Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Really need help please, i missed a lot of classes. Assignment #3 Backyard Technology Inc. (BTI) is a Sherbrooke retailer that sells commercial greenhouse kits.

Really need help please, i missed a lot of classes.

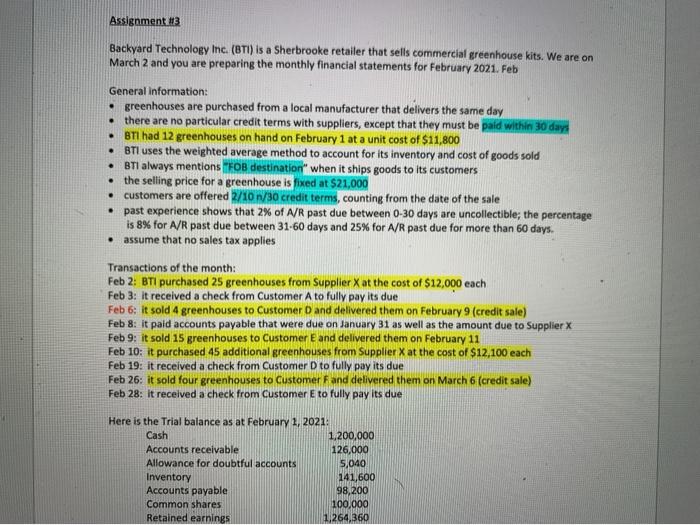

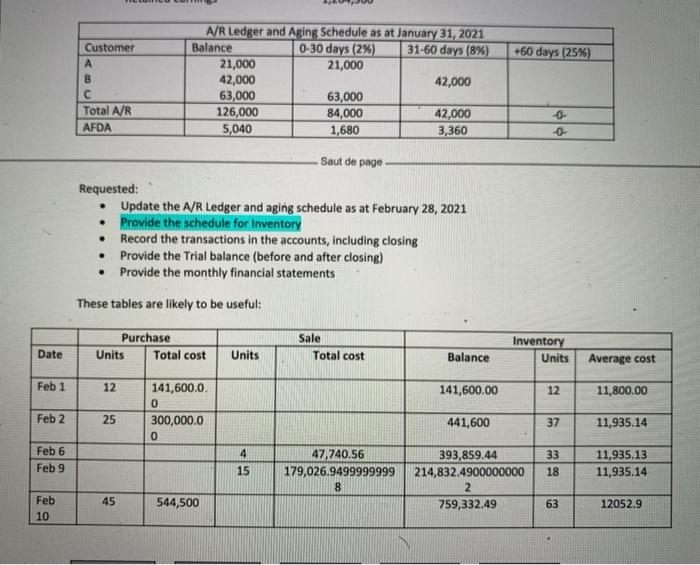

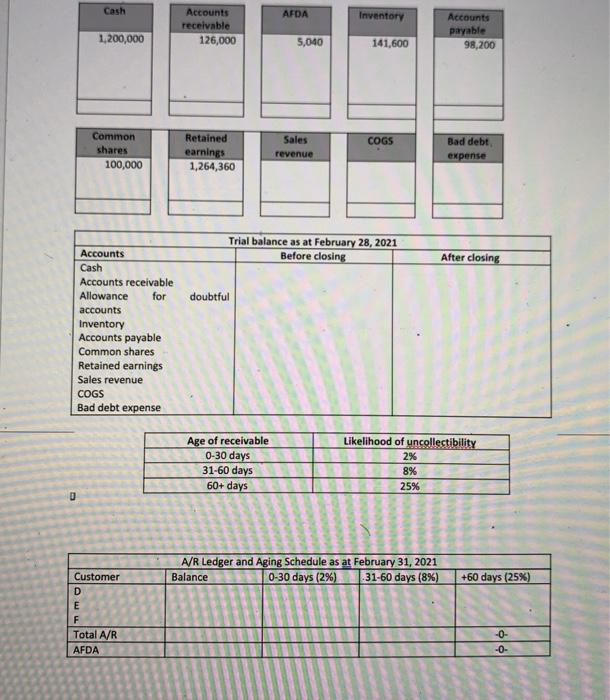

Assignment #3 Backyard Technology Inc. (BTI) is a Sherbrooke retailer that sells commercial greenhouse kits. We are on March 2 and you are preparing the monthly financial statements for February 2021. Feb . General Information: greenhouses are purchased from a local manufacturer that delivers the same day there are no particular credit terms with suppliers, except that they must be paid within 30 days BTI had 12 greenhouses on hand on February 1 at a unit cost of $11,800 BTI uses the weighted average method to account for its inventory and cost of goods sold BTI always mentions FOB destination when it ships goods to its customers the selling price for a greenhouse is fixed at $21,000 customers are offered 2/10 1/30 credit terms, counting from the date of the sale past experience shows that 2% of A/R past due between 0-30 days are uncollectible; the percentage is 8% for A/R past due between 31.60 days and 25% for A/R past due for more than 60 days. assume that no sales tax applies Transactions of the month: Feb 2: BTI purchased 25 greenhouses from Supplier X at the cost of $12,000 each Feb 3: It received a check from Customer A to fully pay its due Feb 6: it sold 4 greenhouses to Customer and delivered them on February 9 (credit sale) Feb 8: it paid accounts payable that were due on January 31 as well as the amount due to Supplier X Feb 9: it sold 15 greenhouses to Customer E and delivered them on February 11 Feb 10: it purchased 45 additional greenhouses from Supplier X at the cost of $12,100 each Feb 19: it received a check from Customer D to fully pay its due Feb 26: it sold four greenhouses to Customer and delivered them on March 6 (credit sale) Feb 28: it received a check from Customer E to fully pay its due Here is the Trial balance as at February 1, 2021: Cash 1,200,000 Accounts receivable 126,000 Allowance for doubtful accounts 5,040 Inventory 141,600 Accounts payable 98,200 Common shares 100,000 Retained earnings 1,264,360 +60 days (25%) Customer A B C Total A/R AFDA A/R Ledger and Aging Schedule as at January 31, 2021 Balance 0-30 days (2%) 31-60 days (8%) 21,000 21,000 42,000 42,000 63,000 63,000 126,000 84,000 42,000 5,040 1,680 3,360 | 0- -0- Saut de page . Requested: Update the A/R Ledger and aging schedule as at February 28, 2021 Provide the schedule for Inventory Record the transactions in the accounts, including closing Provide the Trial balance (before and after closing) Provide the monthly financial statements . These tables are likely to be useful: Purchase Units Total cost Sale Total cost Date Inventory Units Units Balance Average cost Feb 1 12 141,600.00 12 11,800.00 141,600.0 0 300,000.0 0 Feb 2 25 441,600 37 11,935.14 Feb 6 Feb 9 4 15 47,740.56 179,026.9499999999 8 33 18 393,859.44 214,832.4900000000 2 759,332.49 11,935.13 11,935.14 Feb 45 544,500 63 12052.9 10 Cash AFDA Inventory Accounts receivable 126,000 1,200,000 Accounts payable 98,200 5,040 141,600 COGS Common shares 100,000 Retained earnings 1,264,360 Sales revenue Bad debt expense Trial balance as at February 28, 2021 Before closing After closing doubtful Accounts Cash Accounts receivable Allowance for accounts Inventory Accounts payable Common shares Retained earnings Sales revenue COGS Bad debt expense Age of receivable 0-30 days 31-60 days 60+ days Likelihood of