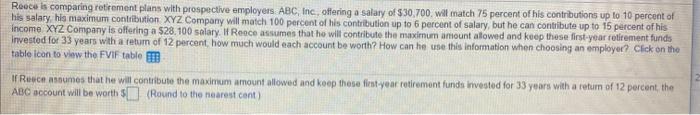

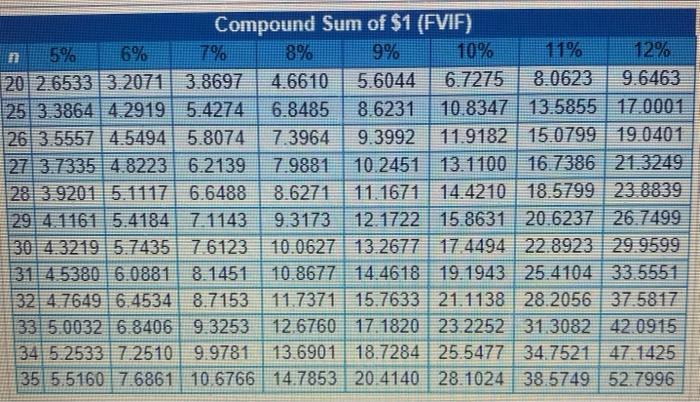

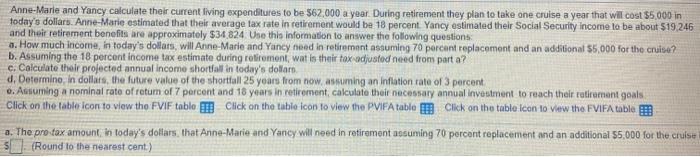

Recce is comparing retirement plans with prospective employers ABC, Inc., offering a salary of $30,700 will match 75 percent of his contributions up to 10 percent of his salary, his maximum contribution XYZ Company will match 100 percent of his contribution up to 6 percent of salary, but he can contribute up to 15 percent of his Income XYZ Company is offering a $28.100 salary. Reece assumes that he will contribute the maximum amount alowed and keep these first-year retirement funds invested for 33 years with a return of 12 percent how much would each account be worth? How can he use this information when choosing an employer? Click on the table icon to view the FVIF table em of Recessumes that he will contribute the maximum amount allowed and keep these first-year retirement funds invested for 33 years with a return of 12 percent, the ABC account will be worth $(Round to the nearest cant) Compound Sum of $1 (FVIF) 5% 6% 7% 8% 19% 10% 11% 12% 220 2.6533 3.207 3.8697 4.6610 5.6044 6.7275 8.0623 9.6463 1253 3864 4.2919 5.4274 6.8485 8.6231 10.8347 13.5855 170001 26 3.5557 4.5494 5.8074 7.3964 9.3992 11.9182 15.0799 19.0401 127 3.7335 4.8223 6.2139 7.9881 10.2451 13.1100 16.7386 213249 28 3.92015.1117 6.6488 8.6271 11.1671 14.4210 18.5799 23 8839 29 4 1161 5.41847. 1143 9.3173 12. 1722 15.8631 20.6237 26.7499 304 3219 5.74357 6123 10.0627 13.2677 17 4494 22.8923 29.9599 31.4 5380 6.0881 8.1451 10 8677 14.4618 19.1943 25.4104 33.5551 32 4.7649 6.4534 8.7153 11.7371 15.7633 21.1138 28.2056 37.5817 133 50032 6.8406 9.3253 12.6760 17 1820 23.2252 31 3082 42.0915 34 5.2533 7.2610 9.9781 13.6901 18.7284 25.5477 34.7521 47. 1425 35 5.5160 7.6861 10 6766 14.7853 20 4140 28.1024 38.5749 52.7996 Recce is comparing retirement plans with prospective employers ABC, Inc., offering a salary of $30,700 will match 75 percent of his contributions up to 10 percent of his salary, his maximum contribution XYZ Company will match 100 percent of his contribution up to 6 percent of salary, but he can contribute up to 15 percent of his Income XYZ Company is offering a $28.100 salary. Reece assumes that he will contribute the maximum amount alowed and keep these first-year retirement funds invested for 33 years with a return of 12 percent how much would each account be worth? How can he use this information when choosing an employer? Click on the table icon to view the FVIF table em of Recessumes that he will contribute the maximum amount allowed and keep these first-year retirement funds invested for 33 years with a return of 12 percent, the ABC account will be worth $(Round to the nearest cant) Compound Sum of $1 (FVIF) 5% 6% 7% 8% 19% 10% 11% 12% 220 2.6533 3.207 3.8697 4.6610 5.6044 6.7275 8.0623 9.6463 1253 3864 4.2919 5.4274 6.8485 8.6231 10.8347 13.5855 170001 26 3.5557 4.5494 5.8074 7.3964 9.3992 11.9182 15.0799 19.0401 127 3.7335 4.8223 6.2139 7.9881 10.2451 13.1100 16.7386 213249 28 3.92015.1117 6.6488 8.6271 11.1671 14.4210 18.5799 23 8839 29 4 1161 5.41847. 1143 9.3173 12. 1722 15.8631 20.6237 26.7499 304 3219 5.74357 6123 10.0627 13.2677 17 4494 22.8923 29.9599 31.4 5380 6.0881 8.1451 10 8677 14.4618 19.1943 25.4104 33.5551 32 4.7649 6.4534 8.7153 11.7371 15.7633 21.1138 28.2056 37.5817 133 50032 6.8406 9.3253 12.6760 17 1820 23.2252 31 3082 42.0915 34 5.2533 7.2610 9.9781 13.6901 18.7284 25.5477 34.7521 47. 1425 35 5.5160 7.6861 10 6766 14.7853 20 4140 28.1024 38.5749 52.7996