Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Recall from the SUA/E-SUA that the corporate income tax rate is 21% for all regular corporations such as Waren. General ledger account numbers for the

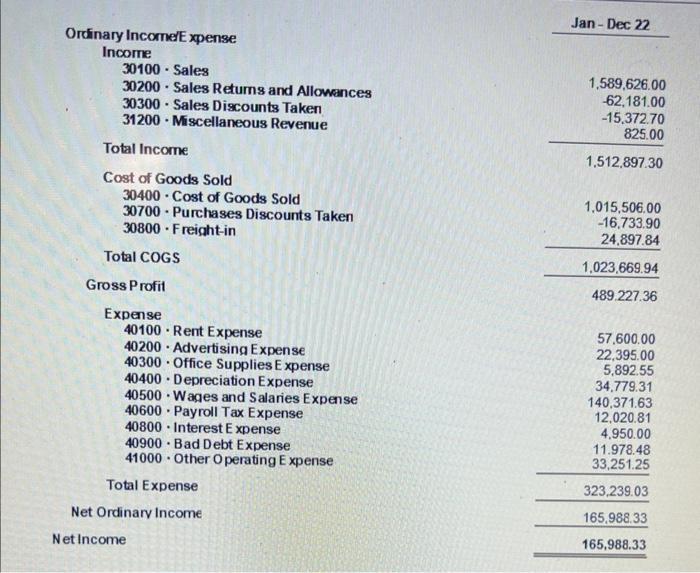

Recall from the SUA/E-SUA that the corporate income tax rate is 21% for all regular corporations such as Waren. General ledger account numbers for the journal entry are A / C # 40700 ( Federal Income Tax Expense ) and A / C #20800 ( Federal Income Taxes Payable ). Either enter the correct amount on the online grading portion of the Armond Dalton Resources website or show your calculation available for download on the website ( consult your instructor ).

Ordinary Income/Expense 30100 Sales 30200 Sales Returns and Allowances 30300 Sales Discounts Taken 31200 Miscellaneous Revenue Income Total Income Cost of Goods Sold . 30400 Cost of Goods Sold 30700 Purchases Discounts Taken 30800 Freight-in Total COGS Gross Profil Expense 40100 Rent Expense 40200 Advertising Expense 40300 Office Supplies Expense 40400 Depreciation Expense 40500 Wages and Salaries Expense 40600 Payroll Tax Expense 40800 Interest Expense 40900 Bad Debt Expense 41000 Other Operating Expense Net Income . . Total Expense Net Ordinary Income Jan-Dec 22 1,589,626.00 -62,181.00 -15,372.70 825.00 1,512,897.30 1,015,506.00 -16.733.90 24,897.84 1,023,669.94 489.227.36 57,600.00 22,395.00 5,892.55 34,779.31 140,371.63 12,020.81 4,950.00 11.978.48 33,251.25 323,239.03 165,988.33 165,988.33

Step by Step Solution

★★★★★

3.51 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

The United States imposes a tax on the profits of US resident corporations at a flat rate of 21 on t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started