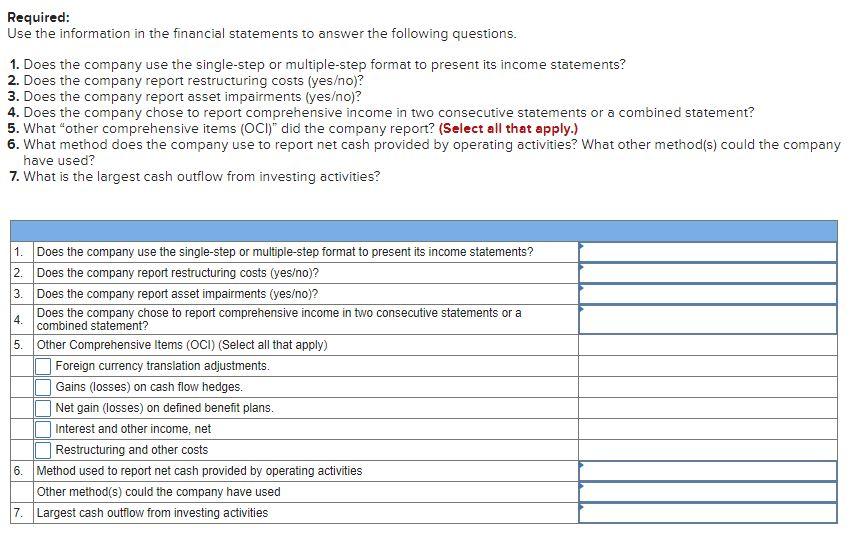

Real World Case 4-15 (Static) Income statement format; restructuring costs; earnings per share; comprehensive income; statement of cash flows; Ralph Lauren (L04-1, 4-3, 4-5, 4-6, 4-8) Ralph Lauren Corporation is a global leader in the design, marketing, and distribution of premium lifestyle products, including men's, women's and children's apparel. Below are selected financial statements taken from a recent 10-K filing. RALPH LAUREN CORPORATION CONSOLIDATED STATEMENTS OF INCOME Fiscal Year Ended ($ in millions, except per share data) April 1, 2017 Net sales $ 6,652.8 Cost of goods sold (3,001.7) Gross profit 3,651.1 Other costs and expenses: Selling, general, and administrative expenses (3,149.4) Amortization of intangible assets (24.1) Impairments of assets (253.8) Restructuring and other costs (318.6) Total other costs and expenses, net (3,745.9) Operating income (94.8) Foreign currency losses (1.1) Interest expense (12.4) Interest and other income, net Equity in losses of equity-method investees (5.3) Income before provision for income taxes (104.9) Provision for income taxes (5.6) Net income (99.3) Net income per common share: Basic (1.20) Diluted (1.20) 8.7 $ $ $ RALPH LAUREN CORPORATION CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Fiscal Year Ended April 1, 2017 $ (99.3) Net loss Other comprehensive income, net of tax: Foreign currency translation adjustments Net gains (losses) on cash flow hedges Net gains (losses) on defined benefit plans Other comprehensive income (loss) Total comprehensive income (48.6) 26.6 5.1 (16.9) $(116.2) RALPH LAUREN CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS Fiscal Year Ended April 1, 2017 (99.3) 307.5 (38.9) 5.2 63.6 253.8 197.9 29.2 (0.3) 54.1 120.4 (27.8) 112.9 (34.0) (20.7) 28.7 952.3 $ Cash flows from operating activities: Net loss Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization expense Deferred income tax expense (benefit) Equity in losses of equity-method investees Non-cash stock-based compensation expense Non-cash impairment of assets Non-cash inventory charges Other non-cash charges, net Excess tax benefits from stock-based compensation arrangements Changes in operating assets and liabilities: Accounts receivable Inventories Prepaid expenses and other current assets Accounts payable and accrued liabilities Income tax receivables and payables Deferred income Other balance sheet changes, net Net cash provided by operating activities Cash flows from investing activities: Capital expenditures Purchases of investments Proceeds from sales and maturities of investments Acquisitions and ventures, net of cash acquired Change in restricted cash deposits Net cash used in investing activities Cash flows from financing activities: Proceeds from issuance of debt Repayment of debt Payments of capital lease obligations Payments of dividends Repurchases of common stock, including shares surrendered for tax withholdings Proceeds from exercise of stock options Excess tax benefits from stock-based compensation arrangements Other financing activities Net cash used in financing activities Effect of exchange rate changes on cash and cash equivalents Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period (284.0) (860.4) 942.4 (6.1) 0.3 (207.8) 3,735.2 (3,851.3) (27.3) (164.8) (215.2) 5.0 0.3 (518.1) (14.4) 212.0 456.3 668.3 $ Required: Use the information in the financial statements to answer the following questions. 1. Does the company use the single-step or multiple-step format to present its income statements? 2. Does the company report restructuring costs (yeso)? 3. Does the company report asset impairments (yeso)? 4. Does the company chose to report comprehensive income in two consecutive statements or a combined statement? 5. What "other comprehensive items (OCI)" did the company report? (Select all that apply.) 6. What method does the company use to report net cash provided by operating activities? What other method(s) could the company have used? 7. What is the largest cash outflow from investing activities? 1. 4 Does the company use the single-step or multiple-step format to present its income statements? 2. Does the company report restructuring costs (yeso)? 3. Does the company report asset impairments (yeso)? Does the company chose to report comprehensive income in two consecutive statements or a 4. combined statement? 5. Other Comprehensive Items (OCI) (Select all that apply) Foreign currency translation adjustments. Gains (losses) on cash flow hedges. Net gain (losses) on defined benefit plans. Interest and other income, net Restructuring and other costs 6. Method used to report net cash provided by operating activities Other method(s) could the company have used 7. Largest cash outflow from investing activities