Answered step by step

Verified Expert Solution

Question

1 Approved Answer

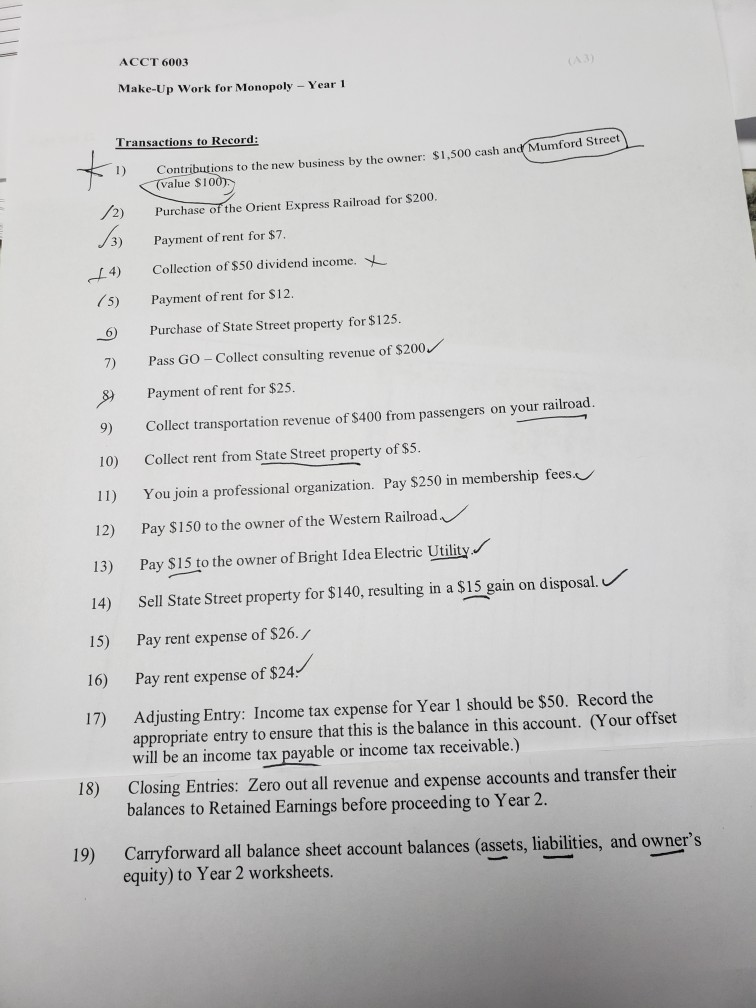

record the above transactions for year 1using monopoly general ledger (horizontal analysis worksheet -excell) provided. follow the instructions in the first page. ACCT 6003 Make-Up

record the above transactions for year 1using monopoly general ledger (horizontal analysis worksheet -excell) provided. follow the instructions in the first page.

