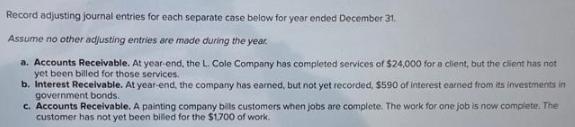

Record adjusting journal entries for each separate case below for year ended December 31, Assume no other adjusting entries are made during the year.

Record adjusting journal entries for each separate case below for year ended December 31, Assume no other adjusting entries are made during the year. a. Accounts Receivable. At year-end, the L. Cole Company has completed services of $24,000 for a client, but the client has not yet been billed for those services. b. Interest Receivable. At year-end, the company has earned, but not yet recorded, $590 of interest earned from its investments in government bonds. c. Accounts Receivable. A painting company bills customers when jobs are complete. The work for one job is now complete. The customer has not yet been billed for the $1700 of work.

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To record the adjusting journal entries for each case we need to recognize the revenue or i...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started