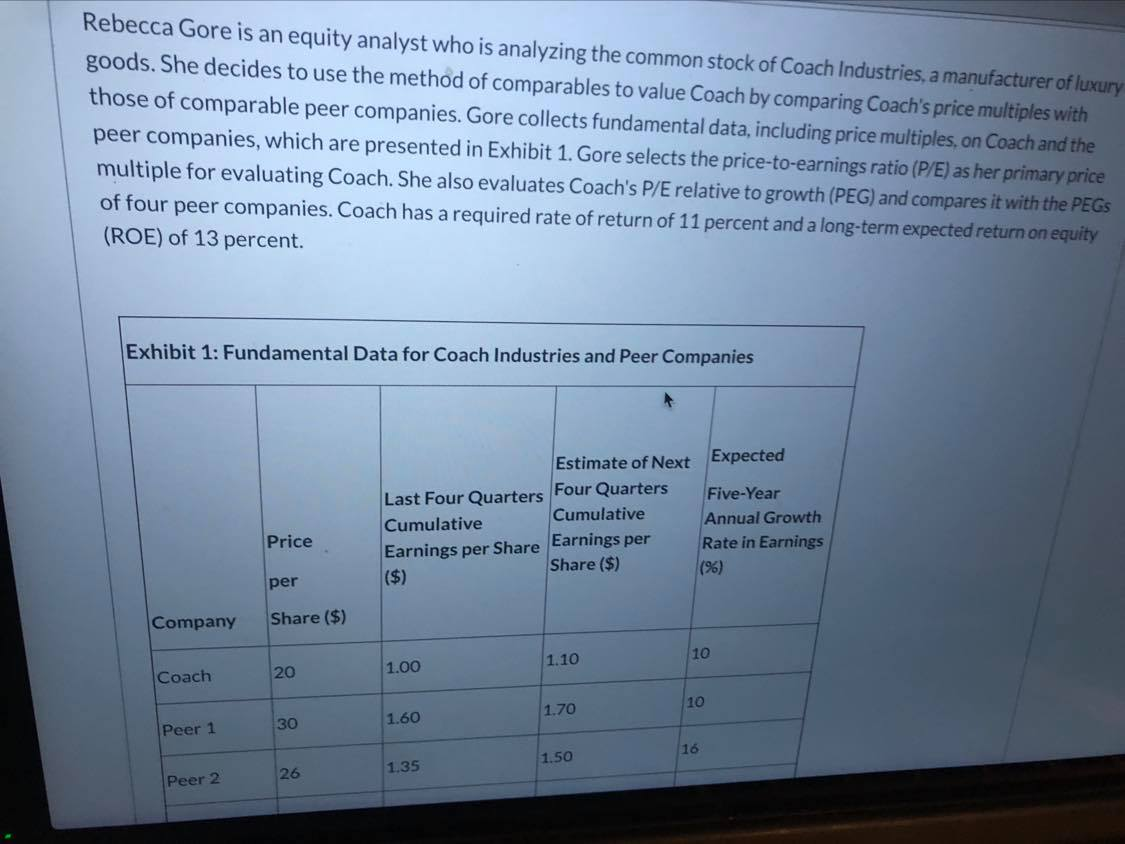

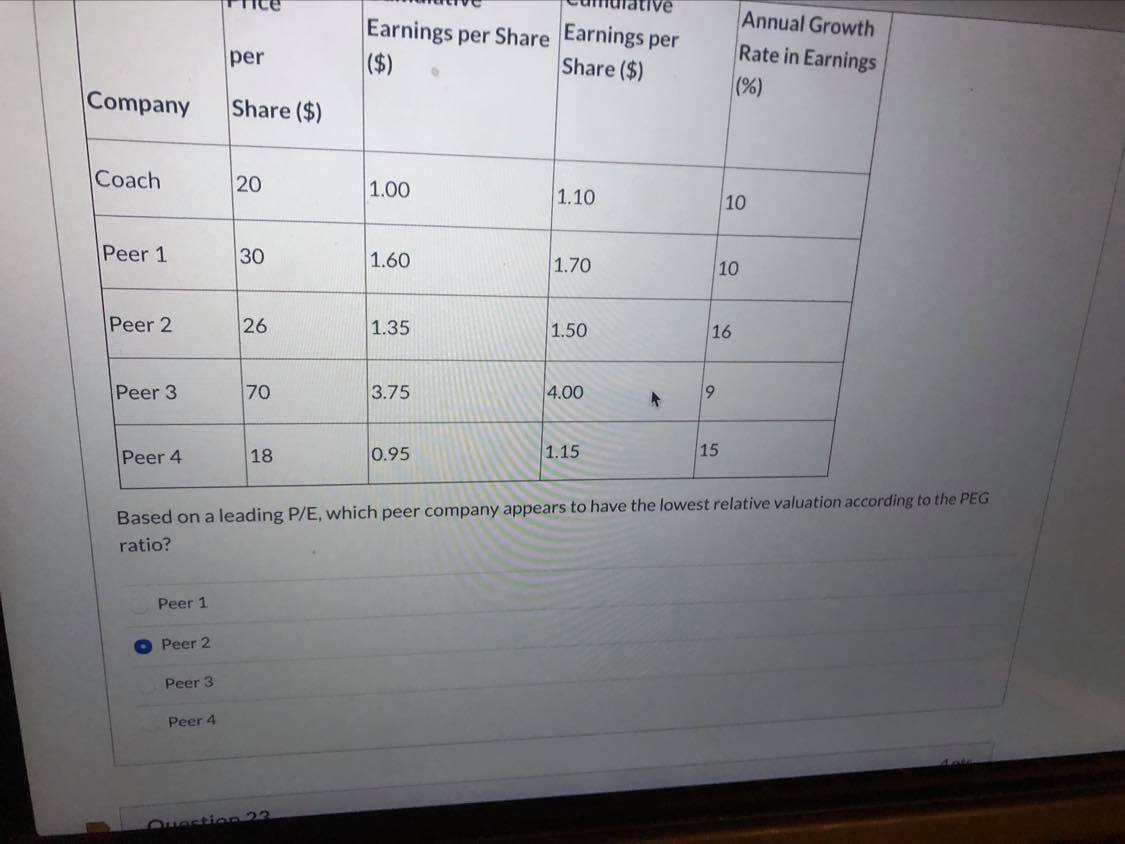

Rebecca Gore is an equity analyst who is analyzing the common stock of Coach Industries, a manufacturer of luxury goods. She decides to use the method of comparables to value Coach by comparing Coach's price multiples with those of comparable peer companies. Gore collects fundamental data, including price multiples, on Coach and the peer companies, which are presented in Exhibit 1. Gore selects the price-to-earnings ratio (P/E) as her primary price multiple for evaluating Coach. She also evaluates Coach's P/E relative to growth (PEG) and compares it with the PEGS of four peer companies. Coach has a required rate of return of 11 percent and a long-term expected return on equity (ROE) of 13 percent. Exhibit 1: Fundamental Data for Coach Industries and Peer Companies Estimate of Next Expected Last Four Quarters Four Quarters Five-Year Cumulative Cumulative Annual Growth Earnings per Share Earnings per Rate in Earnings ($) Share ($) Price per Company Share ($) 1.10 10 1.00 Coach 20 10 1.70 30 1.60 Peer 1 16 1.50 26 1.35 Peer 2 Earnings per Share Earnings per ($) Share ($) per Annual Growth Rate in Earnings (%) Company Share ($) Coach 20 1.00 1.10 10 Peer 1 30 1.60 1.70 10 Peer 2 26 1.35 1.50 16 Peer 3 70 3.75 4.00 19 Peer 4 18 0.95 1.15 15 Based on a leading P/E, which peer company appears to have the lowest relative valuation according to the PEG