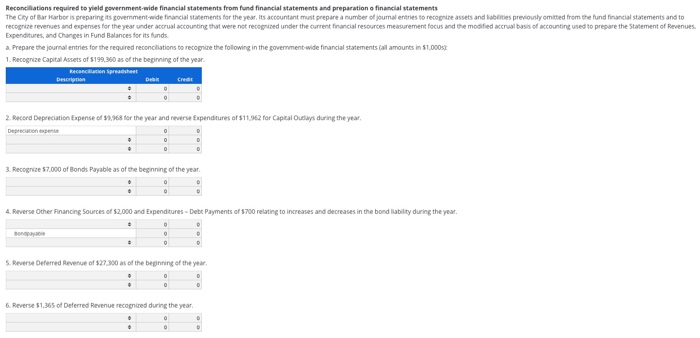

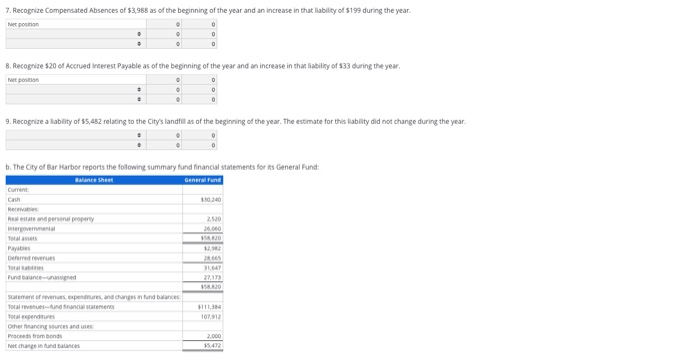

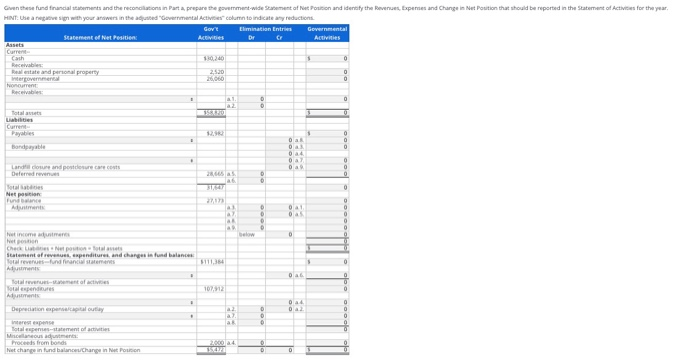

Reconciliations required to yield government-wide financial statements from fund financial statements and preparatione financial statements The City of Bar Harbor is preparing its government-wide financial statements for the year, its accountant must prepare a number of jouma entries to recognize assets and liabilities previously omitted from the fund financial statements and to recognize revenues and expenses for the year under accrual accounting that were not recognized under the current financial resources measurement focus and the modified accrual basis of accounting used to prepare the Statement of Revenues Expenditures, and changes in Pund Balances for its funds a. Prepare the journal entries for the required reconciliations to recognize the following in the government-wide financial statements Call amounts in 51.000 1. Recognize Capital Assets of $199,350 as of the beginning of the year. DHC Deo Credit 2. Record Depreciation Expense of 68 for the year and reverse Expenditures of $11.062 for Capital Outlys during the year 3. Recognize 57,000 of Bonds Payable as of the beginning of the year 4. Reverse Other Financing Sources of $2.000 and Expenditures - Debt Payments of 5700 relating to increases ases in the bond ability during the year. 5. Reverse Deferred Revenue of $27 300 as of the beginning of the year Reverse $1,65 of Deferred Revenue recognized during the year 7. Recone Compensated Absences of of the beginning of the year and an increase in the bit of $199 during the year 8. Recognize 520 of Accred W est Payable as of the beginning of the year and an increase in that ability of 533 during the year 9. Recognize alability of 5.42 relating to the city's land s of the beginning of the year. The estimate for the ability did not change during the year b. The City of Bar Harbor reports the following summary fund financial statements for its General Fund: General Fund a nd persona pery Pays Punded as Tod Total P ombe Land down and poster tatement of e x penditures and changes in balance local revenusundan Depreciation Reconciliations required to yield government-wide financial statements from fund financial statements and preparatione financial statements The City of Bar Harbor is preparing its government-wide financial statements for the year, its accountant must prepare a number of jouma entries to recognize assets and liabilities previously omitted from the fund financial statements and to recognize revenues and expenses for the year under accrual accounting that were not recognized under the current financial resources measurement focus and the modified accrual basis of accounting used to prepare the Statement of Revenues Expenditures, and changes in Pund Balances for its funds a. Prepare the journal entries for the required reconciliations to recognize the following in the government-wide financial statements Call amounts in 51.000 1. Recognize Capital Assets of $199,350 as of the beginning of the year. DHC Deo Credit 2. Record Depreciation Expense of 68 for the year and reverse Expenditures of $11.062 for Capital Outlys during the year 3. Recognize 57,000 of Bonds Payable as of the beginning of the year 4. Reverse Other Financing Sources of $2.000 and Expenditures - Debt Payments of 5700 relating to increases ases in the bond ability during the year. 5. Reverse Deferred Revenue of $27 300 as of the beginning of the year Reverse $1,65 of Deferred Revenue recognized during the year 7. Recone Compensated Absences of of the beginning of the year and an increase in the bit of $199 during the year 8. Recognize 520 of Accred W est Payable as of the beginning of the year and an increase in that ability of 533 during the year 9. Recognize alability of 5.42 relating to the city's land s of the beginning of the year. The estimate for the ability did not change during the year b. The City of Bar Harbor reports the following summary fund financial statements for its General Fund: General Fund a nd persona pery Pays Punded as Tod Total P ombe Land down and poster tatement of e x penditures and changes in balance local revenusundan Depreciation