Answered step by step

Verified Expert Solution

Question

1 Approved Answer

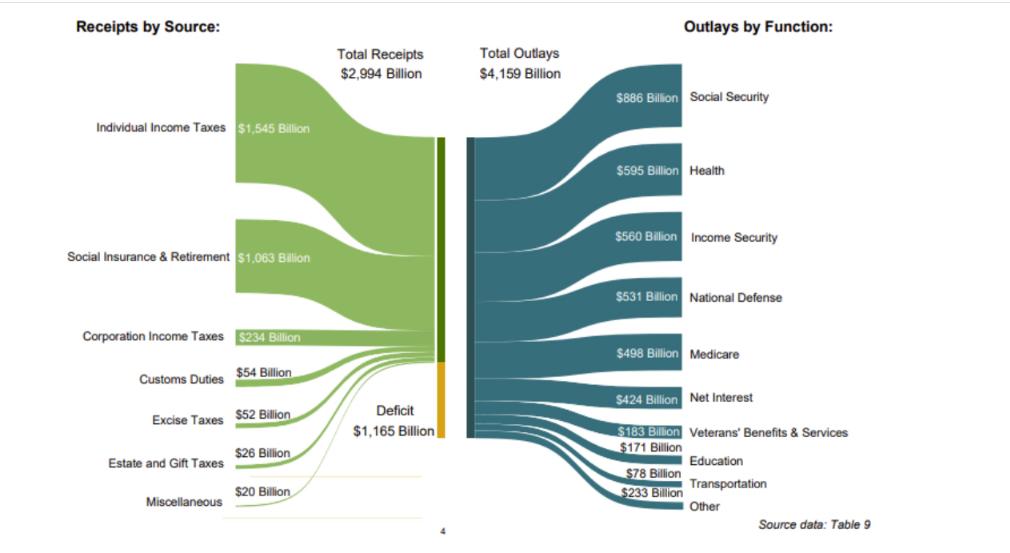

Receipts by Source: Individual Income Taxes $1,545 Billion Social Insurance & Retirement $1,063 Billion Corporation Income Taxes $234 Billion Customs Duties $54 Billion Excise

Receipts by Source: Individual Income Taxes $1,545 Billion Social Insurance & Retirement $1,063 Billion Corporation Income Taxes $234 Billion Customs Duties $54 Billion Excise Taxes $52 Billion Estate and Gift Taxes Miscellaneous $26 Billion $20 Billion Total Receipts $2,994 Billion Deficit $1,165 Billion Total Outlays $4,159 Billion Outlays by Function: $886 Billion Social Security $595 Billion Health $560 Billion Income Security $531 Billion National Defense $498 Billion Medicare $424 Billion Net Interest $183 Billion Veterans' Benefits & Services $171 Billion $78 Billion $233 Billion Education Transportation Other Source data: Table 9 1. Examine Figure above. Examine the overall magnitude and relative importance of each source of revenue and outlay by function in Fiscal Year to Date (FYTD, which started on 10/1/xx and ends on 9/30/xx). a. How much Revenue (or Total Receipts) has the federal government collected FYTD? b. How much has the federal government spent (or total outlays) FYTD? c. How large is the federal government's Budget Deficit (or National Deficit) FYTD? d. Compare the size of the deficit FYTD against the individual sources of revenue and categories of spending. Would it be easy to balance the budget? Do you see any low hanging fruit? Explain.

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a Total receipts revenue collected FYTD is 2994 billion b Total outlays spending FYTD is 4159 billio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started