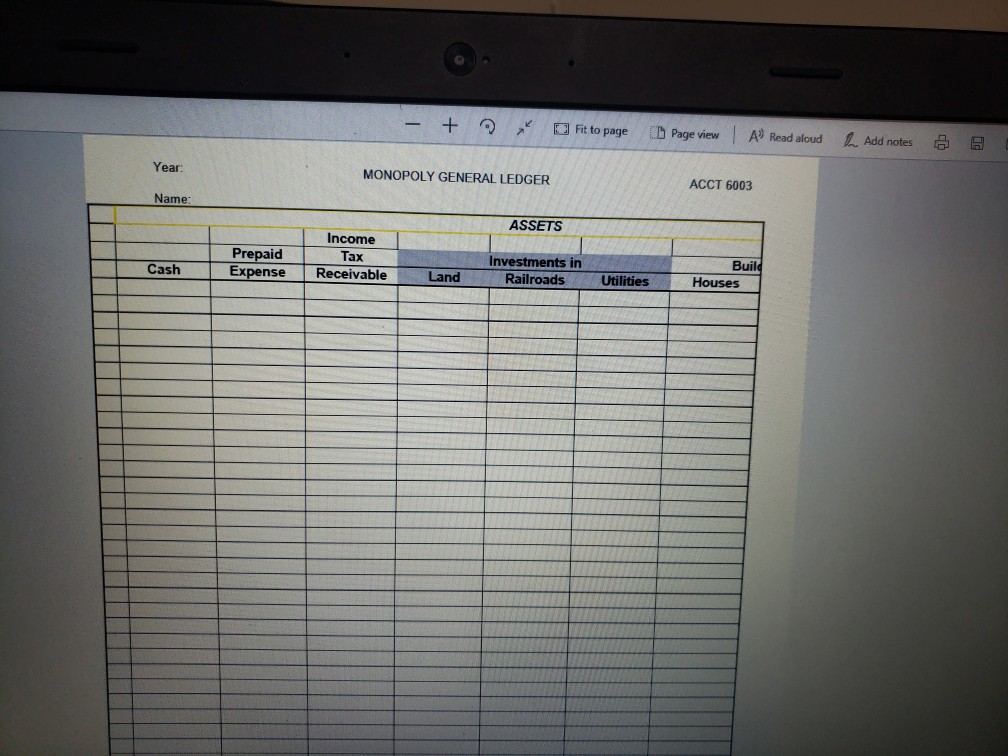

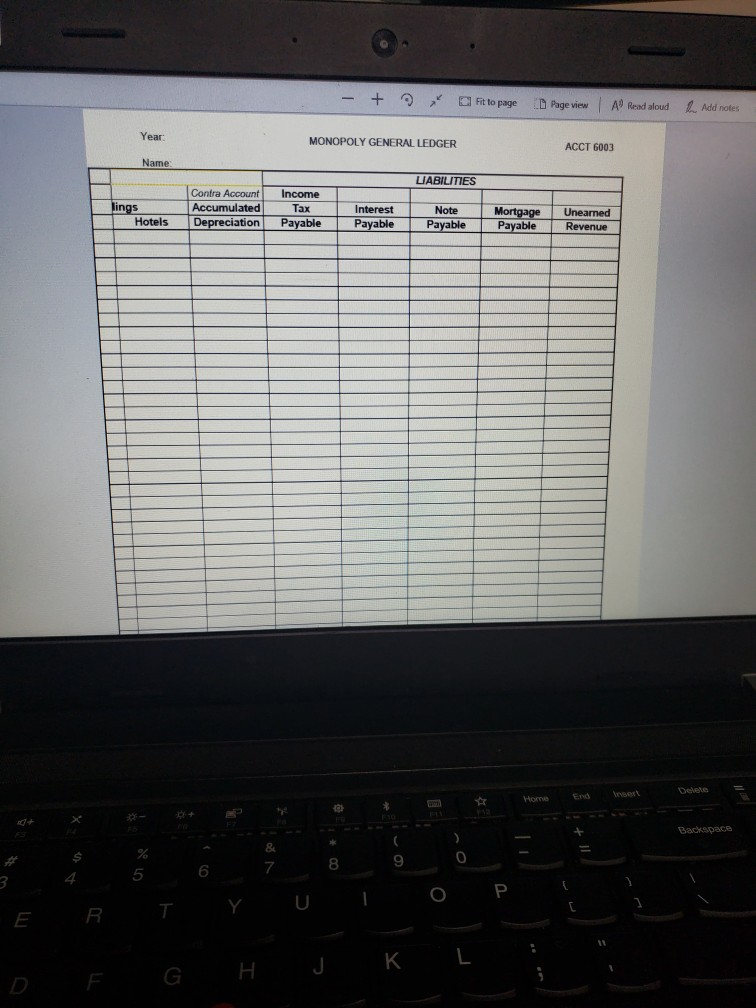

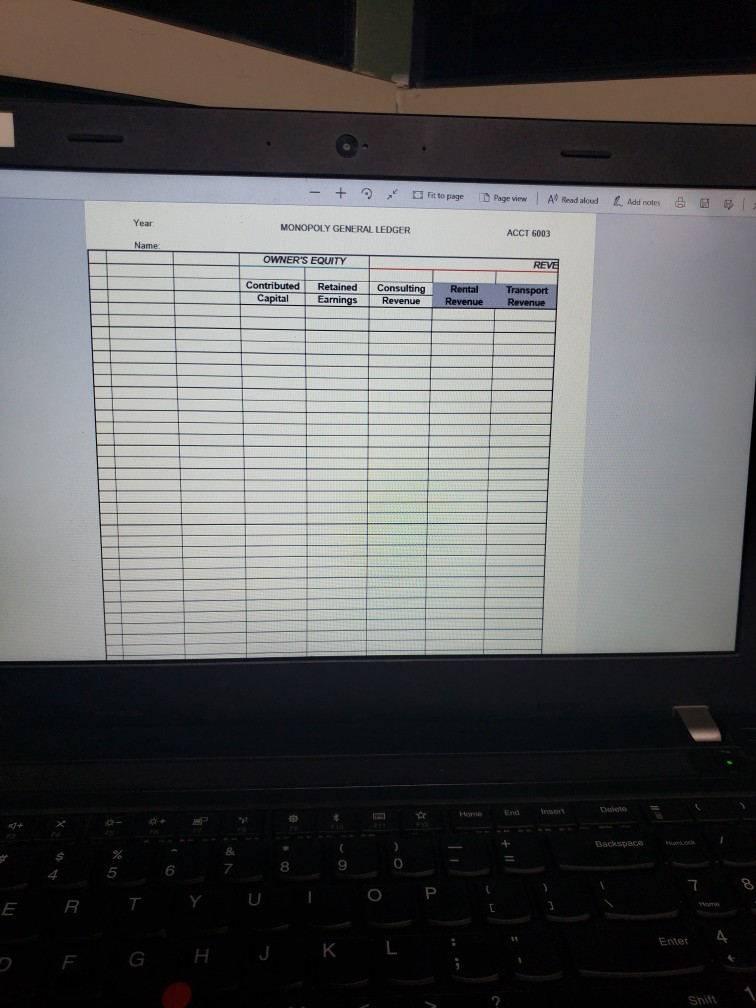

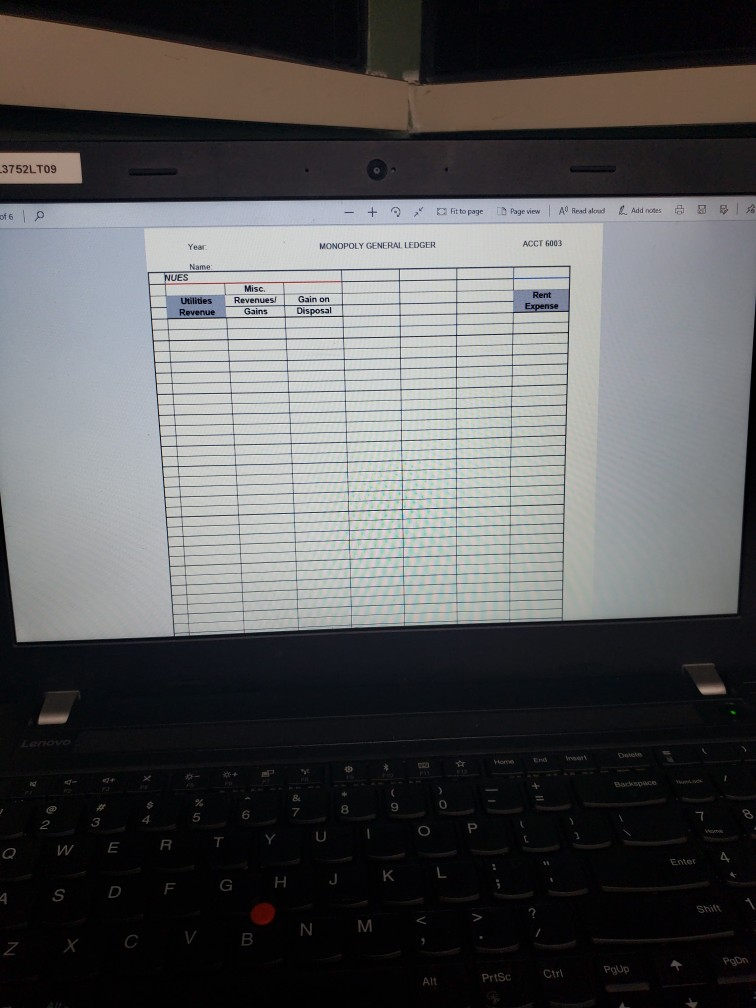

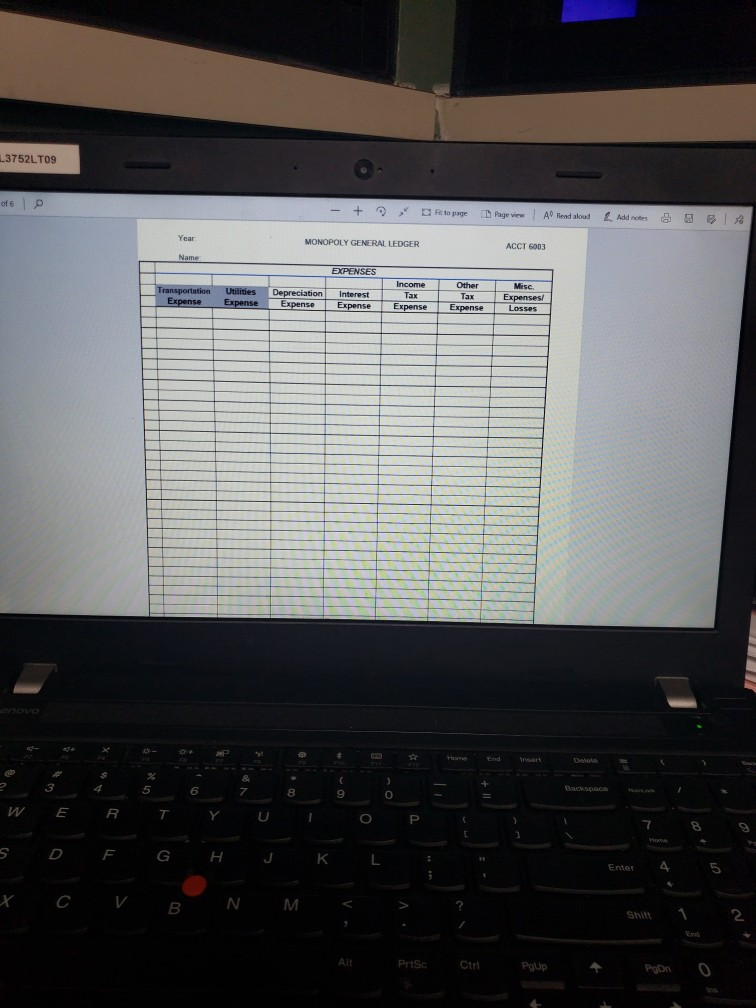

ACCT 6003 Make-Up Work for Monopoly - Year 1 Transactions to Record: Contributions to the new business by the owner: $1,500 cash and Mumford Street Tvalue $100) Purchase of the Orient Express Railroad for $200. Payment of rent for $7. Collection of $50 dividend income. Payment of rent for $12. Purchase of State Street property for $125. Pass GO - Collect consulting revenue of $200 Payment of rent for $25. 9) Collect transportation revenue of $400 from passengers on your railroad. 10) Collect rent from State Street property of $5. 11) You join a professional organization. Pay $250 in membership fees. 12) Pay $150 to the owner of the Western Railroad. Pay $15 to the owner of Bright Idea Electric Utility Sell State Street property for $140, resulting in a $15 gain on disposal. 