Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Really need help with part 2! please show calculations and give explanation as much as possible J & R's Outdoor Furniture Manufacturers J&R Outdoor Furniture

Really need help with part 2! please show calculations and give explanation as much as possible

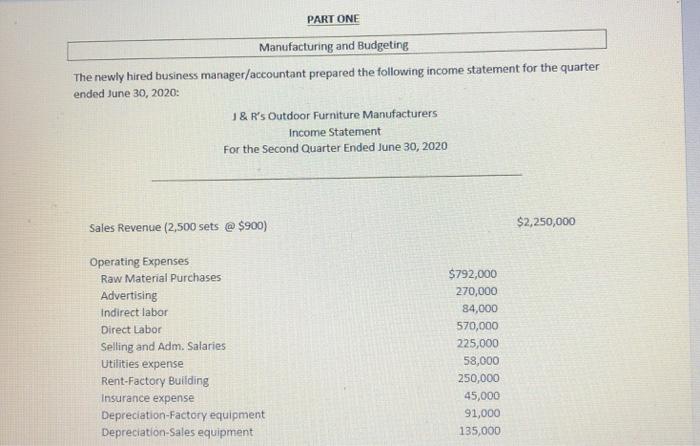

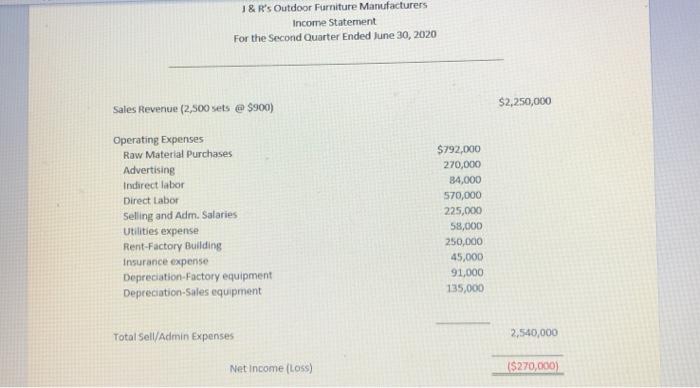

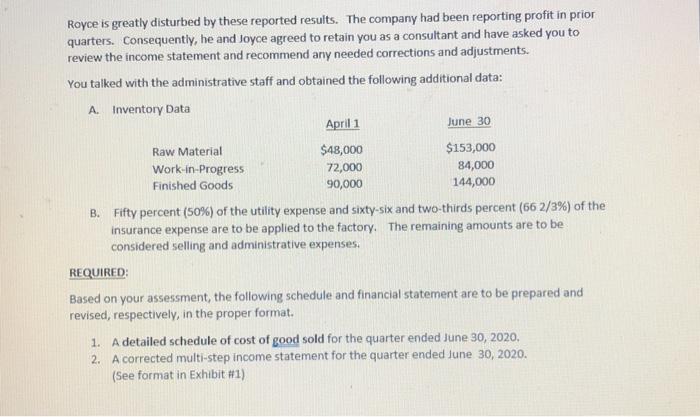

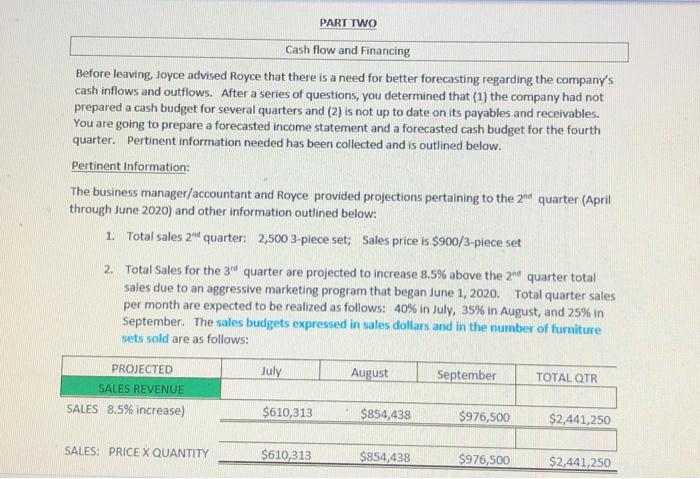

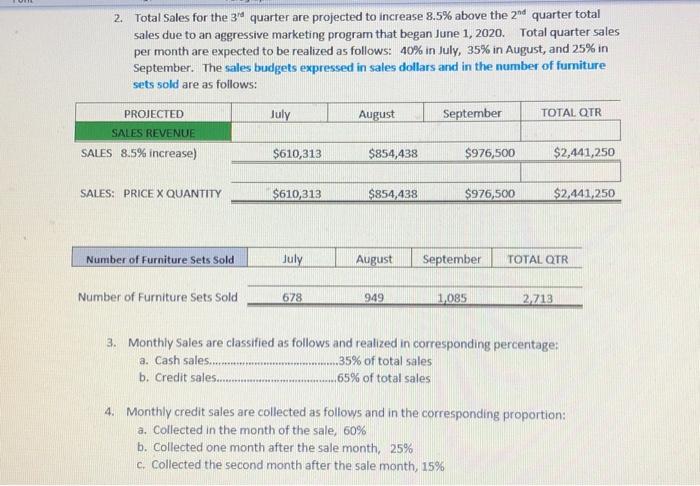

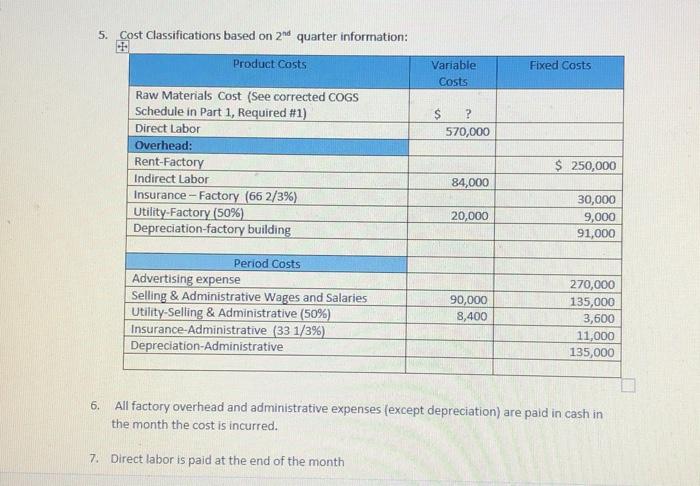

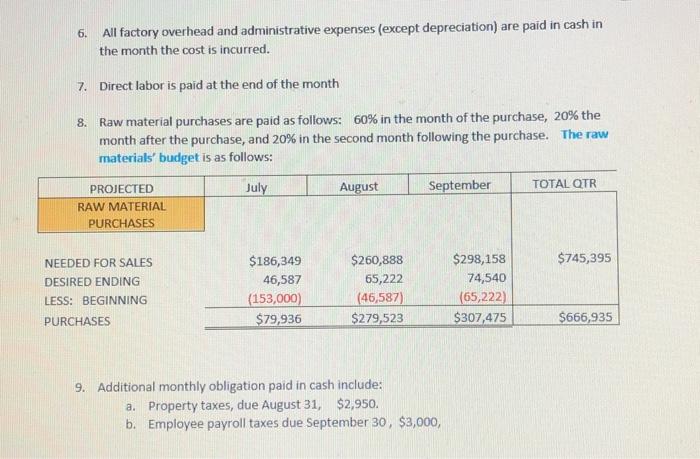

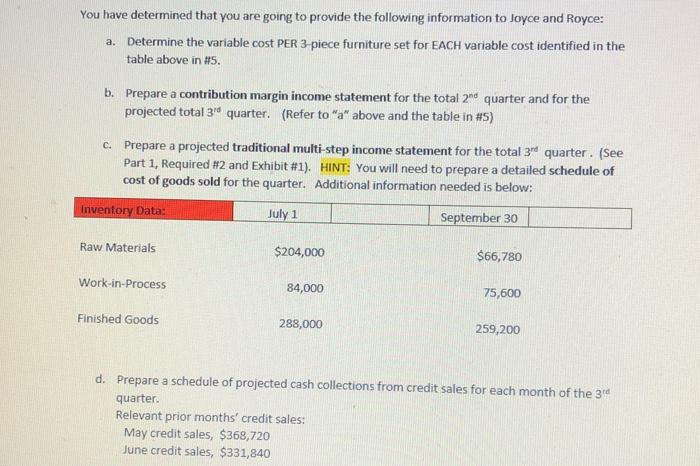

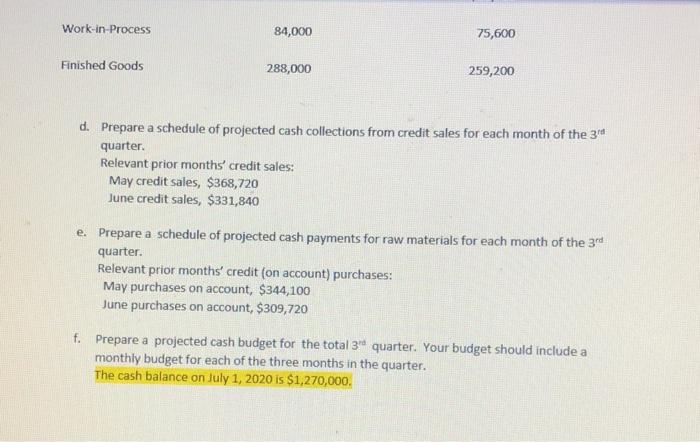

J & R's Outdoor Furniture Manufacturers J&R Outdoor Furniture Manufacturers is owned and operated by twin siblings Joyce Yancy-Tate and Royce Yancey. The company has been in operation for several years and manufactures 3-piece sets of outdoor furniture in a variety of colors and patterns. The company has been quite successful over the past years but has experienced a slow decline in profits for the past couple of quarters, according to reports generated by the administrative staff. A month ago, Joyce, took a leave of absence from the business to take care of her newborn twin Sons. Joyce is the Chief Financial Officer for the Company. An assistant business manager/accountant was hired temporarily to assist the staff in carrying out the accounting and financial duties. The company had been consistently reporting net profits over the years but a decline in profits over the past couple of quarters is quite noticeable. The Yancey twins are troubled by this performance and believe they need an expert to review the company's records and operations. Consequently, they have retained your consulting firm to perform research and evaluation and provide recommendations for improvement and recovery of profitable operations. There is also a need for an improved cash flow management strategy. Two distinct areas that you are investigating are manufacturing operations and cash flow management. Details are provided below for both areas. PART ONE Manufacturing and Budgeting The newly hired business manager/accountant prepared the following income statement for the quarter ended June 30, 2020: 1 & R's Outdoor Furniture Manufacturers Income Statement For the Second Quarter Ended June 30, 2020 Sales Revenue (2,500 sets @ $900) $2,250,000 Operating Expenses Raw Material Purchases Advertising Indirect labor Direct Labor Selling and Adm. Salaries Utilities expense Rent-Factory Building Insurance expense Depreciation-Factory equipment Depreciation-Sales equipment $792,000 270,000 84,000 570,000 225,000 58,000 250,000 45,000 91,000 135,000 1 & R's Outdoor Furniture Manufacturers Income Statement For the Second Quarter Ended June 30, 2020 $2,250,000 Sales Revenue (2,500 sets @ $900) Operating Expenses Raw Material Purchases Advertising Indirect labor Direct Labor Selling and Adm. Salaries Utilities expense Rent-Factory Building Insurance expense Depreciation Factory equipment Depreciation Sales equipment $792,000 270,000 34,000 570,000 225,000 58,000 250,000 45,000 91,000 135,000 Total