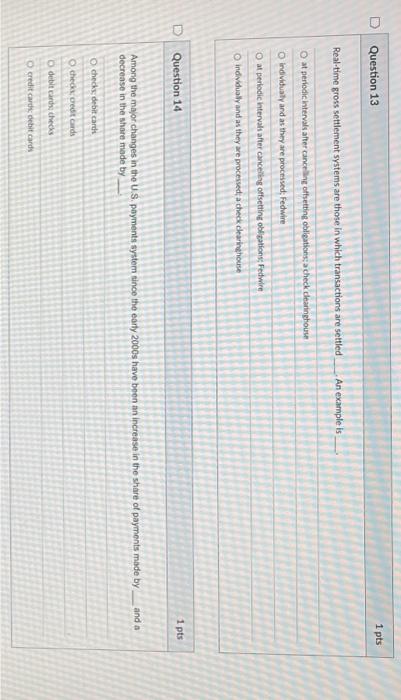

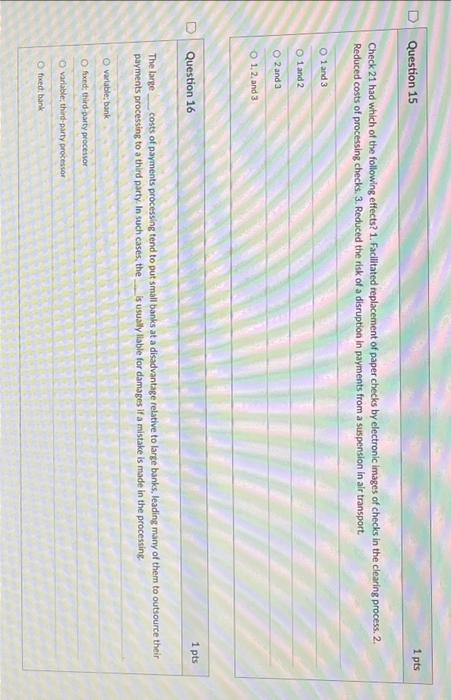

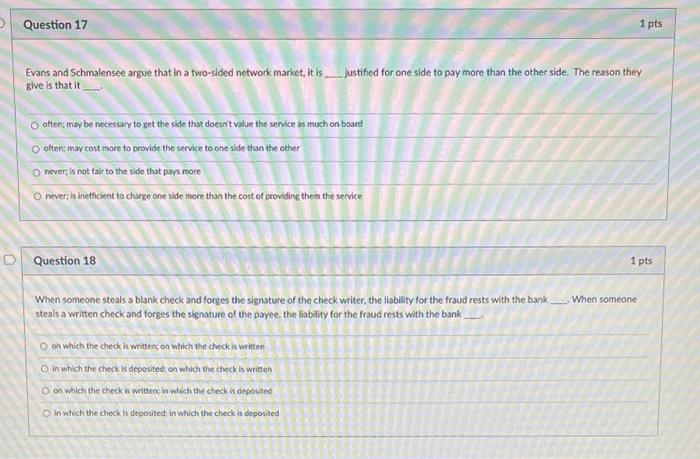

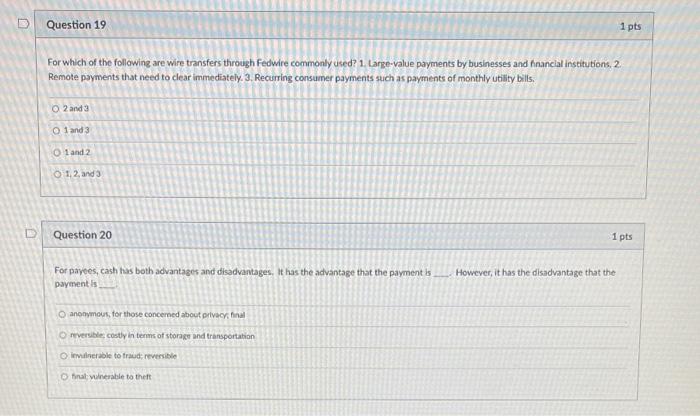

Real-time gross settlement systems are those in which transactions are settled An example is at periodic hterals after canceling offsetting oblleations: a check dearinghouse indivituaty and as they are processed, fectuire at periodic hatervit after canceiks offsetting oblitations: Fedwice individualy and as they are procensed, a theck cleariehtouse Question 14 Among the major changes in the U.S. payments system tince the earty 2000 s have been an increase in the share of payments made by and a decrease in the share made by checks debit carth thecks oedicads debit carths thecks wedit carch debit cards Check 21 had which of the following effects? 1. Facllitated replacement of paper checks by electronic images of checks in the clearing process, 2. Reduced costs of processing checks. 3. Reduced the risk of a disruption in payments from a suspension in air transport. 1 and 3 1 and 2 2 and 3 1,2 and 3 Question 16 The large costs of payments processing tend to put small banks at a disadvantage relative to large banks, leading many of them to outsource their payments processing to a third party. In such cases, the is usually liable for damages if a mistake is made in the processing veciable; bank fixed third:asty procesior varlable, thide party procesvor fixed bank Evans and Schmalensee argue that in a two-sided network market, it is justified for one side to pay more than the other side. The reason they give is that it otten; may be necessary to get the side that doesirt value the service as much on board oftens may cost more to provide the service to one side than the other never; is not fair to the side that pars more never; is inetficient to churge one ilde more than the cost of providing them the service Question 18 When someone steals a blank check and forges the signature of the check writer, the lisbility for the fraud rests with the bank When someone steals a written check and forges the signature of the payee. the liablity for the fraud rests with the bank on which the check is written; on which the check is written in wich the check is deposited, on which the check bs written on which the cheok 6 written, in which the check is deposited in which the check is deposited; in which the check is deposited For which of the following are wire transfers through fedwire commonly used? 1. Large-value payments by businesses and financial institutions, 2 . Remote payments that need to clear immediately. 3. Recurring consumer payments such as payments of monthly utility bills. 2 and 3 1 and 3 1 and 2 1. 2 and 3 Question 20 For payees, cash has both advantages and disadvantages, It has the advantage that the payment is However, it has the disadvantage that the payment is anonymows, tor those concemed about pivsor tinal teversibec costy hin terms of stongs and transportation trat wheratile to thet