Answered step by step

Verified Expert Solution

Question

1 Approved Answer

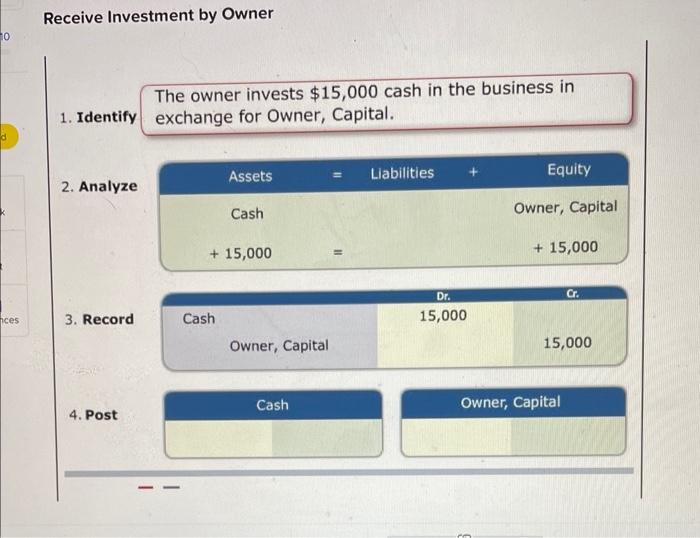

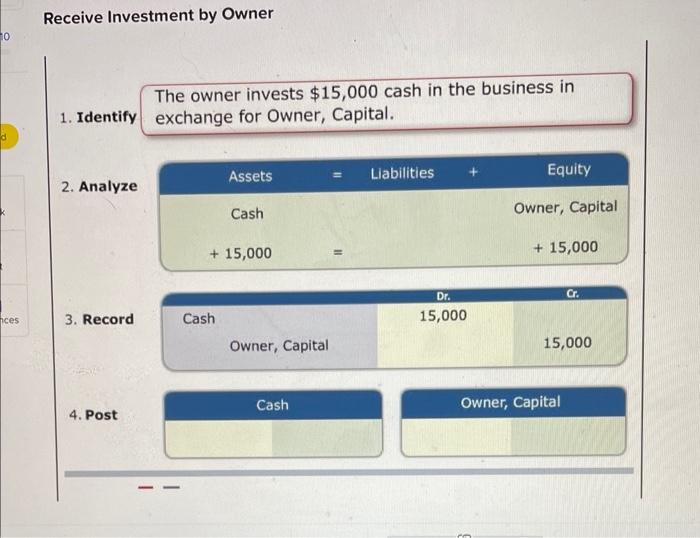

Receive Investment by Owner The owner invests $15,000 cash in the business in 1. Identify exchange for Owner, Capital. 2. Analyze 3. Record On December