Sell/Admin Expenses 2,540,000 Net Income (Loss) ($270,000) Royce is greatly disturbed by these reported results. The company had been reporting profit in prior quarters. Consequently, he and Joyce agreed to retain you as a consultant and have asked you to review the income statement and recommend any needed corrections and adjustments. You talked with the administrative staff and obtained the following additional data: A. Inventory Data April 1 June 30 Raw Material $48,000 $153,000 Work-in-Progress 72,000 84,000 Finished Goods 90,000 144,000 B. Fifty percent (50%) of the utility expense and sixty-six and two-thirds percent (66 2/3%) of the insurance expense are to be applied to the factory. The remaining amounts are to be considered selling and administrative expenses. REQUIRED: Based on your assessment, the following schedule and financial statement are to be prepared and revised, respectively, in the proper format. 1. A detailed schedule of cost of good sold for the quarter ended June 30, 2020, 2. A corrected multi-step income statement for the quarter ended June 30, 2020. (See format in Exhibit #1) PART TWO Cash flow and Financing Before leaving, Joyce advised Royce that there is a need for better forecasting regarding the company's cash inflows and outflows. After a series of questions, you determined that (1) the company had not prepared a cash budget for several quarters and (2) is not up to date on its payables and receivables. You are going to prepare a forecasted income statement and a forecasted cash budget for the fourth quarter. Pertinent information needed has been collected and is outlined below. Pertinent Information: The business manager/accountant and Royce provided projections pertaining to the 2nd quarter (April through June 2020) and other information outlined below: 1. Total sales 2 quarter: 2,500 3-piece set; Sales price is $900/3-piece set 2. Total Sales for the 3 quarter are projected to increase 8.5% above the 2nd quarter total sales due to an aggressive marketing program that began June 1, 2020. Total quarter sales per month are expected to be realized as follows: 40% in July, 35% in August, and 25% in September. The sales budgets expressed in sales dollars and in the number of furniture sets sold are as follows: PROJECTED July August September TOTAL QTR SALES REVENUE SALES 8.5% increase) $610,313 $854,438 $976,500 $2,441,250 SALES: PRICE X QUANTITY $610,313 $854,438 $976,500 $2,441,250 2. Total Sales for the 3rd quarter are projected to increase 8.5% above the 2nd quarter total sales due to an aggressive marketing program that began June 1, 2020. Total quarter sales per month are expected to be realized as follows: 40% in July, 35% in August, and 25% in September. The sales budgets expressed in sales dollars and in the number of furniture sets sold are as follows: July August September TOTAL OTR PROJECTED SALES REVENUE SALES 8.5% increase) $610,313 $854,438 $976,500 $2,441,250 SALES: PRICE X QUANTITY $610,313 $854,438 $976,500 $2,441,250 Number of Furniture Sets Sold July August September TOTAL QTR Number of Furniture Sets Sold 678 949 1,085 2.713 3. Monthly sales are classified as follows and realized in corresponding percentage: a. Cash sales........ 