Answered step by step

Verified Expert Solution

Question

1 Approved Answer

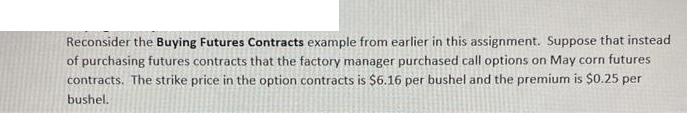

Reconsider the Buying Futures Contracts example from earlier in this assignment. Suppose that instead of purchasing futures contracts that the factory manager purchased call

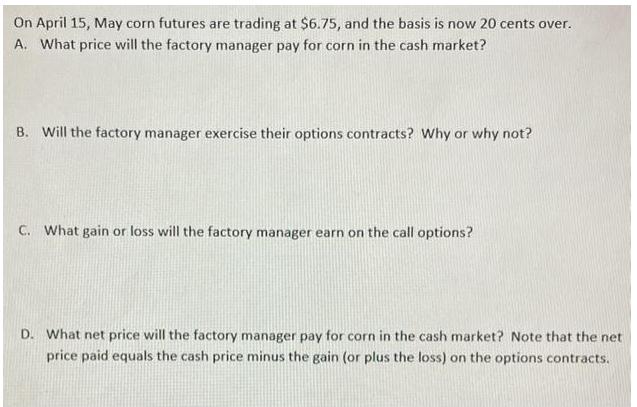

Reconsider the Buying Futures Contracts example from earlier in this assignment. Suppose that instead of purchasing futures contracts that the factory manager purchased call options on May corn futures contracts. The strike price in the option contracts is $6.16 per bushel and the premium is $0.25 per bushel. On April 15, May corn futures are trading at $6.75, and the basis is now 20 cents over. A. What price will the factory manager pay for corn in the cash market? B. Will the factory manager exercise their options contracts? Why or why not? C. What gain or loss will the factory manager earn on the call options? D. What net price will the factory manager pay for corn in the cash market? Note that the net price paid equals the cash price minus the gain (or plus the loss) on the options contracts.

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

A The factory manager will pay 675 for corn in the cash market B No the factory manager will not ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started