Question

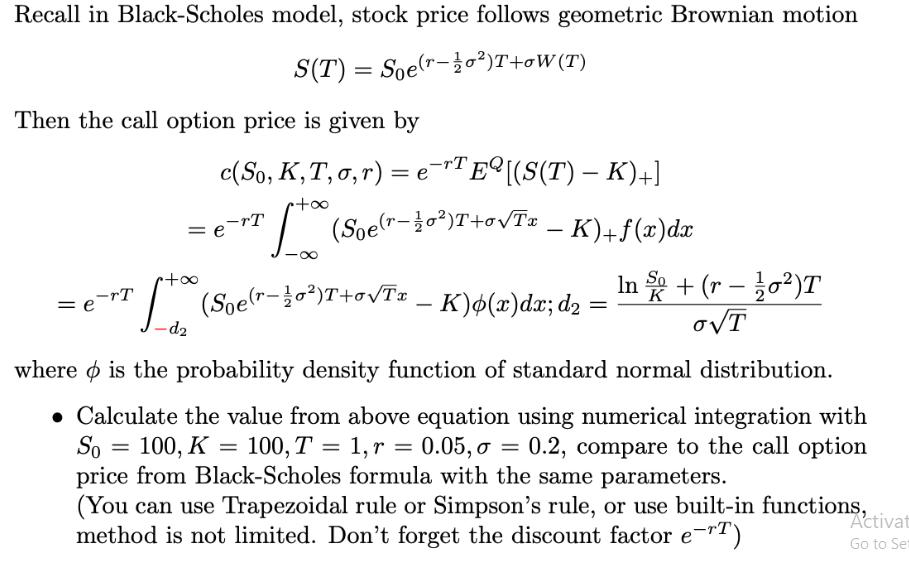

Recall in Black-Scholes model, stock price follows geometric Brownian motion S(T) = Soe(-2)T+0W(T) Then the call option price is given by c(So, K,T,,r) =

Recall in Black-Scholes model, stock price follows geometric Brownian motion S(T) = Soe(-2)T+0W(T) Then the call option price is given by c(So, K,T,,r) = eTEQ[(S(T) K)+] (Soe (1-10)T+0T K) + f(x)dx - =e e-rT 88 (Soe (r10)T+0Tx K)(x)dx; d - = In so + (r-10)T So e-rT +00 -d2 where is the probability density function of standard normal distribution. = Calculate the value from above equation using numerical integration with So = 100, K = 100, T = 1, r = 0.05, 0.2, compare to the call option price from Black-Scholes formula with the same parameters. (You can use Trapezoidal rule or Simpson's rule, or use built-in functions, method is not limited. Don't forget the discount factor e-T) Activat Go to Set

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Options Futures and Other Derivatives

Authors: John C. Hull

10th edition

013447208X, 978-0134472089

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App