35% of total sales b. Credit sales... 65% of total sales 4. Monthly credit sales are collected as follows and in the corresponding proportion: . Collected in the month of the sale, 60% b. Collected one month after the sale month, 25% C. Collected the second month after the sale month, 15% 5. Cost Classifications based on 2 quarter information: Product Costs Fixed Costs Variable Costs $ ? 570,000 Raw Materials Cost (See corrected COGS Schedule in Part 1, Required #1) Direct Labor Overhead: Rent-Factory Indirect Labor Insurance -- Factory (66 2/3%) Utility Factory (50%) Depreciation-factory building $ 250,000 84,000 20,000 30,000 9,000 91,000 Period Costs Advertising expense Selling & Administrative Wages and Salaries Utility-Selling & Administrative (50%) Insurance-Administrative (33 1/3%) Depreciation Administrative 90,000 8,400 270,000 135,000 3,600 11,000 135,000 6. All factory overhead and administrative expenses (except depreciation) are paid in cash in the month the cost is incurred. 7. Direct labor is paid at the end of the month 6. All factory overhead and administrative expenses (except depreciation) are paid in cash in the month the cost is incurred. 7. Direct labor is paid at the end of the month 8. Raw material purchases are paid as follows: 60% in the month of the purchase, 20% the month after the purchase, and 20% in the second month following the purchase. The raw materials' budget is as follows: July August September TOTAL QTR PROJECTED RAW MATERIAL PURCHASES $745,395 NEEDED FOR SALES DESIRED ENDING LESS: BEGINNING $186,349 46,587 (153,000) $79,936 $260,888 65,222 (46,587) $279,523 $298,158 74,540 (65,222) $307,475 PURCHASES $666,935 9. Additional monthly obligation paid in cash include: a. Property taxes, due August 31, $2,950. b. Employee payroll taxes due September 30, $3,000, You have determined that you are going to provide the following information to Joyce and Royce: a. Determine the variable cost PER 3-piece furniture set for EACH variable cost identified in the table above in #5. b. Prepare a contribution margin income statement for the total 2nd quarter and for the projected total 3rd quarter. (Refer to "a" above and the table in #5) c. Prepare a projected traditional multi-step income statement for the total 3rd quarter. (See Part 1, Required #2 and Exhibit #1). HINT: You will need to prepare a detailed schedule of cost of goods sold for the quarter. Additional information needed is below: Inventory Data: July 1 September 30 Raw Materials $204,000 $66,780 Work-in-Process 84,000 75,600 Finished Goods 288,000 259,200 d. Prepare a schedule of projected cash collections from credit sales for each month of the 34 quarter. Relevant prior months' credit sales: May credit sales, $368,720 June credit sales, $331,840 Work in Process 84,000 75,600 Finished Goods 288,000 259,200 d. Prepare a schedule of projected cash collections from credit sales for each month of the 3rd quarter. Relevant prior months' credit sales: May credit sales, $368,720 June credit sales, $331,840 e. Prepare a schedule of projected cash payments for raw materials for each month of the 3rd quarter. Relevant