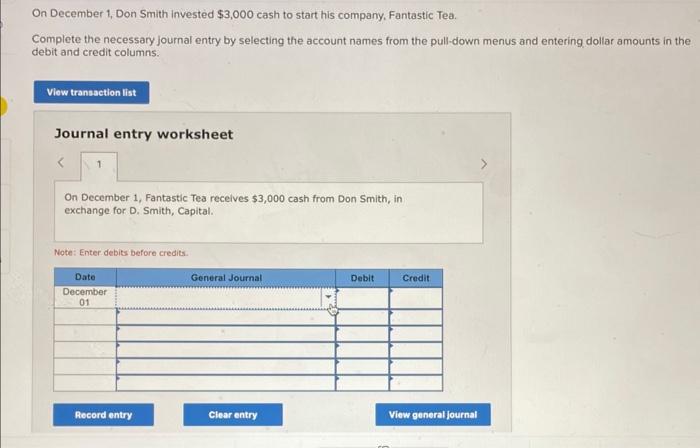

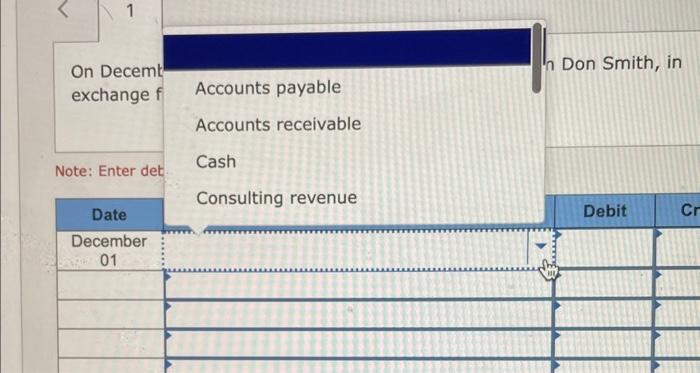

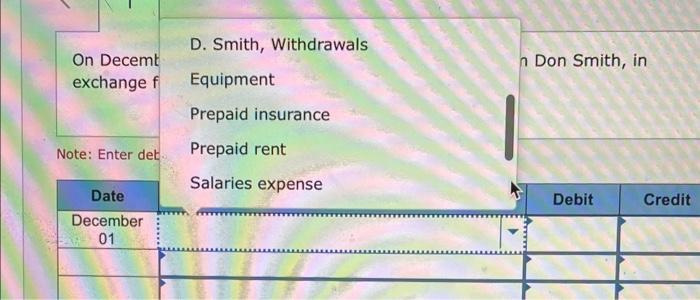

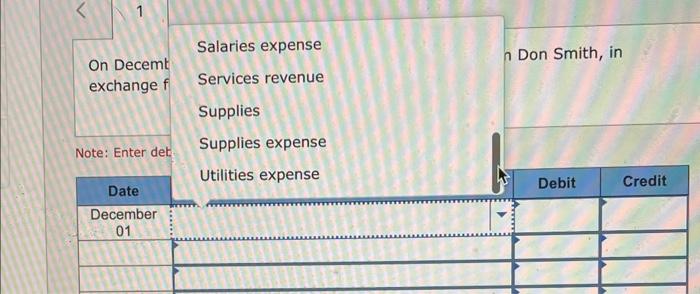

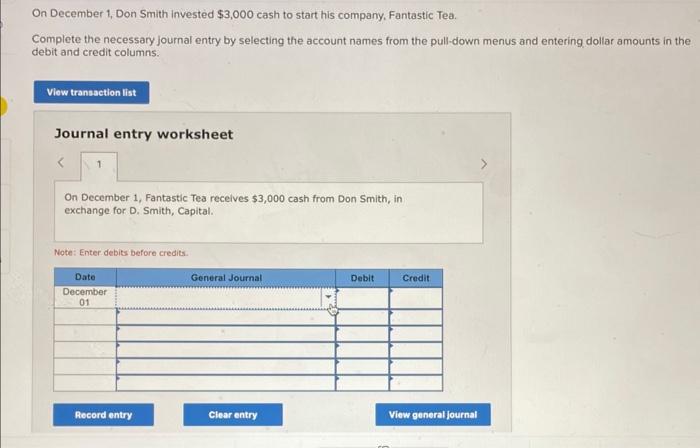

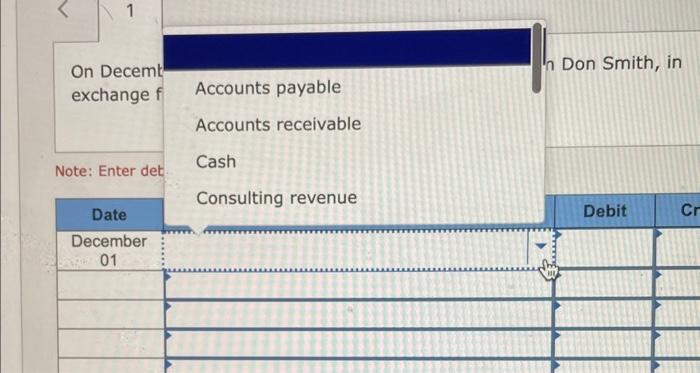

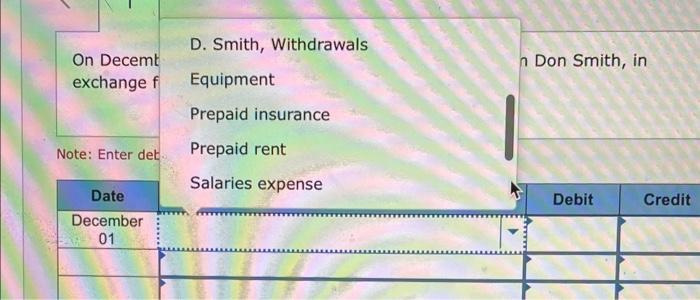

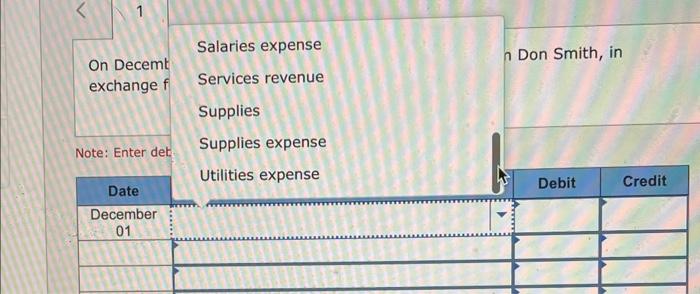

Receive Investment by Owner The owner invests $15,000 cash in the business in 1. Identify exchange for Owner, Capital. 2. Analyze 3. Record On December 1 , Don Smith invested $3,000 cash to start his company, Fantastic Tea. Complete the necessary journal entry by selecting the account names from the pull-down menus and entering dollar amounts in the debit and credit columns. Journal entry worksheet On December 1 , Fantastic Tea recelves $3,000 cash from Don Smith, in exchange for D. Smith, Capital. Note: Enter debits before credits. Salaries expense On Decemt n Don Smith, in exchange f Services revenue Supplies Note: Enter det: Supplies expense \begin{tabular}{|c|c|c|c|} \hline Date & Utilities expense & Debit & Credit \\ \hline December 01 & & & \\ \hline \end{tabular} Receive Investment by Owner The owner invests $15,000 cash in the business in 1. Identify exchange for Owner, Capital. 2. Analyze 3. Record On December 1 , Don Smith invested $3,000 cash to start his company, Fantastic Tea. Complete the necessary journal entry by selecting the account names from the pull-down menus and entering dollar amounts in the debit and credit columns. Journal entry worksheet On December 1 , Fantastic Tea recelves $3,000 cash from Don Smith, in exchange for D. Smith, Capital. Note: Enter debits before credits. Salaries expense On Decemt n Don Smith, in exchange f Services revenue Supplies Note: Enter det: Supplies expense \begin{tabular}{|c|c|c|c|} \hline Date & Utilities expense & Debit & Credit \\ \hline December 01 & & & \\ \hline \end{tabular}