15) Pay rent expense of $26./ 16) Pay rent expense of $24. Adjusting Entry: Income tax expense for Year 1 should be $50. Record the appropriate entry to ensure that this is the balance in this account. (Your offset will be an income tax payable or income tax receivable.) Closing Entries: Zero out all revenue and expense accounts and transfer their balances to Retained Earnings before proceeding to Year 2. 18) 19) Carryforward all balance sheet account balances (assets, liabilities, and owner's equity) to Year 2 worksheets. - + Fit to page Page view A Read aloud L Add notes @ @ Year MONOPOLY GENERAL LEDGER ACCT 6003 Name: ASSETS Prepaid Expense Income Tax Receivable Cash L and Investments in Railroads Utilities Build Houses 1 - + Fit to page Page view A Read aloud L Add notes Year MONOPOLY GENERAL LEDGER ACCT 6003 Name: LIABILITIES lings Hotels Contra Account Accumulated Depreciation Income Tax Payable Interest Payable Note Payable Mortgage Payable Uneamed Revenue 1 Delete Home End yest Backspace U 1 0 P E R T Y F G D H J K L - + fit to page Page view A Read aloud Add notes & B Year MONOPOLY GENERAL LEDGER ACCT 6003 Name OWNER'S EQUITY REVE Contributed Capital Retained Earnings Consulting Revenue Rental Revenue Transport Revenue Ender Derete Backspace 7 4 8 9 0 5 T 6 Y R U 1 E P 0 Entet D F G H L J K Shift 3752LT09 or lo - + Fittopage Pageview A Read aloud L Add notes 8 MONOPOLY GENERAL LEDGER ACCT 6003 NUES Misc Utilities Revenue Revenues! Gains Gain on Disposal Rent Expense TIL 2 W E RT Y UI F G H J K L Enter S D Shill 2 X C v B N M PODN Prisc Carl Pgup $ 5 0 $ Poon & Shin Add notes Enter - Backspace A Riad aloud Poup ACCT 6003 Expenses/ Pageview Ctrl Other Expense III reto page IIIIIIII HHHHHHHH Prisc > Income Tax Expense ///// ///// / / / // L MONOPOLY GENERAL LEDGERStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started