prior months' credit on account) purchases: May purchases on account, $344,100 June purchases on account, $309,720 f. Prepare a projected cash budget for the total 3 quarter. Your budget should include a monthly budget for each of the three months in the quarter. The cash balance on July 1, 2020 is $1,270,000. J & R's Outdoor Furniture Manufacturers J&R Outdoor Furniture Manufacturers is owned and operated by twin siblings Joyce Yancy-Tate and Royce Yancey. The company has been in operation for several years and manufactures 3-piece sets of outdoor furniture in a variety of colors and patterns. The company has been quite successful over the past years but has experienced a slow decline in profits for the past couple of quarters, according to reports generated by the administrative staff. A month ago, Joyce, took a leave of absence from the business to take care of her newborn twin Sons. Joyce is the Chief Financial Officer for the Company. An assistant business manager/accountant was hired temporarily to assist the staff in carrying out the accounting and financial duties. The company had been consistently reporting net profits over the years but a decline in profits over the past couple of quarters is quite noticeable. The Yancey twins are troubled by this performance and believe they need an expert to review the company's records and operations. Consequently, they have retained your consulting firm to perform research and evaluation and provide recommendations for improvement and recovery of profitable operations. There is also a need for an improved cash flow management strategy. Two distinct areas that you are investigating are manufacturing operations and cash flow management. Details are provided below for both areas. PART ONE Manufacturing and Budgeting The newly hired business manager/accountant prepared the following income statement for the quarter ended June 30, 2020: 1 & R's Outdoor Furniture Manufacturers Income Statement For the Second Quarter Ended June 30, 2020 Sales Revenue (2,500 sets @ $900) $2,250,000 Operating Expenses Raw Material Purchases Advertising Indirect labor Direct Labor Selling and Adm. Salaries Utilities expense Rent-Factory Building Insurance expense Depreciation-Factory equipment Depreciation-Sales equipment $792,000 270,000 84,000 570,000 225,000 58,000 250,000 45,000 91,000 135,000 1 & R's Outdoor Furniture Manufacturers Income Statement For the Second Quarter Ended June 30, 2020 $2,250,000 Sales Revenue (2,500 sets @ $900) Operating Expenses Raw Material Purchases Advertising Indirect labor Direct Labor Selling and Adm. Salaries Utilities expense Rent-Factory Building Insurance expense Depreciation Factory equipment Depreciation Sales equipment $792,000 270,000 34,000 570,000 225,000 58,000 250,000 45,000 91,000 135,000 Total Sell/Admin Expenses 2,540,000 Net Income (Loss) ($270,000) Royce is greatly disturbed by these reported results. The company had been reporting profit in prior quarters. Consequently, he and Joyce agreed to retain you as a consultant and have asked you to review the income statement and recommend any needed corrections and adjustments. You talked with the administrative