Question

Recall that an asset-or-nothing call option has payoff function A(S(T)) of the form I for > E, A(x) = x/2 for x = E,

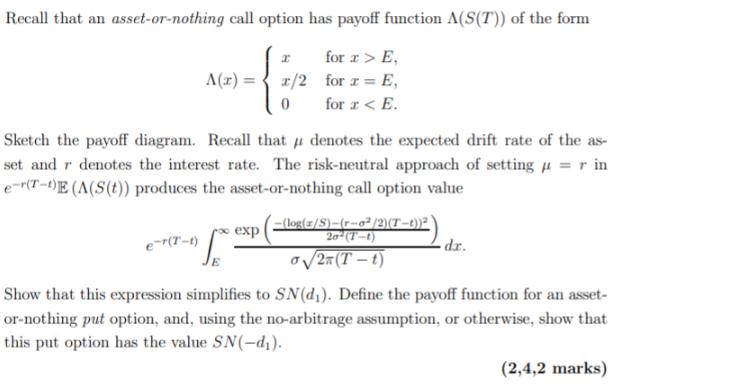

Recall that an asset-or-nothing call option has payoff function A(S(T)) of the form I for > E, A(x) = x/2 for x = E, 0 for x < E. Sketch the payoff diagram. Recall that denotes the expected drift rate of the as- set and r denotes the interest rate. The risk-neutral approach of setting e-r(T-E (A(S(t)) produces the asset-or-nothing call option value = r in exp e-7(T-1) (log(1/S)-(r-2/2)(T-1))2 20(T-1) 2(T-t) dr. Show that this expression simplifies to SN(d). Define the payoff function for an asset- or-nothing put option, and, using the no-arbitrage assumption, or otherwise, show that this put option has the value SN(-d). (2,4,2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Market Practice In Financial Modelling

Authors: Tan Chia Chiang

1st Edition

9814366544, 978-9814366540

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App