ratio? Peer 1 Peer 2 Peer 3 Peer 4 Question 2 Rebecca Gore is an equity analyst who is analyzing the common stock of Coach Industries, a manufacturer of luxury goods. She decides to use the method of comparables to value Coach by comparing Coach's price multiples with those of comparable peer companies. Gore collects fundamental data, including price multiples, on Coach and the peer companies, which are presented in Exhibit 1. Gore selects the price-to-earnings ratio (P/E) as her primary price multiple for evaluating Coach. She also evaluates Coach's P/E relative to growth (PEG) and compares it with the PEGS of four peer companies. Coach has a required rate of return of 11 percent and a long-term expected return on equity (ROE) of 13 percent. Exhibit 1: Fundamental Data for Coach Industries and Peer Companies Estimate of Next Expected Last Four Quarters Four Quarters Five-Year Cumulative Cumulative Annual Growth Earnings per Share Earnings per Rate in Earnings ($) Share ($) Price per Company Share ($) 1.10 10 1.00 Coach 20 10 1.70 30 1.60 Peer 1 16 1.50 26 1.35 Peer 2 Earnings per Share Earnings per ($) Share ($) per Annual Growth Rate in Earnings (%) Company Share ($) Coach 20 1.00 1.10 10 Peer 1 30 1.60 1.70 10 Peer 2 26 1.35 1.50 16 Peer 3 70 3.75 4.00 19 Peer 4 18 0.95 1.15 15 Based on a leading P/E, which peer company appears to have the lowest relative valuation according to the PEG ratio? Peer 1 Peer 2 Peer 3 Peer 4 Question 2