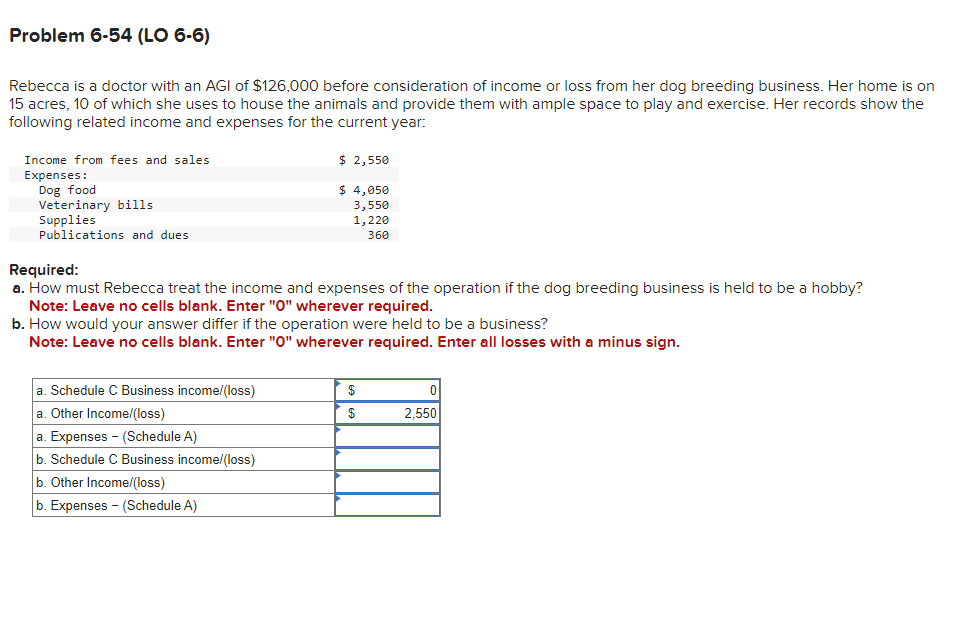

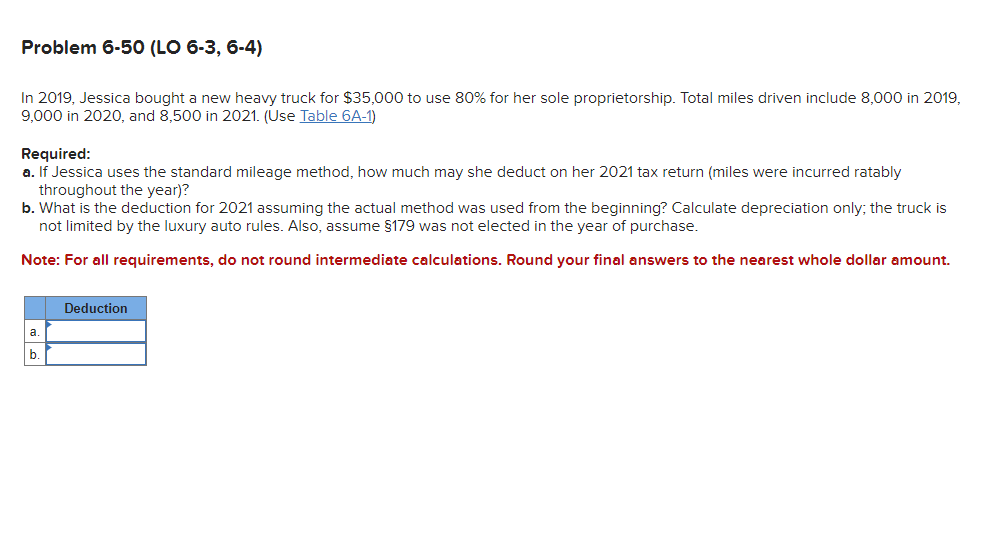

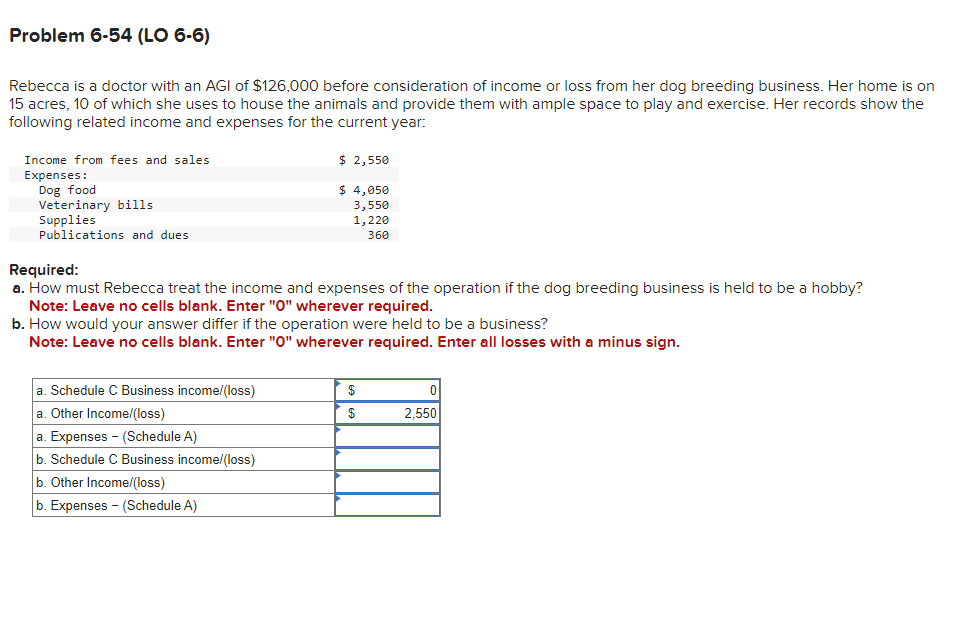

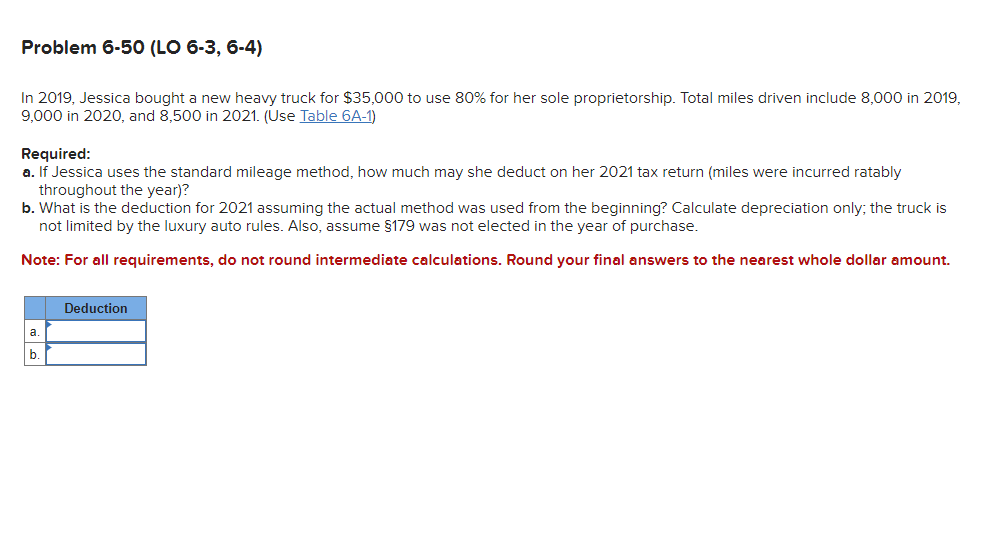

Rebecca is a doctor with an AGI of $126,000 before consideration of income or loss from her dog breeding business. Her home is on 15 acres, 10 of which she uses to house the animals and provide them with ample space to play and exercise. Her records show the following related income and expenses for the current year: Required: a. How must Rebecca treat the income and expenses of the operation if the dog breeding business is held to be a hobby? Note: Leave no cells blank. Enter "O" wherever required. b. How would your answer differ if the operation were held to be a business? Note: Leave no cells blank. Enter "0" wherever required. Enter all losses with a minus sign. In 2019, Jessica bought a new heavy truck for $35,000 to use 80% for her sole proprietorship. Total miles driven include 8,000 in 2019 , 9,000 in 2020, and 8,500 in 2021. (Use Table 6A-1) Required: a. If Jessica uses the standard mileage method, how much may she deduct on her 2021 tax return (miles were incurred ratably throughout the year)? b. What is the deduction for 2021 assuming the actual method was used from the beginning? Calculate depreciation only; the truck is not limited by the luxury auto rules. Also, assume $179 was not elected in the year of purchase. Note: For all requirements, do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Rebecca is a doctor with an AGI of $126,000 before consideration of income or loss from her dog breeding business. Her home is on 15 acres, 10 of which she uses to house the animals and provide them with ample space to play and exercise. Her records show the following related income and expenses for the current year: Required: a. How must Rebecca treat the income and expenses of the operation if the dog breeding business is held to be a hobby? Note: Leave no cells blank. Enter "O" wherever required. b. How would your answer differ if the operation were held to be a business? Note: Leave no cells blank. Enter "0" wherever required. Enter all losses with a minus sign. In 2019, Jessica bought a new heavy truck for $35,000 to use 80% for her sole proprietorship. Total miles driven include 8,000 in 2019 , 9,000 in 2020, and 8,500 in 2021. (Use Table 6A-1) Required: a. If Jessica uses the standard mileage method, how much may she deduct on her 2021 tax return (miles were incurred ratably throughout the year)? b. What is the deduction for 2021 assuming the actual method was used from the beginning? Calculate depreciation only; the truck is not limited by the luxury auto rules. Also, assume $179 was not elected in the year of purchase. Note: For all requirements, do not round intermediate calculations. Round your final answers to the nearest whole dollar amount