Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Really Need Help! Really need help on this asset management question Question 1 The following information is provided by a leading UK asset manager, it

Really Need Help!

Really need help on this asset management question

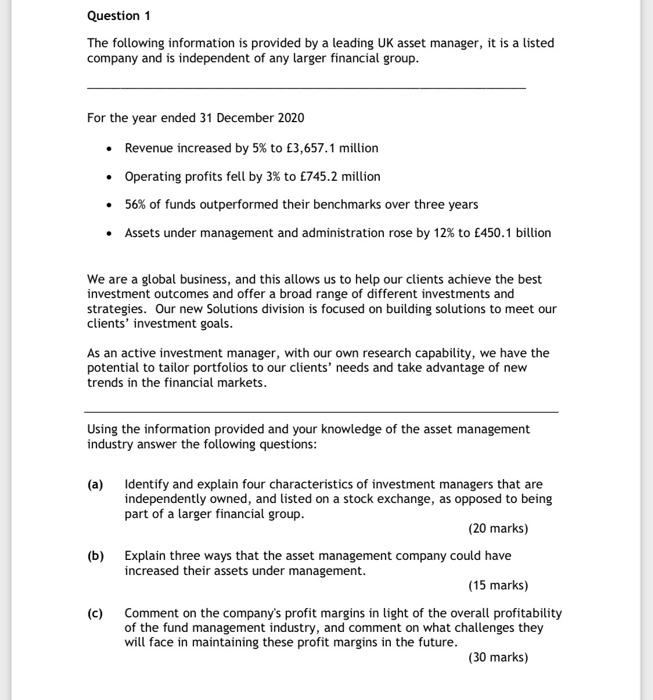

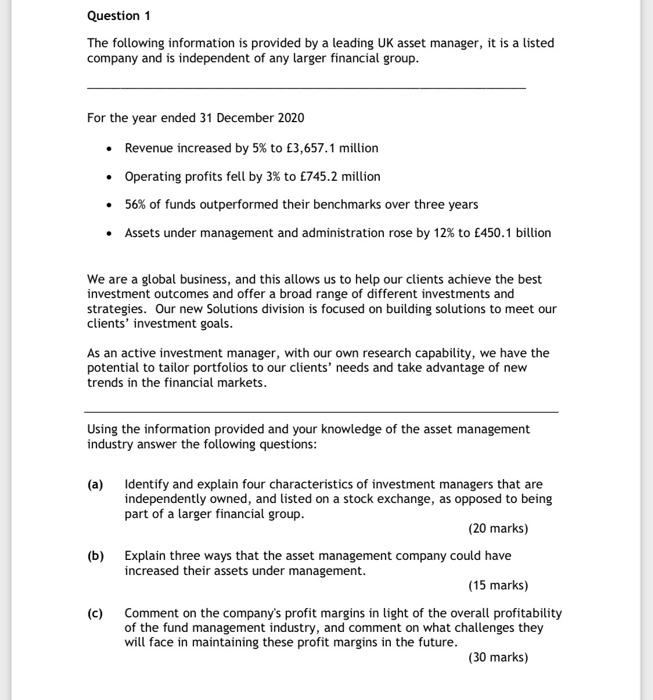

Question 1 The following information is provided by a leading UK asset manager, it is a listed company and is independent of any larger financial group. For the year ended 31 December 2020 Revenue increased by 5% to 3,657.1 million Operating profits fell by 3% to 745.2 million 56% of funds outperformed their benchmarks over three years Assets under management and administration rose by 12% to 450.1 billion We are a global business, and this allows us to help our clients achieve the best investment outcomes and offer a broad range of different investments and strategies. Our new Solutions division is focused on building solutions to meet our clients' investment goals. As an active investment manager, with our own research capability, we have the potential to tailor portfolios to our clients' needs and take advantage of new trends in the financial markets. Using the information provided and your knowledge of the asset management industry answer the following questions: (a) Identify and explain four characteristics of investment managers that are independently owned, and listed on a stock exchange, as opposed to being part of a larger financial group. (20 marks) (b) Explain three ways that the asset management company could have increased their assets under management. (15 marks) (c) Comment on the company's profit margins in light of the overall profitability of the fund management industry, and comment on what challenges they will face in maintaining these profit margins in the future. (30 marks) (d) Suggest four reasons for the growth in the Solutions business. (20 marks) (e) Explain three reasons why active investing might be more attractive than passive investing to their clients. (15 marks) (Total 100 marks) See Next Page Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started