Answered step by step

Verified Expert Solution

Question

1 Approved Answer

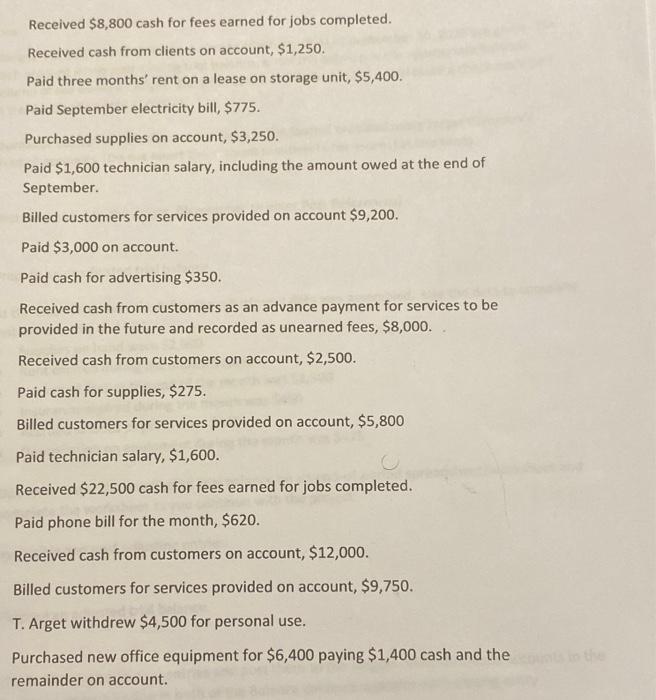

Received $8,800 cash for fees earned for jobs completed. Received cash from clients on account, $1,250. Paid three months' rent on a lease on storage

Received $8,800 cash for fees earned for jobs completed. Received cash from clients on account, $1,250. Paid three months' rent on a lease on storage unit, $5,400. Paid September electricity bill, $775. Purchased supplies on account, $3,250. Paid $1,600 technician salary, including the amount owed at the end of September. Billed customers for services provided on account $9,200. Paid $3,000 on account. Paid cash for advertising $350. Received cash from customers as an advance payment for services to be provided in the future and recorded as unearned fees, $8,000. Received cash from customers on account, $2,500. Paid cash for supplies, $275. Billed customers for services provided on account, $5,800 Paid technician salary, $1,600. Received $22,500 cash for fees earned for jobs completed. Paid phone bill for the month, $620. Received cash from customers on account, $12,000. Billed customers for services provided on account, $9,750. T. Arget withdrew $4,500 for personal use. Purchased new office equipment for $6,400 paying $1,400 cash and the remainder on account.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started