staff and obtained the following additional data: A. Inventory Data April 1 June 30 Raw Material $48,000 $153,000 Work-in-Progress 72,000 84,000 Finished Goods 90,000 144,000 B. Fifty percent (50%) of the utility expense and sixty-six and two-thirds percent (66 2/3%) of the insurance expense are to be applied to the factory. The remaining amounts are to be considered selling and administrative expenses. REQUIRED: Based on your assessment, the following schedule and financial statement are to be prepared and revised, respectively, in the proper format. 1. A detailed schedule of cost of good sold for the quarter ended June 30, 2020, 2. A corrected multi-step income statement for the quarter ended June 30, 2020. (See format in Exhibit #1) PART TWO Cash flow and Financing Before leaving, Joyce advised Royce that there is a need for better forecasting regarding the company's cash inflows and outflows. After a series of questions, you determined that (1) the company had not prepared a cash budget for several quarters and (2) is not up to date on its payables and receivables. You are going to prepare a forecasted income statement and a forecasted cash budget for the fourth quarter. Pertinent information needed has been collected and is outlined below. Pertinent Information: The business manager/accountant and Royce provided projections pertaining to the 2nd quarter (April through June 2020) and other information outlined below: 1. Total sales 2 quarter: 2,500 3-piece set; Sales price is $900/3-piece set 2. Total Sales for the 3 quarter are projected to increase 8.5% above the 2nd quarter total sales due to an aggressive marketing program that began June 1, 2020. Total quarter sales per month are expected to be realized as follows: 40% in July, 35% in August, and 25% in September. The sales budgets expressed in sales dollars and in the number of furniture sets sold are as follows: PROJECTED July August September TOTAL QTR SALES REVENUE SALES 8.5% increase) $610,313 $854,438 $976,500 $2,441,250 SALES: PRICE X QUANTITY $610,313 $854,438 $976,500 $2,441,250 2. Total Sales for the 3rd quarter are projected to increase 8.5% above the 2nd quarter total sales due to an aggressive marketing program that began June 1, 2020. Total quarter sales per month are expected to be realized as follows: 40% in July, 35% in August, and 25% in September. The sales budgets expressed in sales dollars and in the number of furniture sets sold are as follows: July August September TOTAL OTR PROJECTED SALES REVENUE SALES 8.5% increase) $610,313 $854,438 $976,500 $2,441,250 SALES: PRICE X QUANTITY $610,313 $854,438 $976,500 $2,441,250 Number of Furniture Sets Sold July August September TOTAL QTR Number of Furniture Sets Sold 678 949 1,085 2.713 3. Monthly sales are classified as follows and realized in corresponding percentage: a. Cash sales........ 35% of total sales b. Credit sales... 65% of total sales 4. Monthly credit sales are collected as follows and in the corresponding proportion: . Collected in the month of the sale, 60% b. Collected one month after the sale month, 25% C. Collected the second month after the sale month, 15% 5. Cost Classifications based on 2 quarter information: Product Costs Fixed Costs Variable Costs $ ? 