uncollectibility 2% 8% 25% 0 A/R Ledger and Aging Schedule as at February 31, 2021 Balance 0-30 days (2%) 31-60 days (8%) +60 days (25%) Customer D E F Total A/R AFDA -0- -0- Assignment #3 Backyard Technology Inc. (BTI) is a Sherbrooke retailer that sells commercial greenhouse kits. We are on March 2 and you are preparing the monthly financial statements for February 2021. Feb . General Information: greenhouses are purchased from a local manufacturer that delivers the same day there are no particular credit terms with suppliers, except that they must be paid within 30 days BTI had 12 greenhouses on hand on February 1 at a unit cost of $11,800 BTI uses the weighted average method to account for its inventory and cost of goods sold BTI always mentions FOB destination when it ships goods to its customers the selling price for a greenhouse is fixed at $21,000 customers are offered 2/10 1/30 credit terms, counting from the date of the sale past experience shows that 2% of A/R past due between 0-30 days are uncollectible; the percentage is 8% for A/R past due between 31.60 days and 25% for A/R past due for more than 60 days. assume that no sales tax applies Transactions of the month: Feb 2: BTI purchased 25 greenhouses from Supplier X at the cost of $12,000 each Feb 3: It received a check from Customer A to fully pay its due Feb 6: it sold 4 greenhouses to Customer and delivered them on February 9 (credit sale) Feb 8: it paid accounts payable that were due on January 31 as well as the amount due to Supplier X Feb 9: it sold 15 greenhouses to Customer E and delivered them on February 11 Feb 10: it purchased 45 additional greenhouses from Supplier X at the cost of $12,100 each Feb 19: it received a check from Customer D to fully pay its due Feb 26: it sold four greenhouses to Customer and delivered them on March 6 (credit sale) Feb 28: it received a check from Customer E to fully pay its due Here is the Trial balance as at February 1, 2021: Cash 1,200,000 Accounts receivable 126,000 Allowance for doubtful accounts 5,040 Inventory 141,600 Accounts payable 98,200 Common shares 100,000 Retained earnings 1,264,360 +60 days (25%) Customer A B C Total A/R AFDA A/R Ledger and Aging Schedule as at January 31, 2021 Balance 0-30 days (2%) 31-60 days (8%) 21,000 21,000 42,000 42,000 63,000 63,000 126,000 84,000 42,000 5,040 1,680 3,360 | 0- -0- Saut de page . Requested: Update the A/R Ledger and aging schedule as at February 28, 2021 Provide the schedule for Inventory Record the transactions in the accounts, including closing Provide the Trial balance (before and after closing) Provide the monthly financial statements . These tables are likely to be useful: Purchase Units Total cost Sale Total cost Date Inventory Units Units Balance Average cost Feb 1 12 141,600.00 12 11,800.00 141,600.0 0 300,000.0 0 Feb 2 25 441,600 37 11,935.14 Feb 6 Feb 9 4 15 47,740.56 179,026.9499999999 8 33 18 393,859.44 214,832.4900000000 2 759,332.49 11,935.13 11,935.14 Feb 45 544,500 63 12052.9 10 Cash AFDA Inventory Accounts receivable 126,000 1,200,000 Accounts payable 98,200 5,040 141,600 COGS Common shares 100,000 Retained earnings 1,264,360 Sales revenue Bad debt expense Trial balance as at February 28, 2021 Before closing After closing doubtful Accounts Cash Accounts receivable Allowance for accounts Inventory Accounts payable Common shares Retained earnings Sales revenue COGS Bad debt expense Age of receivable 0-30 days 31-60 days 60+ days Likelihood of uncollectibility 2% 8% 25% 0 A/R Ledger and Aging Schedule as at February 31, 2021 Balance 0-30 days (2%) 31-60 days (8%) +60 days (25%) Customer D E F Total A/R AFDA -0- -0 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started