Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rebecca is an 18-year-old female high school student set to graduate soon. She is preparing to go to college next fall, and purchasing her

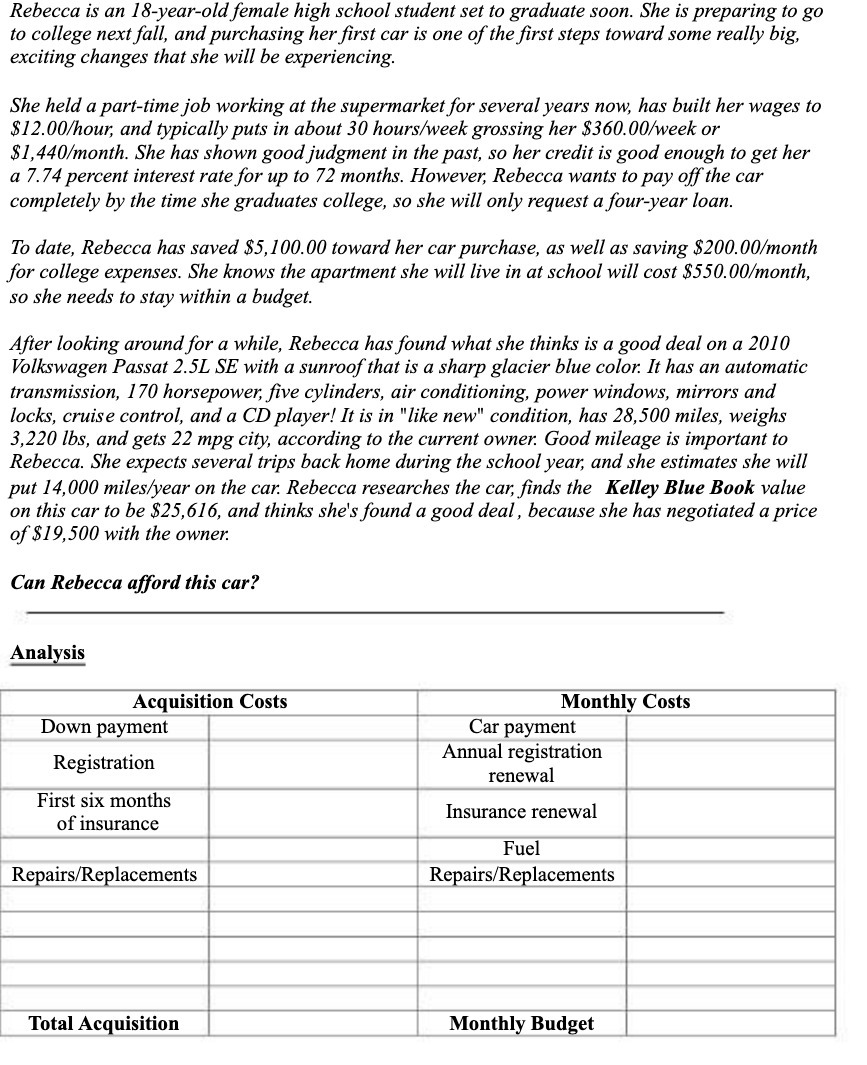

Rebecca is an 18-year-old female high school student set to graduate soon. She is preparing to go to college next fall, and purchasing her first car is one of the first steps toward some really big, exciting changes that she will be experiencing. She held a part-time job working at the supermarket for several years now, has built her wages to $12.00/hour, and typically puts in about 30 hours/week grossing her $360.00/week or $1,440/month. She has shown good judgment in the past, so her credit is good enough to get her a 7.74 percent interest rate for up to 72 months. However, Rebecca wants to pay off the car completely by the time she graduates college, so she will only request a four-year loan. To date, Rebecca has saved $5,100.00 toward her car purchase, as well as saving $200.00/month for college expenses. She knows the apartment she will live in at school will cost $550.00/month, so she needs to stay within a budget. After looking around for a while, Rebecca has found what she thinks is a good deal on a 2010 Volkswagen Passat 2.5L SE with a sunroof that is a sharp glacier blue color. It has an automatic transmission, 170 horsepower, five cylinders, air conditioning, power windows, mirrors and locks, cruise control, and a CD player! It is in "like new" condition, has 28,500 miles, weighs 3,220 lbs, and gets 22 mpg city, according to the current owner. Good mileage is important to Rebecca. She expects several trips back home during the school year, and she estimates she will put 14,000 miles/year on the car. Rebecca researches the car, finds the Kelley Blue Book value on this car to be $25,616, and thinks she's found a good deal, because she has negotiated a price of $19,500 with the owner. Can Rebecca afford this car? Analysis Acquisition Costs Down payment Registration First six months of insurance Repairs/Replacements Total Acquisition Monthly Costs Car payment Annual registration renewal Insurance renewal Fuel Repairs/Replacements Monthly Budget

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine if Rebecca can afford the 2010 Volkswagen Passat we need to calculate the total acquisi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started