570,000 Raw Materials Cost (See corrected COGS Schedule in Part 1, Required #1) Direct Labor Overhead: Rent-Factory Indirect Labor Insurance -- Factory (66 2/3%) Utility Factory (50%) Depreciation-factory building $ 250,000 84,000 20,000 30,000 9,000 91,000 Period Costs Advertising expense Selling & Administrative Wages and Salaries Utility-Selling & Administrative (50%) Insurance-Administrative (33 1/3%) Depreciation Administrative 90,000 8,400 270,000 135,000 3,600 11,000 135,000 6. All factory overhead and administrative expenses (except depreciation) are paid in cash in the month the cost is incurred. 7. Direct labor is paid at the end of the month 6. All factory overhead and administrative expenses (except depreciation) are paid in cash in the month the cost is incurred. 7. Direct labor is paid at the end of the month 8. Raw material purchases are paid as follows: 60% in the month of the purchase, 20% the month after the purchase, and 20% in the second month following the purchase. The raw materials' budget is as follows: July August September TOTAL QTR PROJECTED RAW MATERIAL PURCHASES $745,395 NEEDED FOR SALES DESIRED ENDING LESS: BEGINNING $186,349 46,587 (153,000) $79,936 $260,888 65,222 (46,587) $279,523 $298,158 74,540 (65,222) $307,475 PURCHASES $666,935 9. Additional monthly obligation paid in cash include: a. Property taxes, due August 31, $2,950. b. Employee payroll taxes due September 30, $3,000, You have determined that you are going to provide the following information to Joyce and Royce: a. Determine the variable cost PER 3-piece furniture set for EACH variable cost identified in the table above in #5. b. Prepare a contribution margin income statement for the total 2nd quarter and for the projected total 3rd quarter. (Refer to "a" above and the table in #5) c. Prepare a projected traditional multi-step income statement for the total 3rd quarter. (See Part 1, Required #2 and Exhibit #1). HINT: You will need to prepare a detailed schedule of cost of goods sold for the quarter. Additional information needed is below: Inventory Data: July 1 September 30 Raw Materials $204,000 $66,780 Work-in-Process 84,000 75,600 Finished Goods 288,000 259,200 d. Prepare a schedule of projected cash collections from credit sales for each month of the 34 quarter. Relevant prior months' credit sales: May credit sales, $368,720 June credit sales, $331,840 Work in Process 84,000 75,600 Finished Goods 288,000 259,200 d. Prepare a schedule of projected cash collections from credit sales for each month of the 3rd quarter. Relevant prior months' credit sales: May credit sales, $368,720 June credit sales, $331,840 e. Prepare a schedule of projected cash payments for raw materials for each month of the 3rd quarter. Relevant prior months' credit on account) purchases: May purchases on account, $344,100 June purchases on account, $309,720 f. Prepare a projected cash budget for the total 3 quarter. Your budget should include a monthly budget for each of the three months in the quarter. The cash balance on July 1, 2020 is $1,270,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started