Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Realto Inc. (The Company) is a manufacturer of shoes in Vancouver. This year is full of financial uncertainty. Management wants to do some scenario

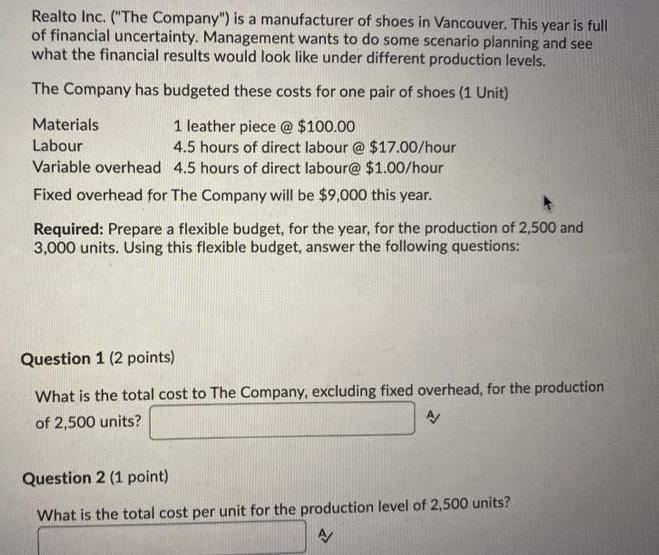

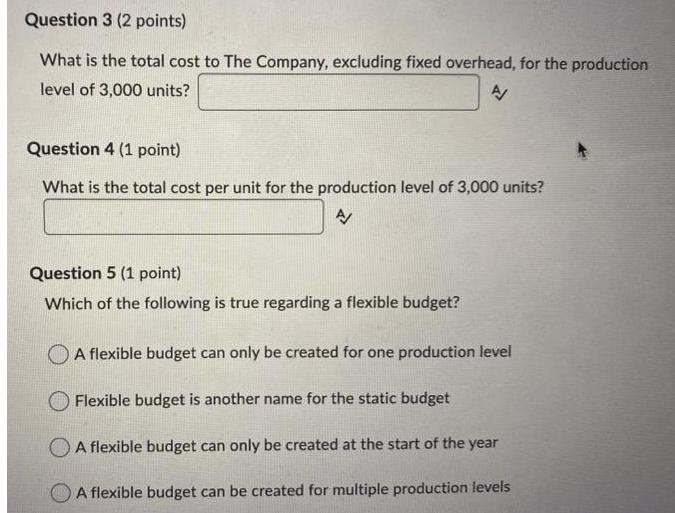

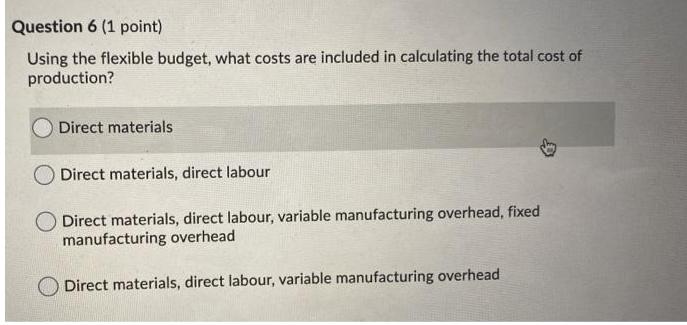

Realto Inc. ("The Company") is a manufacturer of shoes in Vancouver. This year is full of financial uncertainty. Management wants to do some scenario planning and see what the financial results would look like under different production levels. The Company has budgeted these costs for one pair of shoes (1 Unit) Materials 1 leather piece @ $100.00 Labour 4.5 hours of direct labour @ $17.00/hour Variable overhead 4.5 hours of direct labour@ $1.00/hour Fixed overhead for The Company will be $9,000 this year. Required: Prepare a flexible budget, for the year, for the production of 2,500 and 3,000 units. Using this flexible budget, answer the following questions: Question 1 (2 points) What is the total cost to The Company, excluding fixed overhead, for the production of 2,500 units? Question 2 (1 point) What is the total cost per unit for the production level of 2,500 units? A Question 3 (2 points) What is the total cost to The Company, excluding fixed overhead, for the production level of 3,000 units? Question 4 (1 point) What is the total cost per unit for the production level of 3,000 units? A Question 5 (1 point) Which of the following is true regarding a flexible budget? A flexible budget can only be created for one production level Flexible budget is another name for the static budget A flexible budget can only be created at the start of the year A flexible budget can be created for multiple production levels Question 6 (1 point) Using the flexible budget, what costs are included in calculating the total cost of production? Direct materials Direct materials, direct labour O Direct materials, direct labour, variable manufacturing overhead, fixed manufacturing overhead Direct materials, direct labour, variable manufacturing overhead

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

1 2 Total cost per unit for 2 500 units 2 500 units 100 4 5 hours 17 4 5 hours 1 9 000 2 500 units 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started