Question

Record a journal entry for each event during the year. Some transactions may not require an entry. If a transaction does not need to be

Record a journal entry for each event during the year. Some transactions may not require an entry. If a transaction does not need to be recorded, explain why there is no transaction for the business. 2. Create T-accounts for each of the accounts on the balance sheet and enter the beginning balances for 2021. Post each of the events for 2021 in T-accounts (including referencing) and determine the ending balances. 3. Prepare a trial balance at December 31, 2021 in good format. 4. Prepare a classified balance sheet for December 31, 2020 and 2021 in good format.Compute the current ratio for 2021 and 2020. Also assume that other companies within the same industry are 1.8. What does this suggest about the company.

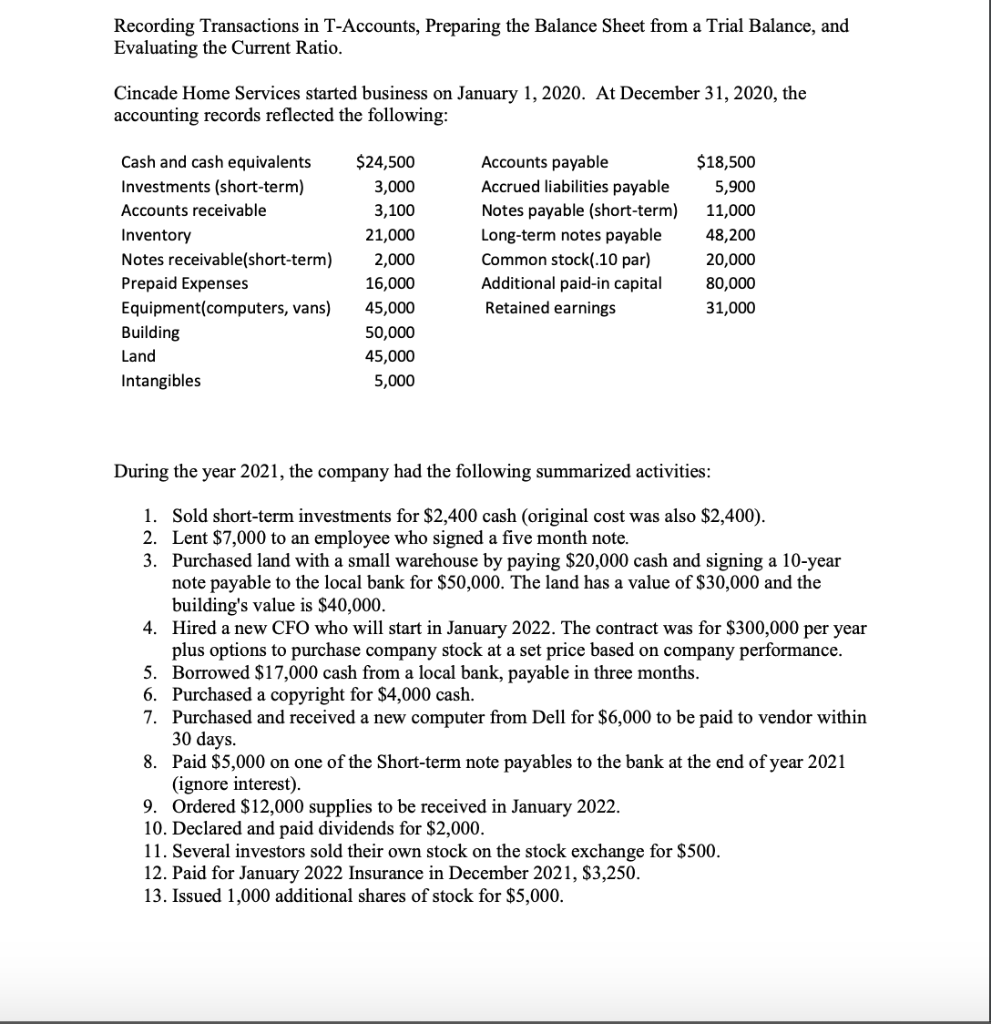

Recording Transactions in T-Accounts, Preparing the Balance Sheet from a Trial Balance, and Evaluating the Current Ratio. Cincade Home Services started business on January 1, 2020. At December 31, 2020, the accounting records reflected the following: Cash and cash equivalents Investments (short-term) Accounts receivable Inventory Notes receivable(short-term) Prepaid Expenses Equipment(computers, vans) Building Land Intangibles $24,500 3,000 3,100 21,000 2,000 16,000 45,000 50,000 45,000 5,000 Accounts payable Accrued liabilities payable Notes payable (short-term) Long-term notes payable Common stock(.10 par) Additional paid-in capital Retained earnings $18,500 5,900 11,000 48,200 20,000 80,000 31,000 During the year 2021, the company had the following summarized activities: 1. Sold short-term investments for $2,400 cash (original cost was also $2,400). 2. Lent $7,000 to an employee who signed a five month note. 3. Purchased land with a small warehouse by paying $20,000 cash and signing a 10-year note payable to the local bank for $50,000. The land has a value of $30,000 and the building's value is $40,000. 4. Hired a new CFO who will start in January 2022. The contract was for $300,000 per year plus options to purchase company stock at a set price based on company performance. 5. Borrowed $17,000 cash from a local bank, payable in three months. 6. Purchased a copyright for $4,000 cash. 7. Purchased and received a new computer from Dell for $6,000 to be paid to vendor within 30 days. 8. Paid $5,000 on one of the Short-term note payables to the bank at the end of year 2021 (ignore interest). 9. Ordered $12,000 supplies to be received in January 2022. 10. Declared and paid dividends for $2,000. 11. Several investors sold their own stock on the stock exchange for $500. 12. Paid for January 2022 Insurance in December 2021, $3,250. 13. Issued 1,000 additional shares of stock for $5,000. Recording Transactions in T-Accounts, Preparing the Balance Sheet from a Trial Balance, and Evaluating the Current Ratio. Cincade Home Services started business on January 1, 2020. At December 31, 2020, the accounting records reflected the following: Cash and cash equivalents Investments (short-term) Accounts receivable Inventory Notes receivable(short-term) Prepaid Expenses Equipment(computers, vans) Building Land Intangibles $24,500 3,000 3,100 21,000 2,000 16,000 45,000 50,000 45,000 5,000 Accounts payable Accrued liabilities payable Notes payable (short-term) Long-term notes payable Common stock(.10 par) Additional paid-in capital Retained earnings $18,500 5,900 11,000 48,200 20,000 80,000 31,000 During the year 2021, the company had the following summarized activities: 1. Sold short-term investments for $2,400 cash (original cost was also $2,400). 2. Lent $7,000 to an employee who signed a five month note. 3. Purchased land with a small warehouse by paying $20,000 cash and signing a 10-year note payable to the local bank for $50,000. The land has a value of $30,000 and the building's value is $40,000. 4. Hired a new CFO who will start in January 2022. The contract was for $300,000 per year plus options to purchase company stock at a set price based on company performance. 5. Borrowed $17,000 cash from a local bank, payable in three months. 6. Purchased a copyright for $4,000 cash. 7. Purchased and received a new computer from Dell for $6,000 to be paid to vendor within 30 days. 8. Paid $5,000 on one of the Short-term note payables to the bank at the end of year 2021 (ignore interest). 9. Ordered $12,000 supplies to be received in January 2022. 10. Declared and paid dividends for $2,000. 11. Several investors sold their own stock on the stock exchange for $500. 12. Paid for January 2022 Insurance in December 2021, $3,250. 13. Issued 1,000 additional shares of stock for $5,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started