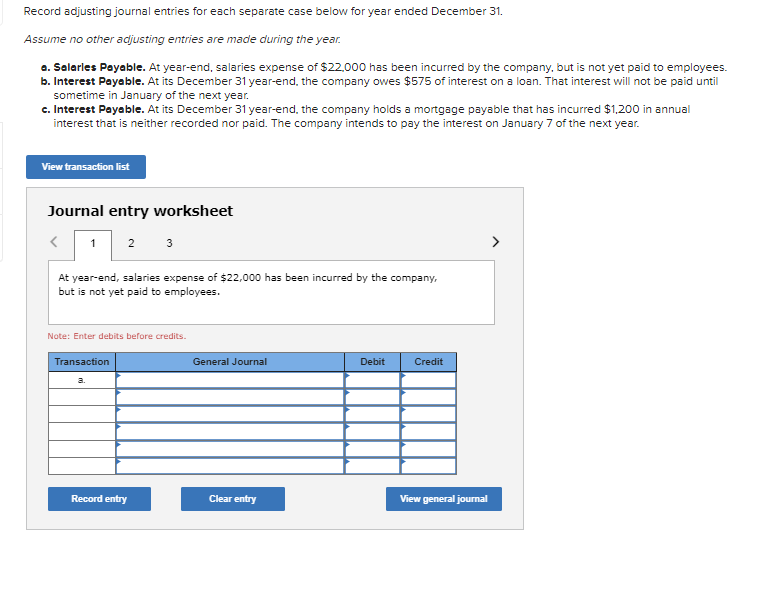

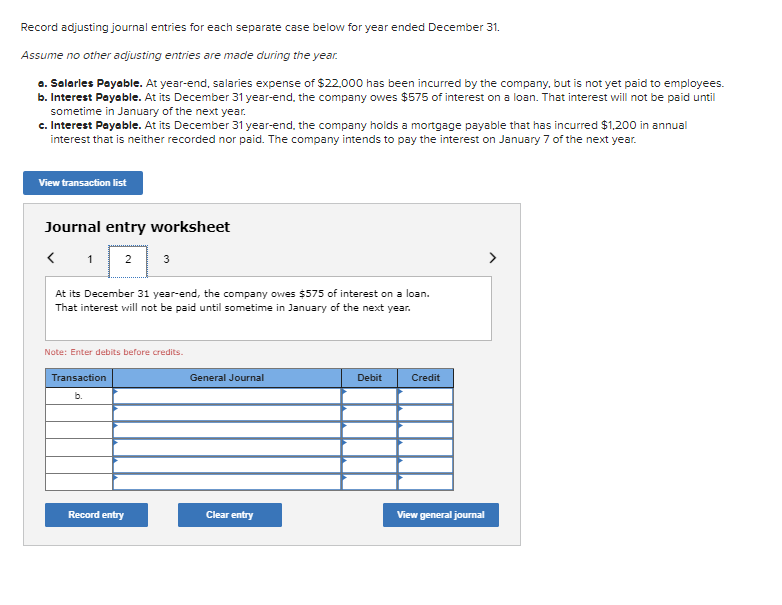

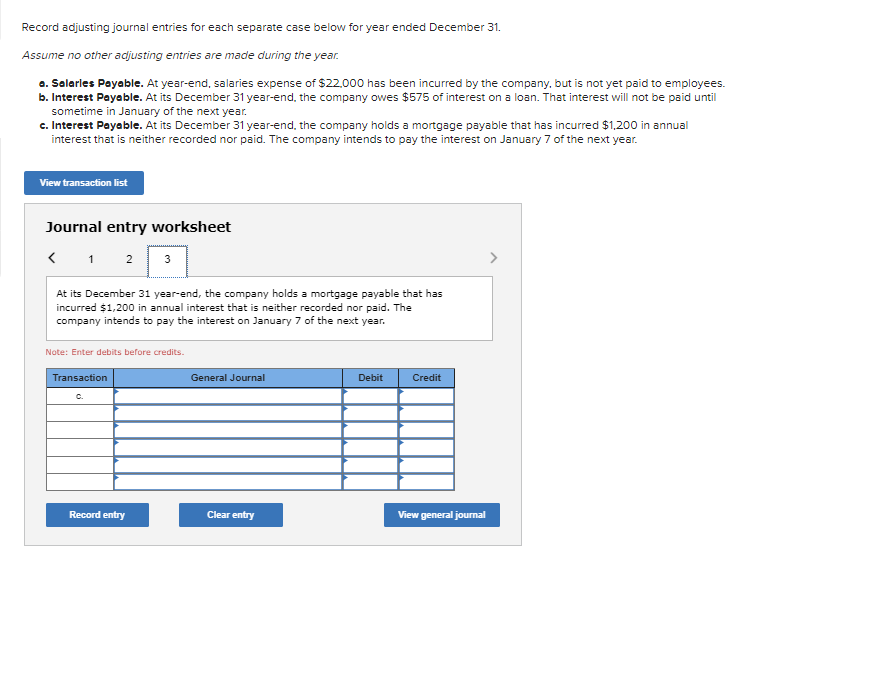

Record adjusting journal entries for each separate case below for year ended December 31 . Assume no other adjusting entries are made during the year. o. Solarles Poyable. At year-end, salaries expense of $22,000 has been incurred by the company, but is not yet paid to employees. b. Interest Payable. At its December 31 year-end, the company owes $575 of interest on a loan. That interest will not be paid until sometime in January of the next year. c. Interest Payable. At its December 31 year-end, the company holds a mortgage payable that has incurred $1,200 in annual interest that is neither recorded nor paid. The company intends to pay the interest on January 7 of the next year. Journal entry worksheet At year-end, salaries expense of $22,000 has been incurred by the company, but is not yet paid to employees. Note: Enter debits before credits. Record adjusting journal entries for each separate case below for year ended December 31. Assume no other adjusting entries are made during the year. o. Solarles Payable. At year-end, salaries expense of $22,000 has been incurred by the company, but is not yet paid to employees. b. Interest Payable. At its December 31 year-end, the company owes $575 of interest on a loan. That interest will not be paid until sometime in January of the next year. c. Interest Payable. At its December 31 year-end, the company holds a mortgage payable that has incurred $1,200 in annual interest that is neither recorded nor paid. The company intends to pay the interest on January 7 of the next year. Journal entry worksheet At its December 31 year-end, the company holds a mortgage payable that has incurred $1,200 in annual interest that is neither recorded nor paid. The company intends to pay the interest on January 7 of the next year. Note: Enter debits before credits. Record adjusting journal entries for each separate case below for year ended December 31 . Assume no other adjusting entries are made during the year. o. Solarles Payable. At year-end, salaries expense of $22,000 has been incurred by the company, but is not yet paid to employees. b. Interest Payable. At its December 31 year-end, the company owes $575 of interest on a loan. That interest will not be paid until sometime in January of the next year. c. Interest Payable. At its December 31 year-end, the company holds a mortgage payable that has incurred $1,200 in annual interest that is neither recorded nor paid. The company intends to pay the interest on January 7 of the next year. Journal entry worksheet At its December 31 year-end, the company owes $575 of interest on a loan. That interest will not be paid until sometime in January of the next year. Note: Enter debits before credits