Receive Investment by Owner The owner invests $15,000 cash in the business in 1. Identify exchange for Owner, Capital. 2. Analyze 3. Record On December 1 , Don Smith invested $3,000 cash to start his company, Fantastic Tea. Complete the necessary journal entry by selecting the account names from the pull-down menus and entering dollar amounts in the debit and credit columns. Journal entry worksheet On December 1 , Fantastic Tea recelves $3,000 cash from Don Smith, in exchange for D. Smith, Capital. Note: Enter debits before credits. Salaries expense On Decemt n Don Smith, in exchange f Services revenue Supplies Note: Enter det: Supplies expense \begin{tabular}{|c|c|c|c|} \hline Date & Utilities expense & Debit & Credit \\ \hline December 01 & & & \\ \hline \end{tabular} Receive Investment by Owner The owner invests $15,000 cash in the business in 1. Identify exchange for Owner, Capital. 2. Analyze 3. Record On December 1 , Don Smith invested $3,000 cash to start his company, Fantastic Tea. Complete the necessary journal entry by selecting the account names from the pull-down menus and entering dollar amounts in the debit and credit columns. Journal entry worksheet On December 1 , Fantastic Tea recelves $3,000 cash from Don Smith, in exchange for D. Smith, Capital. Note: Enter debits before credits. Salaries expense On Decemt n Don Smith, in exchange f Services revenue Supplies Note: Enter det: Supplies expense \begin{tabular}{|c|c|c|c|} \hline Date & Utilities expense & Debit & Credit \\ \hline December 01 & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started