Question

Recent historical financial information for XYZ is presented below. Items are in $ millions unless otherwise stated. Year 2016 2017 2018 Income statement Revenue 1,707

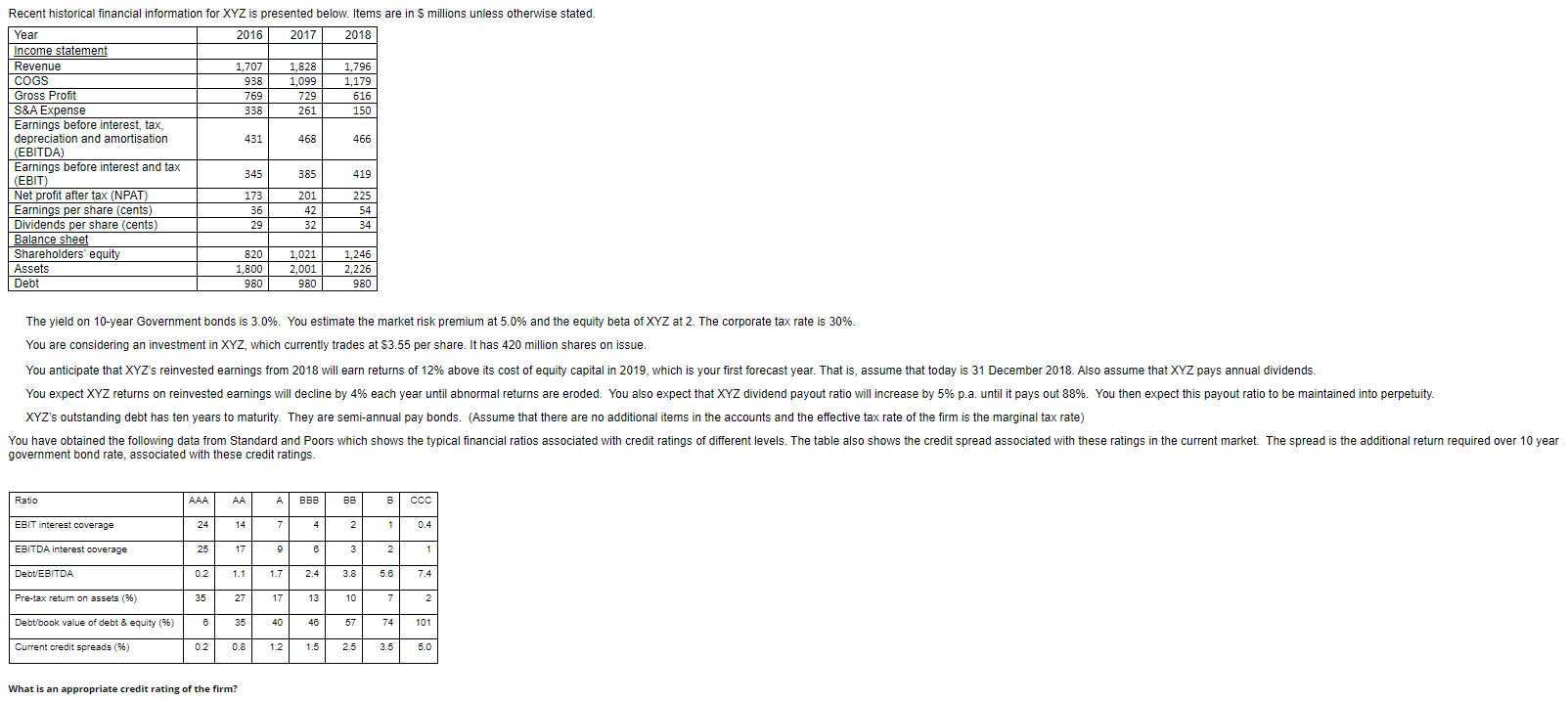

Recent historical financial information for XYZ is presented below. Items are in $ millions unless otherwise stated.

| Year | 2016 | 2017 | 2018 |

| Income statement |

|

|

|

| Revenue | 1,707 | 1,828 | 1,796 |

| COGS | 938 | 1,099 | 1,179 |

| Gross Profit | 769 | 729 | 616 |

| S&A Expense | 338 | 261 | 150 |

| Earnings before interest, tax, depreciation and amortisation (EBITDA) | 431 | 468 | 466 |

| Earnings before interest and tax (EBIT) | 345 | 385 | 419 |

| Net profit after tax (NPAT) | 173 | 201 | 225 |

| Earnings per share (cents) | 36 | 42 | 54 |

| Dividends per share (cents) | 29 | 32 | 34 |

| Balance sheet |

|

|

|

| Shareholders equity | 820 | 1,021 | 1,246 |

| Assets | 1,800 | 2,001 | 2,226 |

| Debt | 980 | 980 | 980 |

The yield on 10-year Government bonds is 3.0%. You estimate the market risk premium at 5.0% and the equity beta of XYZ at 2. The corporate tax rate is 30%.

You are considering an investment in XYZ, which currently trades at $3.55 per share. It has 420 million shares on issue.

You anticipate that XYZs reinvested earnings from 2018 will earn returns of 12% above its cost of equity capital in 2019, which is your first forecast year. That is, assume that today is 31 December 2018. Also assume that XYZ pays annual dividends.

You expect XYZ returns on reinvested earnings will decline by 4% each year until abnormal returns are eroded. You also expect that XYZ dividend payout ratio will increase by 5% p.a. until it pays out 88%. You then expect this payout ratio to be maintained into perpetuity.

XYZs outstanding debt has ten years to maturity. They are semi-annual pay bonds. (Assume that there are no additional items in the accounts and the effective tax rate of the firm is the marginal tax rate)

You have obtained the following data from Standard and Poors which shows the typical financial ratios associated with credit ratings of different levels. The table also shows the credit spread associated with these ratings in the current market. The spread is the additional return required over 10 year government bond rate, associated with these credit ratings.

| Ratio | AAA | AA | A | BBB | BB | B | CCC |

| EBIT interest coverage | 24 | 14 | 7 | 4 | 2 | 1 | 0.4 |

| EBITDA interest coverage | 25 | 17 | 9 | 6 | 3 | 2 | 1 |

| Debt/EBITDA | 0.2 | 1.1 | 1.7 | 2.4 | 3.8 | 5.6 | 7.4 |

| Pre-tax return on assets (%) | 35 | 27 | 17 | 13 | 10 | 7 | 2 |

| Debt/book value of debt & equity (%) | 6 | 35 | 40 | 46 | 57 | 74 | 101 |

| Current credit spreads (%) | 0.2 | 0.8 | 1.2 | 1.5 | 2.5 | 3.5 | 5.0 |

What is an appropriate credit rating of the firm?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started